by Calculated Risk July 1, 2024 12:26 PM

Today’s Calculated Risk Real Estate Newsletter: FHFA’s National Mortgage Database: Outstanding mortgage interest rates, LTV, and credit scores

Short excerpt:

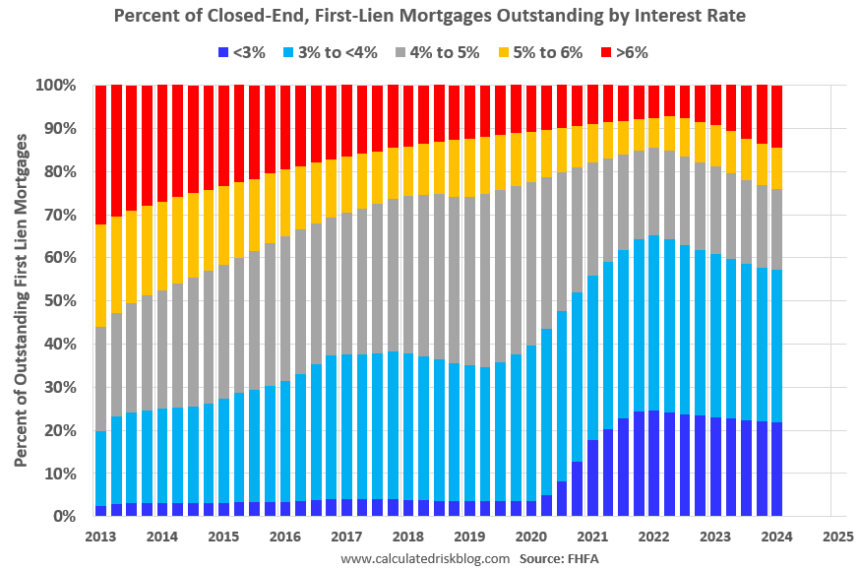

Below are graphs from the FHFA’s National Mortgage Database on outstanding mortgages by interest rate through Q4 2023 (released this morning), average mortgage rates, borrower credit scores, and current loan-to-value ratios (LTVs).

…Below is data showing the interest rate distribution for closed-end fixed rate one- to four-family mortgages outstanding as of the end of each quarter from 1Q2013 through 4Q2023.

This shows that the percentage of loans below 3% and even below 4% has skyrocketed since the beginning of 2020 as mortgage rates have fallen sharply during the pandemic. The percentage of outstanding loans below 4% peaked at 65.3% (now 58.1%) in the first quarter of 2022, while the percentage below 5% peaked at 85.6% (now 77.0%). These low existing mortgage rates are making it difficult for homeowners to sell their homes and purchase new ones, as they would result in significantly higher monthly payments. This is the main reason why existing housing inventory levels are so low. See: “The lock-in effect of rising mortgage interest rates”

The percentage of loans above 6% bottomed out at 7.2% in 2Q22 and increased to 13.4% in 4Q23.

There’s a lot more in the article.