Arctic Images

Over the past few years, there have been two significant changes in the investment outlook for utilities.

- The valuation has decreased

- Underlying growth improved.

We believe that higher than normal growth and reasonable valuations make utilities an attractive investment. While the sector as a whole looks favorable, certain individual stocks are better positioned than others.

First, we’ll discuss improving value and fundamentals, and then we’ll talk about specific stock investment opportunities.

Relative value significantly improved

Utilities are often considered a boring sector because they have traditionally delivered stable, moderate returns. The sector has a low beta and is often uncorrelated with the rest of the market. Utilities price charts often look like a slowly moving upward line.

This trend line will break down in 2020, Utility Select Sector SPDR® Fund ETF (NYSEARCA:R) plummeted from $70.33 on February 21, 2020 to $47.80 on March 20, 2020, a 32% drop in one month.

Over time, while other parts of the market recovered from the pandemic-induced trough, utilities slumped.

10-year chart on the XLU homepage

The underlying damage was not that severe: electricity use fell slightly in 2020, but demand was already rebounding in 2021.

Perhaps the reason pricing in the sector is weak is because a 30%+ drop in a month has tarnished its reputation. Utilities have lost the allure of uncorrelated safety that may have supported prices a bit higher going into 2020.

The sector’s underperformance was exacerbated as interest rates began to spike in 2022. That all changed as Treasury yields approached 5%, transforming investment income sources from rare to ubiquitous. Utilities that yield 5% simply become less attractive when similar income can be earned in short-term Treasury bills.

As a result, utilities lost a significant portion of their two main investor bases: income investors and those looking for a relative safe haven in stocks. With interest declining significantly, the sector has significantly underperformed over the past four years.

The relative evaluations vary widely

The price movements mentioned above were not supported by fundamentals. Utility earnings generally continued to grow at a normal, steady pace. Most of the price movements were driven by the S&P 500 multiple expansion.SP500) and multiple contractions of utilities.

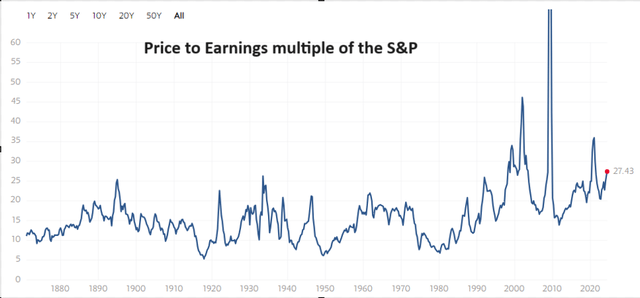

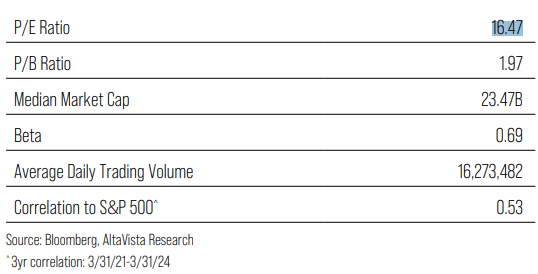

Over the past 12 months, the S&P’s price-to-earnings multiple has expanded to 27.43.

In contrast, utilities, as measured by XLU, have fallen from roughly 20 times 2022 earnings to roughly 16.5 times now.

Bloomberg

This is a dramatic relative valuation change: Utilities has gone from a premium sector to a discount sector relative to its peers.

Utility prices have become cheaper and at the same time future fundamentals have improved significantly.

Demand shifts from stagnation to growth

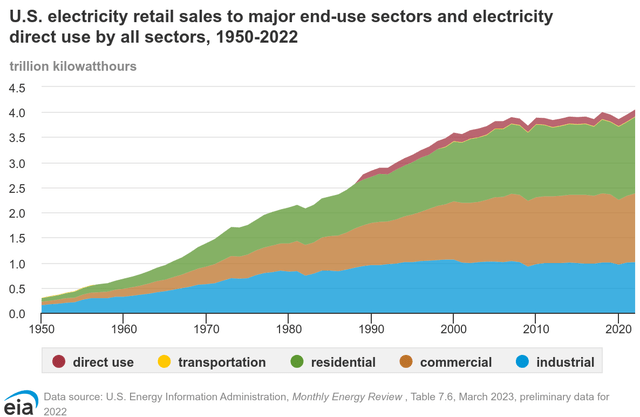

Despite humans’ increasing reliance on technology, electricity use in the United States has remained roughly flat for nearly two decades.

Environmental Impact Assessment

Demand increased due to population growth and increased computer/telephone use, but this was offset by two major negative factors.

- Increased energy efficiency (LED lighting, better matching of power to devices, etc.).

- Demand from industry has decreased due to outsourcing of production to other countries.

Going forward, both of these inhibitors are likely to decrease: as a growing proportion of homes and devices already use efficient technologies, the difference that efficiency gains make should become smaller.

