Hi, Yves. Again, the dedollarization advocates are way ahead of the status quo and short-term outlook. It is true that the dollar’s dominance is eroding as the US’s size relative to global GDP shrinks. And the US is acting like it’s doing all it can to hasten the dollar’s shelf life by overusing sanctions to get its way.

But while Russia and its friends are working hard to create trade settlement mechanisms that avoid the dollar, with increasing success, trade still accounts for less than 5% of global foreign exchange transactions; the vast majority is investment-related. I owe my readers a post or two on why the use of the dollar in investment is not as vulnerable as trade.

Meanwhile, Wolf Richter provides an update on another issue we discussed: despite all the talk that rising U.S. federal debt is making foreign investors wary of U.S. Treasuries, the share of U.S. Treasuries held by foreign central banks is actually holding steady overall, with some states cutting back on purchases while others are increasing them.

Wolf Richter, editor Wolf Street. Originally Wolf Street

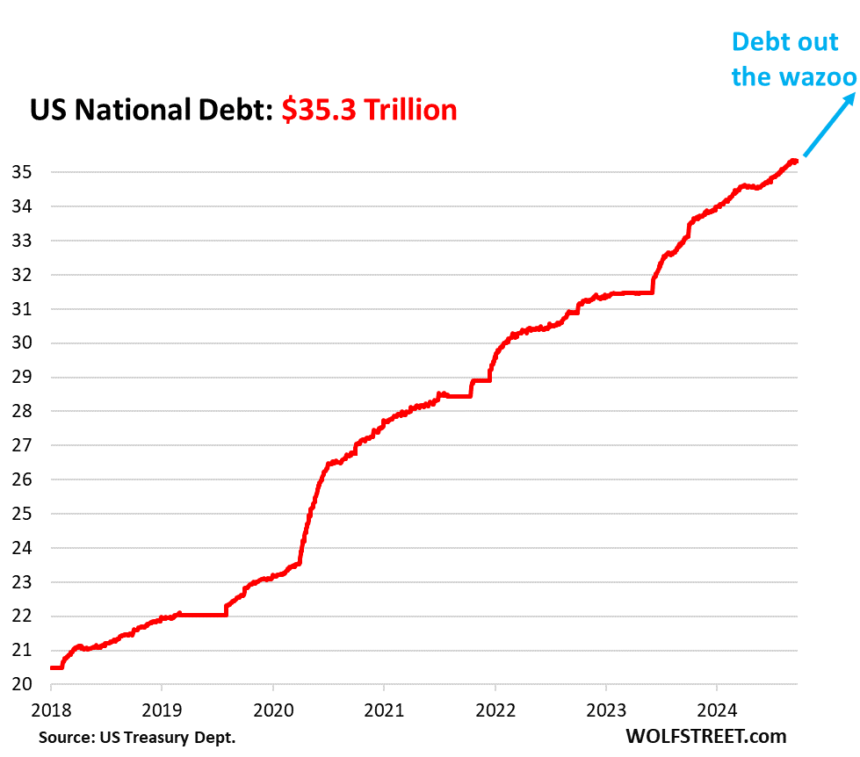

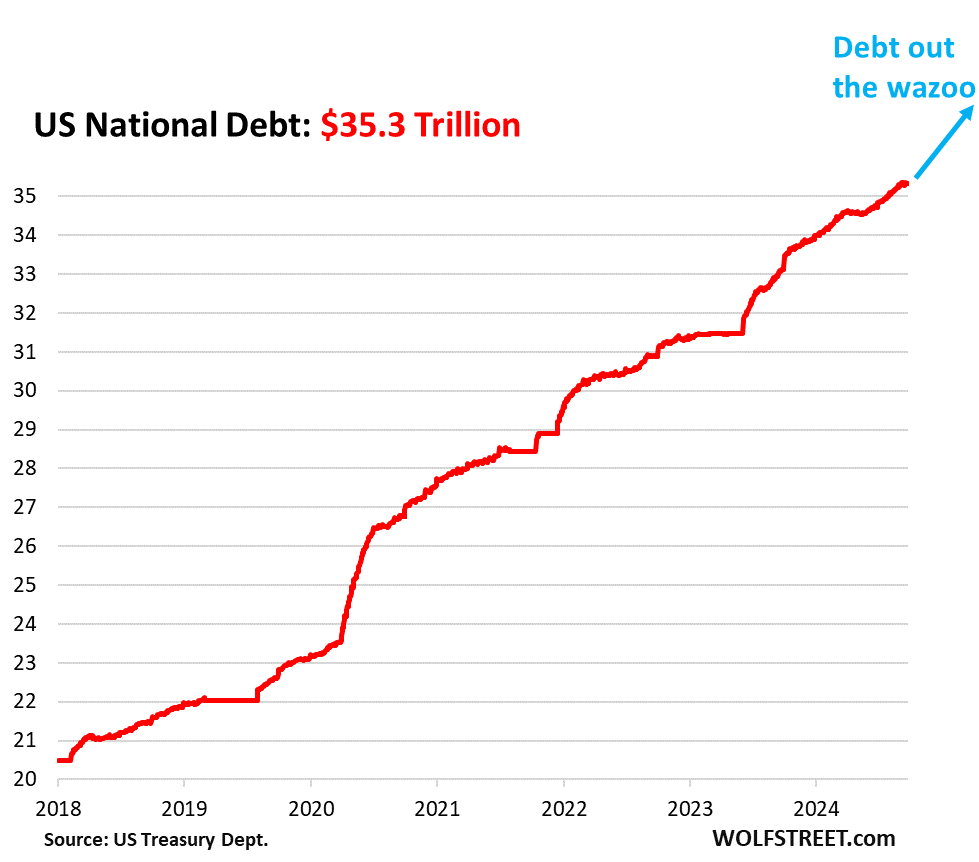

The U.S. national debt has ballooned to $35.3 trillion, up $12 trillion since January 2020, a daunting amount, especially during a period of economic growth. And every single one of those bonds that make up this massive debt is being bought and held by some sort of investor. We’re going to look at the companies that hold those bonds.

Who owns this $35.3 trillion in national debt?

US government funding: $7.11 trillion. The “internal held debt” refers to government bonds held by various U.S. government pension funds and social security trust funds ( SS Trust Fund Holdings, Revenues, and ExpendituresThese Treasury securities are not traded on the market, but are purchased directly from the Treasury by a government fund and are redeemed at par at maturity. They do not incur Wall Street fees or profits and are not subject to the whims of the markets.

The remaining $28.2 trillion in Treasury securities are “held by the public.” As of the end of the second quarter, which we will discuss, the public held $27.6 trillion. Only a small portion of these “held by the public” Treasury securities are untradeable, including the popular Inflation Protected I-Notes and other securities.

The remaining $27.5 trillion is traded and therefore “marketable” Treasury bills, Treasury bonds, TIPS (Treasury Inflation-Protected Notes) and FRNs (Floating Rate Notes), which by far make up the bulk of US fixed income securities, far surpassing corporate bonds ($11 trillion).

