blackred/E+ via Getty Images

Motor Car Parts of America (Nasdaq:MPAA) has seen its shares fall in recent years, mainly due to a surge in interest costs on new debt. The stock has fallen from nearly $20 in November. With the stock price exceeding $10 in 2022 and then just above $10 in February 2024, most investors decided not to own the stock. And you can’t blame them.

StockCharts.com – US Auto Parts, 24-Month Daily Price and Volume Change

According to the Motorcar Parts of America website, the company is a leader in remanufacturing and supplying best-in-class under-hood and under-body parts, with over 4,700 employees in 13 locations across seven countries. Thousands of individual products for nearly every vehicle on- and off-highway are sold to 7,700 auto parts retailers and distributors. Key products include alternators, starters, wheel bearings and hub assemblies, brake calipers, brake master cylinders, brake power boosters, rotors, brake pads, turbochargers, and more. In addition, the company also designs and manufactures: We manufacture testing solutions for performance, durability and testing of electric motors, inverters, alternators, starters and belt starter generators.

Motor Car Parts of America – May Investor Presentation

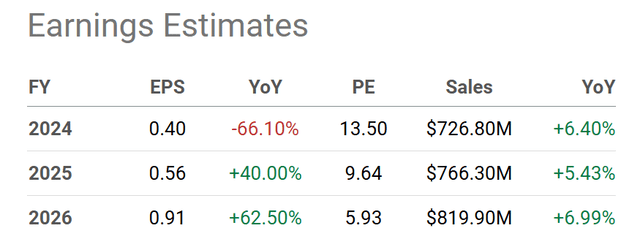

The good news is that the business is actually doing pretty well, with operating profit hitting a five-year high of $48 million over the last 12 months (thanks in part to older cars still on the road since the pandemic), and lower debt levels should help the company see rapid improvement in cash EPS starting in the second half of 2024.

Seeking Alpha Table – Motorcar Parts of America, analyst forecasts 2024-26, created 6/6/2024

My bullish conclusion is that even if interest rates fall and a soft landing occurs by 2025, the total “enterprise value” of the stock, including both equity and debt, is simply too low. In fact, MPAA is priced as if it were in a deep recession similar to that in late 2008 and early 2009. To me, this high value proposition leaves plenty of room for stock appreciation, assuming the economy doesn’t collapse anytime soon. Let me explain.

