da-kuk

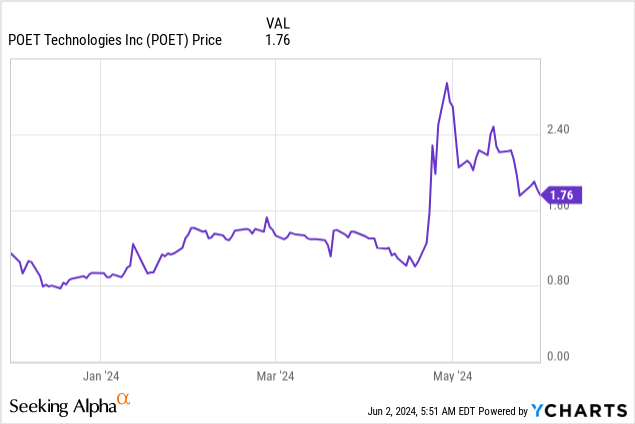

Since my initial analysis of POET Technologies Inc. (NASDAQ:POET), in which I initiated a BUY rating on the stock, the company has experienced a positive change in perception due to a YouTube video from “Ticker Symbol: YOU”. The video already received about 150,000 views and named POET as a potentially big winner in the hot AI equipment market, which led to an explosion in interest and trading volume for the stock.

Meanwhile, POET raised significant cash at this elevated level for CAD3.07 and CAD2.90, which is 122% and 110% above the pre-video share price and about triple the pricing of the previous share issuance earlier this year. This capital raise mitigates the most relevant risk for the company in my eyes. Additionally, POET recently achieved an important design win from Foxconn Interconnect Technology in the AI market, which further validates its technology and provides the company with a strong partner for commercialization. I therefore upgrade my rating on POET to a Strong Buy amid the reduced financing risk and improved commercial perspectives. I do this despite the increased price level, as to me, the company still has a lot of potential.

The Thesis

POET is a photonics company which aims to semiconductorize photonic components and thus open up an avenue to cheap mass production of its patented optical engines. It initially aimed at addressing the data center market, where such components would enable strong cost, space, and power savings, but lately interest from the AI space has grown incredibly strong and resulted in even more spotlight on solutions for these applications. My previous article included a detailed review of the company’s technology, value proposition, customer arrangements, and market potential, which I will only summarize in short here.

The amounts of stored and processed data in the world have grown strongly in the past years and decades. New technologies like cloud computing, big data, and AI are powerful catalysts for this development, which necessitates even faster transmission speed and increased bandwidth. POET provides devices, particularly optical engines, that are able to convert an electrical signal into light for the use in, e.g., fiber optic cables which facilitates the required speed and bandwidth. Different compared to traditional solutions is that POET’s optical engines are about 10x smaller, require about 10x less energy (i.e., electricity) and are therefore significantly more economical. Due to their smaller form factor, more engines can be fitted onto the same “plug”, enabling many parallel lanes and thus more bandwidth. As they can be mass manufactured, in essence like semiconductors, they are also much easier and cheaper to produce. Moreover, according to the company, there are no real competitors.

POET has been flying deep under the radar, yet its strong product KPIs seem to be catching increasing customer attention lately, and initial agreements have already been signed. A particularly promising deal has been an advanced purchase order from Celestial AI for “POET starlight” which Zack’s analyst Lisa Thompson expects to represent an opportunity for POET of “$800 million in potential revenues by itself” as she believes “most if not everything Celestial is planning to sell contains POET”. With POET entering mass production now through its Chinese joint venture Super Photonics Xiamen (SPX), increasing revenues are furthermore on the horizon in the near future.

Recent Progress Update

In the past months, POET further developed its AI product offering in order to showcase live product demonstrations, particularly of its 800G optical engines and POET starlight, at the San Diego 2024 Optical Fiber Communications (OFC) conference exhibition at the end of March. The exhibition seems to have been very successful in terms of attracting customer interest and led to the signing of further customer agreements. POET’s CEO commented on the recent earnings announcement:

At OFC, we showcased four new products, each of which garnered serious attention from the industry, with the strongest interest in our leading-edge optical engine technology that powers optical modules for AI processing clusters, and in our light source products that facilitate chip-to-chip light-based data communications and high-speed computing. In addition to Foxconn, we are expanding our previously announced relationship with Luxshare, to include additional optical module products, and collaborating with MultiLane, a key supplier of high-speed test equipment in the industry to offer 800G and 1.6T optical modules. (Suresh Venkatesan, CEO)

On the conference’s first day, the company also introduced an 800G pluggable transceiver module which will be sold under the name POET Wavelight™, which came as a surprise as the company only announced showcasing partner products before. By assembling entire modules by itself, too, POET can capture more value creation and directly address larger customers at more mature value chain stages. Customer sampling for the product is set to begin in Q3 2024. Next to expanding the Luxshare partnership, POET afterwards announced another collaboration with MultiLane Inc. to develop performance-optimized pluggable 800G, 1.6T, and higher speed transceivers for AI and cloud data center markets.

