Luis Alvarez/DigitalVision via Getty Images

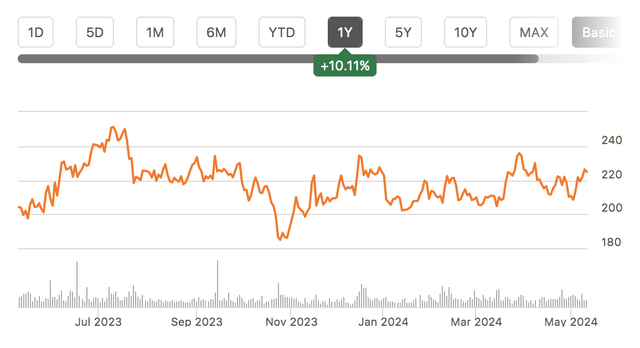

Asbury Automotive Group (New York Stock Exchange:ABG) has had a mixed performance over the past year, increasing just 10%, below last summer’s high.in SeptemberI rate ABG stock as a “strong buy,” but its performance since then has been After that I was disappointed. While the S&P 500 index rose 16%, stock prices were mostly flat. Given this underperformance, it’s time to re-examine whether there is merit in the underperformance or if there is still an opportunity for returns of 15% or more. I remain bullish.

inside the company 1st quarter Asbury reported on April 25 that its revenue was $7.21 on $4.2 billion. Thanks in part to the effects of M&A, sales increased by 17% compared to the previous year. Throughout the year, Analyst The company’s earnings are expected to be $29.73, which is higher than the long-term estimate of $19 per share I used to arrive at a fair value of $260. In other words, the company is The company continues to generate strong profits thanks to favorable vehicle price trends, but its multiples remain extremely compressed as the market clearly questions more sustainable long-term profit levels. There is. I believe some of this pessimism is misplaced.

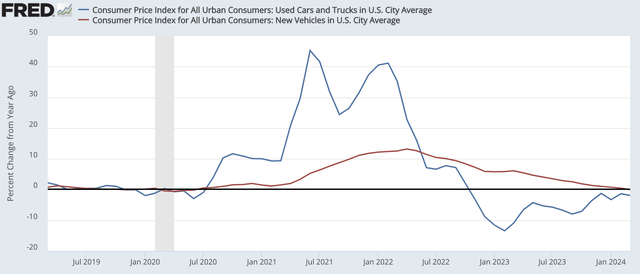

EPS is now down from $8.37 last year, which is not surprising given the normalization of the auto market. The company’s gross profit increased 8% to $750 million, but its gross profit margin fell 158 basis points to 17.9%. In the aftermath of the coronavirus pandemic, used car prices have skyrocketed due to supply chain disruptions, and new car prices have also risen significantly. This significantly expanded dealer margins and reversed prices, reducing this one-time profit.

Vehicle sales have significantly boosted profits and generated excess cash flow that can be used for stock buybacks and dividends, but this is becoming the norm. But the important thing to remember is that vehicle sales are never the central driver of a car dealership business, maintenance and financing are. These units account for about 20% of revenue but generate his 60% of gross profit. Maintenance in particular has far less cyclical effects and provides a stable cash flow over time.

