by Calculated Risk September 23, 2024 11:01 AM

Today’s Calculated Risk Real Estate Newsletter: Be careful with stock numbers!

Short excerpt:

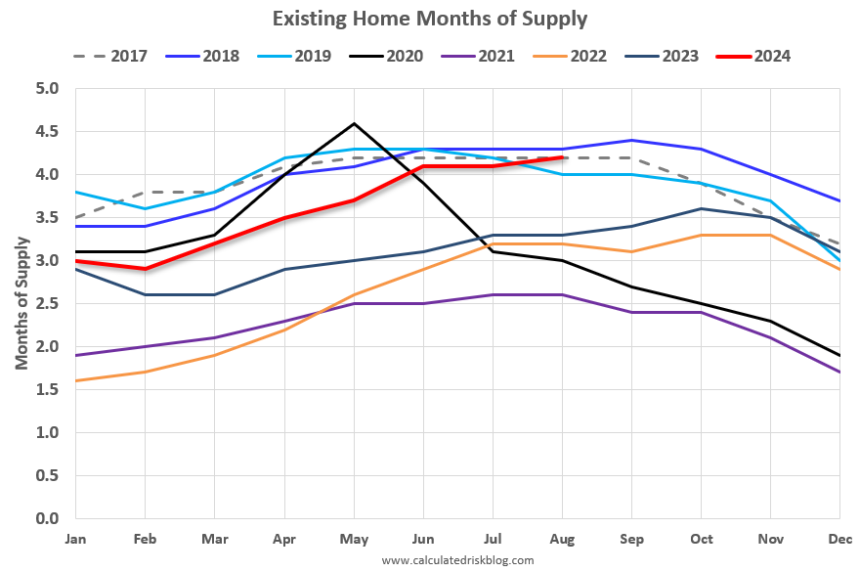

With both inventory and sales well below pre-pandemic levels, I think we need to look at months of supply to predict price movements. Historically, nominal prices have fallen as months of supply approached six months, but that is unlikely to happen anytime soon. However, as expected, months of supply are back to 2019 levels.

The months of supply in August was 4.2 months. Compared to 4.0 months in August 2019, inventory is significantly lower compared to 2019, yet sales are down further, pushing up months of supply.

The following graph shows the months of supply since 2017. Notice that the months of supply is higher than the previous three years (2021-2023) and higher than August 2019. The months of supply was 4.2 in August 2017 and 4.3 in August 2018. In 2020 (black), the months of supply increased at the beginning of the pandemic and then dropped sharply.

…

What would it take to get months of supply to more than 5 months? If sales remain sluggish at 2023 and 2024 levels, how much would inventory need to increase to get to 5 months of supply by, say, June 2024?

There’s a lot more in the article.