The outsourcing of industrial production has actually reversed, and reshoring has become a major focus in the United States. Domestic production of key products is now considered a matter of national security, resulting in significant tax and other incentives to bring production back to the United States. Steel, chips, food, and medicine are increasingly being made in U.S. factories, and many new factories are scheduled to be built between now and 2030.

In addition to the factors mentioned above, AI and data centers require huge amounts of power. This concept was discussed in more detail I mentioned this earlier so I won’t repeat it here.

Overall, this will increase utilities’ baseline demand growth rates by about 1% to 2% per year.

That may not sound like much, but this figure has been around 0% for the past 20 years.

Financial impact of increased demand

Recall that utilities are heavily regulated, meaning that utility rates are set by regulators and return on invested capital is fixed at a predetermined level. For most utilities, ROE is underwritten at around 9% to 11%.

At constant margins, profits vary with capital expenditures: more capital projects equal more profit. Over the past few decades, utility companies have been able to continually grow earnings per share despite little growth in demand because they required large capital expenditures just to maintain the same levels of production.

- Maintaining existing plants

- Replacement of obsolete plants

- Replace grey energy production with sustainable energy.

Each of these capital projects will continue, but going forward, the utility will have further growth opportunities by building additional energy generation and transmission facilities to meet increasing demand.

The pipeline of capital projects among utilities is vast. Below are just a few examples of what is planned:

- Duke Energy (Duke) – $73 billion by 2028

- Dominion (is) – $43 billion five-year investment plan

- WEC Energy (World Economic Forum) – Increase fee base by $13.9 billion by 2028

- Southern Company (So) – $48 billion by 2028.

These investments represent a significant portion of the current enterprise value and should contribute significantly to earnings, as each investment comes with an incremental and pre-determined ROE.

Projected earnings per share growth for the sector is expected to be between 6% and 9% per year over the next four-plus years.

Different investment propositions

The investment outlook for utilities has changed. They are no longer just a stable, low-beta source of income. Utilities are not a high total return sector.

We believe future earnings will be significantly higher than in the past due to the following factors:

- Improved relative evaluation

- The underlying increase in electricity demand will accelerate EPS growth.

My guess is that the utilities sector stands to generate compounded returns of around 8% to 10% per year, with dividend yields of over 4% and earnings growth providing another 6% or so, making for solid total returns assuming multiples remain flat.

I think this level of return is appropriate given the high interest rate environment. Equities have to offer some premium over bonds. I think it will be much harder for the S&P as a whole to provide returns given the elevated valuations. So, on a relative basis, I think utilities will outperform the S&P.

Industry Winners

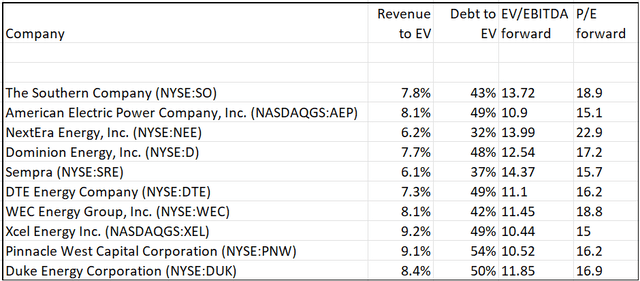

Valuations for power companies are fairly consistent across stocks, with EV/EBITDA ranging from 10.9x to 13.9x.

Future earnings multiples are primarily concentrated in the 16x to 18x range. NextEra Energyknee) trades at slightly higher prices than the others on both metrics due to its sheer size and reputation.

None of the stocks listed above are extremely cheap or overvalued, and the multiples all seem pretty reasonable, so while I’m a value investor at heart, I don’t see much to be gained from buying one stock over another just because it’s 1x or 2x cheaper in terms of earnings multiples.

Instead, I tend to pick utilities that are best positioned to capture growth.

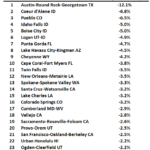

Going forward, total electricity demand is likely to grow 1% to 2% per year, but the growth will be uneven. Some areas will not grow at all, while others will see growth approaching 4%. I would rather own a utility company with service territory in a growing area.

There are three main reasons for the increase in electricity demand.

- Population growth

- Influx of industrial manufacturing

- Building a data center.

Because these factors are not evenly distributed across the country, the increase in electricity demand will likewise not be evenly distributed.

Population growth is strongest in the Sunbelt. Most immigrants are moving to the Southern states, and while internal migration continues to drive job growth, job growth is strongest in the Sunbelt. Domestic migration has slowed since the initial pandemic surge, but the direction is similar.

