Sakorn Sukkasemsakorn

Introduction:

This article is specifically for income investors who prioritize income over growth. It does not mean they should overlook growth, but it is not all about growth. If you are at a stage where you do not require income for several years or decades, then there may be other strategies that would be equally or more appealing and should also be considered. Income can be important for younger folks as well. If you want to have financial freedom at a relatively younger age (let’s say 50 or even earlier), you need to generate income that is sufficient to cover your basic expenses that cover all your needs, not wants.

Most retirees and near-term retirees need some form of income. Sure, folks at age 67 can hope to get social security payments, but it is usually not enough for all their needs. In fact, one can be eligible to get social security starting at age 62, but that reduces the benefit amount substantially for life. So, this decision should be taken very carefully.

How Much Income Is Enough?

So, how much income is enough? This depends on several factors. The most important factors are your spending needs and the age at which you would require the income. For example, if you want to retire at 62 but do not wish to draw on social security until 67, you have to come up with much higher income levels for the intervening five years. However, the income requirement can then dramatically fall once the social security payments kick in. The spending needs can vary from person to person and depend on the place of retirement as well. Also, if you are carrying any mortgage or loans into retirement, that would increase your income threshold. For most folks, we think 70% of their pre-retirement income should suffice for a comfortable retirement, but it can vary.

Compounding of Income:

Just like you need to start early in life to save and invest, it is also important to convert to an income portfolio (rather than a growth portfolio) at least 5-10 years prior to retirement. Growth investing or income investing each requires a different mindset. These few years can give you a head-start to convert your portfolio gradually and also to compound your income and take it to a level where it needs to be.

We will try to explain with the help of an example:

Let’s say if you invest $500,000 at the age of 50 in dividend stocks, yielding an average of 4%, your income would be $20,000 a year. Now, let’s assume that these dividend payers grow their dividends at an average rate of 6% annually, which is typical for 4% dividend payers. By the time you are 62 years old, your dividend income will have doubled to $40,000 from the same portfolio. Obviously, you would probably have saved more during this time, which can now provide additional dividend income. As a second example, let’s say, at age 50, you invested the same $500,000 into relatively safe stocks or funds, yielding an average of 8%, providing an immediate income of $40,000 a year. Now, these companies will likely grow at a slower pace; we will assume that they will increase their dividends at an annual average rate of only 2.5%. In the next 12 years, at this rate, your annual dividend payment should grow to $53,800.

Funds versus Individual Stocks:

We will provide two strategies, one for passive investors and the second one for active investors:

- 8-fund portfolio for passive investors

- 15 individual stocks and 3 CEFs portfolio for active investors.

I) 8-Fund Portfolio

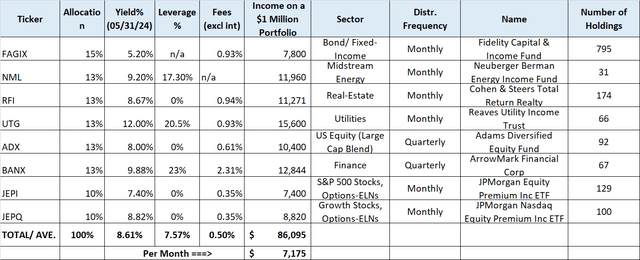

Here is the portfolio with eight funds with an average income yield of 8.6%, hypothetically generating roughly $7,000 monthly on a portfolio of $1 million. If income was not needed, it could be reinvested to make the capital and the income grow faster.

Table-1: 8-Funds Portfolio

Note: ADX used to pay most of the distribution annually, but they have now announced a new policy of distributing roughly 2% every quarter.

Portfolio Analysis:

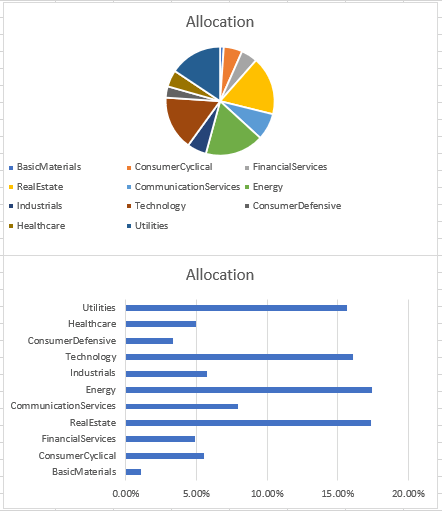

Using the Morningstar X-ray, this is the allocation of the portfolio.

