Alexander Farnsworth/Image editing via Getty Images

Dear readers/followers,

Timing is a funny thing. Sometimes it works, sometimes it comes off completely. In my work, I absolutely try to make sure that my timing and buying and selling are closely tied together. Affects the valuation of a company or investment. This, combined with the patience to endure through good times and bad, and allow companies and investments to “ripe,” has, for me, resulted in consistent outperformance over time. That’s why I don’t buy ETFs. By far, I am above the general market.

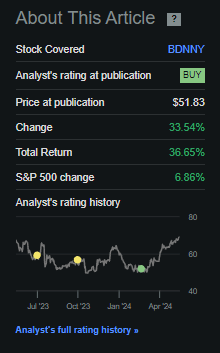

Now, let’s take a look at Boliden (OTCPK:BDNNY) (OTCPK:BLIDF). I’ve been able to weather the ups and downs and have given the company two ‘hold’ ratings, but I’d say I moved to a ‘buy’ on the company just before. It rose based on both valuation and trend.

Read our previous article about the company here – And the results from that are shown below.

Seeking Alpha Boliden RoR (In search of Alpha Boliden RoR)

ROR of 36% or more is good. But it gets even better considering it’s been less than three months since he wrote this article. That’s because the 3-month return is 36% per annum. 242.1%.

That’s a rate of return that I can accept.

In this article, I aim to look at the results, consider the valuation at this point, and see if it would be a good time to “make some quick money” by giving it a rotation. Unlike many other investors, including other long-term holders and value investors, I everytime I’m open to stock rotation, so any stock will do. Every company has an “in” and an “out,” and these can change.

Boliden – The upside is becoming less clear.

So in my last article I made it clear that there was upside potential and that the valuation made the company a good investment. Currently Boliden is going through a period of intense investment which is impacting the company’s overall performance (including its most recent results). This is manifesting in the form of lower prices and terms, reduced overall production and the cessation of production at certain assets such as the Tara asset whilst undergoing extensive mine maintenance and management.

We have Q1 2024 and we’re going to look at them today.

What is Boliden focusing on these days?

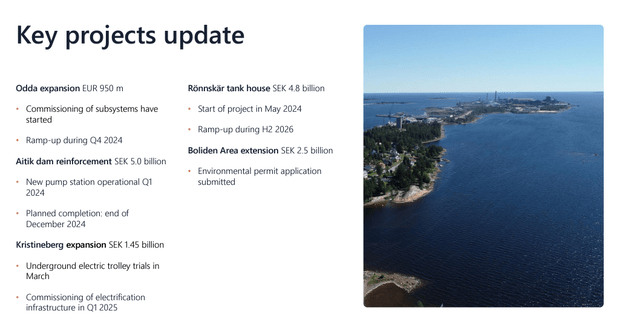

In short, it future-proofs your company’s operations and industry. This includes a new tank house and area expansion in the Boliden area, with projects in Odda, Aitik and Christinburg nearing completion. The company is also focusing on ITIC’s automated transportation system, which will obviously reduce important costs such as salaries (though of course, other companies will just weigh in).

However, this quarter was not easy on a geopolitical level. Finland experienced a series of severe strikes and also experienced very extreme winter conditions in terms of climate. I can attest to this myself as I am currently in the field. There are many days below minus 40 degrees Celsius, and at such temperatures, even conventional fuels like diesel and gasoline suffer from some major problems, such as diesel fuel gelling when the paraffin in the diesel starts to solidify. It’s starting to happen. Fuel could not be pumped out at some stations because it had solidified and froze. And at the temperatures we’re talking about, many cars and machines will have a hard time igniting.

Boliden is active in some areas very far north, so this must be kept in mind.

On the pricing side, there has been an improvement towards the end of the first quarter, which is clearly positive. Productivity in the mining sector has also stabilised and the company is working on a salvage plan for the Tara asset, which is causing considerable strain on Boliden.

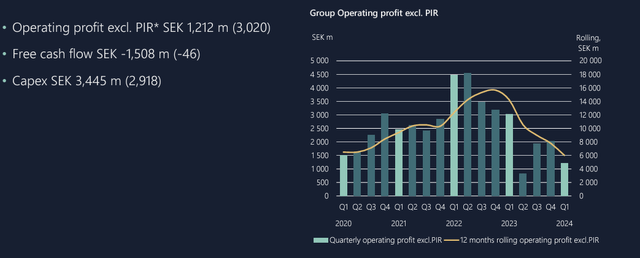

At the operating performance level, the company’s operating profit decreased by almost 60% and FCF was significantly negative. Although you may be concerned, realize that such movements may be part of a cyclical pattern. The company was also weighed down by a significant increase in capital expenditures of $500 million.

But for me, how that capital is used is more important, and given the trends in valuation and price levels, clearly the market seems to agree. And the use of these capitals, including projects, is very positive. So the view of the company here is very “positive”.

At market level, the prices of the company’s base metals zinc nickel and lead are falling, while copper is rising slightly. Precious metals are boosting profits, with gold reaching its ATH and silver prices rising, while platinum and palladium are showing an overall downward trend. Production is so-so. The company is adjusting production to demand, which means less copper concentrate production, less zinc and only a slight increase in nickel. This is also related to the maintenance and trends of the assets, with Boliden being shut down for 7 days due to the aforementioned winter conditions and Tara being fully in the “care and maintenance phase”.

This also leads to the smelter being idle to some extent. Extreme winter conditions have slowed production in Ronshard, while political strikes and process disruptions have slowed production in Harjavarta. The same is true for the Kokkola smelter.