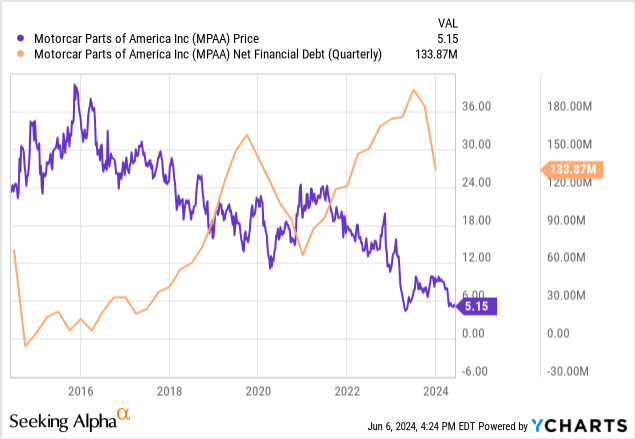

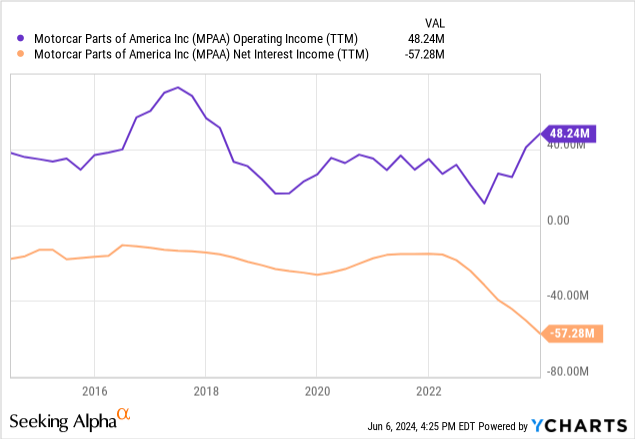

Debt issues

The chart below shows the inverse correlation between the increase in financial debt (net of cash, excluding leases and other long-term contractual obligations, an additional $280 million at the end of December) and the decline in the share price since 2014. The second chart shows that while operating profit levels have remained fairly stable at around $40 million (before interest expense is taken into account), net interest expense has ballooned since the beginning of 2016 due to a sharp increase in borrowing rates (plus contract fees). Note that when Motorcar Parts had almost no debt in 2015 and 2016, the share price was over $30.

YCharts – US Auto Parts, Rising Debt Levels and Falling Stock Prices, 10 Year Period YCharts – Motorcar Parts of America, Operating Income and Net Interest Income/Expense, 10 Years

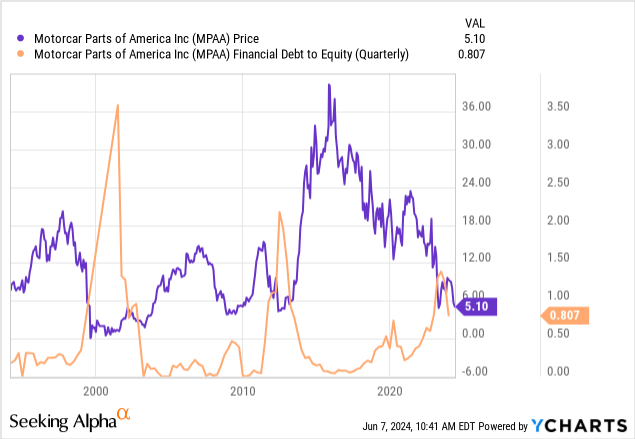

Another way to look at the situation is to look at how stock prices have trended as a function of debt-to-equity ratios since 1994. Again, high debt leads to poor stock prices, so reducing debt should be a top priority if management is committed to future investment returns for shareholders.

YCharts – US Auto Parts, Debt to Equity Ratio, Since 1994

Recession-like undervaluations

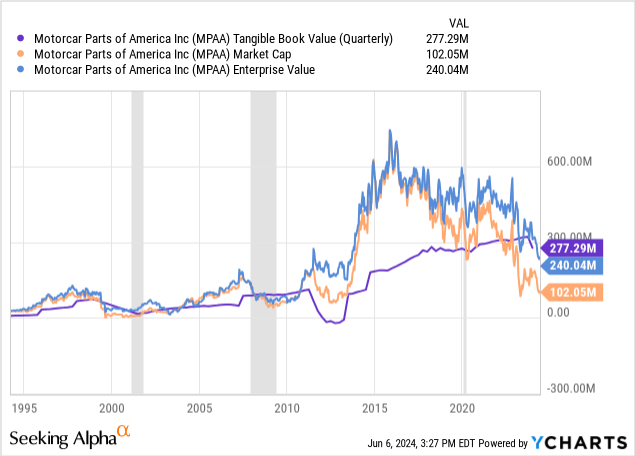

Because there are many moving parts in terms of financial engineering and leverage, including a large one-time charge associated with accounting changes in fiscal 2024, I believe the best way to value the company is through the total acquisition price, which includes the total debt and equity. What I am looking at today is the enterprise value (EV) calculation.

Comparing market capitalization or net enterprise value to tangible (net tangible asset) book value shows that Wall Street is applying an abnormal discount to the business compared to normal cost/depreciation accounting. The discount today is as large as it was at the bottom of the Great Recession of 2008-2009 and during the dot-com bust recession of 2000-2002. A great buy argument can be made from this data set alone.

