Momo Production

When it comes to investing, it’s important to be aware of your weaknesses. One of my biggest weaknesses is timing. Although I can tell the difference between a good investment and a bad one, timing can cause me to miss out on profits or incur unnecessary losses. The disadvantages are, for example Bar Harbor Bankshares (New York Stock Exchange:BHB) is a relatively small financial institution with a market capitalization of $388.1 million at the time of writing.

Last December I Return visit The company was initially article I researched the company in July and ended up rating it a Buy, based on the low share price and other key metrics. However, in December I was wondering if it was appropriate to downgrade the stock, primarily based on the fact that the share price had already fallen. I had predicted a 15% rise in stocks since a July article projected a 15% gain when the S&P 500 was up just 1.3%, but ultimately concluded that it was too early to do so.

Time has passed, and my “buy” rating on the company today has not worked out the best. Bar Harbor Bancshares shares fell 14.8% while the S&P 500 rose another 7.2%. To be honest, I understand why the company experienced this decline. However, it is hard to ignore the high quality of the company’s assets and the low stock price relative to earnings. At this point, I would argue that it is still too early to downgrade the company, even with the share price decline. However, I think the recent financial results warrant a watch for a possible downgrade.

Challenging times

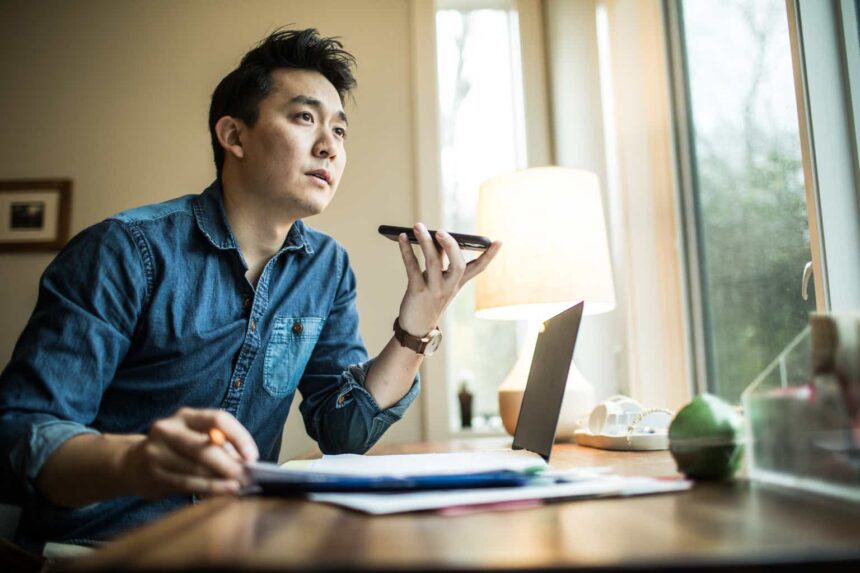

When we last wrote about Bar Harbor Bankshares late last year, we only had data through the third quarter of fiscal 2023. Today, that data has been extended through the third quarter of fiscal 2023. Q1 2024But before we discuss the latest financial results, I think it’s important to understand how the company’s performance has progressed over the past year. 2023 To put it in perspective, the chart below shows net interest income, non-interest income and net income not just for 2023 but for the two years prior to that. As the chart shows, there was a slight increase across the board from 2022 to last year, which is undoubtedly due to the expansion of the balance sheet.

Unfortunately, this trend reversed in the first quarter of the year. Net interest income was $27.8 million, down from $30.1 million a year ago. Part of this is no doubt due to a decline in net interest margin from 3.54% to 3.14%. While this may not seem like a large difference, when applied to the company’s total earning assets in the most recent quarter, it would mean that net interest income would have increased by $14.7 million had net interest margin not declined. Given the current environment, such a contraction is not all that surprising; high interest rates have created increased competition for deposits.

Unfortunately, from a revenue and profit perspective, net interest income wasn’t the only weakness. Non-interest income decreased from $9.2 million to $8.6 million. There were multiple factors that contributed to this change, but the largest was a decrease in bank-owned life insurance income from $1.1 million to just $600,000. Combined with the decrease in net interest income and a nearly $1 million increase in non-interest expenses (mainly due to salaries and employee benefits), the bank’s net income decreased from $13 million to $10.1 million.

