Anthony Bradshaw

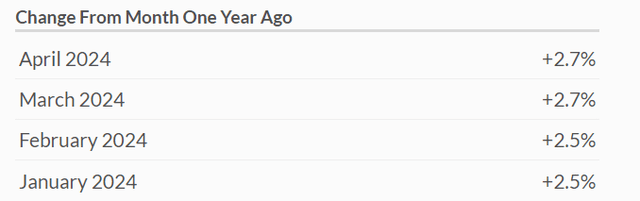

Gold prices remain strong even as geopolitical tensions ease and inflation remains above the Fed’s 2% target. Core personal consumption expenditures, the Fed’s preferred inflation measure, is rising at a

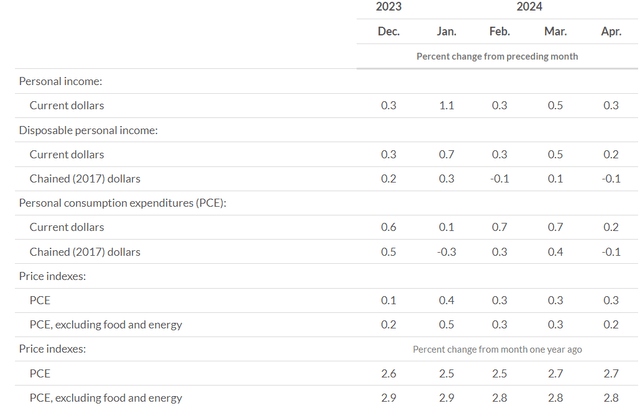

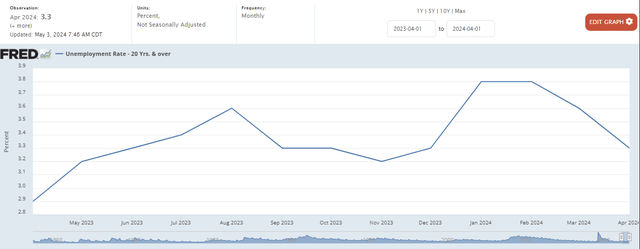

(PCE) Index Consumer prices (excluding food and energy) increased 2.8% in April, according to the statistics. It was released on May 31st. US Unemployment Rate It remains low, with 3.3% reported in April.. It may seem like there is no reason for the Fed to ease monetary policy. But despite some pretty bad news for the gold market, gold is still trading above $2,300. But there’s more to come.C) is the sum of one ounce of gold The price is $3,000But in my opinion, gold should be worth more than that and there is more bullish news to come.

$4000 Gold — Summary of previous article

In my previous article on gold, I argued that the precious metal is undervalued and has the potential to rise even higher, possibly even further. $4,000 per ounce.

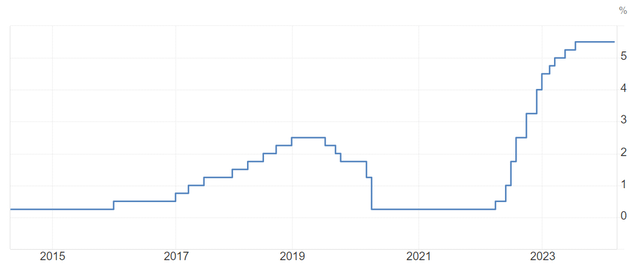

I also highlighted how precious metals prices have remained strong despite high interest rates. Historically, gold has always responded to low interest rates and quantitative easing (QE). I also noted that geopolitical risks and unexpected crises could be strong growth drivers for gold.

At the time of writing, macroeconomic data suggests that the U.S. economy is currently very strong. In the view of many investors, geopolitical tensions are easing. The world’s attention will be on the U.S. economy in the fall of 2023 and beyond. Israel’s war against HamasThere is hope that Israel will agree to a temporary ceasefire. However, this hope may prove futile. I remain bullish on gold despite favorable macro data, especially low unemployment. Thus, my very bullish position remains unchanged.

Economic Data

The core PCE index rose 2.8% from a year ago, unchanged from March and in line with expectations for April. On a monthly basis, the index rose 0.2%, as expected, while the personal consumption expenditures price index totaled 2.7%, also roughly the same as the previous month.

Consumers are still seen spending despite rising prices, and personal income statistics also point to some resilience.

