Shahrir Maulana

This article series is intended to evaluate the relative historical performance and current portfolio metrics of ETF strategies. Reviews with updated data will be posted where necessary.

SLYV Strategy

SPDR® S&P 600 Small Cap Value ETFs (NYSEARCA:Thrive) began investment operations on September 25, 2000 and tracks the S&P SmallCap 600 Value Index. The portfolio consists of 461 stocks, has an expense ratio of 0.15% and a 30-day SEC yield of 2.44%. It is the third ETF in the Vanguard S&P SmallCap 600 Value ETF (Viov) and iShares S&P Small-Cap 600 Value ETF (IJS), which track the same underlying index and have similar expense ratios.

It is described as follows: S&P Dow Jones IndicesThe stocks in the S&P 600 are valued using three valuation ratios and three growth measures to classify them based on their value and growth potential. The valuation ratios are book value. Stock price, earnings, and sales depend on stock price.By definition, 33% of S&P 600 constituents belong exclusively to the value style, 33% belong exclusively to the growth style, and 34% belong to both styles.

The Value style subset defines the S&P 600 Value Index, which is rebalanced annually and is capitalization-weighted, with an adjustment for constituents belonging to both styles. For example, companies with a higher Value rank than a Growth rank will be given a higher weight in the Value index than in the Growth index. Portfolio turnover was 46% in the most recent fiscal year. This article uses the iShares Core S&P Small-Cap ETF (IJR).

SLYV Portfolio

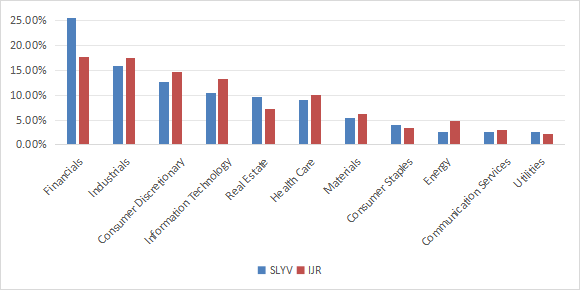

The portfolio’s heaviest sector is financials, accounting for 25.4% of the value, followed by industrials (15.8%) and consumer discretionary (12.6%). Compared to the S&P 600, SLYV is primarily overweight financials and to a lesser extent real estate. Energy is significantly underweight.

SLYV Sector Breakdown (Chart: Authors, Data: SSGA, iShares)

The top 10 holdings, listed below with their valuation ratios, account for 8.5% of the asset value, with the largest position accounting for around 1%. Thus, the portfolio is well diversified across holdings and the risk associated with individual companies is very low.

Ticker | name | weight (%) | P/E ratio over the last 12 months | P/E Forward | Sales in the last 12 months | P/Book | P/Net free cash flow | yield% |

Lincoln National Corporation | 0.98 | 4.42 | 5.45 | 0.33 | 0.85 | N/A | 5.56 | |

Jackson Financial Co., Ltd. | 0.95 | 1.98 | 4.36 | 1.66 | 0.62 | 1.18 | 3.71 | |

DICOM INDUSTRIES, INC. | 0.94 | 23.26 | 22.25 | 1.25 | 4.94 | 59.82 | 0 | |

Organon & Company | 0.94 | 5.04 | 4.64 | 0.84 | 110.72 | 24.27 | 5.44 | |

Mr. Cooper Group Co., Ltd. | 0.93 | 8.49 | 8.55 | 2.68 | 1.22 | N/A | 0 | |

Alaska Airlines Group, Inc. | 0.91 | 21.69 | 8.61 | 0.49 | 1.29 | N/A | 0 | |

Academy Sports & Outdoors Co., Ltd. | 0.75 | 8.43 | 8.33 | 0.70 | 2.20 | 14.35 | 0.78 | |

VF Corporation | 0.71 | N/A | 15.89 | 0.45 | 2.82 | 9.36 | 2.99 | |

Air Lease Co., Ltd. | 0.68 | 9.39 | 10.80 | 2.04 | 0.72 | N/A | 1.80 | |

Sanmina Co., Ltd. | 0.66 | 15.79 | 12.44 | 0.48 | 1.75 | 21.35 | 0 |

Basics

SLYV is cheaper than its parent index in terms of valuation ratios and has a slower growth rate, as explained in the strategy, however the difference in price-to-earnings ratios is small, as shown in the following table.

