Klaus Wedfeldt/DigitalVision via Getty Images

Investment Thesis

Some central banks, including those in Europe and Canada, have recently begun to cut interest rates, causing the capital value of related long-term bond ETFs to soar.Nasdaq:BNDX) invests in government and corporate bonds outside the United States, which would be likely to see asset values rise in an environment of falling international interest rates.

Fund Structure

BNDX is an ETF launched by Vanguard Group, Inc. in 2013. The fund seeks to track the performance of the Bloomberg Global Aggregate ex-USD Float-Adjusted RIC Capped Index (hedged). The fund invests in low-risk non-U.S. government and corporate taxable debt securities primarily in Europe and Japan.

The fund holds just over 6,800 bonds with a yield to maturity of 5.1% and an average maturity of 7.2 years. Vanguard’s official website For more information, see here. The fund has total assets under management of approximately $92 billion and a low expense ratio of 0.07%. Notably, the fund has experienced significant positive inflows of $3 billion over the past three months, signaling growing trust and confidence in its potential.

Vanguard Total International Bond ETF (BNDX) 3-Month Net Inflows: $3 Billion (TipRanks)

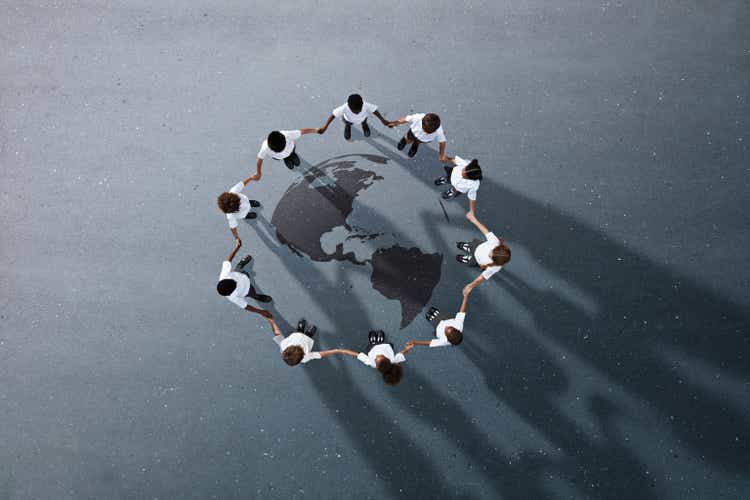

Looking at the bond holdings of the fund, we see that it is heavily invested in Europe, the Pacific and North America (excluding the US). These top three countries hold approximately 87% of the fund’s total bond value, making the fund sensitive to interest rates in those countries, which we will explain more comprehensively later.

BNDX Market Allocation (investor.vanguard.com)

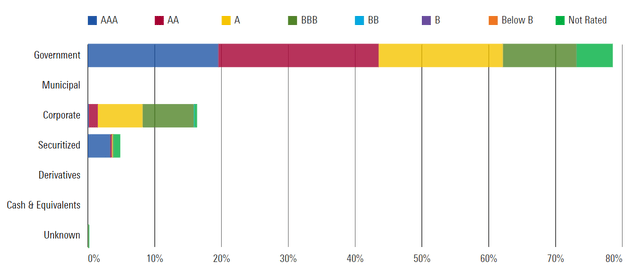

BNDX has a low risk exposure. As mentioned above, BNDX is invested in a diversified fixed income portfolio featuring low risk government and corporate taxable bonds, reflecting the solid credit ratings of BNDX holdings. However, the fund also contains non-investment grade bonds, but the percentage is negligible and does not alter the low risk characteristics of the fund.

Unexpectedly, despite this very low risk exposure, the BNDX is still riskier than other bond ETFs created to track and hold the U.S. bond market. Compare the BNDX to its peer, the Vanguard Total Bond Market Index Fund ETF (BND) has the same fund characteristics but invests only in the US bond market, but since US Treasuries are generally considered to be the safest or risk-free assets in the financial markets, many indicators point to BND’s superiority as a low-risk asset.

BNDX Credit Rating (Morningstar)

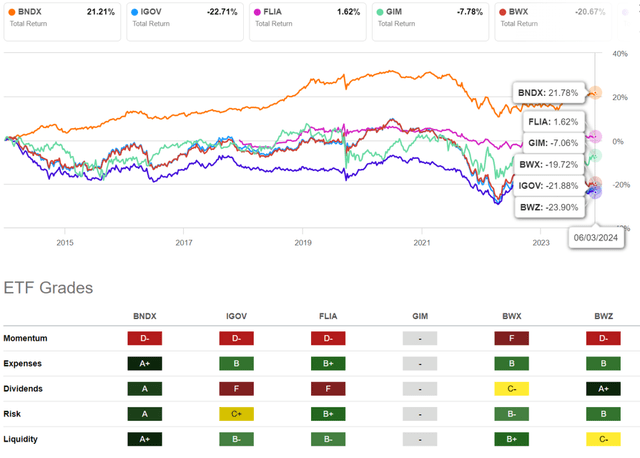

When comparing BNDX to other international bond holdings ETFs in the same category, we see that BNDX has a strong advantage. BNDX is associated with a much lower expense ratio of 0.07%, and this ETF has delivered the highest total return of any other ETF over the past decade. Moreover, BNDX is a comprehensive ETF. a Seeking Alpha ETF grades by sector (expenses, dividends, risk, liquidity) and scores is The reason for the slowing momentum, bearing in mind that most central banks have kept interest rates unchanged beyond September 2023, could be related to the hindering characteristics of holding international government bonds, whose prices are directly linked to global interest rates.

