This week is Naked Capitalism’s fundraising week. We’re pleased to invite 901 donors to join us as they have already invested in our efforts to fight corruption and predation, especially in the financial sector. Donation pageHere’s how to donate by check, credit card, debit card, PayPal, Clover, or Wise. Why are we doing this fundraiser?, What we accomplished last yearAnd our current goal is to Preventing death from overwork.

Hi, I’m Eve. In this article, I discuss the reaction of prediction markets to the Harris vs. Trump debate and the ability of these markets to manipulate. I need to point out that even though these markets are Keynesian beauty contests, i.e. participants try to guess the popular winner rather than choosing for themselves, prediction markets have made some major mistakes. In the UK, betting on election events is allowed, which acts as an even larger prediction market in terms of size compared to the basic vote counts that both prediction markets consider below. In the Brexit vote, supporters of the UK predicted that Brexit would lose by 4 points. In reality, it won by 2 points. It turns out that these bettors were not sufficiently empathetic to the feelings of the general public, rather than their own. It turns out that the number of bets in favor of Brexit was significantly higher than the number of bets against it, but anti-Brexit punters made three times as many bets that Brexit would win. The propensity to vote Remain correlates with class.

Author: Rajiv Sethi, Professor of Economics, Barnard College, Columbia University, and External Professor at the Santa Fe Institute. Originally published on his website

First (and probably the last) Discussion The race between the two major party candidates for the United States presidential election is over.

It is too early to know exactly what impact this debate will have. Poll Average and Various Statistical Model But prediction market activity gives us a glimpse into what may happen in the future.