Thrive | IJR | ||

P/E ratio over the last 12 months | 14.21 | 14.88 | |

Price/Book | 1.21 | 1.63 | |

Price/Sales | 0.69 | 0.96 | |

Price/Cash Flow | 6.51 | 8.25 | |

Revenue Growth | 9.32% | 17.93% | |

Sales growth | 3.98% | 5.62% | |

Cash Flow Growth Rate % | 2.04% | 8.82% | |

sauce: Faithfulness.

In my ETF reviews, risky stocks are companies with at least two of the following red flags: a bad Piotroski score, a negative ROA, an unsustainable dividend payout ratio, or a bad or questionable Altman Z-score, excluding financials and real estate, where these metrics are unreliable. Under this assumption, risky stocks represent about 27% of the asset value, which is bad. Moreover, based on the calculation of the aggregate quality indicators (reported in the following table), the portfolio’s quality is inferior to the benchmark.

Thrive | IJR | |

Altman Z-score | 1.94 | 2.81 |

Piotroski F score | 5.16 | 5.39 |

ROA% TTM | 1.65 | 3.56 |

performance

Since October 2000, there has been little difference between return and risk measures for SLYV and IJR, with annualized returns of 32 bps, maximum drawdown of 3.3 percentage points, and historical volatility (measured as the standard deviation of monthly returns) of 71 bps. Risk-adjusted performance is roughly the same (Sharpe ratio).

Total Return | Annual Report | Drawdown | Sharpe Ratio | Volatility | |

Thrive | 633.59% | 8.79% | -61.49% | 0.45 | 20.32% |

IJR | 686.13% | 9.11% | -58.15% | 0.46 | 19.61% |

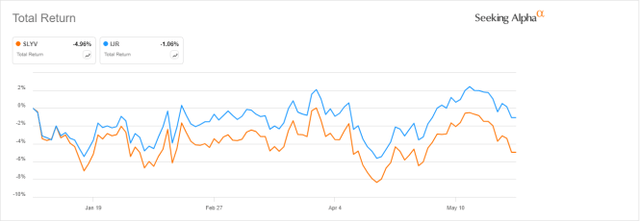

However, SLYV has underperformed its benchmark by about 4% so far in 2024.

SLYV vs. IJR, performance so far this year (Seeking Alpha)

Competitors

The following table compares the characteristics of SLYV with four other small-cap value funds.

- iShares Russell 2000 Value ETF (international), Review here

- Vanguard Small Cap Value ETF (Variable Bit Rate)

- Dimensional US Small Cap Value ETF (DFSV), Review here

- Avantis US Small Cap Value ETF (AVUV).

Thrive | international | Variable Bit Rate | DFSV | AVUV | |

Inception | September 25, 2000 | July 24, 2000 | January 26, 2004 | February 23, 2022 | September 24, 2019 |

Expense ratio | 0.15% | 0.24% | 0.07% | 0.31% | 0.25% |

Assets under management | $3.82 billion | $11.7 billion | $52.02 billion | $3.01 billion | $11.33 billion |

Average Daily Volume | $13.81 million | $187.62 million | $82.81 million | $12.16 million | $58.63 million |

Assets held | 461 | 1415 | 863 | 974 | 772 |

Top 10 | 8.49% | 4.97% | 5.72% | 6.72% | 8.89% |

turn over | 46.00% | 32.00% | 16.00% | 11.00% | 7.00% |

Dividend Yield (TTM) | 2.29% | 1.99% | 2.10% | 1.28% | 1.63% |

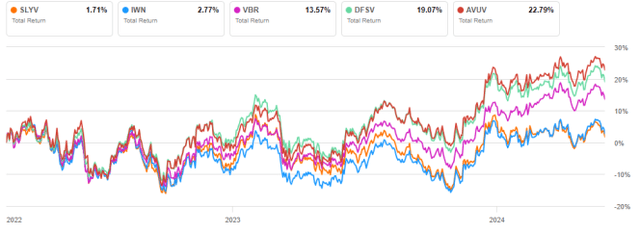

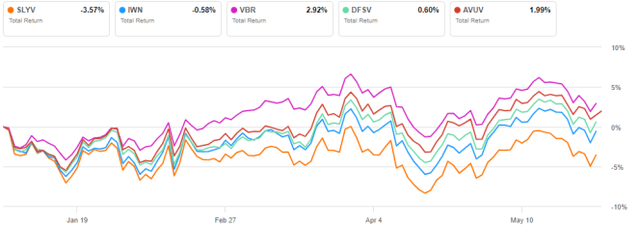

SLYV has the highest yield and trading volume. VBR has the largest assets and lowest fees, but IWN is the most liquid in dollar terms. The following chart compares total returns from February 24, 2022, across all start dates combined. SLYV and IWN performed the worst during this period. These two actively managed funds are leading the way.