Chart-1:

Author

The Individual Funds

- Fidelity Capital & Income Fund (FAGIX):

For the fixed income (or bonds) category, we like Fidelity’s mutual fund FAGIX. In fact, this fund falls under the “high-yield” bond category. Its official benchmark is “ICE BofA US High Yield Constrained Index.”

The fund has a solid long-term record of performance, and that is the reason it has a 5-star rating from Morningstar. The fund’s inception was in 1977 and has provided an annualized return of 9.39% since inception until Mar. 2024. Now, that is a pretty good record for a bond-centric fund. It has been managed by the same manager, Mark Notkin, since 2003. The recent performance is not that stellar, as it was a difficult period for bonds. For the last 1, 3, 5, and 10-year periods, it has returned 13.46%, 4.22%, 6.99%, and 6.24%, respectively, and outperformed its benchmark by at least 2% points (if not more) for each of the periods.

The fund yields roughly 5.2%. It must be kept in mind that this is a bond-centric fund, and its total returns are likely to be inferior to those of stocks. However, we are keeping a 20% allocation for retirees who need some diversification in bonds.

- Neuberger Berman Energy Infrastructure and Income Fund (NML):

We want to keep one fund from the mid-stream energy industry, as they can provide a reliable stream of income. We like the Neuberger’s fund, as some of the best names in the mid-stream industry make up its top-10 list. The leverage is reasonable at 17% and currently offers a 12% discount.

As such, in the midstream space, we like 3 individual companies that one can buy in place of a fund. These three are Enterprise Products Partners (EPD), MPLX LP (MPLX), and Energy Transfer LP (ET). However, these three are Master Limited Partnerships, and they usually come with a K-1 (partnership Income) form at tax time instead of a 1099-Div form.

- Cohen & Steers Total Return Realty (RFI):

Real estate is an important asset class that should be part of any portfolio. Sure, if you already have physical real estate (other than the primary home), that would suffice, but physical real estate comes with a lot of headaches and is not cut out for everyone. RFI will give us wide exposure to the real estate sector in the U.S. with one click of the mouse, along with a decent income. The fund uses no leverage, which is a good thing in the present circumstances.

The real estate sector has been out of favor for the last couple of years due to the high interest rates, but these are cyclical and will change at some point in time. Besides, if history is any guide, in the longer term, RFI has provided very decent total returns. Since its inception in 1993, until the end of 2023, the fund has returned 9.44% (annualized) on an NAV basis, compared to 10.03% for the S&P500.

Some of the top holdings are American Tower (AMT), Prologis (PLD), Welltower (WELL), Simon Property (SPG), Invitation Homes (INVH), Digital Realty (DLR), and Realty Income (O).

- Reaves Utility Income Trust (UTG):

Utilities are known for providing higher income in the range of 4%. To elevate this income to 8%, we can invest in one of the best quality Utility closed-end funds. It offers consistent and reliable dividends and nearly matches the returns of the S&P 500, though on a long-term basis. Most income securities, including Utilities, had a tough couple of years due to the high interest rates environment. But that is likely to change in 2025, if not in 2024. In the meanwhile, we will get 8% income while we wait for recovery.

Some of the top holdings are Constellation Energy (CEG), Public Service Enterprise (PEG), Deutsche Telekom (OTCQX:DTEGY), PPL Corp (PPL), CenterPoint Energy (CNP), NiSource (NI), Talen Energy (OTCQX:TLNE), and CMS Energy (CMS).

- Adams Diversified Equity Fund (ADX):

This fund has a very long history (incepted in 1929) and has survived the great depression and many more recessions. The fund’s main objectives are reasonable income on an annual basis, preservation of capital, and seeking long-term capital appreciation. Until now, the fund had a policy of distributing at least 6% of income, most of which was distributed at the year’s end. However, that is about to change. The fund recently announced that it will distribute 8% of income, with 2% in each quarter. So, basically, the distribution has been raised to a very decent level, and the frequency will be rather regular. Since the announcement, some of the discounts have narrowed down. You can read our detailed analysis of this fund in a recent article here.