All of this means the company is expected to report significantly lower operating results and revenue this year. Yes, his EPS growth is projected at this time. 17 analysts think the company’s EPS will return to his 12%. It manages just south of SEK 25 per adjusted share, but will reduce EPS by nearly 50% in 2023 (paywall FAST graph link) – So, in the larger context, this isn’t all that impressive. In fact, we believe we will see further growth as the situation recedes further.

There is clearly a large discrepancy in operating profits, which is the biggest concern here. This divergence can be explained primarily by two factors beyond the company’s control: demand, and pricing and terms, or demand. There is volatility in the Company’s assets and the Company is addressing this.

Of course, this also affects the fundamentals. Net debt has increased significantly, from approximately SEK 1 billion to SEK 12.4 billion in 2024, and net debt/net equity has increased from 0% to 21%. However, I see this as only temporary and likely to improve as the market improves. And current sentiment seems to reflect this.

The planned outage and maintenance capital investment will be SEK 15.5 billion, resulting in smelter maintenance costs of approximately SEK 400 million in 2024.

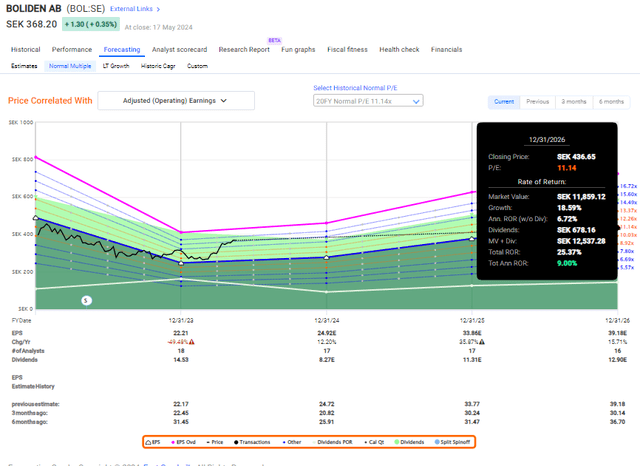

Boliden remains a highly cyclical business. As an analyst, I’ve been very surprised by the large rally we’ve seen over the past few months, but I’d like to show you how this impacts valuation theory, especially as of late. Watch it evolve here.

Boliden’s valuation – I think it’s still a while before it rises, and it’s currently overvalued.

So the first question I have to answer for you is whether I am considering Boliden a “buy” anymore and why (or not). In this case, my previous PT was at the 300 SEK level and the company is now trading at over 350 SEK. In my opinion, as things stand, the company is no longer a “buy”.

In a very short period of time, the company has made very impressive profits, both in absolute and annualized terms. The company currently has a Composite P/E ratio of over 15x, well below the 20-year average of 11.5x, and I’m projecting the company at this level over the long term.

One of the more important things to me about analysts is that they are not easily subverted. There must be a reason for major changes to the paper. If Boliden’s PT were to be increased to between 420 and 500 SEK, which is required here, it would require a very serious and considered reason, but the company’s fundamentals and performance do not require such a reason. there is no.

Instead, I’m looking at this as Overreacting to a possible upswing in 2025-2026. If the company’s growth materializes as expected, here’s what’s likely to happen in 2026.

Boliden annual growth rate FAST graph (Boliden annual increase rate FAST graph)

As you can see, we’re currently below 10% per annum, well below my 15% target and far below what I consider attractive here.

I recognize the fact that markets can and often do overreact on both fronts, and I believe this is one of those times.

For this reason, I am currently willing to “recycle” my position in Boliden and consider the company for profit rotation. In fact, I might make a big profit here and sell all my stocks and put it into cheaper consumer goods or communications for a much better yield and a much safer upside.

Because that’s how I “approach” investing. We try to buy good products at low prices and sell them at high prices. This company has risen much faster than I expected, and I can’t say it has fully achieved my expectations of what Boliden will be like in 2027. But we are not in 2027, and this is premature given the results and the way the market is currently looking.

For this reason, I present the following thesis on Boliden for the remainder of 2024, where I change my assessment of the company.

paper

- Boliden is a class-leading mining and metals company with attractive overall upside potential if purchased at the right price. It has the solid fundamentals required for such an investment and operates primarily in Northern Europe.

- Since COVID-19, the company has seen a huge boost in earnings and share price due to macroeconomic and metal pricing, which is now slowly turning around, and as a result, I think the company’s share price will go down over the next 1-2 years, but will eventually see a reversal.Currently, we are seeing a stabilization rather than a reversal.

- Therefore, I consider Boliden to be overvalued at this price and a business with no upside potential, i.e. PT 300 SEK or long term “Hold”, therefore I am changing my stance.

- I would now change my thesis to “HOLD” but not the overall PT.

Remember, I’m all about:

1. Buy undervalued companies at a discount, even if the undervaluation is mild and not mind-bogglingly large, allowing it to normalize over time and take capital gains in the meantime. And you can get dividends.

2. If the company becomes overvalued far beyond normalization, I harvest the profits, rotate my position into other undervalued stocks, and repeat #1.

3. If the company is not overvalued, but remains within fair value, or goes back to undervalued, buy more as time permits.

4. I reinvest the proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company meets them (Italics).

- This company is overall qualitative.

- This company is fundamentally safe, conservative and well-run.

- This company pays a well-covered dividend.

- This company is cheap at the moment.

- This company has realistic upside potential based on revenue growth or multiple expansions/reversals.

The upside may take a few years, but I consider the company a “hold” for now.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.