YCharts – US Auto Parts, Tangible Asset Value, Market Cap and Enterprise Value, 1994+

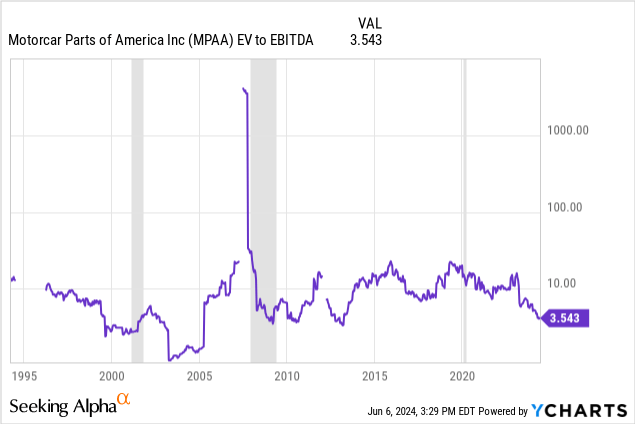

Perhaps even better evidence of a long-term bottom can be found in the cash EBITDA to sales ratio versus enterprise value. EV to EBITDA statistics over the past 30 years show MPAA to be a great buy (assuming a major recession is avoided). The current multiple of 3.5x is the lowest since 2013.

YCharts – US Auto Parts, EV vs EBITDA, since 1994, recessionary portions shaded

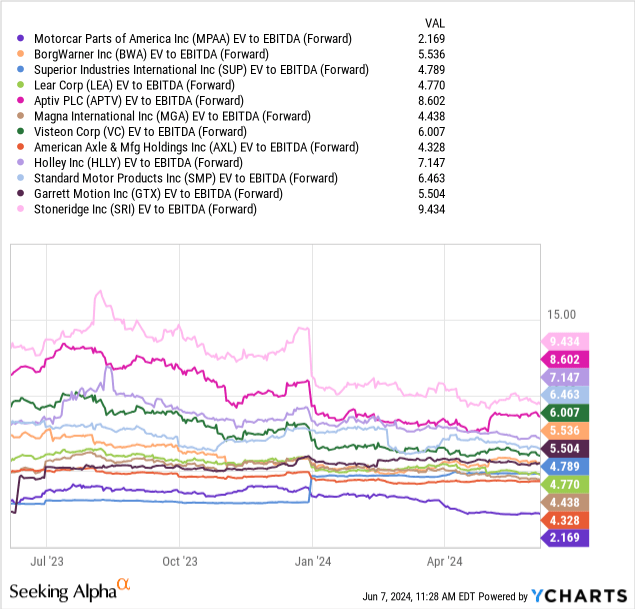

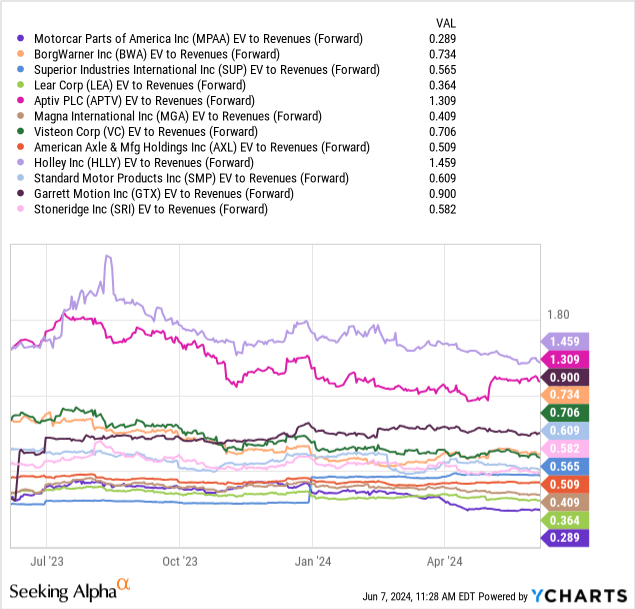

Next, if we compare Motor Car Parts of America’s EBITDA valuation to its peers in the auto parts industry, we see that the stock is indeed a bargain. Its 2.1x estimate is well below the industry average of 5.5x (a 60% discount, actually), making it a much better bargain than it was a year ago. My peer classification grouping includes: BorgWarner (BWA), Superior Industries (Sip), rear (Lee), Aptive PLC (APTV), Magna International (MGA), Visteon (VC), American Axle (AXL), Holly (HLLY), Standard Motor Products (Hmmmm), Garrett Motion (GTTX), and Stone Ridge (SRI).

