Owen Price

The latest inflation-related indicator, PCE, was in line with expectations.

Market participants were not scared before the PCE announcement, and they were right. There was a slight uptick after the announcement. I think the consensus is that inflation is declining. Very slowly. At least it was cool in April and there is no threat of it getting any hotter. With that in mind, concerns about tightening have decreased and it is certain that the Fed will cut rates later this year. The index has held high because the market likes and is ready for clarity. As a result, the 5% selloff felt like a flash in the pan. The VIX is at its lowest since the pandemic, meaning there is relatively little demand to hedge against downside risk.

Friday May Hiring Data brings uncertainty

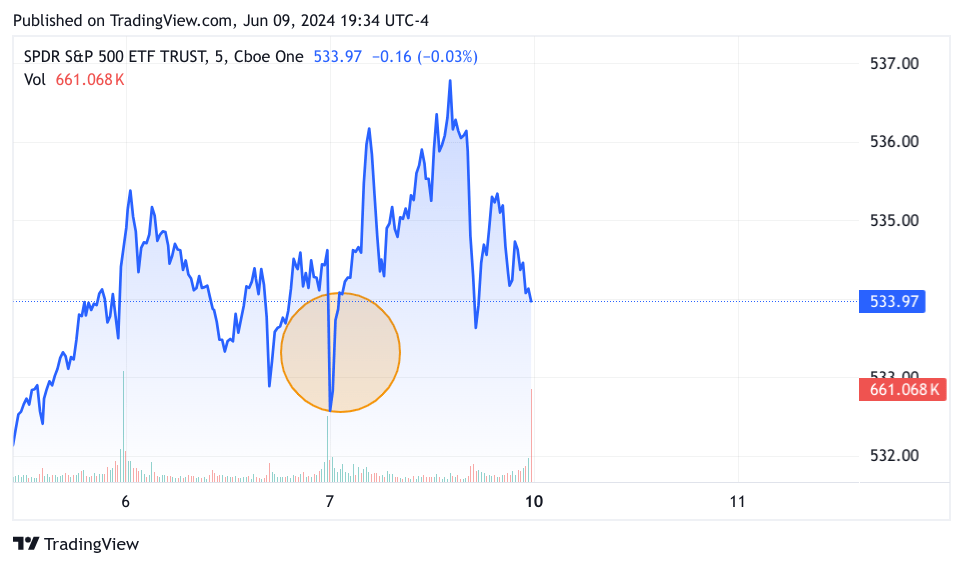

The word on Friday morning before the release was that May employment could fall to 140,000. Other economic data for May showed a slight cooling, and employment will be lower than last month. April employment was 175,000 and unemployment was 3.9%, strengthening expectations that it will not be much higher, if not lower. May employment is expected to be 277,000 and unemployment is 4%, while the consensus was 190,000. I think Friday’s market action will give us a hint as to how Monday and Tuesday will play out as we head into Wednesday. I’m using the 5-day chart for the S&P 500 ETF today, but I’ve shifted my focus to just June 6th and 7th.

Trading View

When this news first hit the market, futures plummeted and the market opened hard, because of course a surge in employment means the economy is not cooling off. What followed immediately after was a big rally, presumably because they want to keep inflation down without damaging the economy. It’s quite a trick, but Powell is trying to pull it off. Over time, the surge subsided and the S&P 500 closed at roughly the same level as the previous day. Perhaps rising unemployment and other indicators beneath the headline numbers showed offsetting weakness that killed the bulls. I think this inconclusive result will add enough uncertainty to lead to selling tomorrow and Tuesday.

