DNY59

Applied Materials (Nasdaq:Amat) be familiar with The company spoke about “eBeam Technology and Product Announcements” in a webcast on December 14, 2022. The company is taking this dramatic approach to announcing new products, and I’m inspired by the December 20, 2022 Seeking Alpha article “Applied Materials’ much-hyped electron beam inspection division loses market share to KLA’s Optical.”

According to the bullet points in that article,

- Applied Materials announced new electron beam metrology and inspection technology on December 13, 2022.

- Despite efforts to promote electron beam technology, optical technology, led by KLA, continues to grow further.

- Optical wafer inspection held 5.4 times the market share of electron beam technology promoted by Applied Materials.

- Even ASML beats Applied Materials in the electron beam inspection space.

Applied Materials boasted “new” technology in 2022, but KLA (KLAC) dominated the market, but AMAT failed. The Information Network’s “Measurement, inspection, and process control in VLSI manufacturing. ”

The rest of this article compares AMAT’s market share in the two main areas in which AMAT’s electron beam systems compete.

AMAT and competitors’ metrology/inspection market share

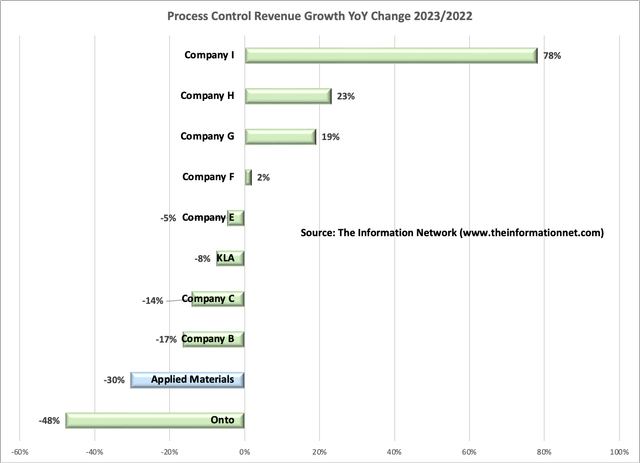

Figure 1 shows the year-over-year revenue change for the top 10 metrology companies in 2023 compared to 2022. These are because Company I has achieved +78% growth compared to the previous year (ontAccording to a report from The Information Network, it has grown by -48%.

AMAT’s revenue change in the metrology/inspection segment of the overall WFE equipment market was -30%. This compares to AMAT’s overall WFE growth rate of +0.1%, as reported by The Information Network.Global Semiconductor Equipment: Market, Market Share, Market Forecast”

chart 1

Table 1 shows the revenues from semiconductor equipment sales to China for the top six non-Chinese equipment companies from 2019 to 2023. The last column is important, as it highlights that AMAT’s revenue growth rate in 2023 compared to 2022 is a staggering 66%, far outpacing competitors like Lam Research (LRCX), KLAC, Tokyo Electron (OTCPK: Tory), and screen.

Due to US sanctions and China’s focus on producing advanced chips (16nm and above), AMAT’s metrology and testing equipment sales were down 30% year over year, but AMAT’s overall WFE growth was +0.1% was.

In contrast, KLAC’s sales from China in 2023 grew only 12% year-on-year. As a result, the company’s metrology/inspection equipment sales declined by just 8%, while overall wafer fabrication equipment (WFE) sales declined by 14.2%.

This suggests that KLAC’s optical systems met the process control demands of cutting-edge chips and were not negatively affected in China.

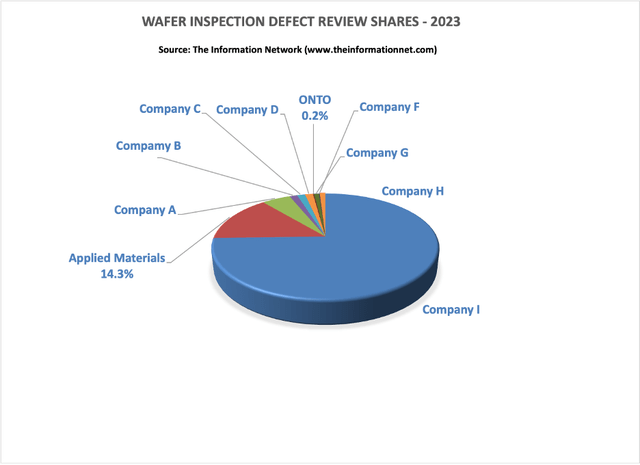

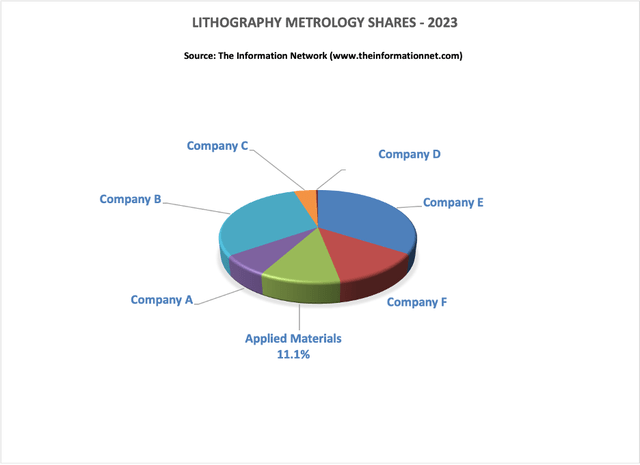

According to the above report from The Information Network, there are two major segments that make up the $12 billion metrology and testing market in which AMAT competes.

