by calculated risk October 24, 2024 02:33:00 PM

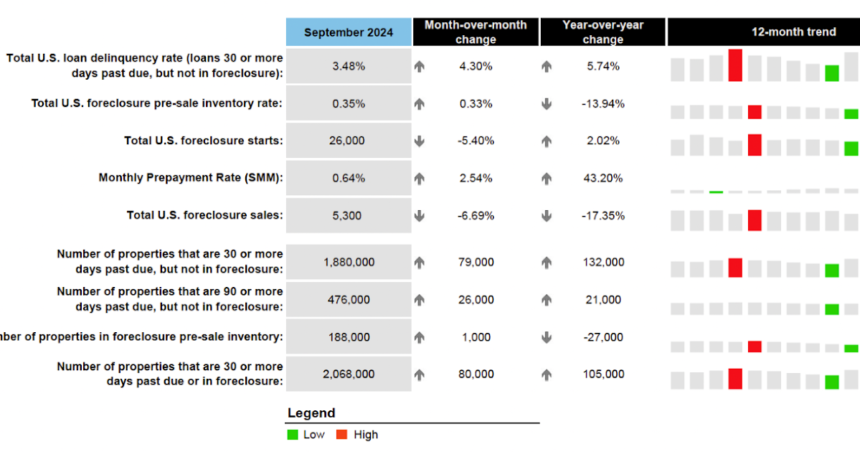

• The national delinquency rate rose 14 basis points in September to 3.48%.4.3% increase from August, 5.7% increase compared to the same month last year

• Mortgage delinquencies increased in September for the fourth consecutive year compared to a year earlier, and the longest since early 2018, excluding the initial impact of the coronavirus pandemic.

• With a 5.9% increase, serious delinquencies (90 days or more past due but not yet foreclosed) hit a 16-month high, marking the second straight month of year-over-year increase. .

• 30-day delinquencies reached the highest level in three months, and 60-day delinquencies reached the highest level since January 2021. Foreclosure activity remains subdued, with both construction starts and sales/completions down in September.

• The number of loans in foreclosure increased slightly (+0.4%) month-over-month, but is down 12.5% from this time last year and remains 34% below pre-pandemic levels.

• Prepayment activity rises to levels not seen since August 2022. +2.5% increase compared to the previous month, +43.2% increase compared to September last year

Emphasis added

This is the ICE table.