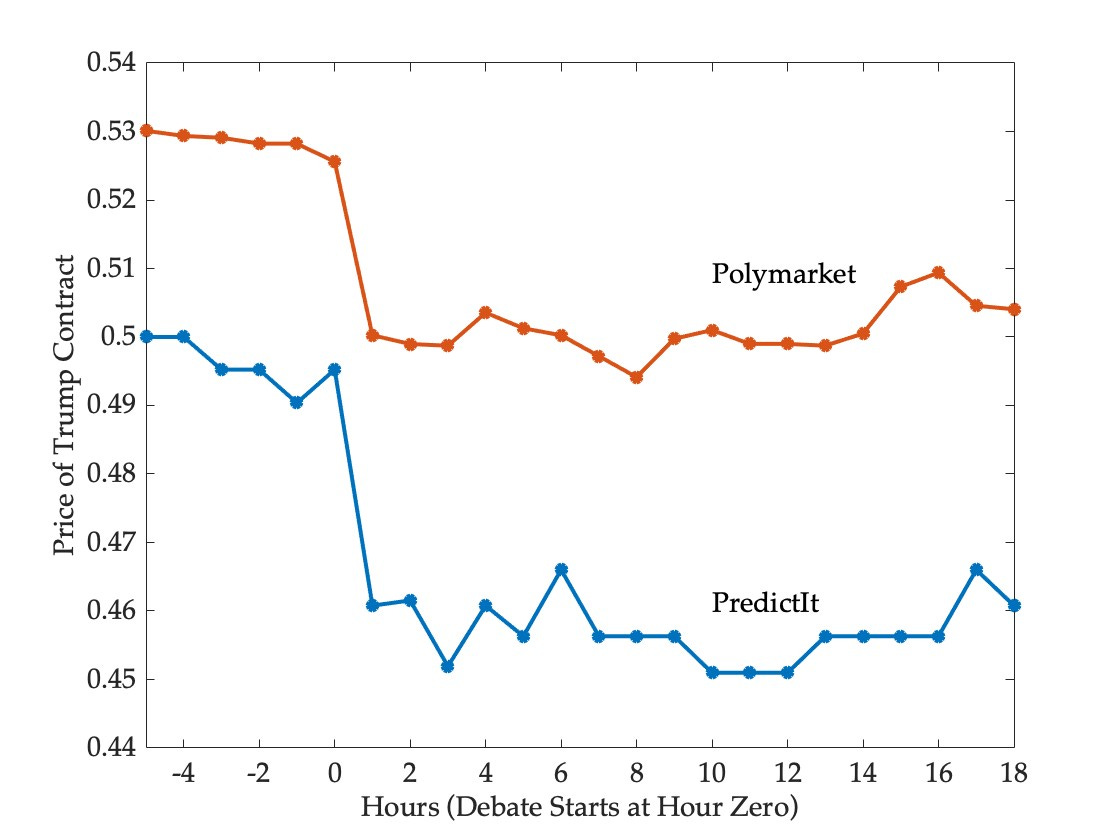

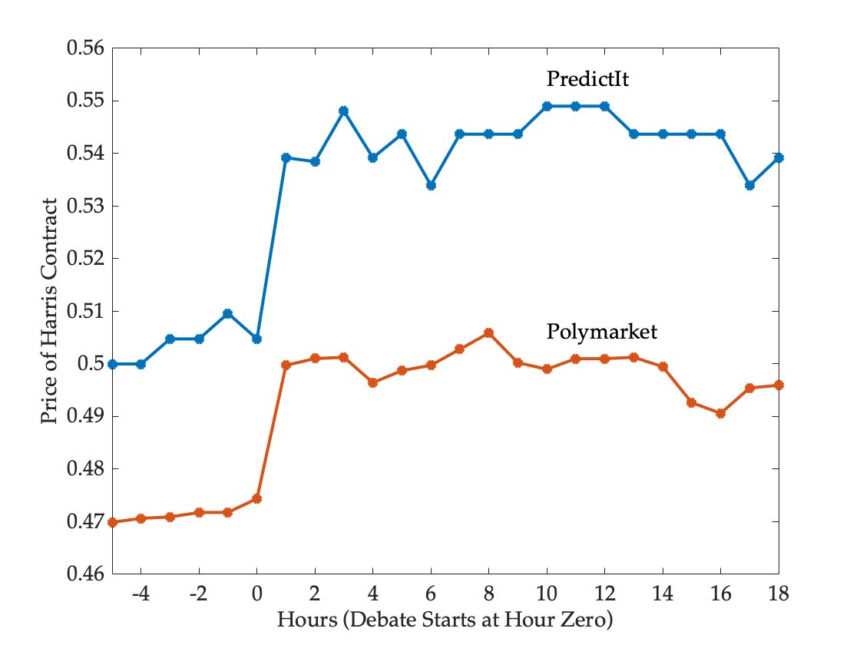

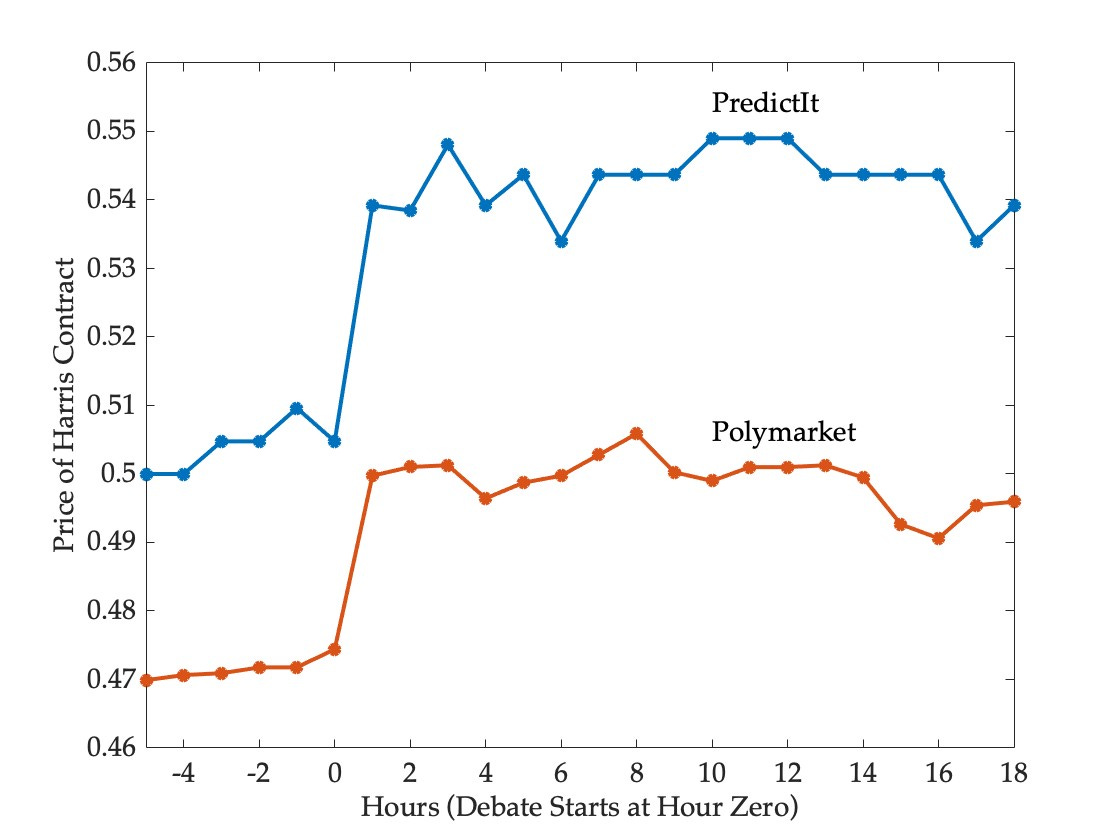

The chart below shows the prices of Harris contracts from PredictIt and Polymarket over the 24 hour period including the debate, scaled so that they can be interpreted as probabilities and to facilitate comparison with statistical models.1

