of Bitcoin Price It fell below $50,000 on Monday, its lowest level in six months, amid widespread selling pressure in global stock markets.

breaking news: #Bitcoin Below $50,000 pic.twitter.com/11og9GoSyi

— Bitcoin Magazine (@BitcoinMagazine) August 5, 2024

Bitcoin fell 20% to around $49,000 before recovering slightly to trade above $50,000 again. The drop coincided with a selloff in stock markets around the world fueled by recession fears.

Japanese The Nikkei Stock Average fell more than 8%, its worst two-day drop since 1987. Asian and European markets have experienced their worst declines on record. In the U.S., the tech-heavy Nasdaq has fallen more than 20% from its peak and is in a correction. The S&P 500 has fallen nearly 4% over the past week.

Rising interest rates, weak technology earnings and signs of economic weakness like Friday’s U.S. jobs report have shaken investor confidence. The bitcoin market has followed stocks down, dropping below $50,000 for the first time since February. Bitcoin’s market capitalization lost about $200 billion over the weekend.

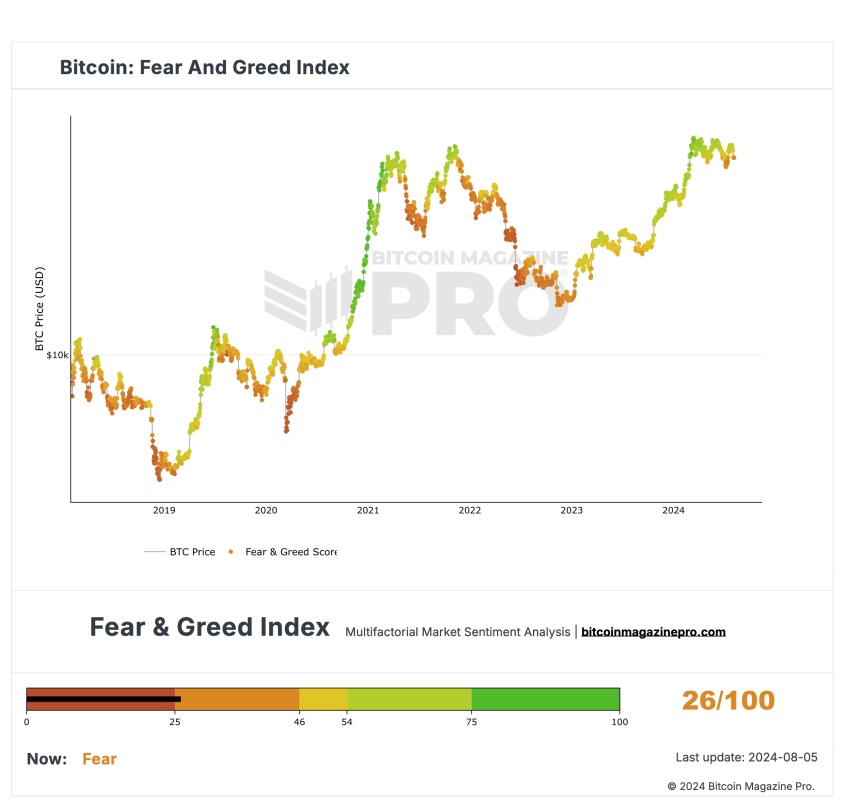

of Bitcoin Fear and Greed Index It dipped into “scare” territory as prices approached six-month lows, but Bitcoin has recovered from similar crashes many times before, including a 20% one-day drop in November last year.

Still, some analysts are warning that a continued decline could signal the end of the bull market and usher in a prolonged bear market, while others argue that this is just a minor correction before hitting new all-time highs as global markets inject more liquidity.

The $50,000 level is considered a key support area for Bitcoin. The recent Bitcoin sell-off illustrates the asset’s volatility and correlation with speculative stocks. However, Bitcoin has recovered from previous sell-offs and resumed its long-term uptrend.