we

introduction

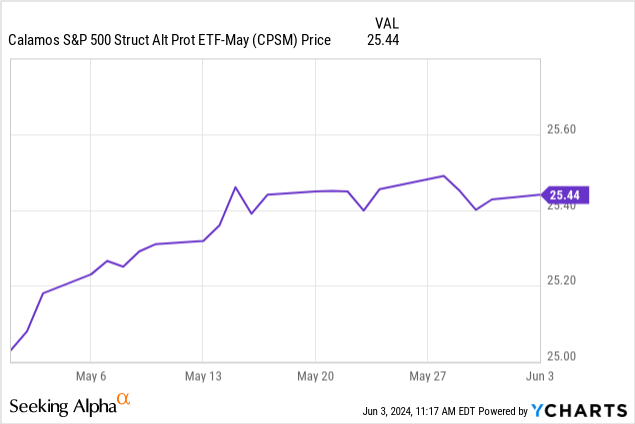

The perfect stock investment is one that gives unlimited access to the potential for capital gains without the risk of loss. More sophisticated investors may know of such an opportunity, but I have yet to find one. Recently, I Innovator US Equity Power Buffer ETF – October (Pokot), which compromises both desired outcomes: limiting ascent and descent (Article LinkCalamos is Calamos S&P 500 Structured Alternative Protection ETF – May (NYSEARCA:CPSM) offers 100% more downside protection (net of fees) than the Innovator ETF, but upside risk is still limited. I liked the POCT ETF enough to rate it a Strong Buy, so I opened a position. The CPSM ETF has only been around for a month, so it is too new to rate it a buy at this point. But it’s worth keeping an eye on. Rating: Hold.

Calamos S&P 500 Structured Alternative Protection ETF – May Review

Seeking Alpha describes the ETF as follows:

The investment seeks to provide investment results comparable to the positive price returns of the SPDR® S&P 500® ETF Trust, before taking into account fees and expenses. Under normal market conditions, the Fund will invest substantially all of its assets in FLexible EXchange Options (“FLEX Options”) that reference the price performance of the SPDR® S&P 500® ETF Trust. FLEX Options are customized equity or index option contracts that trade on an exchange, but allow investors to customize key contract terms, including strike price, style and expiration date. The CPSM was launched on May 1, 2024.

sauce: SeekingAlpha.com CPSM

CPSM has $109 million in assets under management and charges fees of 69bps. The ETF does not yet pay a dividend, and I suspect its structure minimizes or even completely eliminates the possibility of it ever paying a dividend.

The manager describes the ETF as follows:

Calamos Structured Protected ETFs™ are designed to match the positive price returns of the S&P 500® up to stated limits while providing 100% one-year loss protection (before fees and expenses).

Major features

- 100% capital protection. There is no downside risk over the one-year outcome period.

- Upside participation defined. Exposure to the S&P 500® is capped.

- Tax Alpha. It seeks tax-deferred growth within a tax-efficient ETF framework.

Portfolio Adaptation

As a tax-advantaged cash alternative: With the potential for stocks to rise and no risk of decline, you activate your cash on the sidelines.

For retirees looking to reduce risk: Preserve capital near or during retirement.

For equity risk management: For investors who do not want to take on the risk of market downturns, it offers 100% capital protection on equity exposure.

sauce: calamos.com/funds/etf

The cap rate resets each May. Beginning May 1, 2024, CPSM’s starting cap rate is 69bps, a 9.81% gross annual expense ratio. Because both the cap and loss protection move, the initial cap rate and 100% protection (before fees) only apply to investors who buy on May 1 and hold for one year. Current cap/floor limits are posted on the ETF’s website. As of today, the net cap is 7.41% and the net floor is 97.67%, as the ETF has increased in value since the start of the “contract” year.

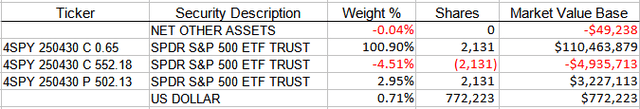

Review of holdings

A significant holding of this ETF is the use of FLEX options, for more information CPSM ETF Prospectus.

Exposure to the S&P 500 Index is through the first listed call option. Possible profits are limited by the sale of the second listed call option. Protection against downside is provided by the purchase of put options. All options expire at the end of the contract year, so no changes to positions other than amount are required. In effect, the manager charges 69bps and only needs to adjust each position as money flows in and out of the CPSM until the options expire next April.

Distribution Review

Because the ETF does not directly own shares in the S&P 500 Index, it is not entitled to receive dividends from the index constituents and therefore you should not expect to receive any dividends from this ETF.

Risk Analysis

The basic strategy is sound. When you sell a call, all the shares represented by the FLEX call option are called. The put option covers 100% of the loss of the S&P 500 Index if it falls below the strike price ($502.13). The premium earned is offset against the premium paid and is used to set the initial strike price of all options. FLEX options and call/put options are guaranteed to settle by an options settlement company. If they default, it would be a major blow to the US economy.

Portfolio Strategy

There seems to be a constant stream of unique investment options. Innovative ETFs and Calamos ETFs broaden that universe, catering to investors who are willing to forgo some capital gains in order to limit losses. This becomes even more important as retirees slowly get older. For my 93-year-old mother, these ETFs are a great way to invest in stocks without any risk of loss.

Based on this Calamos Structured ETF ReportOver the next 12 months, the company plans to launch quarterly versions based on the S&P 500, NASDAQ 100 and Russell 2000 indexes.

Final thoughts

For these and similar ETFs, buying after the start of the year can drastically change the results, as can be seen here: if the market has fallen since the start of the year, then both values (upper and lower limits) provide better value. This is not the case with the CPSM, so both values are not as good as they were at the start of the CPSM.