Jonathan Kitchen

Dear readers and followers,

Last November, I became the CEO of the London Stock Exchange, the stock market operator.OTCPK:LDNXF) (OTCPK:LNSTYI have focused on these types of businesses and have invested in Germany and other European countries. Stock market operators and brokers. There are also some new brokers, mostly digital. Brokers are, in my opinion, a very good investment at the right price. It is always good to be a company where someone earns money simply by “trading”. And these companies are doing exactly that.

Therefore, London Stock Exchange Group, located in one of the major financial hubs across Europe, appears to be a very attractive investment at the right price, as long as its fundamentals and margin tradition continue to grow at the high pace and quality that we have seen.

It’s worth it However, I do not own shares in this company yet, for the simple reason that the valuation is largely unattractive and as I stated in my previous article, this company is a “Hold” for me.

Since this article, which you can see here, The London Stock Exchange also generally underperformed the broader market, despite rising 15% – although the market and my own portfolio have ultimately risen much more than this.

The London Stock Exchange is back (Seeking Alpha)

London Stock Exchange – Updated 2024-2025

In my previous article, I pointed out the solid fundamentals and trends of this stock market operator, but it is not better than its peers. The company is smaller than its competitors, and I would argue that with Brexit, London no longer has the clout it once did, with Paris, Frankfurt, Amsterdam and Brussels slowly usurping its position as the leading financial hub. However, over the last few years I have increased my allocation to stock market operators overall and to European stock markets, with London and England being the latest example.

I have allocated funds to companies like Vodafone (Video on Demand), Reckitt Benckiser, National Grid (NG) are just a few that currently form a significant part of my portfolio and provide exposure to both the Islands and the British Pound.

On the surface, this company has some very solid benefits and trends that make it worth considering investing in. Gross margins are well above 85%, and given the company’s age, it wouldn’t be wrong to call this one of the oldest operating companies on the planet.

The only way to maintain a general level of attractiveness in this market is to have a vertically integrated operation in the market, and that is exactly what my investments in this space are, and LSEG is as well.

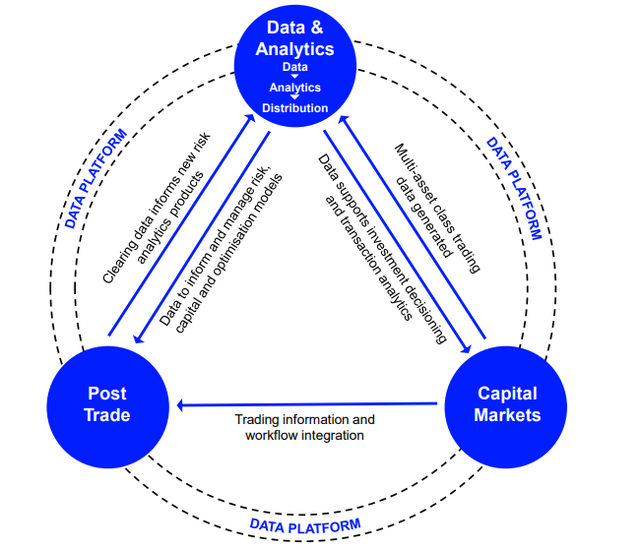

LSEG has exposure to capital markets, data and analytics, and post-trade services. It is not as strong as Deutsche Börse (OTCPK:DBOEY), and while it doesn’t have a market-leading position compared to Clearstream and others, it’s still an interesting and profitable business.

LSEG IR (LSEGIR)

And like its peers, the company expects double-digit growth across a range of areas, including investment solutions, trading and banking.

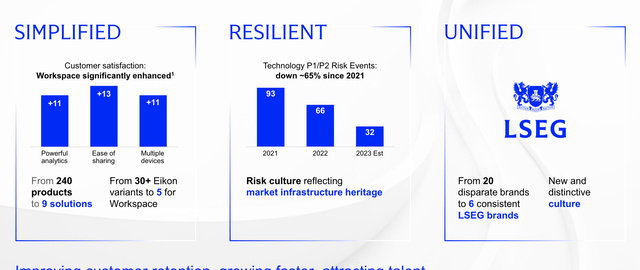

A final noteworthy result is the Q1 2024 results. The company has relatively recently (2020-2023) achieved its own growth targets and is performing extremely well in this regard. The consolidation and rationalization of over 240 products into just nine solution-based business models has improved efficiency, reduced risk and reduced LSEG’s consistent corporate brands from 20 to six.

LSEG IR (LSEGIR)

The company is not yet as good as its peers, but it has a long way to go, so I expect to see improvement here over the next few years.

Q1 2024 confirms these trends. The company has grown over 7% annually, with all divisions performing well, but Capital Markets is the driving force with over 14% growth year-on-year. The company’s subscription sales are growing at a 6% annual level, and the company has an aggressive capital allocation with £500 million earmarked for current and future share buybacks. The company is targeting over £1 billion in share buybacks, multiple bond refinancings, and several M&A during the quarter. In short, the company is growing strongly in this area, and we can expect to see more growth from LSEG in the future.

LSEG has expressed confidence in its growth prospects and has made clear in its performance-oriented approach that it believes it is likely to achieve its previously announced growth rates as of autumn 2023.

The company is also furthering its partnership with Microsoft, which at its current stage of development represents a broad and attractive segment at all stages of the deal and investment lifecycle.

