by Calculated Risk July 24, 2024 2:03 PM

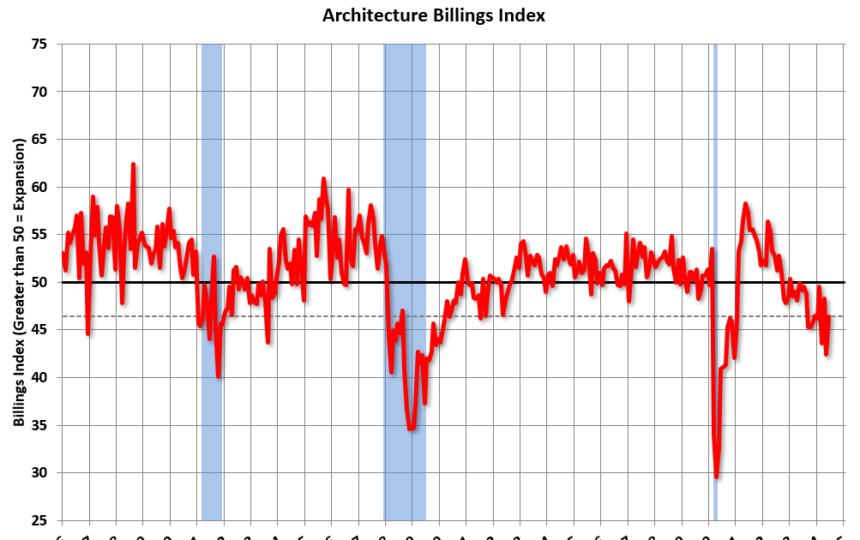

Note: This index is primarily a leading indicator of new commercial real estate (CRE) investment.

From the AIA: ABI June 2024: Business environment remains weak for construction companies

Corporate sales fall for 17th consecutive month, AIA/Deltek Architecture Billings Index (ABI) score: 46.4 (A score below 50 means billings have decreased). While somewhat fewer firms reported a decrease in billings in June than in May, the majority still saw a decrease from the previous month. Indicators of upcoming work were also generally soft, with only just over half of responding firms reporting an increase in new work inquiries. Firms also reported a decrease in the value of newly signed design contracts for the third consecutive month. While many firms still have a healthy backlog of projects in the pipeline (average 6.4 months), this is the lowest backlog in more than three years. Despite this continued softness, firms are generally optimistic that their situation will begin to improve once interest rates begin to fall, but they are likely to continue to experience difficulties at least until then.

Nationwide business conditions remain weak in JuneAll except for firms located in the Northeast, which reported a slight increase in claims for the first time since January 2023. However, firms located in other parts of the country reported a softer situation, especially those located in the Midwest. Claims continued to decline for firms in all specialties in June. Conditions remained soft for firms specializing in multifamily housing, while conditions for other specialties were weaker for the first time in two years, especially for those specializing in commercial/industrial.

…

The ABI score is a leading economic indicator of construction activity, providing a forecast of future non-residential construction spending activity approximately 9-12 months ahead. The score is derived from a monthly survey of construction firms measuring changes in the number of services provided to clients.

Add emphasis

• Northeast (52.2), Midwest (40.9), South (43.9), West (43.1)

• Sector index breakdown: Trade/Industrial (42.0); Institutional (44.3); Apartment buildings (45.1)

This graph shows the Architecture Billing Index since 1996. The index rose from 42.4 in May to 46.4 in June. A reading below 50 indicates a decline in demand for architects’ services.

Note: This includes commercial and industrial facilities such as hotels, office buildings and apartment complexes, as well as schools, hospitals and other facilities.

Because the index typically leads CRE investment by 9-12 months, the index suggests that CRE investment will slow through 2025.

Keep in mind that multifamily billings fell in August 2022, marking the 23rd consecutive month of declines. (Revised). This suggests that apartment housing starts will fall further.