we

At this point in the cycle, I’m not a big fan of growth investing. Value seems to want to outperform on a relative basis, and the market cap-weighted growth index has already seen some big moves. That being said, I know many investors I believe there is still juice left in this part of the market.

If you’re in that camp, one fund that might be worth considering is Invesco S&P 500® Pure Growth ETF (Knee search:RPG). The fund creates a portfolio by selecting securities according to detailed criteria that classify stocks as either value or growth. It evaluates an individual stock’s book-to-price ratio, earnings-to-price ratio, sales-to-price ratio, three-year sales per share growth, three-year EPS to PPS percentage change, and momentum. , assign a score based on each.

growth score and We then use Value Scores to rank each stock by value category (Deep Value, Blend, or Deep Growth). The fund’s holdings come from a subset of “fast-growth” stocks and are then evaluated based on their growth potential. This due diligence process allows RPG to provide focused exposure to the most promising large-cap growth opportunities in the S&P 500® Index (SP500).

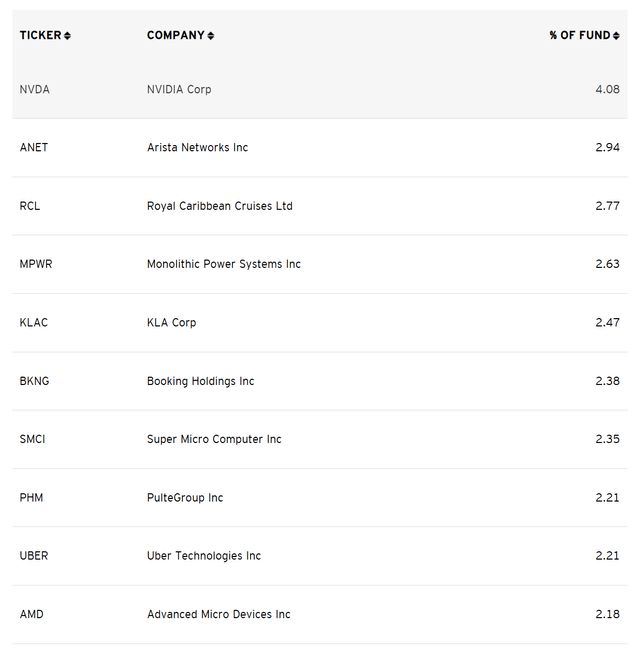

Overview of Holdings

I’m not a fan of growth stocks, but I like the mix of holdings. This is not a stock you would typically see at the top of a growth stock portfolio (though it’s clearly Nvidia (NVDA) This case is a notable exception)

Other than Nvidia at 4%, no other position is more than 3% of the portfolio. This is a pretty well diversified fund overall, which I think is becoming increasingly important.

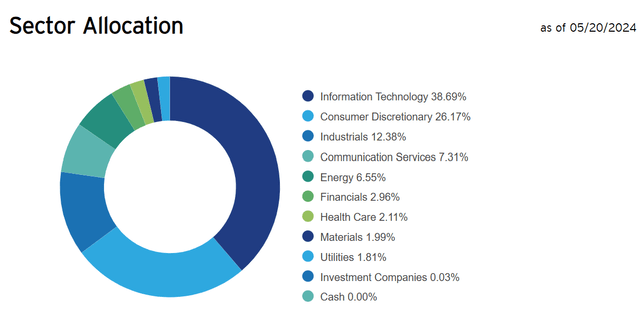

Sector composition and weighting

This is still a growth fund, so it’s no surprise that tech is the largest sector at nearly 39%. While not at all unusual in a growth portfolio, my concerns about this style of investing are heightened even more given how huge technology’s performance has been recently compared to all other sectors.

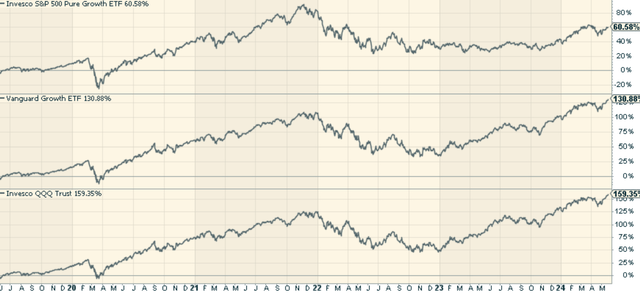

peer comparison

Two strong competitors in this space are the Vanguard Growth ETF (VUG) and Invesco QQQ Trust ETF (QQQ). VUG tracks the CRSP US Large Cap Growth Index. QQQ (nedix), a real 800-pound gorilla that has been competing with other growth-oriented funds for the past few years.

Looking at the performance of the three companies, RPG is significantly underperforming. The reason is obvious. This is due to the absence of Microsoft, the low weighting of Nvidia, and the overall lack of concentration in the “Mag 7” stocks that have led bull markets in the past. One and a half years. This is not necessarily a bad thing, but it does explain the results.

Pros and Cons

One of the immediate benefits of investing in RPG is the ability to focus on the growth opportunities of the highest net growth large-cap stocks of the S&P 500 Index. The RPG eliminates non-growth play and maintains a weight-based, factor-engineered selection methodology. This is expected to give it its own return stream in the future.

problem? There is no real momentum that has driven other market-cap-weighted growth portfolios. And the worry is that the economic cycle could turn against growth overall, meaning the fund may have missed the moment to some extent. This will be my main concern here, but I like that the top holdings are different from what we see in our peers.

Verdict: Good opportunity for growth-oriented investors

Despite my misgivings about the growth style, I think this is a decent fund for investors interested in targeted exposure to large growth segments of the US stock market. At least it’s trying to do something different with the filter methodology used, and clearly has a different performance path than its peers (though it’s lagging for now).

I guess it all comes down to your view on growth and whether you think growth momentum will extend beyond the Magnificent 7/AI play. It certainly could, and if so, I would expect the Invesco S&P 500® Pure Growth ETF to outperform other growth ETFs on a relative basis. I’m not so sure about that, broadly speaking.

Predict crashes, corrections, and bear markets

Predict crashes, corrections, and bear markets

Tired of being a passive investor and ready to take control of your financial future? Check out the Leadlag Report, an award-winning research tool designed to give you a competitive edge. This is an introduction.

The Lead-Lag Report is your daily source for identifying risk triggers, discovering high-yield ideas, and gaining valuable macro observations. Stay one step ahead with key insights into leaders, laggards, and everything in between.

Move from risk-on to risk-off easily and confidently. Subscribe to the Lead Lag Report now.

Click here to access and try the Lead-Lag Report free for 14 days.