BNDX Total Return and Grade (Seeking Alpha)

BNDX is safe, but is it profitable?

BNDX experienced a severe price crash starting at the end of 2022. The ETF’s price fell by nearly 16% and has remained at this low level ever since. As a result, those who invested in this ETF will suffer huge book losses and real losses if they decide to sell. This price drop can be explained by high inflation in the US, Europe and other global economies after the pandemic and frequent reports of interest rate hikes in the US, followed by interest rate hikes by the European Central Bank and other major central banks. Finally, the European Central Bank (where the majority of BNDX bonds are concentrated) began a series of interest rate hikes from 0% in July 2022, reaching a final rate of 4.5% in September 2023. These forced hikes caused immediate principal write-downs of bonds held by BNDX, which is directly reflected in this sharp decline.

BNDX prices August 2021 to present. (Morningstar)

However, BNDX continues to generate a 4% to 5% cost dividend, which is considered reasonable compensation for the ETF price decline. With its competitor BNDWe can see that the 30-day SEC yield on the BNDX is just 3.3% lower than the 4.6% SEC yield on the BND and the 4.8% yield on the 10-year US Treasury. Nevertheless, the US economy is still under inflationary pressure and may be even worse than it looks, so it is always a good practice to diversify your investment allocation (investors can find out more here). here).

Capital values are expected to rise

As mentioned above, the average duration of bonds on the BNDX is 7.2 years. This is an indicator of how sensitive the prices of bonds and bond mutual funds are to interest rate trends (average duration), according to the official Vanguard website. As a result, if a bond ETF has an average duration of 7.2 years, its price will rise by about 7.2% if interest rates fall by one percentage point. The reverse is also true: if interest rates rise by one percentage point, the price of the bond will fall by about 7.2%.

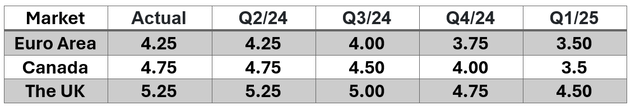

Therefore, we can directly link the price of BNDX to the interest rates of major bond issuers. When these issuers lower their interest rates, the price of BNDX stock will rise. The European and Canadian central banks recently officially cut interest rates by 25 basis points (bps) and there is solid prediction and analysis that they will continue to do so in the future. We have summarized interest rate forecasts for major bond issuers below.

Interest Rate Forecast, TradingEconomics.com (Author)

According to the above facts, I believe it is perfect timing to enter BNDX. Some of the two largest bond issuers, which account for 60% of fund holdings, have already started lowering interest rates, which will lead to capital appreciation in fund AUM and thus to an increase in ETF prices. However, because the characteristics of fund holdings are nested, it is very difficult to create a direct mathematical model that characterizes the relationship between interest rates and capital appreciation. But in simple terms, lowering interest rates for bond issuers will increase the price of BNDX. This situation can continue until the ETF share price returns to the 2022 price level of $56 (about 15% share price increase from the current value of $48.7).

Shortcomings of the Fund and Related Risks

BNDX is a low-risk investment, it pays decent dividends every month and has a high potential for capital appreciation. However, all this comes with a number of negative effects and possible risks, which we will summarize below.

- BNDX does not have a clear strategy. It is a diverse collection of government and corporate bonds, with all of its capital allocations outside the U.S., where investors and even governments around the world view U.S. Treasuries as the least risky of all other fixed income securities.

- The yield on the BNDX is low compared to its peers. Still, with the T-Bills ETF you can get a relatively high 5% yield with very low risk, and with the Long Term Treasury ETF you can get an acceptable 3.7% yield with the potential for price appreciation.

- Indeed, while the European Central Bank and other central banks around the world have begun to cut interest rates, the United States has not and likely won’t do so anytime soon. Fed Watch Tool Still, it is expected that there may be one or at most two interest rate cuts by the end of this year. At the same time, economic reporters point out that the US inflation rate is higher than expected. As a result, if the US does not cut interest rates, other major central banks will not be able to continue to cut interest rates, as this will put a lot of pressure on local currencies.

Investor View

BNDX is an ETF that invests in low-risk bonds (government and corporate bonds) outside the U.S. It is well diversified and has a portfolio with huge holdings across a vast financial market, allowing it to invest in international bond markets and reduce the concentration of its investments.

However, exposure to non-US bond markets can be irrational, especially when US interest rates are comparable or higher than those in other markets. Many investors and governments classify US Treasuries as risk-free, and there are a number of ETFs on the market that focus on US Treasuries, which in many ways can offer a more precise strategy and a safer investment.

Meanwhile, BNDX is considered a good solution for short-term and medium-term investments. Investors can use it to simultaneously invest in the investment-grade international bond market, including Europe, Japan, Canada, the UK, and other financial markets. Investors can effectively grow their portfolio from potential capital gains whenever any of these countries cut interest rates.

Lastly, as we have shown above, BNDX has strong investment characteristics including diversification, capital appreciation potential, steady monthly income, low expense ratio, investment grade holdings, etc. Therefore, we initiate a strong buy recommendation for BNDX as now is a great time to invest in an ETF that will benefit greatly from lower global interest rates.