SLYV vs. competitors after February 24, 2022 (Seeking Alpha)

Additionally, SLYV is lagging behind four of its competitors in 2024 so far.

SLYV vs. competitors this year so far (Seeking Alpha)

compare Thrive and My Value Standards

The Dashboard List is a list of 80 stocks in the S&P 1500 Index that is updated monthly based on a simple quantitative methodology. All stocks on the Dashboard List have a price-to-earnings ratio, price-to-sales ratio, and price-to-free cash flow ratio that are cheaper than their respective industry averages. After applying this filter, the list is left with the 10 companies with the highest return on equity in every sector. Some sectors are grouped together, such as Energy & Materials, Communications & Technology. Real Estate is excluded because these valuation metrics do not work well in this sector. I have been updating the Dashboard List monthly on Seeking Alpha since December 2015, first in my free access articles and then in Quantitative Risk & Value.

The following table compares SLYV’s performance since inception to the Dashboard List model, which is reconstituted annually and adjusted for comparison to passive indexes.

Total Return | Annual Report | Drawdown | Sharpe Ratio | Volatility | |

Thrive | 633.59% | 8.79% | -61.49% | 0.45 | 20.32% |

Dashboard List (Annual) | 1263.11% | 11.68% | -56.38% | 0.63 | 17.48% |

Past performance is no guarantee of future returns. Data source: Portfolio123.

The dashboard list shows it outperforms SLYV by 2.9 percentage points in annualized returns and has lower risk as measured by drawdown and volatility, but with a word of caution: the ETF performance is actual and the list is simulated.

Two Weak Points of Value Indexes

I’m all for using a mix of ratios to rank value stocks, but most value indexes have two weaknesses, and the S&P 600 Value Index is no exception. The first is that they classify all stocks on the same basis, meaning that valuation ratios are assumed to be comparable across sectors and industries. Clearly they are not. Monthly S&P 500 Dashboard We show how ratings and quality indicators vary across sectors.

The second weakness comes from the price-to-book ratio (P/B), which adds some risk to the strategy. Historical data shows that a large group of companies with lower P/Bs have more volatility and deeper drawdowns than a similarly sized group of companies with lower price-to-earnings, price-to-sales, and price-to-free cash flow ratios. The following table shows the return and risk metrics for the cheapest quarter of the S&P 500 (i.e., 125 stocks) measured by price-to-book, price-to-earnings, price-to-sales, and price-to-free cash flow. The set is reconstituted annually from January 1, 2000 to January 1, 2024, with equal weighting on each component.

Annual Report | Drawdown | Sharpe Ratio | Volatility | |

Quarter with the Lowest P/B | 9.86% | -73.88% | 0.47 | 23.25% |

Cheapest P/E quarter | 10.63% | -63.06% | 0.55 | 19.88% |

Cheapest quarter in P/S | 11.60% | -68.78% | 0.54 | 22.70% |

Cheapest P/FCF Quarter | 12.65% | -64.24% | 0.62 | 20.63% |

Equal weight index (RSP) | 9.16% | -59.92% | 0.5 | 17.55% |

Data calculated using Portfolio123.

This is why we use P/FCF instead of P/B in our dashboard listing models.

The actively managed ETFs AVUV and DFSV take a smarter approach than a typical value index, which is why they’ve outperformed passively managed ETFs.

remove

The SPDR S&P 600 Small Cap Value ETF combines two of the original’s three components. Fama French ModelValue and size. Holdings are well diversified but overweight financials. SLYV, IJS and VIOV have the same underlying index and are comparable for long-term investors. However, IJS is better suited for short-term trading due to its higher liquidity.

SLYV’s performance and risk metrics since 2000 are very close to the S&P SmallCap 600, but its portfolio quality is poor. The strategy has not been able to deliver excess returns over the parent index over the long term. Like most value indexes, the strategy has two weaknesses: it ranks stocks without regard to industry and it relies too heavily on price-to-book multiples.