- ArrowMark Financial Corp. (BANX):

BANX is a closed-end fund that invests to a large extent in regulatory capital relief securities (87% of the total) but also in preferred equity, subordinated debt, convertible securities, and common equity. The primary objective is to provide a steady high income and, more or less, a stable NAV. It offers investors exposure to floating rate instruments that have been benefiting from the rise in interest rates. This should also appeal to investors who like the distribution to be well covered by their investment income. The current yield is 9.88%, and shares are trading at an over 15% discount.

However, please keep in mind that with close to 10% distribution income, there is not much scope left for capital gains, but we do get special distributions now and then. Also, the fund is currently trading at a 15% discount to its NAV, which provides some margin of safety. The fund raised its quarterly dividend from $0.39 to $0.45 a share in October 2023. There is some concern that with rates starting to decline in 2024 and 2025, the fund’s investment income may go down (due to exposure to floating-rate instruments), but those issues may be overblown.

Both JEPI and JEPQ are income-focused ETFs offered by JPMorgan. The funds are fairly new. JEPI was launched in 2020, while JEPQ has an even shorter history, as it was launched in 2022. JEPI is invested in the major stocks that make up the S&P500, while JEPQ is invested in large-cap growth stocks in the U.S. that are part of the Nasdaq index. Both funds write covered calls on their respective indices. The primary objective of the fund is to deliver a monthly income stream from the option premiums and stock dividends. The other objective is to get a significant portion of the total returns of their respective indices with lower volatility.

Since these are option-based products, in a bull market, the investor is likely to forego some of the upside of the underlying stocks, so overall, the returns will likely lag their respective indexes. However, these funds are also designed to offer some protection during a down market. Another plus point is that by investing in JEPI and JEPQ, we are getting exposure to a large number of high-quality large-cap stocks, while it commits roughly 20% of net assets to ELNs to generate income. These funds use a complex approach of using ELNs (Equity-Linked-Notes) instead of writing straight-covered calls. The ELNs that the funds invest in are derivative instruments that are designed to offer the economic benefits/loss of the covered calls written on the respective indexes.

In the case of JEPI, the trailing 12-month yield is a bit lower than in previous years but still decent at 7.33%. JEPQ yield is higher at 8.80%.

As we would expect, JEPQ is filled with large technology names, and some of its top holdings are Microsoft (MSFT), Nvidia (NVDA), Apple (AAPL), Alphabet Inc (GOOGL), Amazon (AMZN), Meta Platforms (META), and Broadcom (AVGO).

Some of the top holdings of JEPI are also the top names in the S&P500. In the top 10, besides some of the top technology names, it has Trane Technologies (TT), Progressive (PGR), Southern Co (SO), Mastercard (MA), and Visa (V).

II) 18 Individual Stocks/Securities Portfolio:

We carefully selected 15 individual stocks from as many industry segments as possible and 9 different sectors. Our criteria for selecting these stocks are as under:

- Three of the companies were selected for high growth and growing dividends, Microsoft (MSFT), Automatic Data Processing (ADP), and Morgan Stanley (MS). However, MSFT is mainly for growth as dividend yield is very low.

- Three companies are selected based on their high but relatively safe yield. They are MPLX LP (MPLX), Ares Capital (ARCC), and BCE Inc. (BCE). The dividend safety and reliability of MPLX and ARCC are strong, while BCE is mediocre.

- Three companies are REITs, though from different sub-sectors of the real-estate sector. All of them offer 6% plus yields. These are Realty Income (O), Gaming and Leisure Properties (GLPI), and Crown Castle (CCI).

- Two companies are selected for the decent moat, stable dividends, and leadership in their respective industries. They are PepsiCo (PEP) and Chevron (CVX).

- Bristol Myers Squib (BMY) and British America Tobacco (BTI) were selected for very attractive valuation, high income, and contrarian plays.

- (RIO) was selected for high income and as commodity play. Also, Bank of Nova Scotia (BNS) is one of the major Canadian banks with over 6.5% plus yields.

