BGR Achieves Nearly Net Zero Revenues Over the Last Decade

Shutthiphong Chandaeng/iStock via Getty Images

It’s always nice to get a good asset at a discount. And if you can add a good yield to that, then all is well. But that’s not always the case. Today, This fund should have performed very well on paper, but the reality was that it didn’t. We would like to provide our perspective on where this fund stands today.

BlackRock Energy & Resources Trust (New York Stock Exchange:green)

According to the company’s website:

BGR’s investment objective is to provide total return through a combination of current income, current profits and long-term capital appreciation. The Trust seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its total assets in equity securities of energy and natural resource companies and equity derivatives with exposure to the energy and natural resource industries. The Trust It invests directly in such securities or synthetically through the use of derivatives. The Trust utilizes option writing (selling) strategies to enhance dividend yields.

Source: BGR

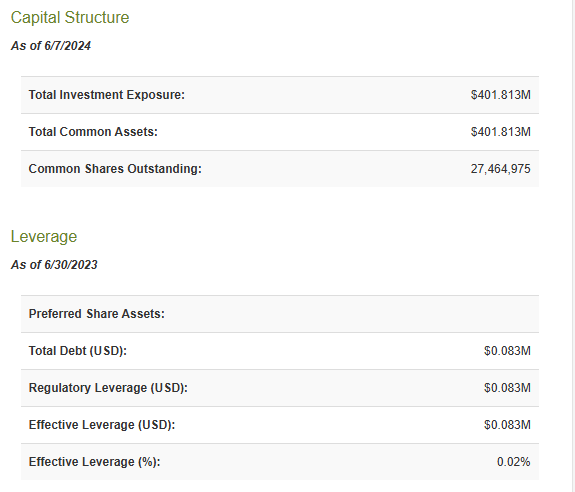

BlackRock Inc.black) owns a number of closed-end funds, and one of their best features is that most of them do not use any leverage whatsoever. This was our obsession in backing many of our closed-end funds. Leverage is a double-edged sword, and investors will find out how painful it can be in the next bear market. But BGR is no problem in this regard. Total leverage is a rounding error.

CEF Connect

The top holdings do not include speculative stocks.ZOM), BP PLC (BP) and Canadian Natural Resources Ltd (CNQ).

CEF Connect

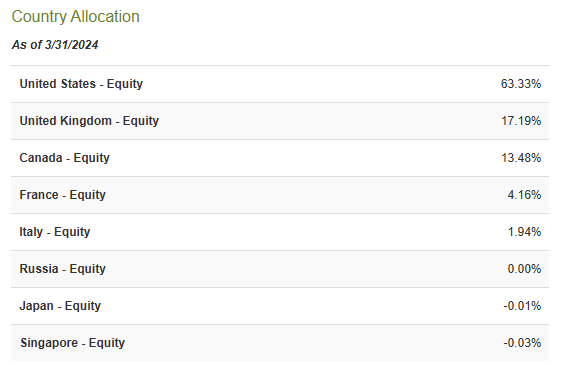

The fund is a global fund and, like most global funds, about two-thirds of its assets are from the United States.

CEF Connect

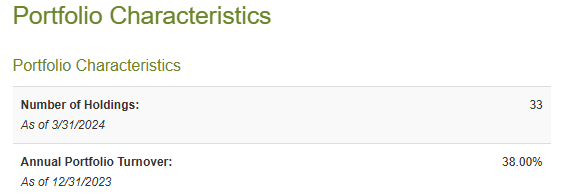

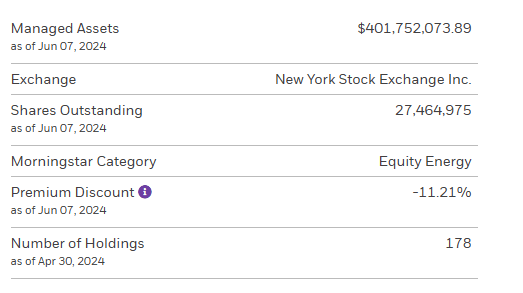

There is a big difference in the total number of holdings shown on CEF Connect and the fund’s website: on CEF Connect, the fund is treated as a concentrated fund with just 33 holdings.

