OZK Bank

introduction

Bank OZK (Nasdaq:Ozuku) has struggled recently as the market continues to focus on the negative impact that commercial real estate has on bank loan balances. Author Mark Dockray writes: Citigroup (C) OZK under torpedo attackBank OZK has a clear overweight position in CRE as a portion of its total loan book, but the average LTV ratio for this segment remains low. In fact, total delinquent loans actually fell in the first quarter of this year, even as loan book grew. Meanwhile, the bank is forecasting record profits this year, which is why I’m taking a closer look at preferred stocks, as well as considering investing in common stocks.

Yes, the balance sheet is exposed to CRE

Before we discuss bank balances Before preparing the financial statements, I think it is important to first take a closer look at the bank’s earnings profile. After all, the higher the earnings, the higher the potential loan loss reserves a bank can set aside to cover potential losses.

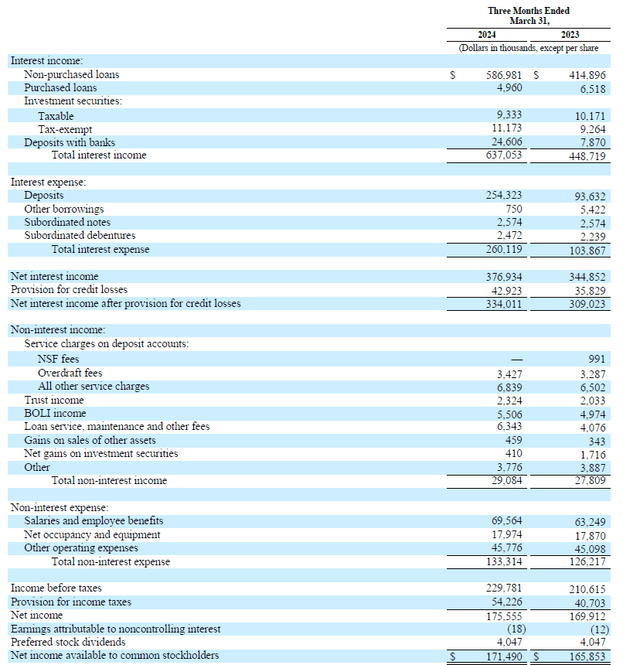

And that is where OZK Bank is succeeding. As shown below, the bank’s interest income increased from just under $450 million to more than $637 million in the first quarter of the current fiscal year compared to Q1 2023. Total interest expenses also increased, but Net interest income increased from just under $345 million to nearly $377 million.This represents an increase of $32 million.

Another great achievement of OZK is Manage other operating expensesNon-interest income increased by just $1.2 million, while total non-interest expenses increased by just $7 million. This allowed Bank OZK to report income before taxes and loan loss reserves of approximately $273 million. Bank OZK recorded a loan loss reserve of $43 million and a tax expense of $54.2 million. Net income was just over $175 million.

From this amount, we must deduct the quarterly preferred dividend of $4.05 million, resulting in first quarter net income attributable to Bank OZK shareholders of $171.5 million, or $1.51 per share, a 6% increase compared to Q1 2023 EPS of $1.42. Needless to say, the preferred dividend was well covered, with the bank being able to cover it with less than 3% of Q1 net income.

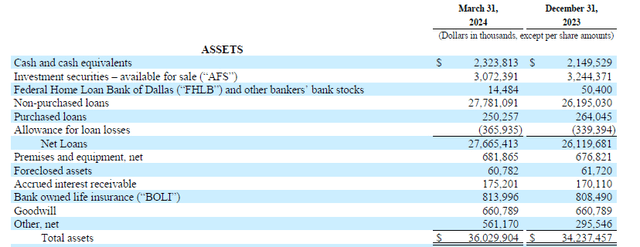

So, one of the most commonly heard arguments against investing in Bank OZK is its exposure to commercial real estate. This cannot be denied or glossed over. It is simply a fact. Let’s look at the asset side of the balance sheet. As you can see below, the bank’s balance sheet has grown to just over $36 billion. Liquidity levels are good with nearly $5.4 billion in cash and securities available for sale.