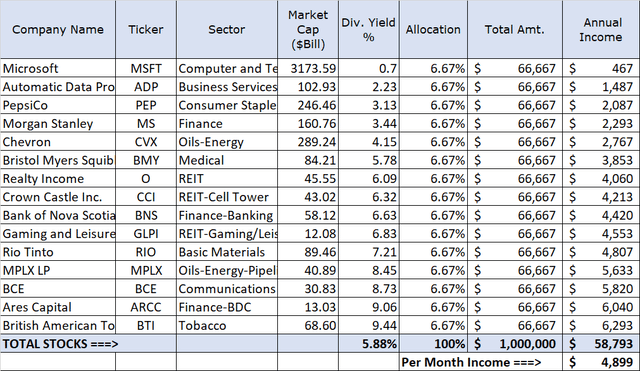

Table-2: Portfolio of 15 DGI stocks

Now, as you can see in Table-2, this portfolio of 15 stocks will provide nearly 6% income. It is reasonably high and may be sufficient for most folks, but it is still no match to the fund portfolio. There is only so much income you can get from individual stocks unless they are weighted heavily in certain sectors.

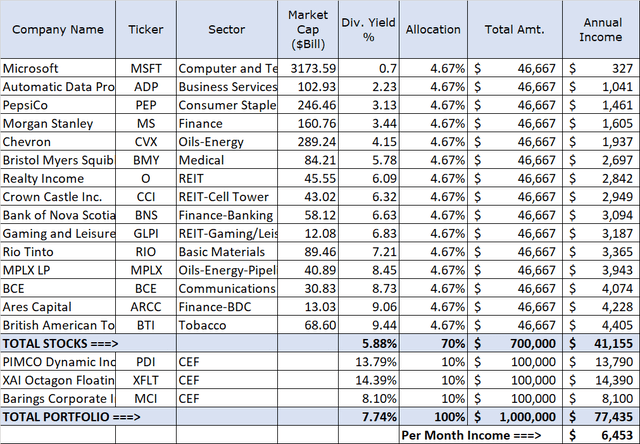

For folks who need higher income, we will have to add three high-income CEFs, each with a 10% allocation, while the DGI stocks allocation will need to come down to 70%. Please be aware that the inclusion of these high-income CEFs certainly raises the risk profile of the portfolio to a certain extent. Here is the revised portfolio.

Table-3: Portfolio of 15 DGI stocks and 3 Funds

Note: Readers who may like to have more information on Barings Corporate Investors (MCI) can read our previous article here.

Likely Risks with the Portfolio:

Here are some risks with the above portfolios that the investors should be aware of:

• No Downside Protection: There is no downside protection in these portfolios. During the 2008-2009 financial crisis, a portfolio of this kind would have had a drawdown of roughly 45% to 50%, very similar to the S&P 500. However, the difference was that this portfolio would have continued to provide roughly the same income during the crisis period. That should make it much easier to ride down any such difficult period.

• Valuation: The broader market is at an all-time high. Many of the funds and stocks in the above portfolios may be overvalued at this time. Some of them may be trading at a premium to NAV. One way to mitigate this risk is to buy in multiple installments using the dollar-cost average method.

• Interest Rates Uncertainty: The Fed has been giving mixed signals. Inflation has been in a downtrend but certainly not where the Fed needs it to be to start cutting rates. There is a level of uncertainty about the direction of rates. They may stay at their current levels for much longer than many people expect. Many of the funds in this portfolio, especially the ones with leverage and focused on a fixed income, will likely underperform. Even the technology sector is highly sensitive to the interest rates. One way to mitigate this is to diversify and invest gradually for the long term.

• Unexpected situations: The future is always unpredictable, and the portfolio may not perform as we expect. The only way to mitigate this risk would be to monitor the funds/stocks at least periodically and make sure that nothing has changed fundamentally.

• Market risk: Obviously, there is a market risk with any portfolio. If the broader market were to enter into a prolonged downturn, this portfolio would perform in line with the market. In certain situations, it could even perform worse. To mitigate this risk and allow a faster recovery, the investor should withdraw less income during the down-market years and possibly more during the bull years.

Concluding Thoughts:

We have presented two alternative portfolios in this article, providing $6,500 to $7,000 a month on a one-million-dollar investment. The first one is with just eight funds, which makes it highly diversified and very easy to implement. It also met and exceeded our income threshold.

The second alternative presented was a 15-stock portfolio, but it failed to match the income threshold of $6,500 a month. We subsequently added three high-income funds with a 30% allocation (leaving 70% for DGI stocks) to elevate the income to $6,500.

In our opinion, folks with less requirement (of income) should go for an all-stock portfolio, while folks who want or need higher income should opt for the 8-Fund portfolio. Each one has pluses and minuses. In the end, it boils down to individual temperament, needs, risk tolerance, and preferences.