This also suggests that consumers are more optimistic. At the same time, it means that consumers don’t have much cash left to save, which wasn’t the case in 2020 and 2021 when Americans got big bucks from the government. COVID relief spending But it also suggests that personal income and spending are holding up while inflation remains above the Fed’s 2% target.

The US labour market is also doing very well: The unemployment rate for April 2024 is currently at 3.3%, roughly in line with historical figures.

Recent unemployment figures are also close to levels seen in 2019, before the pandemic, when the job market was particularly strong.

Overall, it can be said that the economy is not slowing down, but inflation is running above the Fed’s 2% target, which has led some analysts and market experts to say: Fewer rate cuts We are looking forward to it again this year.

What if the Fed doesn’t ease up?

But the key question is: what will happen to the U.S. economy if the Fed doesn’t ease monetary policy fast enough? There are many different opinions on this question. Generally, rising interest rates for a long period of time risks causing a recession. However, some experts say the U.S. economy can withstand rising interest rates for a longer period of time. One of them is: David Kelly The chief global strategist at JPMorgan Asset Management said that because the US economy is doing well, consumer spending and inflation are high, and unemployment is very low, raising interest rates for a long period of time may be appropriate for the economy, as long as interest rates do not remain high. Higher interest rates may cool the economy a little and allow the Fed to achieve its inflation target. Therefore, if this scenario is true, the US economy would have a “soft landing.”

At the same time, raising interest rates for too long can easily lead to overshooting, as tightening monetary policy will eventually push the economy into recession. What happens to gold in this case? When markets start to panic, all asset classes except the US Dollar plummet in value, but then as the Fed eases monetary policy and investors start buying different asset classes, they soar in value. This is also true for gold.

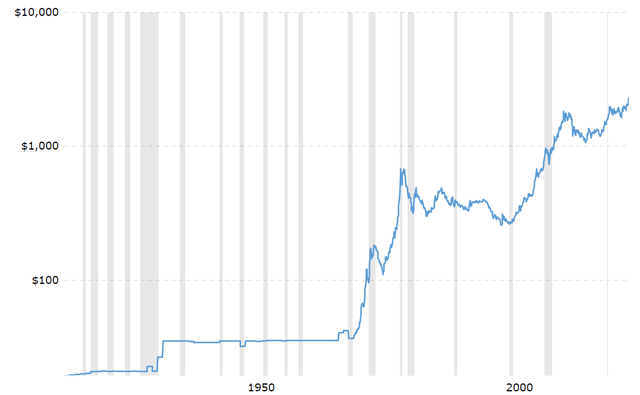

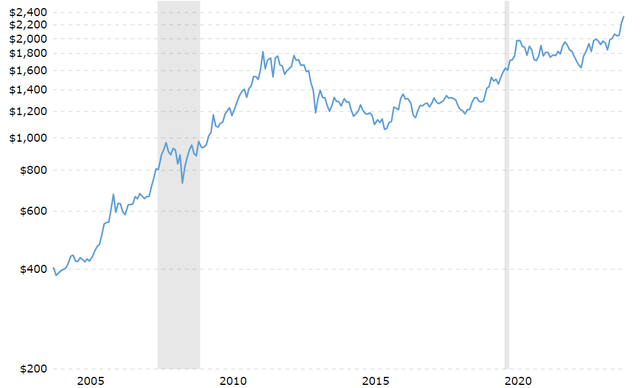

Here’s how gold behaves during recessions: The graph below shows the 100-year history of gold prices, with recessions shown in the grey areas.

Gold Price History

The most obvious example of gold correcting and then surging to an all-time high was in 2008, when the price of the precious metal fell from $1,000 to under $800 before surging to $1,800. This was due to Fed stimulus measures and investor panic.

In fact, something similar may happen now: the next recession may spur a longer-lasting surge in gold prices.

But this is not the only bullish factor for gold.

Easing geopolitical tensions

On Friday, US President Joe Biden Israel’s Latest Ceasefire ProposalIt could lead to a permanent ceasefire, something Hamas might be prepared to accept. However, Israel seems unlikely to accept a permanent ceasefire agreement. Prime Minister Netanyahu President Trump risks losing his job if he accepts the agreement due to pressure from the far-right political elite. Moreover, the Middle East wars are not over yet. The situation looks dangerous. Therefore, it seems to me that any major provocation in the region could force the major powers, especially Israel and Iran, to act.