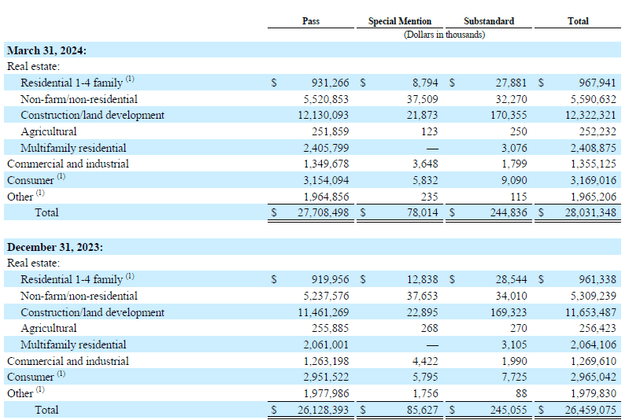

I’m obviously interested in the $27.7 billion loan book, and as you can see below, the majority of the loan book is made up of commercial real estate: Of the $28 billion in loans (before reserves), less than $325 million are classified as special mention or substandard loans.

Although banks have a high exposure to commercial real estate, there are two key factors working in OZK’s favor.

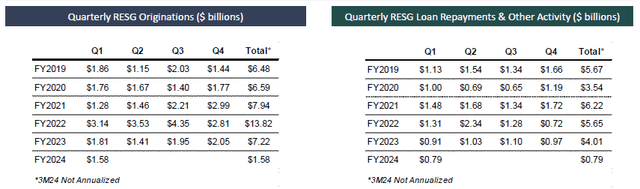

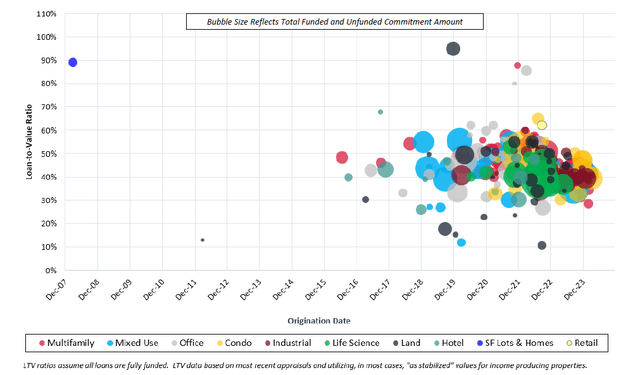

First, the average LTV ratio is quite low. The bank’s real estate specialty group is a leader in CRE construction and development finance. The RESG division accounts for $18 billion in total loan book volume, with an average loan-to-cost ratio of 52% and an average LTV ratio of about 43%, so OZK’s CRE lending division certainly keeps a close eye on loan quality. Loans in this category are typically “the last dollar to fund a project” and the first dollar to be repaid, as the bank explains. Meanwhile, some of the loans include mezzanine debt and preferred equity, which are subordinated to the senior secured loans the bank provides.

The image below shows the total impact of repayments. As you can see, the bank made almost $1.6 billion in new loans. Received $790 million in repaymentsThis certainly means that CRE loan balances are still growing, but at a slower pace, and the newest loans are obviously being issued using more conservative valuation parameters.

In other words, the roughly $9 billion in CRE loans made since the beginning of 2022 may have a lower risk level than “older” loans, and the $4.8 billion in cumulative loan repayments since the beginning of last year likely related to loans where the value of the underlying buildings had already declined.

The chart below also gives a clear picture of the underwriting process: As you can see, most of the loans issued over the past three years have LTV ratios in the 40-60% range. And even the biggest problem children, office-related CRE, have relatively low LTV ratios (excluding one office loan issued in FY22 that had an LTV ratio of nearly 90%).

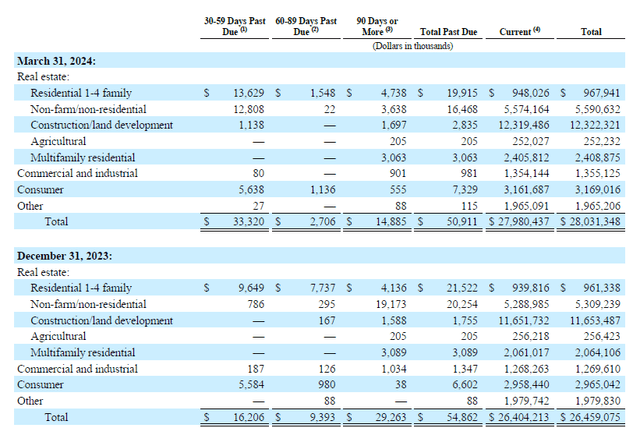

The relatively low LTV ratio also explains why the bank’s loan quality remains strong. In fact, in the first quarter of this year, the net amount of delinquent loans decreased quarter-on-quarter. As shown below, out of a total of over $28 billion in loans, just under $51 million was classified as “delinquent.”

