by calculated risk October 29, 2024 01:55:00 PM

In today’s Calculated Risk Real Estate newsletter: Lawler: Mortgage rates have skyrocketed since the Federal Reserve cut interest rates last month.

excerpt:

Housing economist Tom Lawlor said:

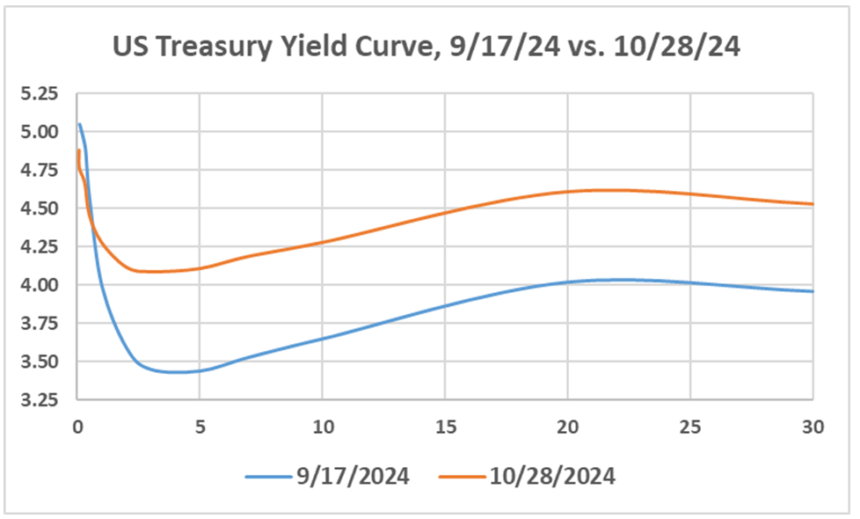

For the past month and a half, those who expected mortgage rates to fall when the Federal Reserve began lowering the target range for the federal funds rate have been left stunned and confused. Since September 18, the day before the Fed lowered its funds rate target by 50 basis points, 30-year MBS yields have increased by 84 to 96 basis points, and mortgage rates have increased by 72 to 89 basis points. At the same time, medium- and long-term US Treasury yields rose by 53-67 basis points.

There are two main reasons why MBS and mortgage rates rose more than Treasury rates during this period. First, implicit interest rate volatility spiked as many market participants were caught off guard by a series of unexpectedly strong economic indicators (and slightly higher inflation indicators) following the Fed’s interest rate decision. For example, the BofAML MOVE index, a measure of implied interest rate volatility derived from one-month options on U.S. Treasuries across the yield curve, rose from 101.58 on September 17th to 130.92 on October 28th, 2023. It was the highest price since March 30th. Because mortgage investors effectively write prepayment options into home borrowers, higher implied interest rate volatility also increases the premium investors require on Treasuries to cover prepayment risk).

And second, MBS option-adjusted spreads, which were at the lower end of the “no Fed MBS intervention” range immediately before the Fed’s action, have since risen.

There’s a lot more to this article.