Luis Alvarez

ETF Overview

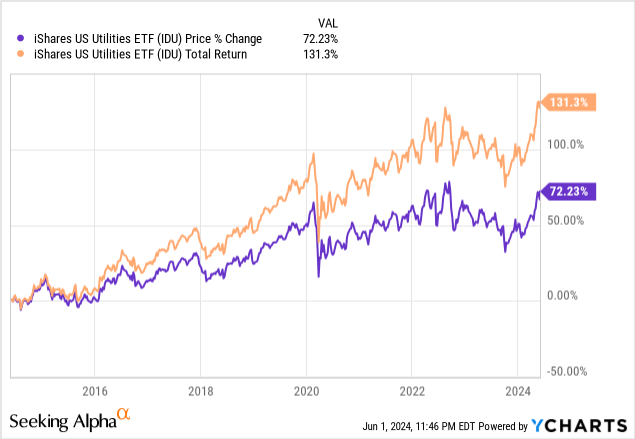

iShares US Utility ETF (NYSEARCA:India) holds a portfolio of large- and mid-cap U.S. utility stocks. Its expense ratio of 0.4% is high compared to its peers. For example, the Fidelity MSCI Utilities ETF (Futhy) has an expense ratio of just 0.08%. IDU has low volatility, but its slow growth means that over the long term its total return may be inferior to the overall market. Its valuation is also not cheap at the moment. Therefore, we cannot recommend this fund at this time.

Y Chart

Fund Analysis

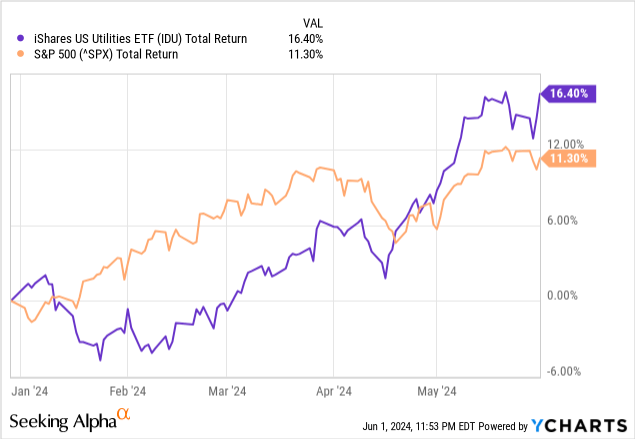

IDUs have outperformed the broader market so far this year

First, let’s look at IDU’s performance over the past two years: IDU has performed extremely well this year, with the fund delivering a total return of 16.4%, outperforming the S&P 500 Index’s return of 11.3%.

Y Chart

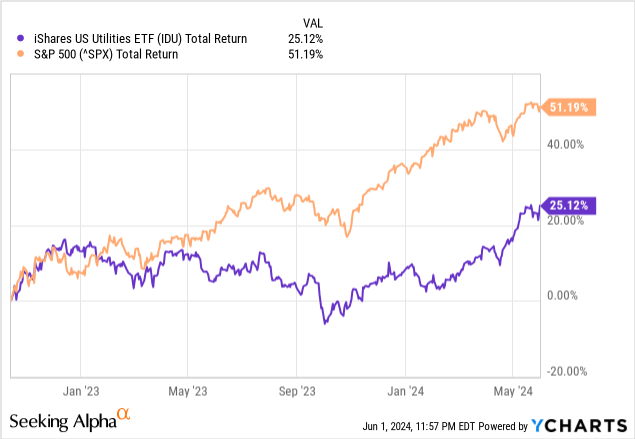

but, The fund’s performance has been less than outstanding as the overall market hit cyclical lows in October 2022. Since October 2022, IDU has only delivered a total return of 25.1%. In contrast, the S&P 500 Index has delivered a total return of 51.2%, more than double IDU’s total return.

Y Chart

IDUs are less volatile than the overall market

IDU is less volatile than the overall market. This is evident from the fact that its five-year average beta ratio to the S&P 500 Index is only 0.74. As a reminder to our readers, beta is a measure of a fund’s volatility. A high beta (greater than 1) indicates that the fund will fluctuate more than the overall market when the index rises or falls. In contrast, a low beta (less than 1) indicates that the fund will be less volatile than the overall market. Since IDU’s beta ratio was less than 1, IDU is expected to have less downside risk than the overall market.

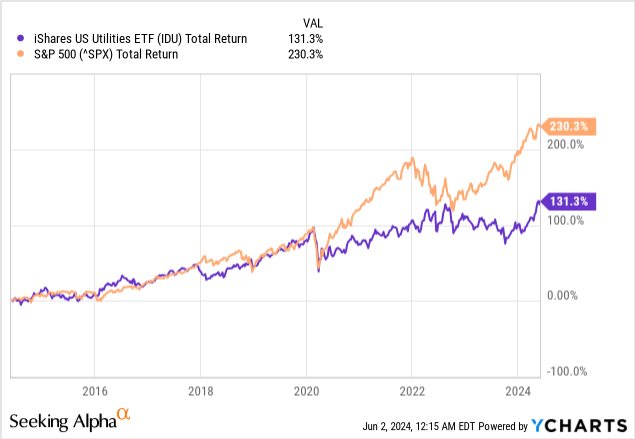

However, IDU is likely to underperform the broader market over the long term.

Although IDUs have low volatility, their total returns have historically underperformed the S&P 500. As can be seen in the chart below, over the past 10 years IDUs have returned 131.3% in total, well below the S&P 500’s return of 230.3%.

