Hello, this is Eve. Just when you thought the economy had gotten bad enough for the Fed to cut rates, the recession is back. The market still believes we need at least one rate cut this year. However, investors have been well ahead of any planned central bank actions.

Wolf Richter, editor Wolf Street. Originally Wolf Street

Our drunken sailors, so to speak, are drunk in moderation, and are hardly disturbed by interest rates.

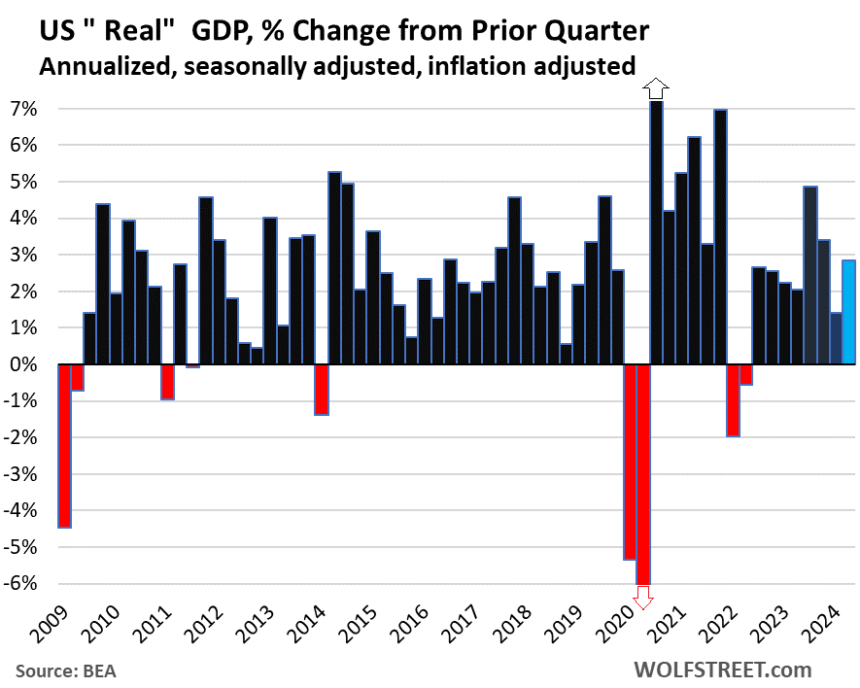

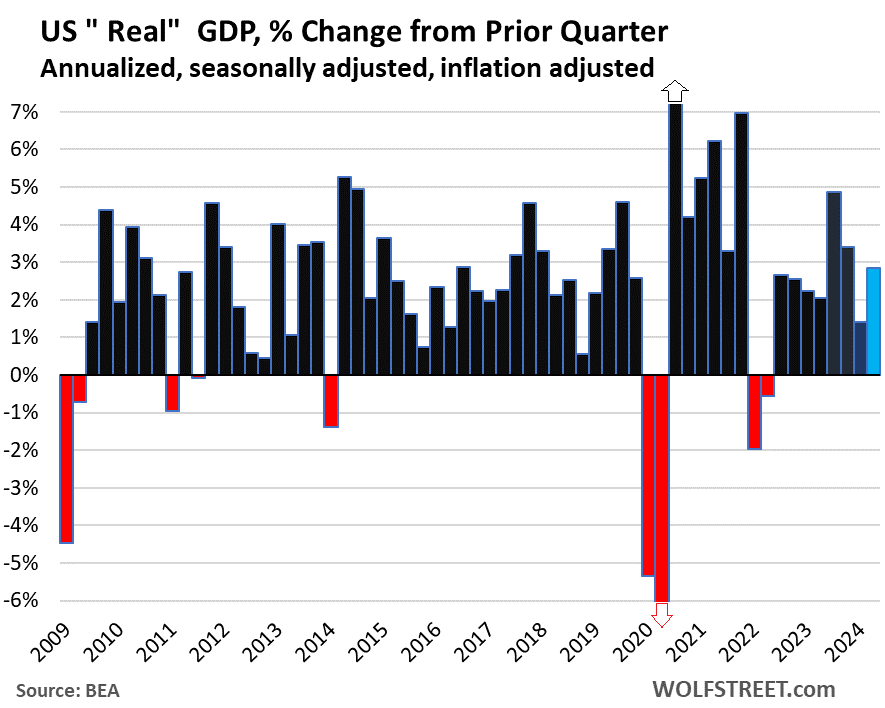

The Bureau of Economic Analysis reported today that inflation-adjusted GDP (“real GDP”) rose at an annualized rate of 2.8% in the second quarter from the first quarter, double the first quarter’s growth rate (+1.4%).

