PM Images/DigitalVision via Getty Images

overview

I vividly remember in college, as a broke college student trying to learn how to make some extra cash trading options, completely ignoring the lectures. At the time, my focus was on a list of YouTube videos on how to effectively deploy options strategies in a small portfolio. Times have changed since then, and we are now in one of the best times in modern history for income-first investors. There are now a plethora of different income-based funds managed by top firms that offer diversified exposures, large yields, and include options strategies.

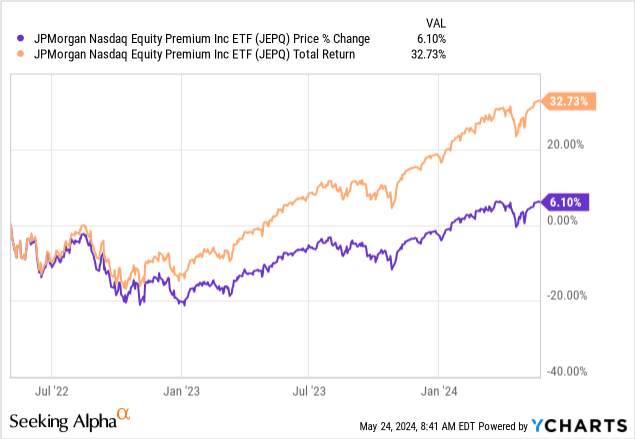

JP Morgan’s Nasdaq Equity Premium Income ETF (Nasdaq:Jep) is one of the newer options-based funds. It offers the opportunity to earn high returns every month. This ETF aims to generate income through a combination of selling options and investing in large US-based companies. It uses option premiums and dividends earned from stock holdings to collect distributed income. The strategy aims to deliver returns comparable to the Nasdaq 100, but with less volatility.

JEPQ is a relatively new fund, with a launch date of mid-2022. The fund’s annual expenses are very reasonable at just 0.35%, given its market capitalization of $13.6 billion. The current dividend yield is around 8.8%, with distributions paid to shareholders monthly. I believe this fund is a valuable asset to any dividend enthusiast’s portfolio, as it provides instant diversification and world-class management from JP Morgan.JPM), you receive monthly distributions, and because the fund’s holdings are biased toward tech companies, you’ll continue to be in the running to capture any price gains.

Strategy and Catalyst

A look at the top holdings reveals a diverse range of holdings across all industries, although the fund is leaning more towards technology as it aims to mimic the composition of the Nasdaq. We’ve compiled the top 10 stocks and ranked them by largest weighting: Holding JEPQ gives you exposure to some of the largest and highest quality companies in the world.

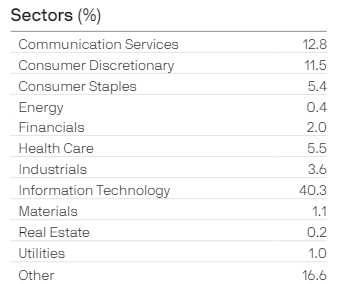

The latest factsheet shows that exposure is across a variety of industries, with technology making up the largest portion of the fund at 40%, followed by consumer services at 12.8% of the total portfolio and consumer discretionary at 11.5%.

JEPQ Fact Sheet

While diversification is a good thing, the primary benefit of this fund is the result of its options trading strategy. Funds that rely on options trading to generate income are most useful during periods of high volatility and market uncertainty. The incorporation of these options is sometimes referred to as a covered call strategy. JEPQ charges a premium for options trading, and during periods of high volatility, the premium tends to be higher due to the uncertainty. The average investor typically views uncertainty as “riskier,” which is why these options cost more and why JEPQ is able to make more income.