- Wafer inspection/defect review

- Lithography Metrology

Graph 2 shows that AMAT had a 14.3% share in the wafer inspection/defect review sector in 2023, down from 15.2% share in 2022.

chart 2

Chart 3 shows AMAT capturing an 11.1% share of the lithography metrology segment in 2023, down from a 12.7% share in 2022.

chart 3

Key points for investors

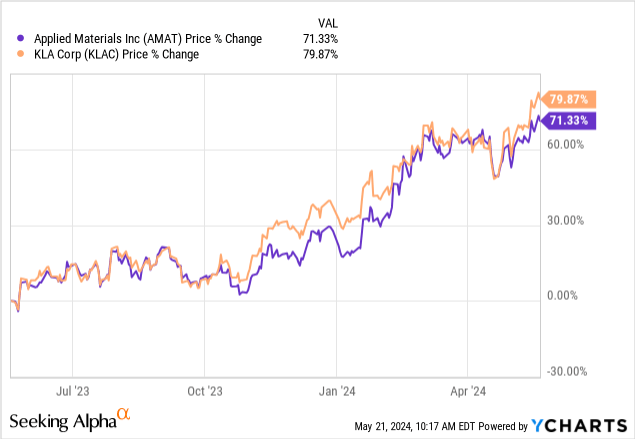

AMAT is not only losing market share to competitors such as market leader KLAC in the measurement and testing sector, but its stock price is also stagnant.

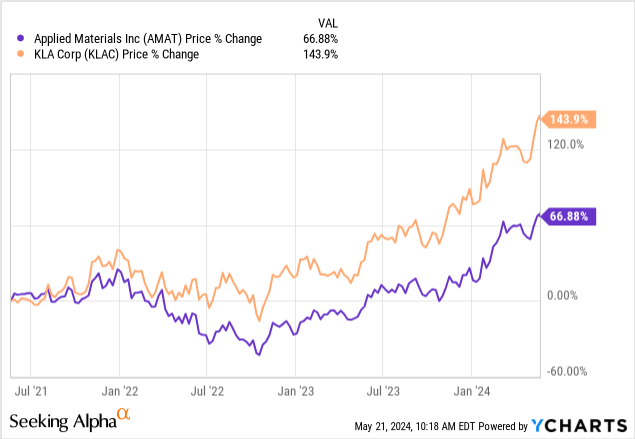

Figure 4 shows the stock price changes of KLAC and AMAT over a period of one year and shows that KLAC (79.87%) has performed better than AMAT (71.33%).

Y chart

Chart 4

Figure 5 shows the stock price changes of KLAC and AMAT over a three-year period, showing a significant performance improvement for KLAC (143.9%) compared to AMAT (66.88%).

Y Chart

chart 5

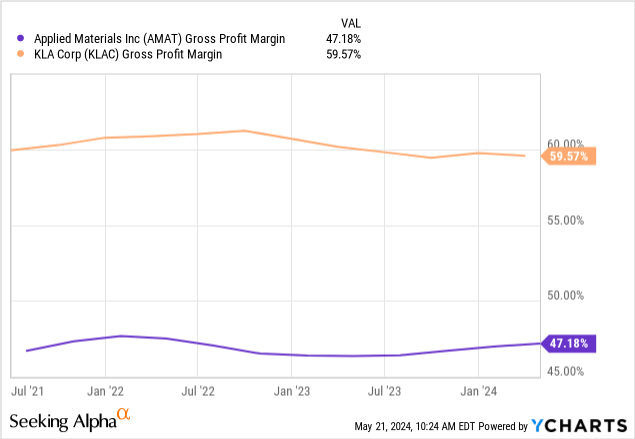

Figure 6 shows that KLAC’s gross profit margin is significantly higher than AMAT’s over three years.

Y Chart

chart 6

The hype behind the theatrical montage of AMAT’s new electron beam device is unfounded considering the market share data provided in this article.

Despite strong growth in revenue from China, these sales are actually hurting the metrology/testing business. Also, according to a February 7, 2024 article from Semiconductor Deep Dive Investing Group, ASML will lead the global WFE equipment market in 2023, with China’s Naura maintaining the 9th position.

I continue to rate AMAT as a “sell”.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.