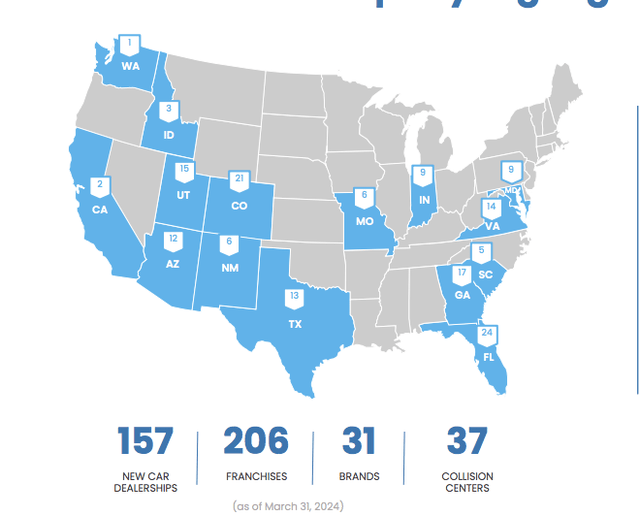

But first, if we look at car sales, new car sales in the first quarter were $2.06 billion, accounting for 49% of sales. Although new car sales increased 17%, gross profit decreased 9% to $163 million. This was as margins contracted by 223 basis points to 7.9%, a more normalized level. In line with the trend in CPI data, new car prices fell 1% to $58,000. It is also worth noting that same-store new vehicle sales decreased by 1% due to increased revenue from M&A. The company’s business is quite diversified, with 30% domestic products, 29% luxury products, and 41% imported products. Toyota is the largest brand at 20%, followed by Ford at 12%. Thanks to acquisitions, its geographical footprint has also become more diverse.

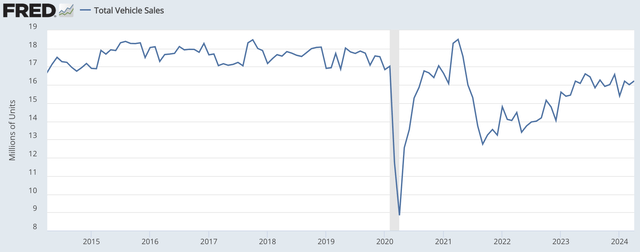

ABG’s new vehicle inventory is now 54 days, compared to 30 days a year ago. This is a more normal level after last year’s shortages. If there is no shortage in the market, pricing power is weakened, which is why profit margins shrink. The business is structurally low-margin, accounting for almost half of revenue but just 22% of gross profit. Importantly, we do not expect volumes to drop. Approximately 16 million cars were sold. This is a healthy level, but slightly below pre-COVID-19 norms. Still, management doesn’t expect demand to increase significantly without two or three rate cuts, which doesn’t seem imminent. As such, I tend to expect sales to remain roughly flat going forward and further margin pressures to be modest.

Used cars account for 32% of revenue at $1.36 billion, but only 10% of gross profit. Used car gross profit fell 7% to $72 million as profit margins contracted from 6.9% to 5.5% despite a 20% increase in revenue. On a same-store basis, used sales decreased 4% and prices fell 3% to $302,000. Although the used car boom is almost over, it is starting to stabilize. Asbury’s gross profit margin per unit for him was $1,647, about flat quarter over quarter. Inventories are still low as of the 27th, so management expects used car supply to normalize on the 27th. 2026.

Our vehicle profits have passed their peak, but our maintenance department continues to perform well. Maintenance costs accounted for 14% of his revenue at $590 million and generated 45% of gross profit. Maintenance margin expanded by 188bp to 56.6%. On a same-store basis, maintenance increased 2% and gross profit increased 6% due to strong margins. Beyond the strength of existing stores, ABG’s own stores have higher maintenance sales than acquired stores. With most of the integration complete, he expects per-store growth to increase by his 5% over the year, with further gains in maintenance revenue. Given the high margins, this should be a meaningful tailwind for earnings.

Finally, funding is $190 million, 5% of revenue and 14% of gross profit. Finance and Insurance decreased 4% to $2,259 per unit. Approximately 75% of this F&I decline is due to changes in deferred revenue, which should ease by the end of the year. Rising interest rates are also a headwind for financing activities, but we expect the trend to remain generally stable going forward.

Considering the lower gross margin, ABG’s operating margin was 6.3% compared to 7.7% last year. This figure is still higher than 2019’s 4.6%, given the strength of maintenance and the still strong auto sales environment. As gross profit on new cars decreased, the ratio of same-store SG&A expenses to gross profit rose 459 basis points to 62.3%. This year, too, this percentage will remain in the low 60% range.

ABG continues to generate very high cash. Operating cash flow was $209 million and free cash flow was $183 million, down slightly from last year’s $229 million. It’s worth noting that, taking into account seasonality, first quarter capital spending was only $26 million, a fraction of the full-year budget of $200 million to $225 million.