YCharts – Comparison of Motor Car Parts of America with other companies in the industry, EV and future expected EBITDA, 1 year

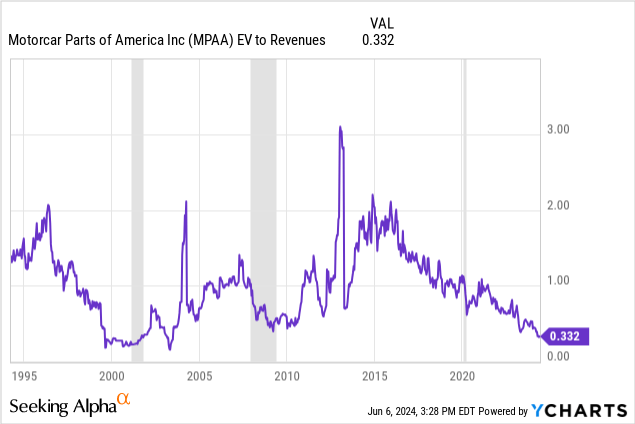

The bullish setup continues to impress in the EV-to-revenue statistic, with MPAA’s historic figure of 0.33x actually lower than the key stock price bottom in 2009. Only a few years in the last 30 years have offered more sensible sales valuations, including the months of 1999, 2000, 2001, and 2003.

YCharts – US Auto Parts, EV vs. Revenue, since 1994, recessionary portions shaded

Considering peer valuations for projected revenues for the remainder of 2024, the EV-to-future revenue ratio is 0.29x, roughly half the sector median average of 0.6x.

YCharts – US auto parts manufacturers and industry peers, EV and future forecast sales, 1 year

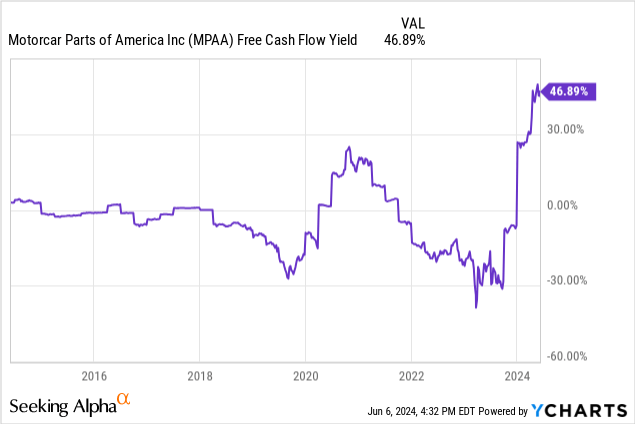

Finally, Wall Street loves free cash flow generation, but it doesn’t like it being generated by Motorcar Parts of America, so shouldn’t investors flock to the nearly 50% FCF yield, a 10-year high, on an abnormally low $5 share price?

YCharts – Motor Car Parts of America, Free Cash Flow Yield, 10 Year

Final thoughts

Despite favorable underlying business trends, bearish analysts and investors may be overly focused on MPAA’s debt/interest expense (which could easily decline over time), worrying about the impact of the recession on overall demand for auto parts, and only looking at negative numbers due to temporary accounting changes.