By comparison, the average annual growth rate over the past 14 years has been 2.2%. So a growth rate of 2.8% is well above average and pretty good for the U.S. economy.

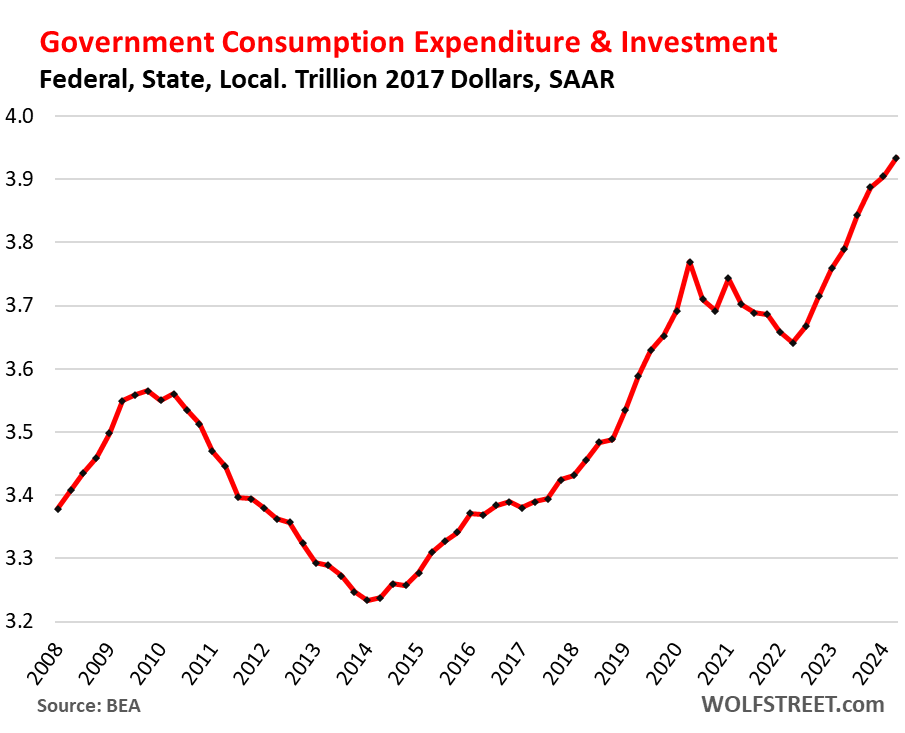

The weak first quarter result (+1.8%, now revised down to +1.4%) was due to a “temporary uptick”, which we said was due to a “temporary uptick”. decline Federal spending and investment turned out to be correct, the bump was only temporary and bounced back in the second quarter (+3.9%), just as everyone expected since the drunks in Congress aren’t going to suddenly slow down.