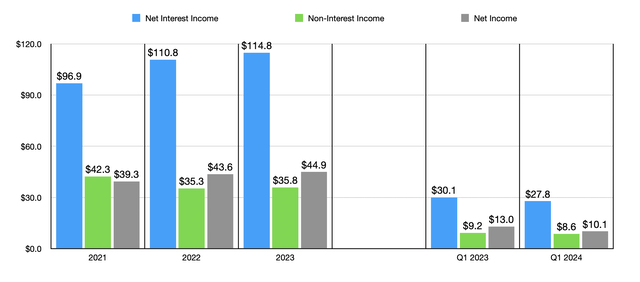

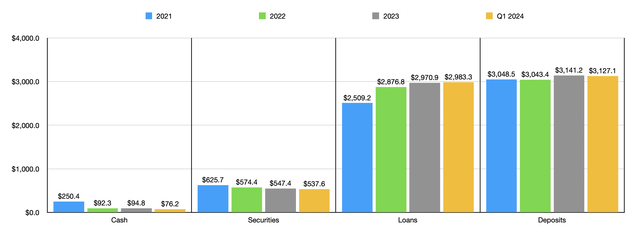

There were other interesting developments during this period. Deposits increased from $3.04 billion in 2022 to $3.14 billion in 2023, but slightly decreased to $3.13 billion in the first quarter of 2024. This is not enough to cause major concerns. However, it is not good to see deposits decreasing, and investors should continue to pay close attention to this indicator to see if a trend starts to form. Although deposits decreased, the bank benefited from an increase in loans from $2.97 billion to $2.98 billion. But at the same time, the value of securities decreased from $547.4 million to $537.6 million, and cash on hand decreased from $94.8 million to $76.2 million. At the same time, the amount of outstanding debt of financial institutions improved slightly. It decreased from $331.5 million at the end of 2023 to $329.9 million in the first quarter of this year.

These results are somewhat mixed in my opinion. I hate to see deposits declining, and declining revenues and profits are depressing. The decline in cash and securities is also less than ideal, but the overall decline is by no means large. The good news is that loan values are continuing their upward trend, and while liability values are declining, the decline is only marginal.

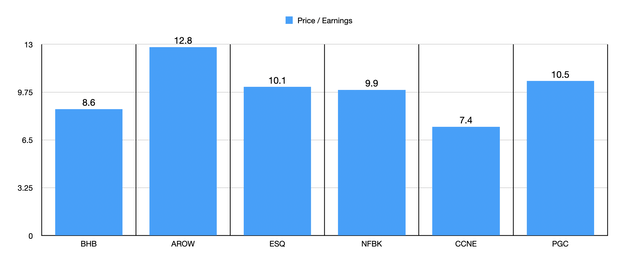

There are three different approaches I like to use when valuing a company. In the chart above, I compare the P/E ratio of this institution to that of five comparable companies. In absolute terms, 8.6 is certainly attractive; many of the banks I have looked at and valued have P/E ratios in the 6-9 range, so this is right in my sweet spot. The stock also looks cheap relative to comparable companies; only one of the five is cheaper.

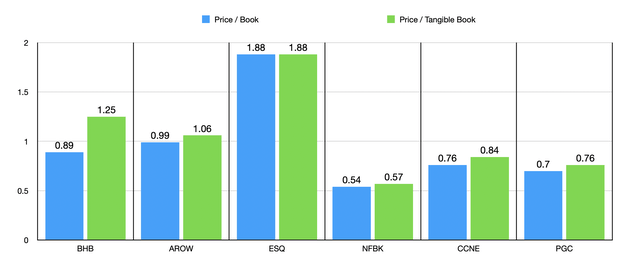

Unfortunately, the picture changes when we look at price-to-book and price-to-tangible book value approaches. The chart above shows what this looks like. I would argue that on an absolute basis, Bar Harbor Bancshares is fairly attractively priced. However, it is not the cheapest of the group. Three out of five companies are cheaper than Bar Harbor Bancshares on a price-to-book multiple, and four out of five companies are cheaper than Bar Harbor Bancshares on a price-to-tangible book value approach.

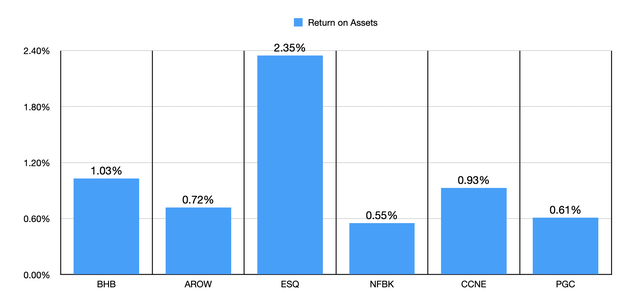

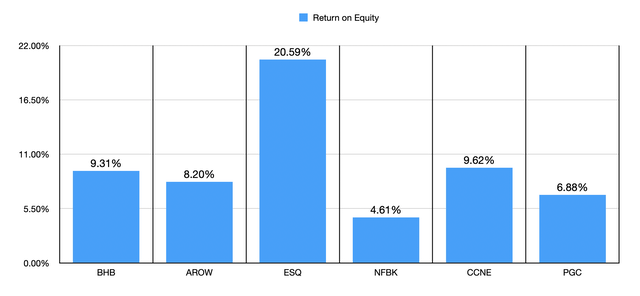

Relative to its peers, the company’s stock looks more or less fairly valued. However, there is one area where this company stands out and could justify trading at a slight premium – the quality of its assets. In the chart above, you can see the return on assets for not only Bar Harbor Bankshares, but also the same five companies compared in this article. Of the five, this company’s stock has the highest return. In the chart below, you can see each company’s return on equity. Of the five, only two have a higher return than Bar Harbor Bankshares’ current number.

remove

Based on the data provided, I would have to say that Bar Harbor Bankshares is definitely not my favorite stock in the space, but it’s not the worst either. There are some positives, including growing loan volumes, a cheap stock price, and relatively high asset quality. On the other hand, there are some weaknesses, especially for the most recent quarter for which data is available. Putting all this together, I would say that Bar Harbor Bankshares could see some upside from here. In fact, I would argue that there is enough upside to warrant a “buy” rating. On the other hand, it wouldn’t take much to consider a downgrade.