MicroStockHub

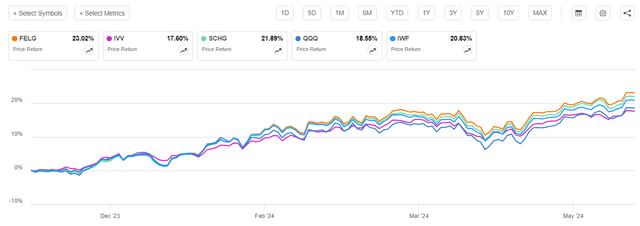

Continuing our series of articles on growth-focused exchange-traded funds, today we will be looking at the Fidelity Enhanced Large Cap Growth ETF (NYSEARCA:FergusFELG was established in 2007, but most of its achievements are Changed to November 2023 Converted From mutual funds to ETFs. FELG has had a fairly strong start in ETF history, benefiting from investors increasingly placing their money in long-term stocks. But in addition to an impressive price gain, it has also been a big player in the growth ETF space, behind the market and Schwab US Large Cap Growth ETF.SCHG) and Invesco QQQ Trust ETF (HeheheheIn addition, the iShares Russell 1000 Growth ETF (International Women’s Federation),Chase An index that essentially acts as a selection target for FELG.

Given such a confident start, FELG certainly deserves a thorough review. To ensure proper context, I decided to line up its factor mix with that of SCHG, which is I called FELG was named “one of the best choices for growth investors” in March. Can it beat the passive Schwab ETF on factors? Let’s take a closer look.

What is at the heart of FELG’s strategy?

As we can see from Fidelity WebsiteFELG is actively managed, aiming to grow capital. How does it achieve robust total returns? The idea is to select stocks from the Russell 1000 Growth Index that are likely to produce high returns using “computer-based quantitative analysis of historical valuations, growth, profitability and other factors.” This is clearly an interesting approach, given that growth strategies often start with a simpler selection universe, such as the 500 largest U.S. companies, the S&P 500, the Russell 1000, or similar market-cap-weighted baskets that provide exposure to a particular market stratum that blends growth and value stocks. In FELG’s case, the group it selects already incorporates an element of growth factors. Importantly, the ETF may branch out into foreign stocks. An example of the current version of the portfolio is Spotify Technology SA (spot) and New Holdings (new).

Does FELG have a factor advantage over SCHG?

While there are significant differences in composition and FELG has a much smaller portfolio (104 stocks vs. 245 in the SCHG portfolio), the ETFs have a lot in common, so it’s questionable whether the Fidelity fund has the edge. In many ways, they’re roughly comparable, as 76.2% of FELG’s portfolio is stocks that are also in the Schwab ETF. However, SCHG offers a slightly stronger growth story, while FELG has more exposure to highly efficient companies (as measured by ROE and ROA).

Both funds have significant allocations in the trillion dollar league, which is certainly the biggest contributor to their robust gains this year: over 52% for SCHG and just under 50% for FELG. In this regard, it is not surprising that the weighted average market capitalizations of both funds are roughly the same, $1.446 trillion for FELG and $1.49 trillion for SCHG, according to my calculations.

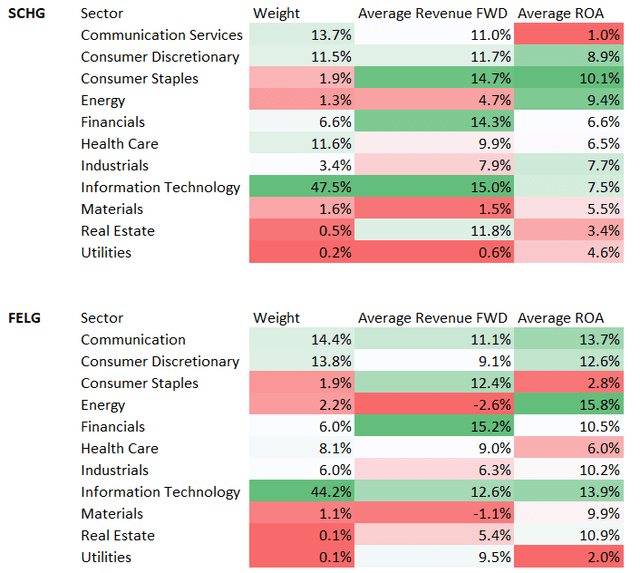

When it comes to sectors, the differences are more pronounced.

