While there is no shortage of small business accounting software available today, choosing the right tool to manage your ecommerce accounting needs can be challenging. With similar functionality and different in pricing, it’s easy for business owners to choose the wrong accounting tool.

Switching to another accounting program can seem more of a hassle than it’s worth––a great example of the sunk cost fallacy––which makes choosing the right tool in the first place important.

Ahead, discover the best accounting software for small businesses in 2024, include the pros and cons of each product, to help you decide which is best for you.

8 best accounting software for small businesses

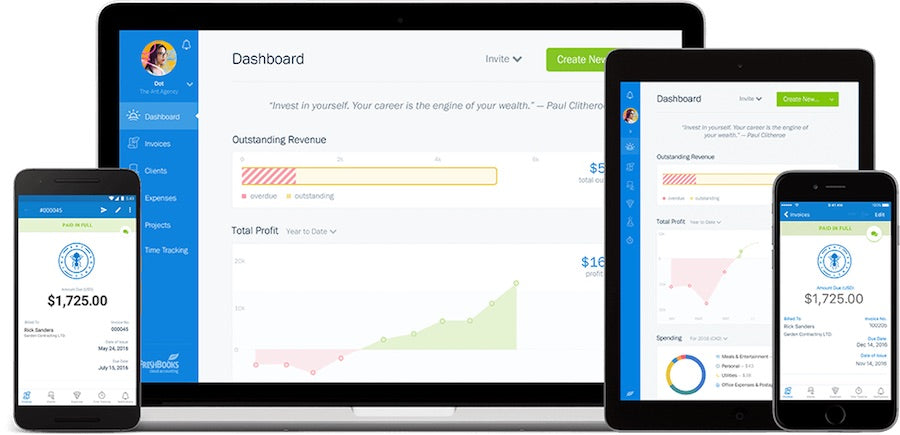

1. FreshBooks

Best accounting software for customer support

One of the most popular and well-known small business accounting tools available today is FreshBooks.

FreshBooks’ accounting software includes smart technologies and back-office automation designed to reduce manual data entry and make bookkeeping easy. For instance, FreshBooks can be configured to automatically reconcile credit and debit amounts and can automatically import financial data from a range of sources.

Users can easily access important financial statements like:

Users can also adjust access permissions on an individual basis. For example, employees can be granted limited access to financial reports, while accountants can be provided with additional administrator privileges.

Pros:

- Highly rated customer support

- Time-tracking and mileage tracking features included in all plans

- Wide range of cloud accounting features

Cons:

- Limited number of users and clients

- Lowest-tier plans don’t offer bank reconciliation or accountant access

- No quarterly tax estimates

Available for: Web application (cloud-based software)

Mobile app: Android, iOS

Price: Plans begin at $19.00 per month for lite plan

Free trial length: 30 days

Shopify app or integration: Yes

2. Wave

Best free accounting software

Many of the small-business accounting software tools on this list are inexpensive. But for newly launched businesses with little cash to spare, any additional expense can break the bank. Wave, an accounting tool designed for small businesses, understands that problem, which is why it’s 100% free.

Available for Windows and OS X, and with Android and iOS apps for invoicing and receipts, Wave is ideal for independent businesses still finding their feet. Wave Accounting can do almost everything premium accounting software tools can do, including expense management, banking reconciliation, and invoicing.

If all this sounds too good to be true, sign up for a free account and see how Wave can help you manage your business’s accounts in less time––all without spending a dime.

Pros:

- Free to use

- Double-entry accounting reports

- Unlimited users with control over user permissions

- Unlimited invoice creation with customizable templates

- Mobile invoicing accounting app

Cons:

- No phone support; live chat only available for paid add-ons (Wave Payments and Payroll)

- No advanced accounting options

- Features like unlimited digital receipt capture only available on Pro Plus plan

Available for: Web application (cloud)

Mobile app: Android, iOS

Price: Starter Plan: free, Pro Plan: $16 per month

Free trial length: n/a

Shopify app or integration: No

3. Zoho Books

Best mobile accounting software

Zoho Books is an online accounting software with accounts payable, accounts receivable, and inventory management capabilities. The invoicing software is blazing fast and its bookkeeping software offers a lot of features for a good price. Zoho Books is a great alternative to more expensive options and can still meet all your business needs.

Pros:

- Most accounting tasks possible through the mobile app

- Fairly powerful free version of software

- More affordable than similar accounting software

- Multicurrency capabilities in top tier plan

Cons:

- Must pay for advanced features like project tracking and workflow automation

- No ability to track fixed assets like real estate, land, or equipment

- Limited number of users with each tier

Available for: Web application (cloud)

Mobile app: Android and iOS

Price: Free for businesses generating less than $50,000 per year in revenue; paid plans start at $15/month

Free trial length: 14 days

Shopify app or integration: Yes

4. QuickBooks Online

Best overall accounting software

Intuit’s QuickBooks Online is a popular accounting platform that can help business owners handle their accounting quickly and easily.

QuickBooks Online has everything small business owners need to take control of their bookkeeping. It features a clean, simple interface and intuitive reporting, meaning even newcomers can get up to speed quickly. All QuickBooks Online plans include mileage, income, and expense tracking, sales and tax reporting, and tools to manage 1099 contractors.

QuickBooks Online’s other plans offer additional functionality, such as inventory tracking, support for up to 25 individual users, and even access to a dedicated customer support manager.