LSEG IR (LSEGIR)

In addition to its partnership with Microsoft, the company also has a partnership with Aladdin, a subsidiary of BlackRock.blackAlthough the company is a UK company, it derives a significant proportion of its business mix from the Americas and 15% from Asia, with over half of the company’s business being conducted outside Europe and Asia. largely As expected, half of the business is sell-side, with buy-side making up just 17% of the total.

In terms of offering, LSEG remains a data-focused market player/firm – 50% of the company’s revenue comes from data and analytics, and just 5% from risk intelligence etc. However, post-trade and capital markets services are growing and a more diversified mix is part of what we expect from LSEG.

Despite significant fluctuations in the overall underlying market, the company has maintained a relatively stable and balanced organic growth rate.

LSEG IR (LSEGIR)

LSEG’s biggest weakness is that it is not a clear market leader in any one sector. It is a market participant in most sectors. Even in its largest sector, Data & Analytics, it only has a 10-12% market share. There are bigger players in this sector, and bigger players in Europe, so as long as LSEG remains “too expensive” relative to investment attractiveness, I will continue to keep an eye on these players.

Overall, I would say that the strong market in which LSEG operates makes it a very attractive base to invest in LSEG at the right price. The company’s partnership will add further value to the investment proposition here. Also, the fact that LSEG has significantly exceeded its transformation plan with only 15 months of execution shows that the company is on track.

Additionally, there remains a large untapped opportunity in the market that LSEG has “control over” in the form of OTC derivatives. This is a $39 trillion market that is currently over 49% unsettled. There is an increasing need for regulatory capital and counterparties need deal routing and contracting solutions. This is the direction the M&A company is heading and is perhaps one of the most interesting possibilities for LSEG.

LSEG IR (LSEGIR)

Therefore, I would say the company remains fundamentally attractive and that the main issue has been and continues to be valuation.

So let’s see what happens over the next few years.

LSEG – In my opinion, the company warrants lower prices

As mentioned here, LSEG is also the company’s native ticker on the London Stock Exchange (LSE).

The company typically trades at 20-21x P/E, which is above its 20-year average, and I have no problem projecting it at that level. That’s all it is worth. The company is A-rated and has a strong trend of beating or meeting expectations. And the chances of not meeting them are slim (paid FAST graph link).

The problem we face is the apparent premiumization of the company. On a 5-10 year average, P/E has risen to 26-29x, and I don’t see how the company can grow at this pace or sustain such a premium at this low yield in a world where risk-free rates are much better. That said, I believe the company should be trading much closer to where we originally expected it to be. Long-term trends.

What exactly does this involve?

Given that the current price-to-earnings ratio (P/E) is almost 28x, LSEG would need to get its P/E to at least 29x over the long term to achieve the 15% per annum RoR that I am looking for. This would entail 13-14% annualized EPS growth, which is above the company average and leaves LSEG with very little room for error.

This is not my preferred way of investing: valuing the company at a 20-year average P/E of 21x, this projection and estimate would result in an annual RoR of less than 3%, which is completely inadequate.

My last price target was around £72 per share. At present I have not changed this price target, which is at a level I saw in early 2023. There are more attractive companies in this space and this company is too expensive so I do not see it as an attractive potential at present.

Other analysts have given the company a range of targets, all above mine: 17 analysts have given the company a low of £86 per share and a high of £130 per share, with an average of £105 per share, and 6 analysts recommending a “Buy”.

In other words, analysts are now Explore The company has a price-to-earnings premium of 28-30 times. This is a position you can take, but I think it only works if you’re willing to accept not just the current growth rate, but a growth rate well beyond the projected growth rate. I think this is way too exuberant for this company.

We also believe there are many more attractive investments available at the moment.

So, here are my arguments against the company:

paper

- The London Stock Exchange Group is one of the largest stock exchange operators in Europe. The company is fundamentally a qualitative company and will not decline in the future. If properly valued, it is a “buy” stock that is expected to rise by double digits.

- Unfortunately, at this price, you’d need a P/E of 26-28x to see double-digit RoR growth of 15%+ per year. Well above averagewhich is well above the historical average P/E of 19-20x, and I believe this valuation is unsustainable in the long term.

- Looking at the most recent quarter, Q1 2024, the company doesn’t look all that attractive, so we maintain a conservative outlook and target price here, preferring to invest at lower prices. Let’s see how things go in Q2 2024.

- I have given the company a “Hold” rating here and set the PT at around £72 per share, which is a conservative view, but even in this sector there are better companies to invest in here.

Remember, I am all about:

1. Buy undervalued companies (even if the undervaluation is only slight and not mind-bogglingly large) at a discount, allow them to normalize over time, and earn capital gains and dividends.

2. If the company becomes overvalued far beyond normal, I take my profits, switch my position to other undervalued stocks, and repeat #1.

3. If the company is not overvalued and remains within its fair value range or goes back to being undervalued, buy more as time allows.

4. Reinvest earnings from dividends, savings from work, or other cash inflows as specified in 1 above.

Here are my criteria and how the company meets them:Italics).

- This company is overall high quality.

- The company is fundamentally safe, conservative and well-managed.

- The company pays a well-covered dividend.

- This company is currently cheap.

- This company has realistic upside potential based on earnings growth or price multiple expansion/reversion.

That said, I don’t think the stock’s upside potential is significant enough to interest me compared to its much more attractively valued peers. I’m giving the company a “Hold” rating here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.