Richard Drury

Seema Shah, Chief Global Strategist

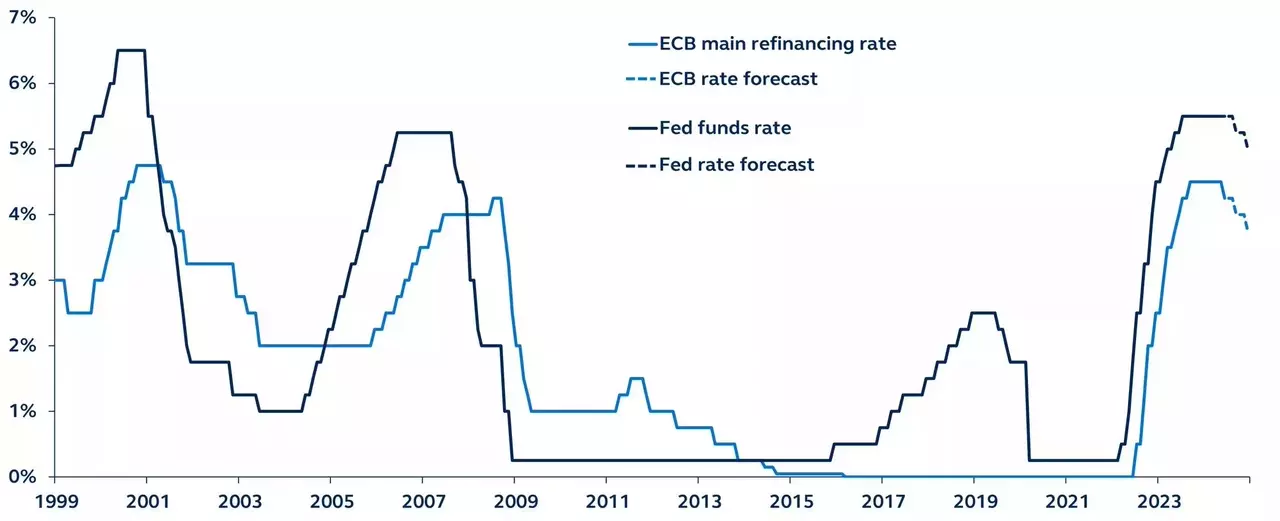

The European Central Bank’s decision to cut interest rates by 25 basis points ahead of the Federal Reserve highlights the difference between the post-COVID economic recoveries in the eurozone and the United States.

As the euro area grows Given that eurozone interest rate cuts have been delayed and inflation has fallen from its peak, the ECB’s aggressive stance is justified. However, this divergence could put pressure on the euro and reignite inflation concerns. Future ECB rate cuts are likely to be in line with the Fed’s schedule.

ECB vs. Fed policy interest rates

1991 – Present

sauce: Bloomberg, Principal Asset Management. Forecasts are Principal Asset Management forecasts. Data as of June 7, 2024.

The European Central Bank (ECB) cut interest rates by 25 basis points on Thursday. In contrast, the Federal Reserve (Fed) is expected to keep rates on hold when it meets this month.

Typically, the Fed They should lower interest rates before they do. Indeed, until yesterday, the ECB had never cut interest rates before the Fed. But with the Eurozone experiencing significantly weaker post-COVID growth than the US, and headline inflation in the Eurozone plummeting to 2.6% from a peak of 10.6%, the ECB had strong reasons not to wait for the Fed.

Still, the ECB will be wary of a shift in policy direction: a widening gap between U.S. and euro zone policy rates could put downward pressure on the euro and raise inflationary pressures. The ECB has every reason to fear such a development.

While the euro zone’s inflation efforts have been impressive, with recent inflation and wage data showing stronger-than-expected gains, a further weakening of the euro would add to concerns that de-inflation in the euro zone may be stalling.

Global policy coordination is needed. The next ECB rate cuts will likely come in September and December, when the Fed is also likely to cut rates. But if the Fed postpones the start of its easing cycle until early 2025, the ECB’s next move could be delayed as well. A longer period of higher US interest rates means a longer period of higher European interest rates.

Editor’s note: The summary bullet points for this article were selected by Seeking Alpha editors.