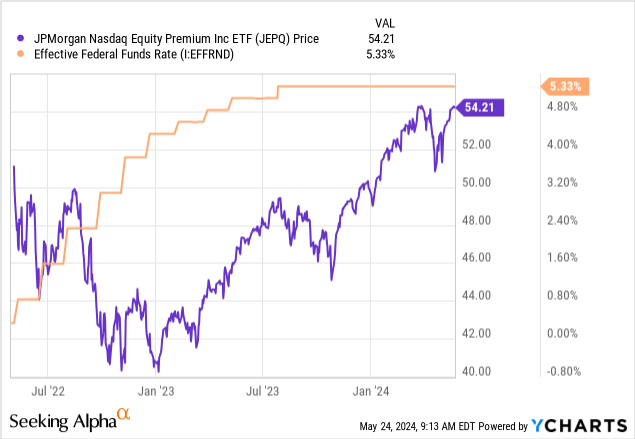

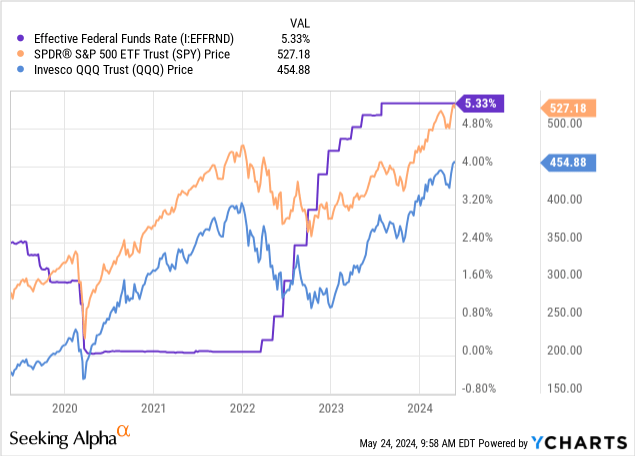

To visualize this concept, let’s look at how JEPQ performed during a period of sharply rising interest rates. I have covered a number of business development companies and closed-end funds over the past quarter, all of which have reacted negatively to rising interest rates. The market perceives this extended period of rising interest rates as risky, as defaults tend to increase, higher debt service costs slow growth and slow borrowing activity.

While the market views this as high risk, JEPQ has been able to avoid and offset this with its option writing strategy. It is no coincidence that JEPQ’s dividend yield hit an all-time high around the same time that interest rates peaked around mid-2023. At the time, JEPQ’s dividend yield was well above 12%. We expect there will be more uncertainty over the next 12 months, which will continue to contribute to JEPQ’s success.

First, we need to consider the market reaction to the Fed’s interest rate cut discussion. The Fed has decided to keep interest rates unchanged for the past few meetings while waiting for the release of more economic data on inflation and employment. With inflation remaining higher than expected, this will continue the high interest rate environment for a longer period than normal. Morgan StanleyWe believe there is a possibility of a rate cut as soon as September, but also a possibility that it may be delayed until 2025. This is due to the elections in the US starting around November. The combination of these two events will likely lead to increased volatility and uncertainty, which will be the main condition for JEPQ to continue providing high levels of income.

Risk Profile

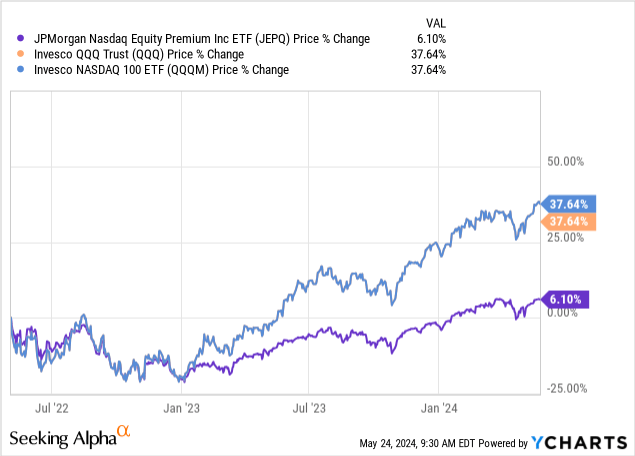

These covered call ETF strategies come with several risks. One of the main risks is the possibility of underperforming the Nasdaq Index during a bull market. This is because JEPQ uses 5% out-of-the-money calls, effectively limiting upside to 5%. Call options are considered out-of-the-money when the strike price is above the current market price of the option’s underlying, in which case the strike price is strategically set 5% above the current market price. This 5% gap is where JEPQ captures the option premium, but once the underlying price crosses this 5% buffer, JEPQ itself will not capture any additional upside.

To demonstrate this, we compare the price performance of JEPQ with that of the Invesco QQQ Trust (Hehehehe) or Nasdaq 100 ETF (QQQM). You can see that during this period, the price of JEPQ only increased by 6%, which significantly underperforms these alternative approaches. Therefore, you need to understand that you are very likely giving up capital growth here in favor of the income aspect of JEPQ. If you are looking for capital growth, you may have to settle for a much lower yield by choosing one of these more traditional ETFs.

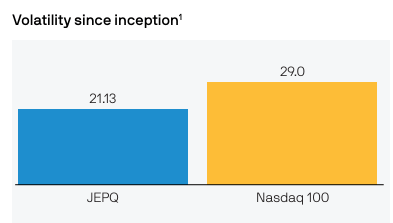

The benefit that offsets much of this risk is that the JEPQ offers a lower level of volatility than the Nasdaq 100 Index. supplementFrom this, we can see that JEPQ has maintained low volatility since its inception. The ability to distribute revenues without a period of credit risk helps to mitigate this volatility risk.