Let’s also consider the possibility of selling Nvidia (NVDA) into the mix

While I can’t say it’s 100% certain, it’s not unusual for shares to sell off a little at first after a stock split. Why? I think a lot of people got excited about the stock split and bought shares before the split. They, and maybe some investors who held NVDA for a while, can now chip away at their shares. Eventually others will buy NVDA and push it to new highs, but for now, it makes sense for NVDA to consolidate all the gains it’s made so far. In just 12 trading days, NVDA has seen an astounding 23% rise. This is even more astounding considering its already massive market cap. This 23% or so surge has pushed it to $3 trillion at one point, or a market cap of $3 trillion. The closing price this Friday was $2.9741 trillion in market cap. Don’t ask me why $NVDA is worth every penny. I agree with you. I know nothing goes up in a straight line, and I think many would be willing to let go of a few shares after the split with gains like that. I would also argue that anyone who practices good portfolio management would not increase any position beyond a certain level, be it 5%, 7%, 10%, etc. It makes sense to single out NVDA specifically. NVDA is the single huge driving force behind the current bull market. The other “Super 6” pale in comparison. They are happy to pay tens of billions of dollars for NVDA’s amazing chips. If NVDA were to fall 5% or 3%, I expect other tech companies to follow suit. So NVDA will pause for a moment and fall a bit to spur selling.

What are we up against? Will the CPI and Powell’s FOMC statement cause markets to fall further?

I wish I had known! It’s quiet right now, so we haven’t heard anything from the Fed. It’s still a question of how many cuts there will be this year. As the year progresses, there are fewer expectations of multiple cuts this year, and they’re starting later. Depending on the data, Powell will provide a view on the Fed’s view of inflation, which will either spark another uptick or the sell-off will continue. Frankly, I’m not looking that far ahead. I think we’ll see a sell-off on Monday and Tuesday, so prepare for that possibility and worry if it happens on Wednesday. If we get a strong number on CPI, Powell should mention it in his 2pm presentation.

To summarise…

Let’s take a look at where we are now. The VIX level does not indicate any expectations of volatility. In other words, market participants are very uninterested. The dogma is that the Fed will cut interest rates this year, and there is zero chance of them raising them. Market participants appreciate the visibility that Fed Chairman Powell is providing with the signals he is sending. Also, the first quarter earnings season is looking good, and the second quarter looks similar. With all this positive outlook leading up to Friday’s May employment report, I think the likelihood of the CPI rising is increasing. I’m not predicting that the CPI will rise, just that the possibility is emerging. Not only that, but we also happen to have two pieces of important macroeconomic data that could move the market on their own. Right now, combined with the 8:30am and 2pm data, I think there could be enough selling in the market that we would need to hedge. As an aside, if the selling is large enough, it could “prevent” any bad news that may be waiting on Wednesday. So it’s a good idea to hedge on Monday morning and exit on Tuesday afternoon. If there’s bad news on Wednesday, you can either look for bargains among the failed stocks or re-hedge, or both.

I was net short in put options before Friday’s jobs report.

It just happened naturally. I was a Lululemon employee.Lulu) earnings report and thought it was low quality at the open, so I bought puts at a strike of 310, much lower than the 337 it opened at. I thought I got too excited, but I quickly made a 60% profit, so it was a very quick trade. This made me think there might be a lot of froth in the market, so when LULU recovered a bit, I took a second swipe. I also bought puts on eBay Inc. (Ebay) Etsy, Inc. (ETSY) and a few others that I thought were overpriced, plus the 3X QQQ ETF (Wow) because I decided that no matter what the numbers were, the expectations were so low that even if they were in line with the consensus, they would just disappoint. The minute the market opened, I exited all my hedges and was fine. Well, all my hedges except for Boeing were exited (BA) I have puts at 185, but they are currently trading at 190. Why? Is it because the rockets were launched 4 years too late? They are still leaking helium in space and planes are being built at a snail’s pace. I also have VIX calls at a strike price of 12.5, which are out of the money. In my opinion, the VIX is at a ridiculous level. It just is. Tomorrow I will be hedging the Nasdaq 100 and now the Russell as well. With the VIX so low, options are cheap and I will be looking for stocks that I think are top of the line. I will also be thinking about stocks that will be adversely affected by rising interest rates and will be short on the puts there as well.

I hope this helps. This is just me thinking out loud about the short term and putting it on paper. To add, I am not going to sell my investments even if stocks get cheap. I will probably sell them if NVDA sells enough. No one reading this will have the impression that they should sell their investments. I am very bullish on the long term outlook. It may take time, but inflation will come down. Probably at a slower pace than the Fed would like. For now, the current Fed Funds rate set by the Fed does not seem to be hurting the economy. The truth is that 4.5% on the 10 year rate is plenty, and even 5% is not the end of the world. The economy just needs to adjust to the true cost of credit, and that will improve.

Good luck to everyone!