Y Chart

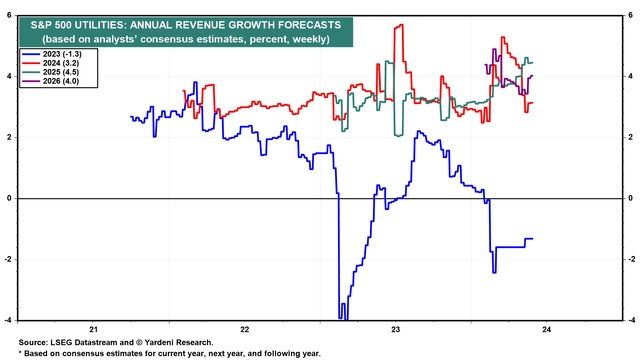

What is causing the low long-term returns of IDUs? The answer is quite simple: the utilities sector is not a fast-growing sector. Take the S&P 500 utilities sector as an example. As you can see from the chart below, the annualized earnings growth forecast for 2024 and 2025 for utilities stocks in the S&P 500 index is just 3.2% and 4.5%, respectively. This is much lower than many other growth sectors, such as the technology sector, which typically has average earnings growth in the low to high double digits.

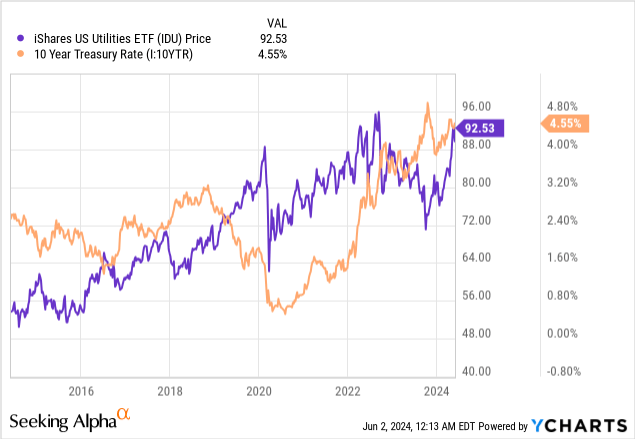

IDU fund prices are sensitive to government bond interest rates

Utility stocks are generally considered dividend stocks, so investors who hold these stocks typically consider the dividend yield. Therefore, the valuation of utility stocks is generally affected by government bond yields. When government bond yields rise, stock prices usually fall and vice versa. This is exactly what we have observed with IDU fund prices. As can be seen from the graph below, IDU fund prices are usually inversely correlated with the 10-year government bond yield. In the long term, IDU fund prices may rise, but in the short term, fund prices may be very sensitive to changes in government bond yields.

Y Chart

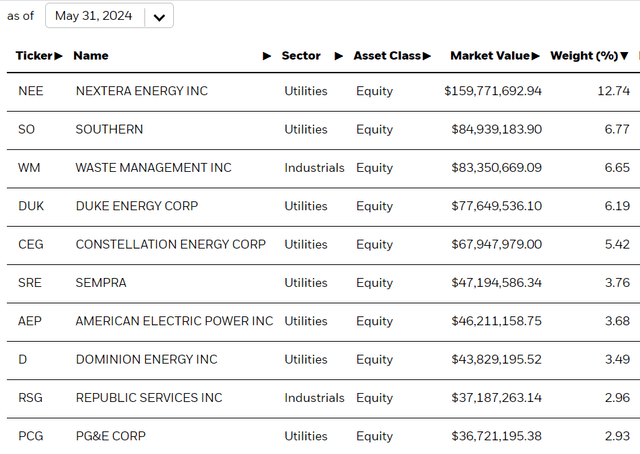

Top Holdings

IDU’s major holdings include many well-known utility companies. For example, its largest holding, NextEra Energy (knee) is a company that operates a stable electricity generation and distribution business mainly in Florida. NEE’s sales and profits have been steadily increasing in recent years. Southern Electric, the second largest holding company,So) has 9 million customers across three states. The company’s business is primarily electricity generation and distribution, and gas distribution. SO’s revenues have also grown steadily over the past three years. Overall, most of these companies are expected to grow their business steadily.

Fair evaluation

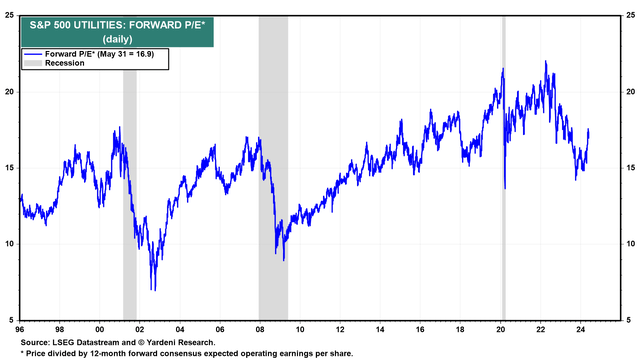

Now that we know the characteristics of IDU, we can evaluate its valuation. Since there is no historical average of IDU’s forward P/E ratio, let’s look at the forward P/E ratio of the S&P 500 utility stocks. As you can see from the chart below, the average forward P/E ratio for the S&P 500 utility sector is currently 16.9x. Historically, forward P/E ratios have ranged from 10x to 20x, with an average of about 15x. Therefore, the current forward P/E ratio of 16.9x is higher than the long-term average over the past 30 years. In other words, it is not cheap at the moment. However, it is nowhere near the roughly 22x recorded in 2022. Therefore, we do not consider IDU to be very expensive either.

Investor View

If your objective in holding IDU is to seek total return over the long term, IDU is not the fund to own as its total return will likely underperform the S&P 500 Index. For those who want to hold IDU regardless of its growth characteristics, its valuation is not cheap. Therefore, we cannot recommend this fund at this time and believe investors should sit on the sidelines or wait for a dip.