This means that the total amount of delinquent loans decreased by $4 million, even as loan balances increased by more than $1.5 billion.

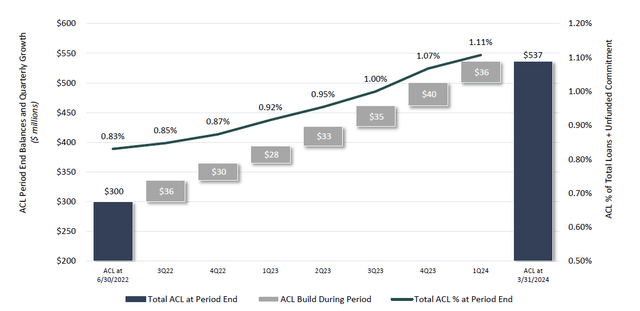

Meanwhile, banks have continued to build up reserves, with total credit loss reserves increasing to $537 million over the past two years, representing 1.11% of total funded and unfunded loan commitments and roughly 10 times the total amount of loans currently past due.

Of course, if the loan fails, that doesn’t mean OZK Bank will lose its entire investment. Even if the assets are seized and sold, the bank can still recover a significant portion of its investment. That’s why the RESG sector has been so popular. First quarter financial results announcementBecause it “produces superior returns with below average risk.”

Another look at preferred stocks

As As explained in the previous articleOZK Bank has issued one series of preferred stocks, (Nasdaq:Oz Cup) is used as the ticker symbol. The preferred stock offers a preferred dividend yield of 4.625% based on a par value of $25.

With 14 million preferred shares outstanding, Bank OZK is required to pay preferred dividends of $16.2 million per year, or $4.05 million per quarter. As discussed earlier in this article, the dividend payout ratio is in the low single digits as a percentage of net income. The preferred shares can be called after November 2026.

Last Friday, the preferred stock closed at $15.84, giving it a yield of about 7.30% based on the current share price.

Investment Thesis

OZK Bank expects record profits this year (which is Supported by consensus estimates The company expects earnings per share to be over $6 by 2020 and over $7 by 2026, but the market is likely still a bit reluctant as the growth will mostly come from the real estate specialization group and the total amount of commercial real estate on the balance sheet is likely to increase. It doesn’t matter how many times the exposure is to CRE, as it’s how risky the loan is that matters. Bank OZK seems to have a good grip of the situation, as the RESG division has strict underwriting standards and LTV ratios are below 50%. Sure, CRE will be painful for some investors, but it will be the mezzanine and equity tranches that will hurt the most. Banks with LTV ratios of 40-50% on projects should be able to handle the impact.

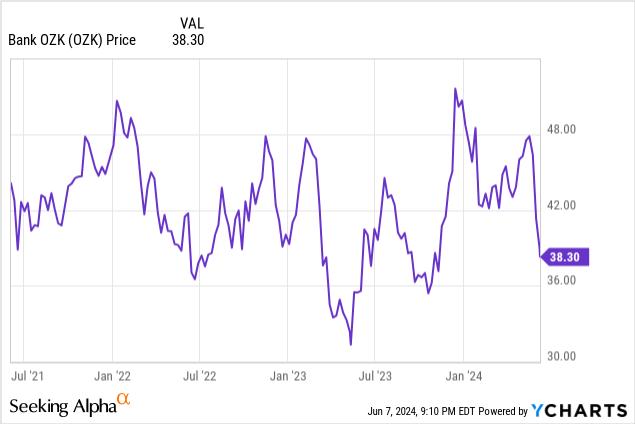

I am long on Bank OZK’s preferred stock, but am beginning to become interested in the common stock as well. The share price recently fell due to Citibank’s downgrade, but the bank’s profitability remains strong and the stock is currently trading at less than 7x earnings. I understand the market’s concerns about the CRE portfolio, but as long as risk management takes precedence over growth, I think the risk/reward ratio is very interesting at the current share price, which is just above Bank OZK’s tangible book value.