Created by author using Seeking Alpha and ETF data

For example, while both are overweight IT stocks, FELG is a little lighter in technology with a lower allocation of 3.4%. They are also less optimistic about healthcare but more confident about the potential of industrial and consumer discretionary sectors. The latter has a large stake in Home Depot (High resolution) ignores SCHG but not FELG and allocates 1.7% of net assets. Future Revenue Growth Companies with negative future growth rates for EBITDA and EPS qualify for this portfolio.

growth

At least in its current incarnation, FELG does not have an edge over its more diversified peers. For example, by my calculations, FELG’s weighted average forward earnings growth is about 16.8%, compared to SCHG’s 18%. There are a few reasons for this, but the main one is FELG’s small exposure to NVIDIA (NVDA), 10.8% vs. 11.4%. It also has about a 3.7% allocation to companies that are expected to experience declining sales going forward, compared to just 2.9% for SCHG. In terms of revenue, the Schwab ETF again leads the way, with a WA Forward EPS Growth of 27.1% compared to FELG’s 26.1%. Overall, I think the best sign here is that stocks with a B- Quantitative Growth Rating or better make up a 73.5% weighting in SCHG, compared to just 63.8% for FELG.

quality

Investors looking for a balanced combination of growth and quality will likely be pleased with both SCHG and FELG, although the latter is more capital efficient, with both return on assets and adjusted return on equity outperforming SCHG. Upon further investigation, we found that this difference was due to the fact that FELG made better picks in the IT and Energy sectors.

| ETF | Adjusted ROE | ROA |

| SCHG | 20.5% | 19% |

| Fergus | 23.4% | 19.8% |

Calculations by author using Seeking Alpha and ETF data

However, WA’s net profit margin of 25.2% is slightly lower than SCHG’s 25.6%. Furthermore, SCHG allocates 97.5% of its funds to companies with a B- Quant Profitability rating or higher, which is 1% higher than FELG.

value

In terms of value, FELG has a slight advantage over SCHG, as evidenced by its adjusted earnings yield (negative numbers excluded) of 3.07% vs. 2.76% for SCHG. Its P/S ratio is 11.1x vs. 12x for SCHG, again due in part to FELG’s smaller exposure to NVDA. Additionally, SCHG holds almost exclusively stocks that are overvalued from a quant perspective (95.5% allocation to companies rated D+ or below), while FELG has a slightly smaller allocation to such stocks at 89.5%.

Low volatility and momentum

Betting that long-term stocks will continue to rise means being willing to compromise not only on valuation but also on volatility. Exposure to growth and high beta go hand in hand, and both growth ETFs demonstrate this: SCHG and FELG have weighted average 24-month beta coefficients of 1.26x and 1.24x, respectively, making them clearly more volatile than the market. At the same time, both ETFs are significantly overweight momentum stocks, although here again the Schwab ETF has a slightly more competitive edge.

| ETF | Quant Momentum grade B- or higher |

| SCHG | 83.9% |

| Fergus | 80.7% |

Calculations by author using Seeking Alpha and ETF data

Investor View

In summary, FELG is a solid, actively managed investment vehicle that looks like a sound choice to weather a bull market driven by AI narratives and dovish sentiment. It has the quality, volatility and growth characteristics expected from a fund with a similar mission. While it impressed with its fiery start, the problem here is that its trading history since conversion is too short. As such, we can only speculate how it will perform in a down market like March 2020 or in 2022.

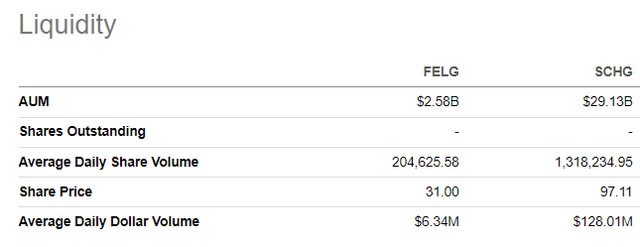

So what is the conclusion? I think FELG will be a good alternative to SCHG and QQQ. But the main problem is Expense ratio SCHG is 18 bps compared to 4 bps for SCHG. Additionally, SCHG has greater depth of exposure and a much longer track record (started in December 2009). Secondly, SCHG has much better liquidity.

Therefore, while I believe FELG is clearly worth including on my shortlist, I’m not convinced enough to initiate coverage with a Buy rating.