by Calculated Risk August 6, 2024 11:00 AM

From the NY Fed: Household debt to grow modestly in Q2 2024; auto and credit card delinquency rates remain high

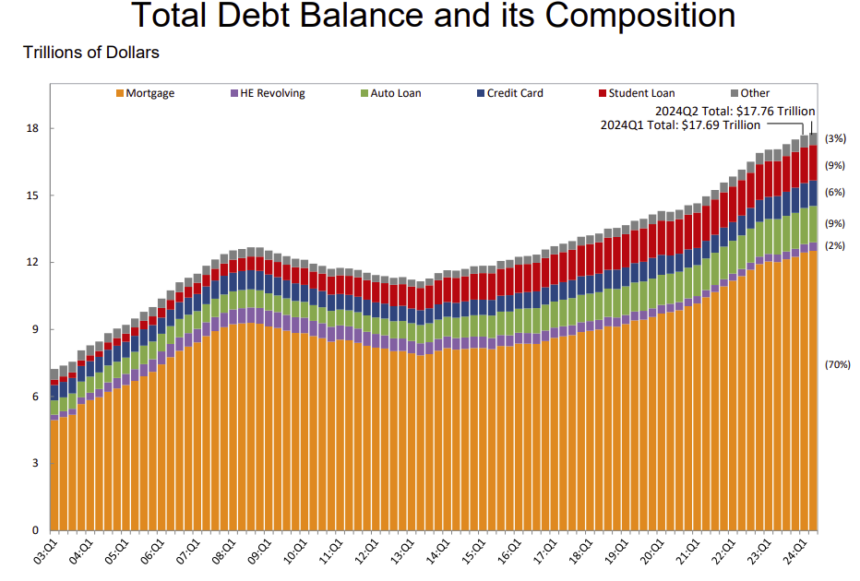

The Federal Reserve Bank of New York’s Microeconomic Data Center today Household Debt and Credit Quarterly ReportTotal household debt is expected to increase by $109 billion, or 0.6 percent, to $17.80 trillion in the second quarter of 2024, according to the report, which is based on nationally representative data from the Federal Reserve Bank of New York. Consumer Credit PanelIt includes a one-page summary of key takeaways and supporting data points.

The New York Fed also Liberty Street Economics Blog Post Investigating the rise in home equity line of credit (HELOC) balances.

“Mortgage lending remains low“This is primarily due to a slowdown in refinancing activity,” said Andrew Hoehout, director of household and public policy research at the New York Fed. “Homeowners continue to build up their HELOC balances as an alternative way to draw down on their home equity.”

Mortgage balances increased $77 billion from the previous quarter, reaching $12.52 trillion at the end of June. HELOC balances increased $4 billion, the ninth consecutive quarter of increases since the first quarter of 2022, to $380 billion. This is an increase of $63 billion from the series low in the third quarter of 2021. Credit card balances increased $27 billion to $1.14 trillion. Auto loan balances increased $10 billion to $1.63 trillion. Other balances, including retail cards and other consumer loans, increased $1 billion and were essentially flat.

Mortgage loan volumes continued to grow at roughly the same pace as the past four quarters, reaching $374 billion. Credit card account limits increased slightly to $69 billion, up 1.4% from the previous quarter. HELOC limits increased by $3 billion, marking the ninth consecutive quarter of increases.

Overall delinquency rates unchanged from the previous quarter3.2% of outstanding debt is in some stage of delinquency. Delinquency rates for credit cards, auto loans and mortgages increased slightly.

Add emphasis

The following is report:

The first chart shows that household debt increased in the second quarter. Household debt previously peaked in 2008 and bottomed in the third quarter of 2013. Unlike after the Great Recession, there has been no decline in debt during the pandemic.

From the NY Fed:

Total household debt outstanding increased by $109 billion in Q2 2024, up 0.6% from Q1 2024. The outstanding now stands at $17.80 trillion, up $3.7 trillion from the end of 2019, just before the pandemic recession.

Delinquency rates remained roughly steady overall in the second quarter. According to the New York Fed:

Overall delinquency rates were unchanged from the first quarter of 2024. As of June, 3.2 percent of outstanding debt was in some stage of delinquency. … Delinquency transition rates for credit cards, auto loans, and mortgages increased slightly. About 9.1 percent of credit card balances and 8.0 percent of auto loan balances moved into delinquency over the past year. Mortgage early delinquency transition rates increased 0.1 percentage point but remain low by historical standards.

From the NY Fed:

Credit quality of new loans remained stable, with 3.9% of mortgage loans and 16.7% of auto loans going to borrowers with credit scores below 620, up slightly from the first quarter. The average credit score for new mortgage loans increased slightly to 772, while the average credit score for new auto loans was 719, five points below the all-time high recorded in 1Q24.

And much more report.