Torsten Asmus

Consumer Staples Select Sector SPDR Fund ETF (NYSEARCA:What is XLLP?) offers investors the opportunity to invest in a wide range of companies that provide household goods, food, beverages, personal care products and other basic goods essential to everyday life. These types of companies are: This ETF, which is generally recession-proof, could see strong relative performance going forward as cracks appear in the economy. This ETF It has assets of about $15.45 billion and a very low expense ratio of just 0.09%. The ETF is generally a low-risk, stable way to gain exposure to the stock market, and has returned about 6.8% annually since its inception on December 16, 1988. There has been increased interest in this ETF recently as investors believe there is an increased risk of a recession as the Federal Reserve continues to maintain high interest rates for an extended period of time. Take a closer look.

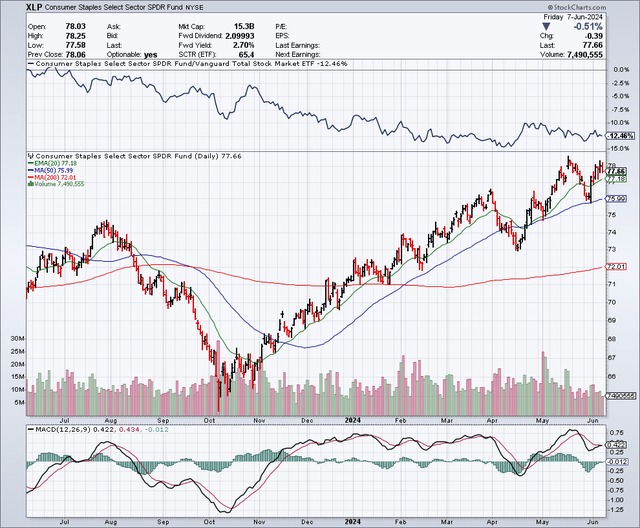

chart

The ETF bottomed out in October at around $64 per share. It has been on a steady uptrend since then and is currently trading at around $77 per share. The 50-day moving average is around $76 and the 200-day moving average is around $72. This chart shows that buying the lows has been a winning strategy over the past few months and this ETF is trending up. I believe the uptrend will continue and that buying the lows strategy will continue to pay off for investors.

Stock Chart

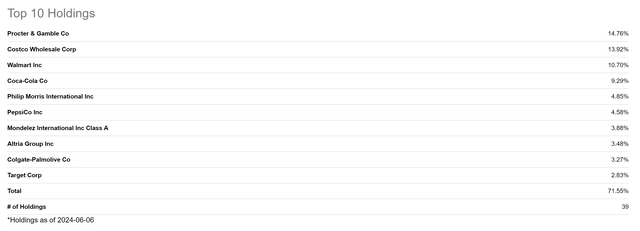

Top 10 Holdings

The fund’s top 10 stocks include many well-known companies with products used in almost every home. Below is the list of the top 10 stocks:

Find Alpha

Let’s take a look at this ETF’s top three holdings.

Procter & Gamble Co.PG) is a consumer goods company that owns numerous household brands, including Bounce, Pampers, Downy, Tide, Bounty, Charmin, Always, Braun, Old Spice, Cascade, Dawn, and Swiffer. These household products tend to sell well in good times as well as bad, making them defensive stocks for many investors. They also offer a dividend yield of about 2.41%, making them attractive for income investors. The stock is the ETF’s largest holding, accounting for about 14.76% of total assets.

Costco Wholesale (Fee) owns and operates “warehouse” style retail stores that are extremely popular with consumers who want to buy in bulk and save money. The company has a great business model, but it’s also very expensive, trading at about 1.5 times earnings. 50 times the revenue, It appears to have a cult following. The stock’s high valuation and the fact that it makes up about 14% of the ETF’s holdings are a bit worrying, but with Costco stock not being a historically low PE stock and the company continuing to grow internationally, this great growth stock is likely to remain a great one for shareholders.

Walmart (World Trade Center) is another popular retailer that focuses on delivering value. Some investors and analysts have speculated that Target (target), and that could continue if the economy weakens. Walmart is valued much less harshly than Costco, trading at just $100 a share. 27 times the profitIf the company continues to grow and gain market share, there’s plenty of room for its shares to rise. Walmart makes up about 11% of the ETF’s portfolio.

dividend

This fund is Quarterly Dividend It trades at about $0.55 per share, or $2.10 on an annualized basis. This gives it a yield of about 2.7%. This yield is currently lower than many other investment options, but the yield is sustainable and comes from the consumer staples sector, making it a potentially lower-risk option.

Why this ETF is a great defensive play

While the job market and overall economy still appear resilient on the surface, cracks are emerging in several areas that could widen over the coming months. Many investors seem to believe that the Federal Reserve will time its interest rate cuts perfectly to pull off a soft landing, and that a “Goldilocks” scenario will play out in which the economy continues to grow and inflation settles down to the Fed’s 2% target level. However, I believe this is easier said than done, and there are many signs pointing to a recession.

For example, Starbucks (SBUX) recently reported results that could be a sign that consumers are moving away from even affordable luxuries like lattes. assignment The banking sector may face stronger headwinds as it suffers heavy losses on its bond holdings. The commercial real estate market has seen a sharp decline in values due to a sharp rise in interest rates. Losses for banks holding commercial real estate may become even more of a problem in the coming months as fixed-rate loans come due, potentially resulting in more keys being handed over to banks in foreclosures.

One reason the economy has held up longer than expected is likely due to the huge amount of stimulus pumped into the economy during the coronavirus pandemic, but that extra money appears to be running out for lower-income earners. Auto loan defaults Credit card debt has increased recently. Record levelsThis could mean that many consumers are simply running out of cash. For all of the reasons above, the U.S. economy appears to be slowing, which makes it an ideal time to consider more defensive investments, such as the consumer staples stocks offered by this ETF.

Potential downside risks

Some of the stocks held in this ETF are trading at high valuations that are typically reserved for momentum or fast-growth stocks. For example, Costco is highly valued and represents a very large portion of this ETF, so I think it is a risk investors should consider. There are other stocks in this ETF that may pose downside risk due to their significant positions. The top three stocks in this ETF represent about 40% of the total assets, so it is not as diversified as many other ETFs. This is a potential downside risk to consider, and it only makes sense to invest in it if you are likely to hold the top three stocks in your portfolio anyway. Another potential risk to consider is opportunity cost. While this ETF has provided solid returns since inception, these returns are much lower than the returns generated by tech stock ETFs.

In summary

I believe this ETF can continue to deliver solid returns over the next few years, but for now, I would only buy on the downside given how strong it has been over the past few months. I believe the risk of a recession is much higher than average at this point in the economic cycle, and rising interest rates appear to be hurting everything from low-income households to commercial real estate, auto loans, and consumer credit card debt. These factors could lead to this ETF being a relative outperformer over the next few months. While many investors are chasing highly valuated AI stocks, you might benefit from being a bit contrarian and buying into the defensive consumer staples stocks that this ETF offers.

No warranties or representations are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. Information is for informational purposes only. Always consult with your financial advisor.