About 1.5 months after the exhibition, POET declared to have signed its most significant customer collaboration up until now by achieving a design win in the AI market with Foxconn Interconnect Technology (FIT). FIT intends to use POET’s optical engines to jointly develop 800G and 1.6T pluggable optical transceiver modules “to address the growth in demand from cutting-edge AI applications and high-speed data center networks”. Foxconn, being the world’s largest electronics contract manufacturer, opens up the potential for large customer-sizes and global markets for POET that could lead the company to an entirely new level. According to FIT’s CTO, POET’s technology will in turn enable FIT to ramp to high volume at a much faster pace and in a cost-efficient manner. There are no updated analyst estimates up until now, but I could imagine this deal to surpass the impact of the Celestial AI partnership by far.

The Financial Situation

Considering the criticism I addressed in my last article about POET, I am particularly pleased with the progress the company achieved regarding its financing issues as it completed two private placements and advanced sales through its at-the-market (ATM) offering. While shareholder dilution is never a nice thing, POET was in such a critical financial situation that the share price suffered badly and any activities to stabilize the situation must be welcomed. And as the stock price hovered at elevated levels after the aforementioned YouTube clip was published, POET managed to sell CAD10 million worth of shares twice – one at a price of CAD3.069 to a single institutional investor, and the other at a price of CAD2.90 to two further institutional investors. POET’s CEO commented in the earnings announcement that the interest of these institutional investors could, in fact, be attributed to the OFC exhibition as well:

The enthusiastic reception from OFC helped us to secure multiple successful capital raises from institutional investors committed to our company’s success. The additional capital fortifies our financial foundation as we navigate the next phase of our growth. (Suresh Venkatesan, CEO)

Moreover, the company declared to have earned another CAD10.8 million through its ATM offering in the United States at an average price per share of CAD2.17.

While POET had about one quarter of runway before these financing activities were completed, it can now sustain operations for about one year at a working capital cash position of USD22.8 million (end of Q1) and a quarterly cash burn rate of about USD5.5 million (average of the last two quarters). Yet, the company also reported an increased cash burn in the past quarter which could point to a higher cash use with ramping commercialization and manufacturing activities, and would shorten the company’s runway. Since the stock price is now, however, at much higher levels and the company seems on a good path to achieve contribution profits in the future, I feel much safer with the current capital situation. I will still keep my eyes open for increased cash burn in the coming earnings releases, though.

Outlook and Valuation

Compared to my last analysis, POET’s outlook has improved further – particularly regarding its commercialization activities, including new customer partnerships and a better visibility within the industry. Its situation is now also much more stable from a financial perspective, and I believe investors have it much easier now to focus on the company’s future potential. On the other hand, the past quarter still did not bring any signs and comments respective to when revenues will finally start to ramp and how quickly this might occur. It is therefore still next to impossible to assign a reliable valuation to POET which is based on future earnings potential.

Nevertheless, the one Wall Street analyst covering POET assigns a Strong Buy with a price target of $4.30. The only Seeking Alpha analyst covering the company, in recent times at least, is me, and I just upgraded my rating from Buy to Strong Buy, too. Moreover, Zack’s Small Cap Research analyst Lisa Thompson assigned a price target of $14.5 to the company – yet this report was published in October 2023, so before POET messed up a share issue last November and the stock price crashed. Still, if POET keeps executing the way it did in the last quarter, I feel the company could easily achieve the price levels it used to have a year ago at about $5. As soon as the company manages to show its full potential, I believe even the Zack’s target price should be within reach again – particularly since the report and the Wall Street price target did not yet include any potential from the Foxconn deal.

Involved Risks

As a small cap with largely unproven technological maturity in mass production and a low capital position, POET is subject to increased risk. Particularly if the technology proves to be more difficult to manufacture, costs could rise or timelines might become unsustainable and thus endanger the company’s persistence. Also, even though the situation is less critical now, POET still has a relatively low cash position and could at any time be forced to issue new shares with negative implications to the share price – as seen in November 2023. Additionally, as an innovative technology provider with no long-standing customer relationships, POET could be outcompeted by an even more innovative solution.

Furthermore, there is the usual regulatory risk in being active as a manufacturer and seller in the Chinese market, like I explained in my previous article. This is especially true for the currently heated regulatory battlefield of semiconductors:

Another potential risk stems from SPX, POET’s manufacturing JV in China. As we have seen repeatedly in the past, Chinese policy is not shy to suddenly regulate sectors when it would like to achieve certain goals. Semiconductors are additionally a field where China and particularly the US have been intervening heavily to secure strategic interest. If POET’s technology turns out to actually be revolutionary, it might be in the spotlight of political interest accompanied by trade restrictions or possibly even interventions regarding the company’s economic freedom. While it is important to acknowledge that China has lately been trying to increase investor confidence by granting more investment security and imposing fewer restrictions to foreign companies, risks still remain and relations with the western world might take a turn for the worse. (Last SA article on POET).

Final Thoughts

All in all, POET is clearly in a better position compared to back in February as it now exhibits a much better handle on its financial position and achieved a big success through its design win with Foxconn. The agreements and management commentary after the San Diego exhibition convey that POET’s technology is increasingly having an impact in the industry, and even big players have taken notice. Recent private placements with institutional investors at elevated share prices moreover show that capital market participants are more and more convinced of the company’s potential, too.

As a result, I upgrade my rating for the company from a Buy and to a Strong Buy now. I am now more convinced than ever that the technology is groundbreaking, and the recent agreements and private placements have substantially reduced the associated risks. Any position should, however, still be fitted in size, being aware of investors’ individual risk-appetite.