Relations between Russia and the US, and between the US and China, have not improved recently and remain a concern for many investors, so news on this front should be closely monitored.

Logically, a significant increase in geopolitical risk could send gold prices higher.

Money supply and the value of gold

Citigroup Gold prices Gold will hit $3,000 an ounce in the next six to 18 months. The bank said the recent rise in gold prices has been driven by geopolitical risks and coincides with record levels in stock prices.

Goldman Sachs (GS) It raised its year-end forecast to $2,700 an ounce.This is due to the Fed’s planned interest rate cuts later this year.

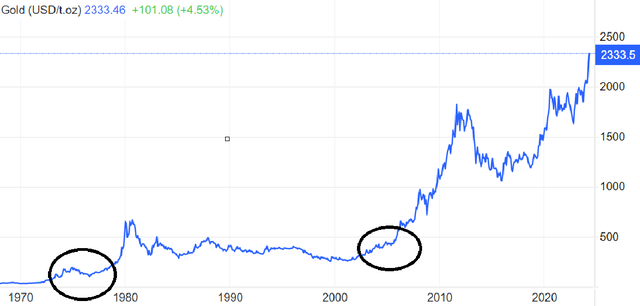

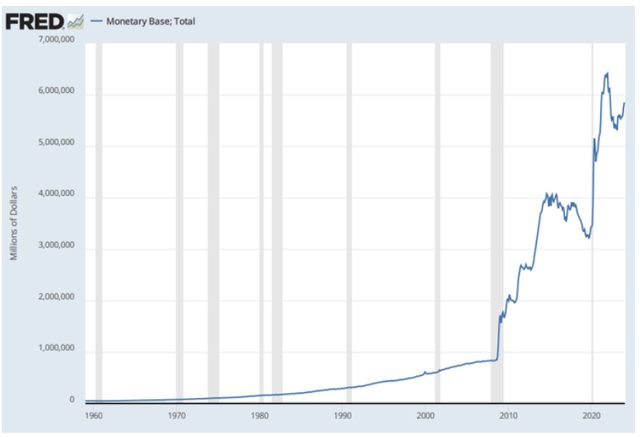

However, as I have stated in other articles on gold, I believe $4,000 per ounce is the fair price right now. The reason is that the money supply in the US economy is at a record high, despite record interest rates. A large supply of US dollars means that the real value of the dollar is very low. Naturally, the higher the money supply, the weaker the US dollar. A weaker dollar has traditionally meant higher gold prices.

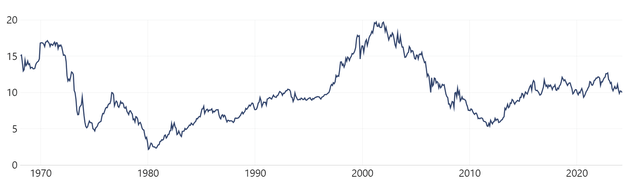

The US Money Supply/Gold ratio is quite high. However, it was even higher in the early 1970s and 2000s. These periods preceded the explosive growth of gold prices. This can be clearly seen in the graph below.

Gold is currently undervalued relative to the US money supply.

US Money Supply/Gold Ratio

Now, you may be wondering why gold is objectively worth $4000.

The graph below, taken from the Fed website, shows that since the pandemic, the money mass has surged two-fold, just as it did after the 2008 crisis. Because there is a direct correlation, the price of gold should have also surged two-fold. However, this has not happened, which means that the precious metal has plenty of growth potential and should be worth close to $4000.

Downside risks

In my opinion, the downside risks are clear.

First, the bad news is that interest rates are going to remain high for a long time, as recent macroeconomic data suggests, but if interest rates do not fall over time, this will trigger a recession and ultimately lead to a real gold rally.

Second, geopolitical risks could decline. The war between Israel and Hamas could end and Israeli-Iranian relations could improve. US-Russia tensions and the US-China conflict over Taiwan could de-escalate. In this case, safe haven assets like gold might not be in high demand. But in my opinion, it is highly unlikely that any of these conflicts will escalate this year.

Conclusion

Recent macroeconomic data suggests that interest rates will be cut less than expected this year, but gold remains undervalued despite its recent rally. The conflict between Israel, Hamas and Iran seems to be dragging on, and tensions in the Middle East don’t seem to be ending anytime soon. Thanks to the very high money supply, gold should be worth twice as much as it is now.