Five hours before the debate, the market was divided on the outcome, with PredictIt believing the race was a coin toss and Polymarket predicting Trump would win. After the debate, the market is still divided, but Polymarket now sees the race as evenly matched and PredictIt predicts Harris will win.

Despite these differences, the two markets reacted very similarly to the debate, moving in roughly the same direction to roughly the same extent: One hour after the debate began, the odds of a Harris win rose from 50 to 54 on PredictIt and from 47 to 50 on Polymarket. Prices then fluctuated around these higher levels.

The statistical model is Five Thirty Eight, Silver Bulletin,and economist You can’t react instantly to events like this. It will take days for the effects of the debate, if any, to show up in the horse racing polls, and the model Respond when the poll was conducted.

This is one of the advantages of markets as a predictive mechanism: they take new and qualitative information into account without delay and can continue to make consistent predictions even when models are unpredictable. Loss of continuity and credibility In the face of An unprecedented event.

But the market also has its drawbacks. Overreaction and operationSo we’ll be watching to see how the model predictions change over the next few days — there are likely confounding factors, of course, so this isn’t a pure experiment — but what the market is predicting is that once the model adjusts for the effects of the debate, it will increase Harris’ chances of victory by about 3-4 percentage points.

Markets reacted to the debate in a similar fashion, but the divergence between markets on the outcome of the election has not narrowed. This raises the question of how such divergence can be sustained when financial incentives exist. Could a trader bet against Trump on Polymarket and against Harris on PredictIt and secure a solid gain of about 4% in two months, or 26%+ annualized? And would pursuing such arbitrage opportunities bring prices between markets into line?

There are some obstacles to implementing such a strategy. PredictIt is restricted to verified US residents who fund their accounts with cash, while trading on Polymarket is Crypto-based Additionally, the exchange does not accept cash deposits from US residents. This leads to market fragmentation and limits arbitrage between markets. Additionally, PredictIt has limit There is an $850 limit on position size in a particular contract, Pricing.

A natural question arises: which market should be taken more seriously as a prediction mechanism? Polymarket has no limits on position sizes and much larger trading volumes, with nearly $900 billion at stake. Presidential Election Winner Market To date ( Serving Markets However, higher trading volume does not necessarily mean better forecasts, and position limits Improved forecast accuracy Ensure that no single trader is large relative to the market as a whole.

Arbitrage puts limits on the extent of market disagreement, but statistical models have no such constraints. Here, disagreement is substantially larger, with the probability of a Trump victory increasing from 45% to 100%. Five Thirty Eight 49 percent economist 62 percent Silver Bulletin.

Why are there such big differences between models that use essentially the same materials? One reason is that the Silver Bulletin model’s “conventional bounce adjustment” is questionable, without which the discrepancy with the FiveThirtyEight would not exist. Negligibly small.

However, there appear to be significant differences in the correlation structures underlying these models. Very puzzlingFor example, according to the Silver Bulletin model, Trump has a higher chance of winning New Hampshire (30%) than Harris has a higher chance of winning Arizona (23%). The other two models rank the two states quite differently, making a Harris win in Arizona significantly more likely than a Trump win in New Hampshire. Convention bounce adjustments aside, the correlation structure between states in the Silver Bulletin model is not at all convincing to me.

In any case, once the election is over, we will be reviewing the predicted performance of various models and markets. Profitability Test Analysis of predictive accuracy is already underway and we look forward to reporting the results soon.

1 The adjustment is necessary because the prices of the two contracts do not always sum to one due to commissions and the fact that the two contracts trade independently. To convert prices to probabilities, divide the price of each contract by the sum of the prices of the two contracts. For example, at the end of the period shown, the Harris contract and the Trump contract were trading at 55 cents and 47 cents, respectively, on Predictit. This means that the probabilities are 54 percent and 46 percent. The adjusted price of the Trump contract is (by construction) the mirror image of the Harris price.