Who owns $27.05 trillion in “marketable” government bonds?

The Securities Industry and Financial Markets Association (SIFMA) released its Quarterly Bond Report for the second quarter, which details a variety of information, including who held $27.05 trillion in marketable Treasury securities as of the end of the second quarter.

Foreign holders: 33.5% of marketable securitiesThis includes private sector holdings and public holdings such as central banks.

Foreign holdings continue to grow at record highs. Major financial centers, European countries, Canada, India and others are increasing their holdings to new records. China, Brazil and others have been reducing their holdings for years ( For more information on foreign holders, please click here).

US companies hold the remaining 66.5%.

US Mutual Funds: 17.7% The share of marketable Treasury securities, such as bond mutual funds and money market mutual funds (about $4.8 trillion), decreased from the first quarter (18.0%).

Federal Reserve: 16.1% The Fed has already sold $1.38 trillion of Treasury securities under its QT program since its peak in June 2022, reducing its holdings to $4.4 trillion as of early September (according to our research). Federal Reserve Balance Sheet Update).

US Individuals: 11.1% Marketable Treasury securities (about $3 trillion). These are investors who hold Treasury securities in accounts in the U.S. They increased their holdings since the first quarter (9.8% share, from about $2.7 trillion).

Banks: 8.1% Marketable Treasury securities outstanding (about $2.2 trillion) remained roughly flat from the first quarter.

State and local governments: 6.2% Marketable Treasury securities (about $1.7 trillion) were down slightly from the first quarter (6.3%).

Pension funds: 3.7% Marketable Treasury securities (about $1 trillion) were down from the first quarter (4.3%, or $1.7 trillion).

Insurance companies: 2.2% Marketable Treasury securities (about $600 billion) increased holdings for the first time since the first quarter (1.9%) and reflect Warren Buffett’s conglomerate Berkshire Hathaway (which includes GEICO). Over the past two years, the Bank of Japan purchased large amounts of government bonds up until the second quarter..

Other: 1.4% Marketable government bonds (approximately $400 billion)

America’s debt burden: These interest-earning assets held by investors are costly liabilities for governments. Here we discuss the burden of national debt, how much of tax revenue goes to interest payments, and how that has changed over the decades. Soaring interest payments on ballooning U.S. government debt and tax revenues, GDP and inflation