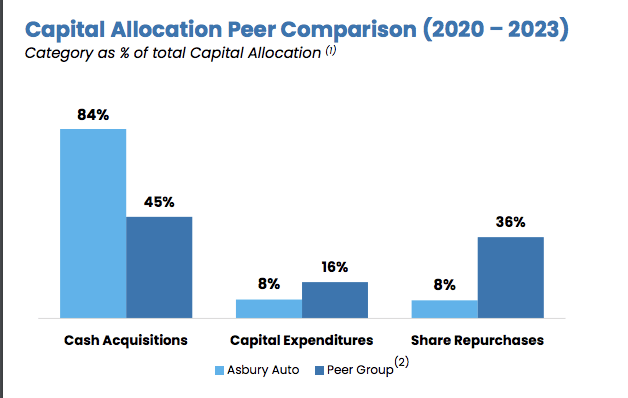

ABG conducted a $50 million share buyback in the first quarter. Therefore, the number of shares in the company decreased by 6% from last year. The company still has $153 million remaining on its buyback authorization. ABG is unique among dealers by using strong cash flow for growth rather than stock buybacks. We believe this strategy makes sense, although the stock price may have seen less of an increase over the past year, perhaps due to the company’s focus on integrating new stores. This is because this strategy allows the company to diversify its business geographically and build scale, which is expected to lead to business growth. It has margins and is more resilient.

asbury automotive

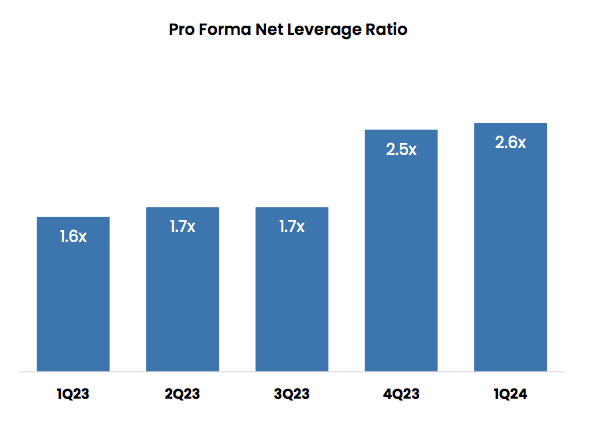

Although the leverage ratio has increased thanks to M&A, the balance sheet remains strong, at 2.6x, which is at the lower end of the net debt/EBITDA target of 2.5-3.0x. Given the rising interest rate environment, we do not expect further M&A activity in the near term, even as we leverage towards the lower end of our target.

asbury automotive

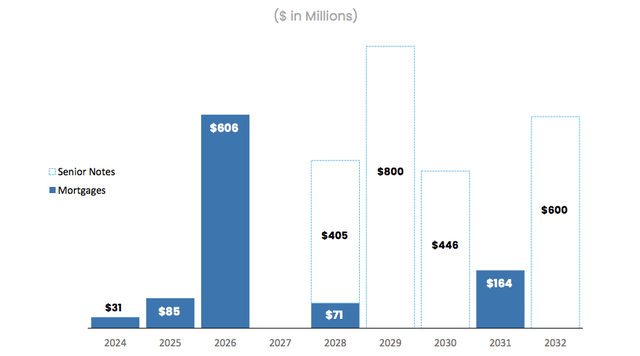

Asbury’s debt profile is also well-staged, with low short-term sensitivity to interest rates and no significant maturities until 2026.

Given continued growth in maintenance, stabilization of used vehicles, and further pressure on new vehicle margins, ABG is well positioned to earn about $30 per share this year, giving it a price-to-earnings ratio of 8x. After factoring in stock reductions and maintenance gains, ABG’s run-rate EPS is currently around $21, which is 11.5x, even assuming used-to-new car margins decline to half of last year’s over time. means it is trading with a run rate profit of . I believe long-term valuations are attractive for a company with a strong balance sheet, strong free cash flow, and improved maintenance productivity across its business areas. While M&A-focused performance may take longer to show benefits than a buyback-first approach, the integration is largely complete and these benefits should materialize in the coming months, in my fair opinion. Considering the value multiple, the stock could be pushed towards $300 or 14 times run-rate earnings. Up to 15x on maintenance and finance, 10x on used cars. I remain a buyer.