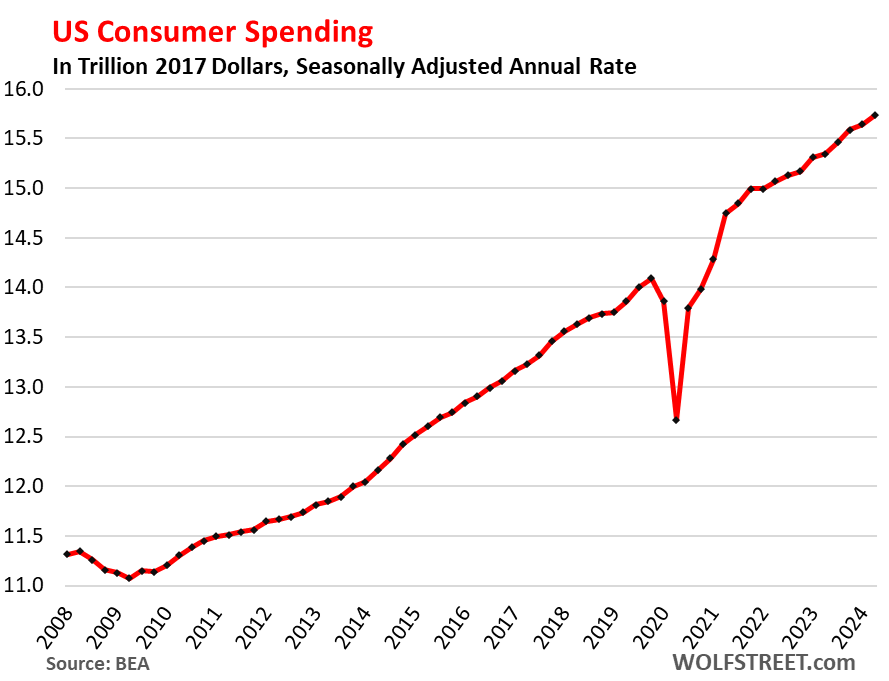

- Consumer Spending (69% of GDP): Spending on durable goods (such as automobiles, recreational vehicles, and household durables) increased 4.7% to +2.3%, services +2.2%, and nondurable goods +1.4%.

- Total private investment (18% of GDP): +8.4% while business investment increased by 11.6% and residential fixed investment decreased by 1.4%.

- Government Consumption and Investment (federal, state, local, 17% of GDP): +3.1%, following a 1.8% increase in the first quarter. Federal +3.9%, state and local +2.6%.

- Changes in private stocks Investment held back GDP growth in the first quarter but boosted it in the second quarter.

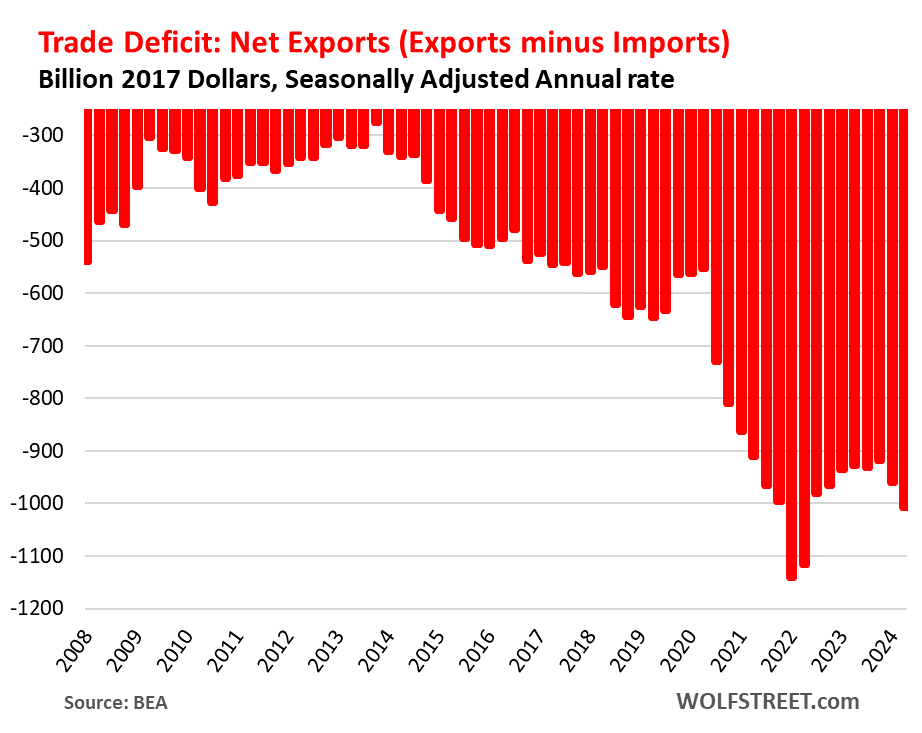

- Trade deficit worsens It was the second straight quarter of strong growth as imports surged to meet rising U.S. demand for durable goods, which are a drag on GDP.