CEF Connect

The fund’s website puts the figure at more than five times that.

CEF Connect

I believe the difference comes from counting what they consider to be “holdings.” In the diagram above, BGR would count all derivatives of a security (read covered calls here) as different holdings. Interestingly, their fact sheet seems to say the opposite.

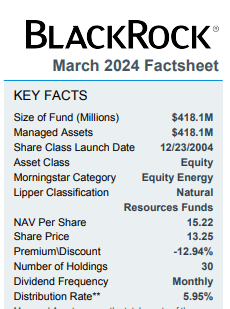

green

performance

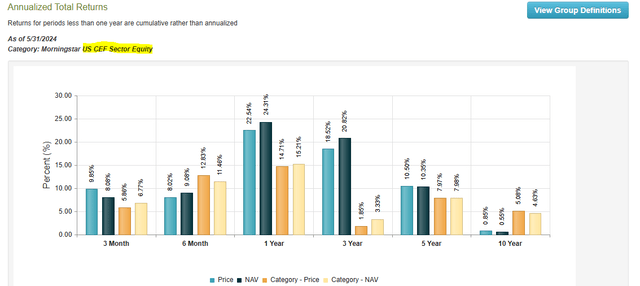

So, we have a relatively large energy and resources concentrated fund. How has this fund performed over the years? Pretty bad. Its total return on NAV and price over the last 10 years has been close to 0.5% per year. Of course, this includes dividends.

CEF Connect

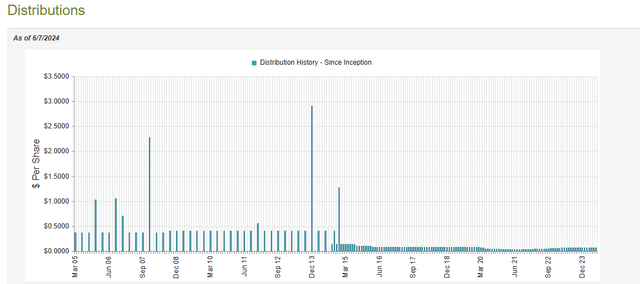

This performance is pretty poor, and I will explain why later. However, I will state that CEF Connect’s Sector Equities are not a good comparison. They include all funds that focus on one sector, such as energy, financials, banking, insurance, real estate, etc. Comparing this to BGR makes no sense. That said, this is of little comfort to investors who have made less than what 3-month Treasury bills have made over that period. Of course, you might get a counterargument from people who say they are “earning income.” But that’s also pretty dubious. Distributions have fallen by about 50% over the past decade. Note that payments were quarterly at one point, then changed to monthly.

CEF Connect

At the bottom (post-COVID-19), distributions were about 50% lower than current levels, which is why the fund saw its distributions fall by as much as 75% at one point, and has only delivered a total return of 0.5% over the past decade. That’s a tough number.

Outlook and verdict

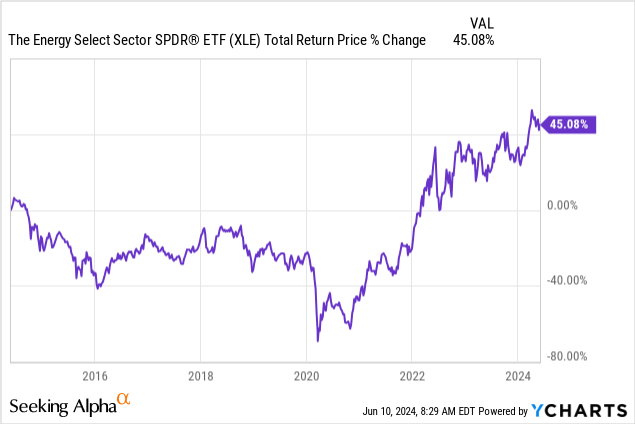

Selling blind covered calls is a rather poor way to generate returns. Most ETFs sell calls mechanically and fall into this “blind” category. Closed-end funds have more discretion. You’d think that would generate better returns and some outperformance, especially in a sector that has performed so poorly over the past decade. But BGR’s total return was about 5%, compared to the Energy Select Sector SPDR (XL) was delivered within the same time period.

