by Calculated Risk July 16, 2024 10:00 AM

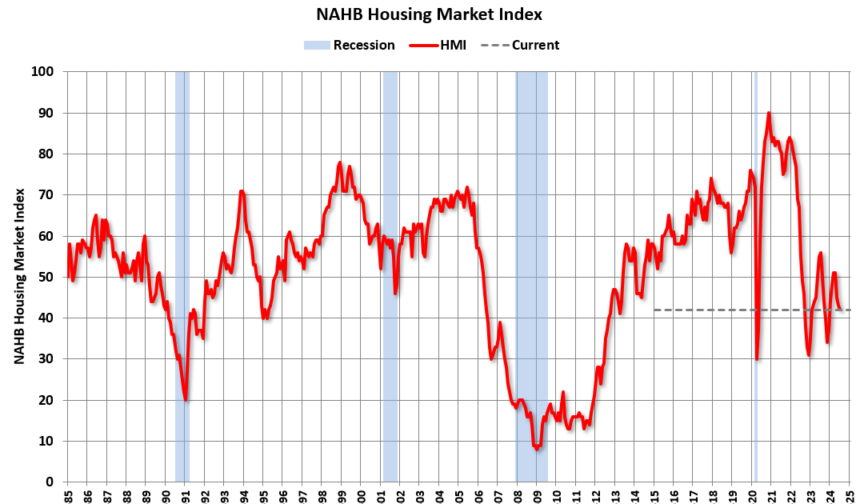

The National Association of Home Builders (NAHB) announced that its Housing Market Index (HMI) fell to 42 from 43 in the previous month. A reading below 50 indicates that more builders view home sales conditions as poor than as good.

From the NAHB: High mortgage rates continue to erode homebuilder confidence

According to Freddie Mac, mortgage rates averaged 6.92% in June, with interest rates on construction and development loans also rising, continuing to negatively impact homebuilder sentiment.

Builder confidence in the new single-family home market was 42 in July, down 1 point from June.This is the lowest level since December 2023, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today.

“While buyers appear to be waiting for interest rates to fall, homebuilders’ six-month sales expectations are rising and with inflation data showing signs of easing, homebuilders are indicating they expect mortgage rates to gradually decline later this year,” said Carl Harris, a custom homebuilder in Wichita, Kansas, and chairman of NAHB.

“Inflation remains above the Federal Reserve’s 2% target, but appears to be subsiding again. NAHB expects the Federal Reserve to begin cutting interest rates at the end of the year, a move that will lower interest rates for homebuyers, builders and developers,” said NAHB chief economist Robert Dietz. “While housing inventory is increasing, overall market inventory remains short at 4.4 months, indicating a need for more homebuilding in the longer term.”

In the July HMI survey, 31% of builders lowered home prices to boost sales in JulyWhile July’s price drop was higher than June’s 29%, the average price drop rate was 6%, remaining flat for the 13th consecutive month. Meanwhile, the rate of sales incentive use was 61%, remaining flat, the same as June.

…

The HMI index, which measures current sales conditions, fell one point to 47 in July, while a gauge showing how likely buyers are to visit stores also fell one point to 27. A factor measuring sales expectations over the next six months rose one point to 48.Looking at the three-month moving average of regional HMI scores, the Northeast fell six points to 56, the Midwest fell four points to 43, the South fell two points to 44, and the West fell four points to 37.

Add emphasis

This graph shows the NAHB index since January 1985.

This was slightly below the consensus estimate.