by Calculated Risk July 22, 2024 3:21 PM

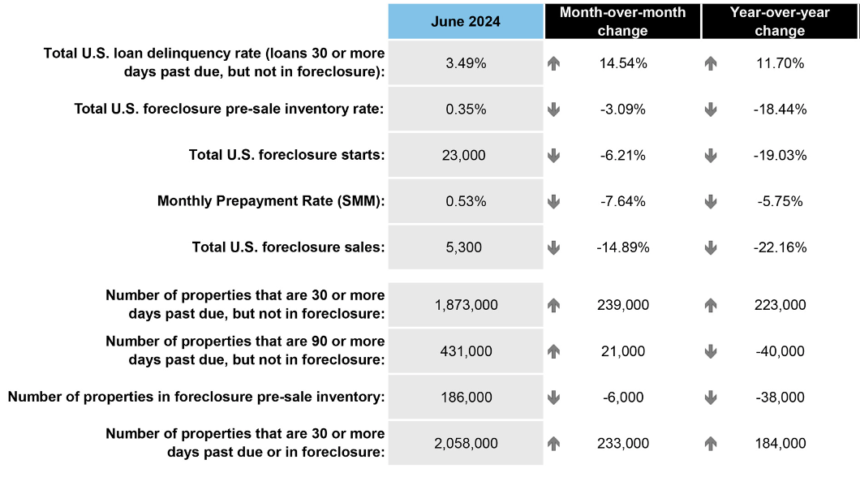

• May was the lowest on record and June ended on Sunday. The national delinquency rate increased +14.5% (+45 basis points) to 3.49%.The second highest level in the last 18 months

• Ending the month on a Sunday often sees a spike in mortgage delinquencies because payments made on the last day of one month aren’t processed until the following month, but this is usually temporary.

• As such, the number of borrowers who are late on one payment rose 19.6% in June, the highest inflow since May 2020, while delinquencies of 60 days or more increased 11.8%, hitting a five-month high.

• Though up 5.1% from May, serious delinquencies (loans that are 90 days or more past due but not in foreclosure) fell 8.5% from a year ago and remained 10.1% below pre-pandemic levels.

• Foreclosure starts fell 6.2% in June, and the number of foreclosures is the lowest since the end of the COVID-19 moratorium and is now 34% below pre-pandemic levels.

• 5.3K foreclosure sales were completed nationwide in June, down 14.9% from the previous month and the lowest level since February 2022, but still well below pre-pandemic levels.

• As the seasonal peak in home sales approaches and homebuying challenges and interest rate constraints persist, prepayments fell 7.6 percent from May, halting a six-month trend of increasing prepayments.

Add emphasis

Below is a table from ICE.