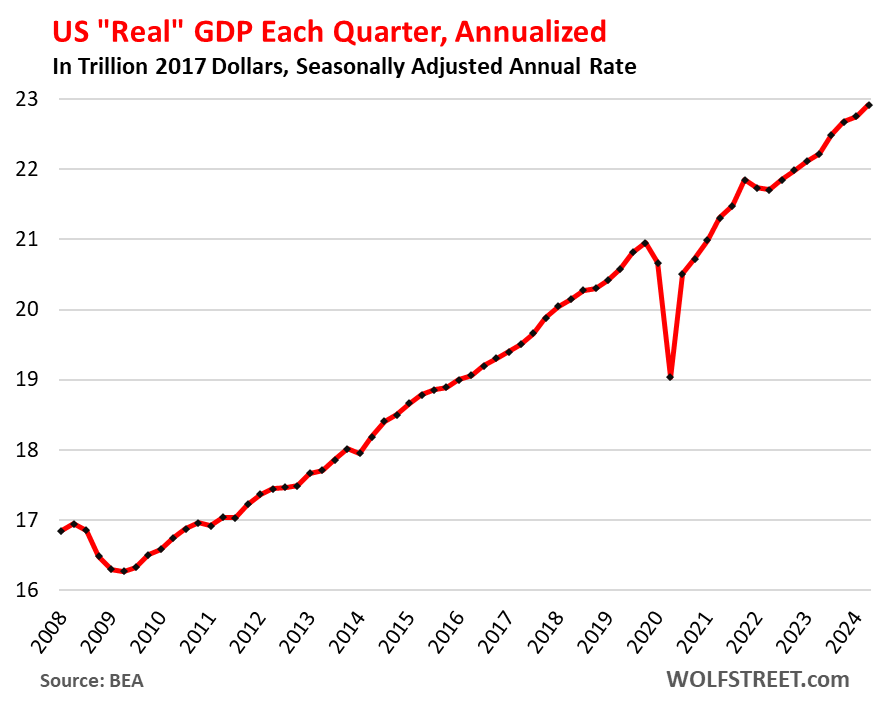

The actual size of the US economy: “Current dollar” GDP (not adjusted for inflation, expressed in current dollars) increased 5.2%, to an annualized $28.6 trillion.

This current dollar GDP of $28.6 trillion represents the actual size of the U.S. economy measured in today’s dollars and is used for GDP ratios such as the U.S. debt-to-GDP ratio.

“Real” GDP in DollarsAdjusted for inflation, in 2017 dollars, the annualized figure rose to $22.9 trillion in the second quarter.

Consumer Spending Spending on goods and services in the second quarter increased 2.3% from the first quarter to an annualized rate of $15.7 trillion, adjusting for inflation, accelerating from first-quarter growth of 1.5%. Consumers stepped on the gas again in the second quarter.

- Services: +2.2%.

- Durable goods: +4.7% (after a 4.5% decline in the first quarter), led by motor vehicles, household durables, and recreational vehicles and goods.

- Non-durable goods: +1.4% (after a 1.1% decline in the first quarter), with increases in food, beverages and gasoline and decreases in clothing and footwear.

The drunken sailors are drinking again, but in moderation, so to speak, and are hardly disturbed by rising interest rates.

Gross Private Domestic Investment The inflation-adjusted annualized rate was $4.25 trillion, up 8.4%, accelerating significantly from the first quarter (+4.4%) and fourth quarter (+0.7%).

Fixed investment+3.6%, including:

- Residential Fixed investment: -1.4% after a surge of +16.0% in the first quarter

- Non-resident Fixed investment: +5.2%, highest growth in one year:

- Structures: -3.3%.