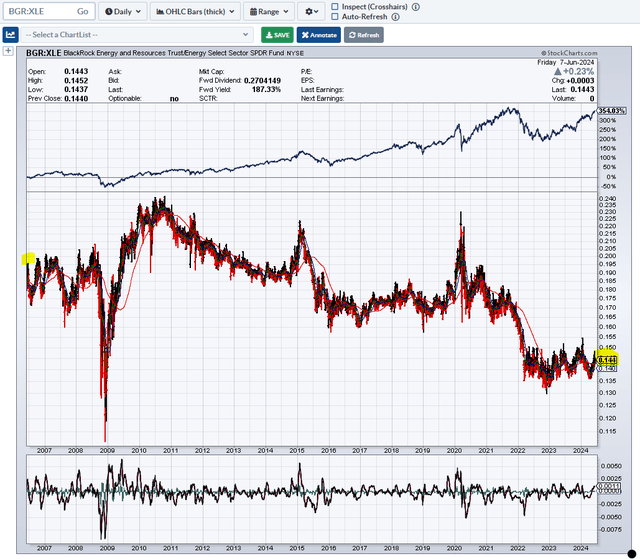

You can see the same results over longer time periods. Here we use a ratio chart from Stock Charts. For those who don’t know, you enter a symbol in Stock Charts and it will show you the total return including dividends/distributions. If you want the price return only, you need to add an underscore before the symbol. The total return ratio chart shows that XLE outperforms BGR.

Stock Chart

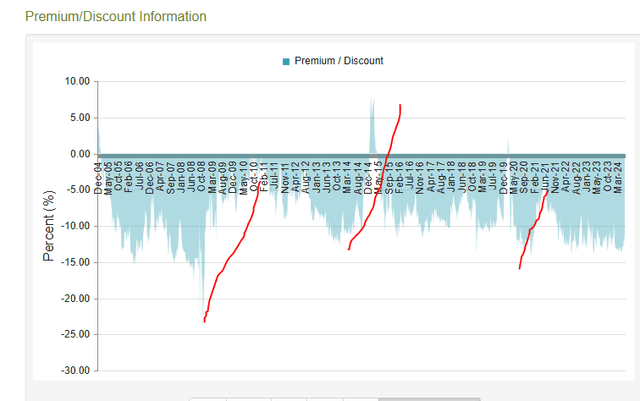

Of course, there is always the expectation that BGR will outperform XLE going forward. But we don’t see that happening here. Looking at the ratio chart above, there are clear phases where BGR outperformed XLE. During those phases, BGR’s discount to NAV narrowed rapidly. XLE is an ETF and trades pretty close to NAV, so that has never been a factor. But the change in BGR’s discount makes a big difference.

CEF Connect

So this is my only trading reason to hold BGR.

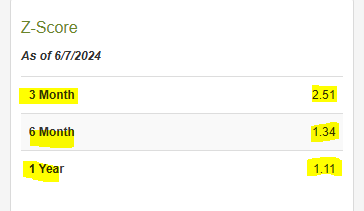

At the moment, the Z-score looks too bad to bet on such an outcome.

CEF Connect

All Z-Scores indicate that the fund is relatively expensive compared to its historical performance. You may wish to hold off on investing in the fund until the relative risk and return improves.

Please note that this is not financial advice. It may seem that way, but surprisingly it is not. Investors are urged to do their own due diligence and consult with professionals who understand their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.