Pinnacle West (Northwest Pacific)

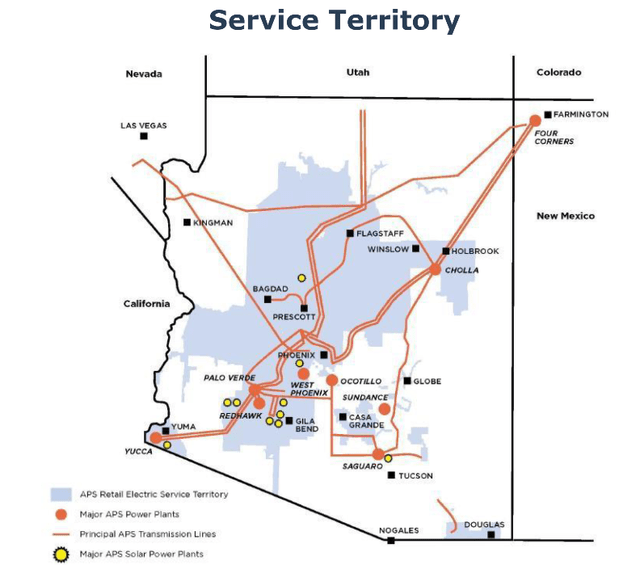

Pinnacle West is one of our most favorable service areas, covering a large portion of Arizona, including most of Phoenix.

With Phoenix experiencing a strong influx of jobs and population, and rapidly becoming a data center hub, we expect electricity demand growth in our PNW service area to significantly exceed the U.S. average.

Duke Energy (DUK)

May 29NumberDuke Energy Announced The agreements with the majority of the seven companies will allow them to supply large amounts of clean energy to support the construction of data centers in Duke’s service area.

It’s a structure that paves the way for power purchase agreements (PPAs) that allow tech companies to document that they’re buying clean energy to help meet their own goals, and allow Duke to sell large amounts of additional power.

Regulators would likely favor such an agreement because it would allow Duke to move forward with the green energy transition without passing on the associated costs to grid customers.

Duke already serves a region with strong manufacturing growth, and this will further increase its project pipeline.

Dominion Energy (D)

There’s a lot to like about Dominion, many of which are Already discussed As I mentioned in a recent post , the main selling point here, in a nutshell, is that we serve NOVA, the epicenter of growing data center power demand.

I also believe the market significantly undervalues their ship, the Charybdis. The Jones Act, which regulates maritime commerce, requires that certain shipments be made on vessels owned by U.S. citizens. Other countries have similar ships, but Dominion’s ships are unique in that they comply with the Jones Act.

In the short term, the ship will help Dominion’s massive Virginia Coast Offshore Wind (CVOW) project stay on schedule and potentially become a revenue stream for the company in later years. Because a ship of this size takes years to build, Dominion will have near-sole authority to rent the ship to other energy companies needing to install offshore wind turbines.

I believe Dominion’s growth will be significantly stronger than expected and the stock will trade significantly cheaper than its mid-tier share price multiple would suggest.

Capture price fluctuations of individual stocks

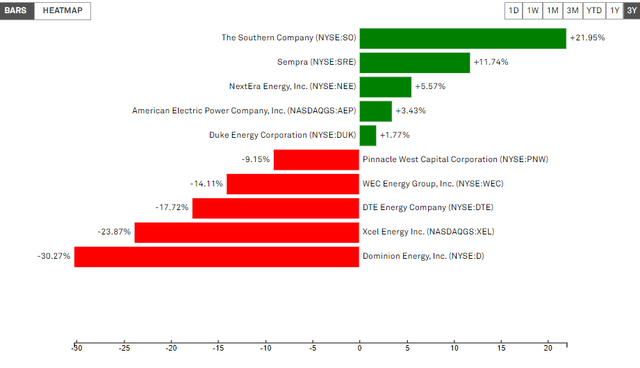

While the utilities sector has tended to be stable, there is a lot of price volatility within the sector, with some stocks dropping substantially over a three-year period, while others have risen substantially.

S&P Global Market Intelligence

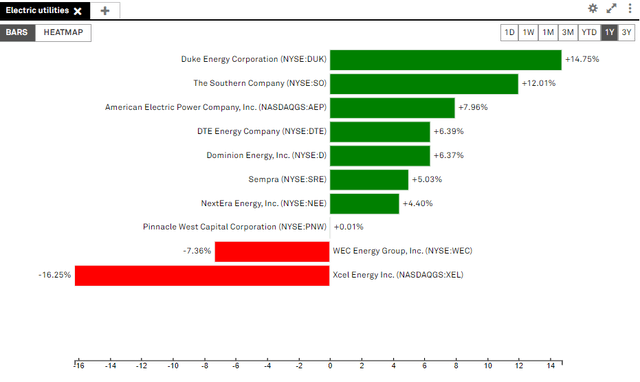

Keep in mind that among the stocks that have fallen over the three-year period, there are some that have performed well in the last year.

S&P Global Market Intelligence

Price volatility in the absence of fundamental volatility creates opportunity.

Building a screener to monitor how these companies move against each other can be extremely valuable, as it can help you capture value when blue-chip companies are trading at abnormally low prices.

Conclusion

The combination of discounted valuations and improving growth is a great combination for this sector, and with careful stock selection there is an opportunity to capture even better growth.