- Gear: +11.6%

- Intellectual property products (software, films, etc.): +4.5%.

Finally, we are back to the peak of the pandemic free money surge in Q1 2022.

Government consumption expenditure and total investment On an inflation-adjusted annualized basis, it rose 3.1% to $3.9 trillion, up from 1.8% growth in the first quarter.

Federal, state, and local government consumption and investment account for 17 percent of GDP (state and local governments account for 61 percent of government spending and the federal government for 39 percent).

this is do not have It includes transfer payments and other direct payments to consumers (such as stimulus payments, unemployment benefits, and Social Security payments), and is counted in GDP when consumers and businesses spend or invest these funds.

- State and local governments: $2.42 trillion, up 2.0 percent.

- Federal government: +3.9% to $1.51 trillion, up from -0.2% in the first quarter.

- Defense spending +5.2% ($846 billion)

- Non-defense spending increased 2.2% ($668 billion).

Trade deficit in goods and services (“net exports”) It got even worse:

- Exports: +2.0%, $2.55 trillion

- Imports: $3.56 trillion, up 6.9%, with goods increasing 7.7% and services increasing 3.6% (services imports include spending by international tourists).

- Net exports (exports minus imports): -4.7%, -$1.1 trillion.

Exports increase GDP and imports decrease GDP. Because exports are much smaller than imports in dollar terms, we have a trade deficit, or negative “net exports.”

The worsening import performance reduced GDP growth (+2.8%) by 0.93 percentage points. If imports had remained at the same poor level as in the first quarter instead of worsening further, GDP growth would have been 3.7% instead of 2.8%.

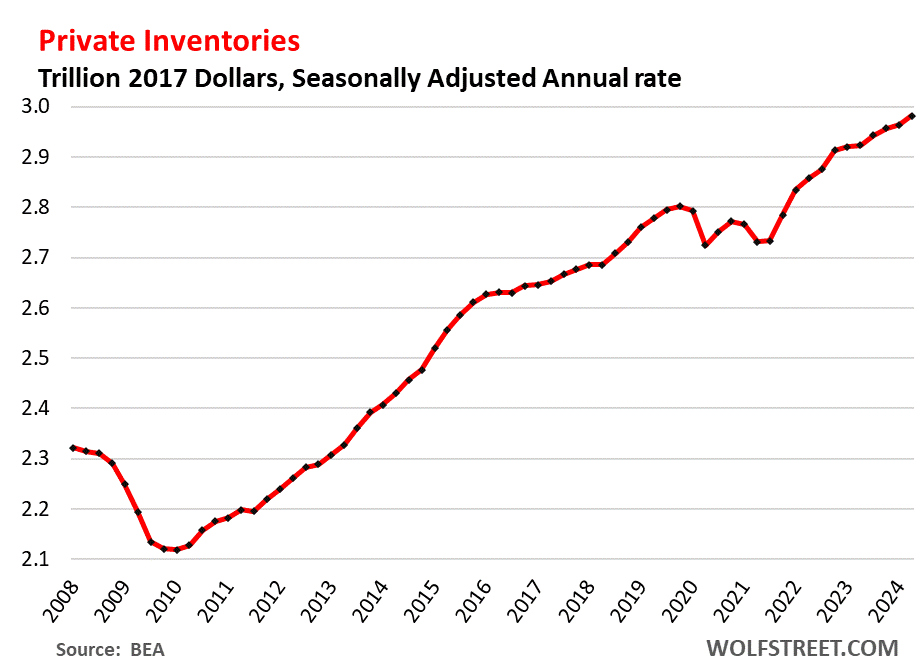

Changes in civilian inventory: Inventories rose at an annualized rate of 2.4% in the first quarter to $2.98 trillion. Increases in inventories are counted as business investment in GDP. In the second quarter, the faster growth rate added 0.82 percentage points to GDP growth, while the slower growth rate in the first quarter reduced GDP growth by 0.42 percentage points.