Pros:

- Inventory management included with QuickBooks Online Plus and Advanced

- Double-entry accounting reports

- Third-party app integration

- Plenty of QuickBooks Online tutorials, experts, resources, online

Cons:

- Monthly plans are pricier than other accounting software options

- Each plan allows only a limited number of account users

- Advanced features come with a learning curve

Available for: OS X, Windows, web application (cloud)

Mobile app: Android, iOS

Price: Plans begin at $15 per month

Free trial length: 30 days

Shopify app or integration: Yes

5. Sage 50cloud

Best accounting software for customization

Sage 50cloud Accounting offers comprehensive, cloud-based accounting software for small businesses with extensive customization options and advanced features.

Sage 50cloud’s Pro Accounting plan––the least expensive option––is aimed at smaller independent businesses. It can handle a range of tasks, including expense management, accounting records, invoicing, and inventory tracking. Sage 50cloud Accounting also integrates seamlessly with Microsoft Office.

Sage’s other plans offer additional advanced features, such as role-based security privileges and account management for multiple companies, but may be prohibitive for smaller businesses with more modest budgets.

Pros:

- Lots of customization options to fit your needs

- Tools to manage and track inventory

- Microsoft 365 integration

Cons:

- No mobile app

- Clunky user interface

- Time tracking not included with any plan option

Available for: Web application (cloud), Microsoft 365 integration

Mobile app: No

Price: Plans begin at $346/year

Free trial length: None, but you can get a live demo of the software

Shopify app or integration: No

6. Kashoo

Best accounting software for workflow automation

Kashoo’s small business accounting software aims to help business owners automate much of the administrative work behind bookkeeping.

Thanks to machine-learning algorithms, Kashoo understands your business better the more you use it. Everything from receipt categorization to sales tax tracking is analyzed by Kashoo, which lets the tool make individualized recommendations on steps to save money, minimize waste, and streamline overall efficiency.

Kashoo’s intelligent, automated approach to accounting won’t be for everybody. Business owners interested in its approach to bookkeeping can sign up for a free trial.

Pros:

- User friendly

- Unlimited number of users

- Great customer support

- Automation of a lot of administrative processes

Cons:

- Relatively few integration options

- Lacks features like time-tracking and inventory management

Available for: Web application (cloud)

Mobile app: iOS

Price: $324 per year

Free trial length: 14 days

Shopify app or integration: No

7. OneUp

Best accounting software for inventory management

Like Kashoo, OneUp aims to make bookkeeping a much more streamlined process by automating routine tasks.

Over time, OneUp “learns” how your accounting works by analyzing inputs, such as bank account transactions. OneUp then prompts the user to validate suggested reconciliations with a single swipe on a mobile device. These validations further train OneUp’s algorithms to offer more accurate suggestions in the future. OneUp can also match individual bank transactions with overdue invoices, saving business owners even more time.

Pros:

- Excellent inventory management module

- Simple setup process

- Built-in CRM function

- Pulls in banking info for automatic bookkeeping

Cons:

- No payroll capabilities

- Expensive for businesses with a lot of team members (unlimited user plan $169/month)

- No time-tracking features

Available for: Web application (cloud)

Mobile app: Android

Price: Plans begin at $9/month

Free trial length: 30 days

Shopify app or integration: No

8. Xero

Best accounting tool for growing businesses

For business owners who find themselves constantly on the go, Xero might just be the accounting tool they’ve been waiting for.

Xero is an intelligent accounting software tool aimed at small businesses, with an emphasis on ease of use and mobile utility. Xero can be synced across multiple devices and offers users updates in real time, giving business owners the latest information wherever they might be.

The product features a clean, intuitive user interface and can handle a range of accounting tasks, including payroll (via an integration with Gusto), expense tracking, billing and invoicing, and sales tax calculation, among other features.

Pros:

- Unlimited users for all plans

- Hubdoc included in all plan tiers (automatic capture of receipts and bills)

- Can manage fixed assets

- Effective project tracking

Cons:

- No automatic reminders for unpaid invoices

- No phone support

Available for: Web application (cloud)

Mobile app: Android, iOS

Price: Plans begin at $15/month

Free trial length: 30 days

Shopify app or integration: Yes; third-party integrations available

Read more: The Entrepreneur’s Guide to Small Business Finance and Accounting

Accurate accounting means better business

No two businesses are exactly alike, and an accounting solution that works well for one business may not work at all for another.

While there’s a great deal of overlap between the small business accounting services above, only you can decide which tool is right for your business.

Some business owners may see sophisticated reporting functionality as an essential feature, whereas some may prioritize automated reconciliation. Before investing in a new accounting system, it may be worth taking advantage of a few free trials before committing to a decision.

Accounting software FAQ

Which accounting system is useful for small businesses?

While the accounting software you choose will depend on the individual needs of your small business, we recommend selecting one of the cloud-based accounting solutions from the list above.

What software do most small businesses use?

Most small businesses need good accounting software, document management software, and CRM software. Your best bet is to find comprehensive software that can perform all three of these functions, or integrate seamlessly with existing platforms.

Why is QuickBooks best for small business?

QuickBooks is one of the more versatile accounting software available for small businesses, and offers all the core accounting features small business owners need, including financial reporting, expense tracking, inventory management, and sales tax tracking, among others.

Which accounting software is the cheapest?

Wave’s accounting software is completely free. However, before you opt for free accounting software like Wave, be sure that it has all the features you need for your business.