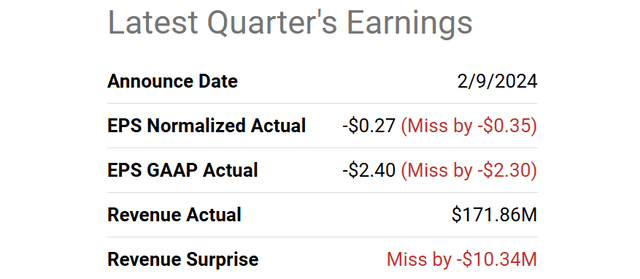

We’ll likely learn more about the health of the company’s business when it reports its fourth-quarter earnings on June 11. Analysts are expecting normalized EPS of $0.16 on revenue of about $200 million. It will be difficult for the company to report earnings that are as disappointing as last quarter’s.

Seeking Alpha Table – Motor Car Parts of America’s third-quarter fiscal 2024 earnings disappoint

Admittedly, the charts for auto parts are downright ugly. But prices remain near last year’s bottom of $4. Signs of a sell-off are showing up in my short-term proprietary momentum formula. But I can’t guarantee that a final bottom has been reached. Overall, I recommend MPAA as a long-term undervalued stock, pure and simple.

The recession and the period before and after it were not very kind to MPAA investors, which is the main reason to be cautious about the stock, and also the next logical excuse for the weak share price after factoring in the excessive debt use.

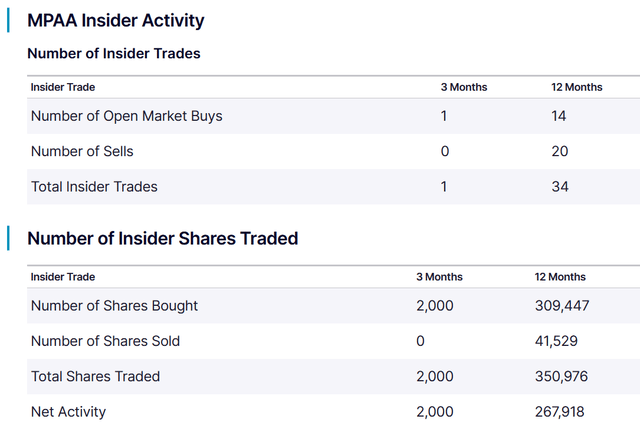

What are the other trading risks? MPAA is a small organization, so any major changes in business conditions will be seen by management and insiders before the general investor public. In this regard, I view the moderate level of insider buying activity as a positive. I remind readers that smaller companies tend to have higher share price volatility and may experience meaningless short-term fluctuations. This is often the result of a single hedge fund or investor acquiring/liquidating a major position.

Nasdaq.com – Motor Car Parts of America, Insider Trading Activity, June 7, 2024

On the positive side, I strongly believe it would be prudent for another auto parts manufacturer to acquire the company at this low valuation. A takeover offer of up to $10 per share would be of great value to various large players in the industry. The total acquisition price, including debt extinguishment, would be approximately $350 million, allowing one owner to earn up to $75 million in EBITDA and over $50 million in pretax operating profit in 2025.

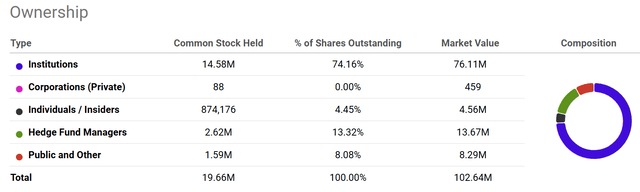

With an ownership structure of insiders and management holding less than 5% of the outstanding common stock, a premium takeover bid, especially one bid nearly double the current market price near the 52-week high, should have a higher chance of success.

Seeking Alpha Table – Motor Car Parts of America, Shareholder Ownership Breakdown, March 2024

When weighing the risks of a recession against the potential benefits in a growing macroeconomic environment, I believe Motor Car Parts of America’s stock price is too cheap to ignore. buyand holds a small position. With a market cap of approximately $100 million, MPAA is a speculative security and would benefit from a low weighting in portfolio construction.

Thank you for reading. Please consider this article as the first step in your due diligence process. We recommend consulting with a registered and experienced investment advisor before making any transactions.