JEPQ Supplement

There is a cap on upside, so you effectively get a portion of any upside moves, but take the full impact of any downside moves that occur. A sustained period of unfavorable conditions could result in capital erosion over time. JEPQ uses out-of-the-money calls to offset some of the risk of erosion, but this remains a long-term concern and there is not enough long-term data at this time to really determine how this will play out for JEPQ.

dividend

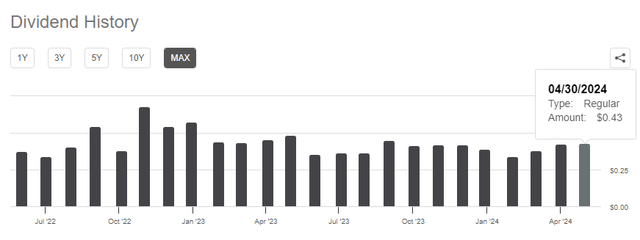

Latest Declared The monthly dividend is $0.4311 per share, with a current dividend yield of 8.8%. The dividend yield has frequently traded in the double digit range recently, but is currently backing down to a target level of around 8% to 9%. If you’re looking for a steady, growing stream of income similar to a traditional dividend growth stock, you may be better off looking elsewhere, as JEPQ’s dividend can change based on performance. A quick look at the history below shows that the dividend has changed from month to month.

As volatility rises, dividends from option issuance are expected to increase. However, a prolonged period of low volatility could result in a significant decline in dividends. It is no coincidence that dividend yields surged to their highest levels just as interest rates began to rise sharply toward the midpoint of 2022-2023. Now that the ripple effects of rising interest rates have subsided, dividends have declined slightly. However, with the election approaching and discussion of future interest rate cuts on the horizon, dividends may start to increase again.

One thing to keep in mind is that dividends received from a JEPQ are classified as “ordinary dividends”, which means they are taxed at a higher rate than dividends classified as “qualified dividends”. You may be able to offset this by prioritizing this type of asset in a tax-advantaged account.

Outlook

While I have already mentioned that the election and ongoing debate over interest rates could lead to increased volatility, I believe the market will rise over the next year. Interest rates will eventually have to be lowered, which will create room for significant upside. JEPQ’s portfolio is highly diversified, so I believe it can maintain high levels of income while also seeing price appreciation. We have already seen how near-zero interest rates have boosted overall market valuations throughout 2020 and 2021.

As interest rates start to fall, borrowing volumes will increase, stimulating growth across many of the industries JEPQ is involved in. For example, technology companies rely on access to cheaper borrowing to fuel various growth initiatives and fund research and development of new innovations. The same goes for consumer-based businesses, whose operating margins and profit margins may have been squeezed by rising interest rates due to higher raw material costs. Lower interest rates will be a breath of fresh air that could act as a catalyst for most sectors.

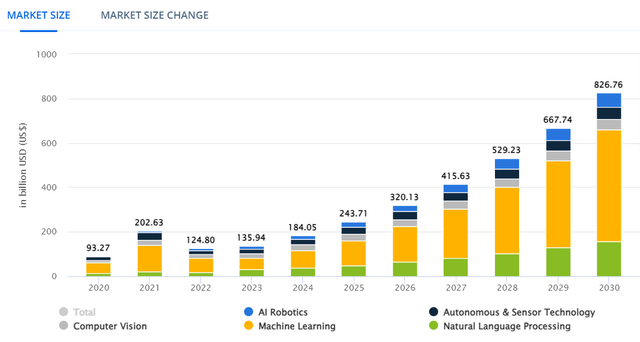

Moreover, the boom in the AI sector will continue to grow as the demand for innovation in this field increases. The AI market is currently worth approximately $184 billion in 2024, which is Projected It is expected to grow to $826.7 billion by the end of 2030. This includes many aspects of AI, from the simple generative AI chat tools we are familiar with to robotics, machine learning, autonomous sensors, language processing, and more.

remove

In conclusion, JEPQ is a great way to gain exposure to both a diversified and technology-focused ETF while capturing a high dividend yield from rising market uncertainty and volatility. The dividend yield is currently around 8.8%, but distributions may fluctuate from month to month based on performance, the success of option writing strategies, and overall market sentiment. While there are some risks to consider with covered call ETFs, we believe JEPQ’s structure and strategy allows it to efficiently take advantage of what we believe to be potential catalysts. This includes ongoing talks around interest rate cuts and an election that could cause another spike in volatility.