by Calculated Risk July 27, 2024 8:11 AM

The main report this week is the July employment report.

Other important reports include the Case-Shiller home price index for May, the ISM manufacturing index and July auto sales.

The FOMC meets this week but is not expected to change the federal funds rate.

—– Monday, July 29th —–

10:30 AM: Dallas Fed Manufacturing Activity Survey July edition.

—– Tuesday, July 30th —–

9:00AM: S&P/Case-Shiller Home Price Index For May.

9:00AM: S&P/Case-Shiller Home Price Index For May.

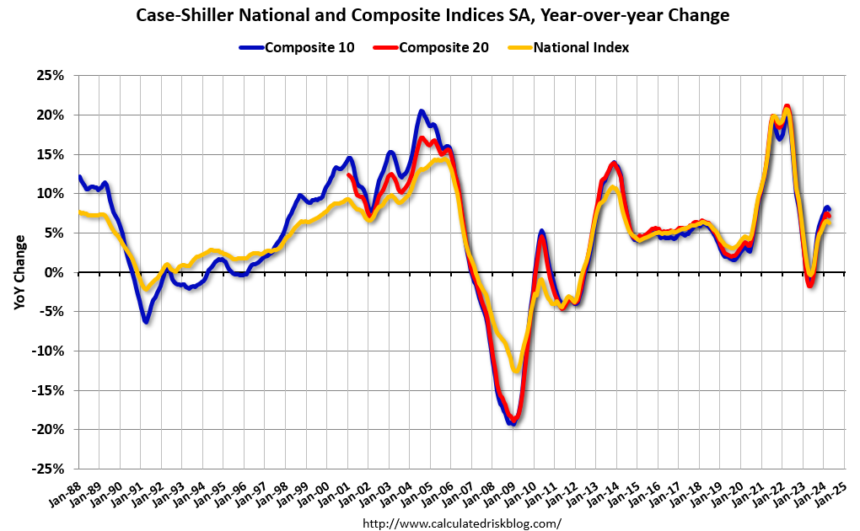

This chart shows the year-over-year changes in the seasonally adjusted national index, the Composite 10 index, and the Composite 20 index through the most recent report (the Composite 20 was launched in January 2000).

The consensus forecast for the Comp 20 Index is a 6.0% increase year-over-year in May.

9:00 AM: FHFA Home Price Index May issue. Originally it was a repeat sale of only GSE, but there is also an extended index.

The graph shows job openings from JOLTS (yellow line), hires (purple), layoffs, firings and other (red columns), and resignations (light blue columns).

The number of job openings increased from 7.92 million in April to 8.14 million in May.

The number of job openings (yellow) was down 13% year-on-year, and the number of resignations was down 14% year-on-year.

—– Wednesday, July 31 —–

7:00 AM EST: The Mortgage Bankers Association (MBA) Mortgage Purchase Application Index.

8:15 AM: ADP Employment Report June employment. This report only covers private sector payrolls, not government payrolls. The consensus is that June employment increased by 168,000, up from 150,000 in May.

9:45 AM: Chicago Purchasing Managers’ Index July edition.

10 am: Pending Home Sales Index The consensus is for the index to rise 1.5% in June.

10 am: Housing Availability and Homeownership in Q2 2024 From the Census Bureau.

2 pm: FOMC Meeting AnnouncementNo changes in the federal funds rate are expected.

2:30pm: Federal Reserve Chairman Jerome Powell A press conference will be held after the FOMC announcement.

—– Thursday, August 1 —–

8:30 AM: Unemployment claims (weekly) The report is coming out. The consensus is for new claims to be 230,000, down from 235,000 last week.

10 am: ISM Manufacturing Index The consensus forecast is that the ISM index will rise to 49.0 in July from 48.5 in June.

10 am: Construction Expenditures Construction spending is expected to increase 0.2% in June.

This graph shows light vehicle sales since BEA began collecting data in 1967. The dashed line is last month’s sales rate.

—– Friday, August 2 —–

8:30 AM: Employment Report Payrolls are expected to increase by 175,000 in July, with the unemployment rate expected to remain unchanged at 4.1%.

8:30 AM: Employment Report Payrolls are expected to increase by 175,000 in July, with the unemployment rate expected to remain unchanged at 4.1%.

The economy added 206,000 jobs in June, bringing the unemployment rate to 4.1%.

This chart shows the number of jobs added each month since January 2021.