Heather Shimmin

introduction

In May 2023, I It was rated a buy Capital One (New York Stock Exchange:CorfuAt the time, my case relied on manageable delinquency rates, strong deposit inflows, and an attractive valuation. Today, after the company’s stock price has risen roughly 56%, I Capital One offers an attractive entry point for investors. The pace of delinquency growth is showing signs of slowing, suggesting an improving charge-off environment in the coming quarters, which could lead to a 30%+ increase in net income and valuation. Finally, given the bullish factors, I believe Capital One’s valuation remains attractive at current levels. Therefore, I continue to view Capital One as a buy.

Delinquency growth is slowing

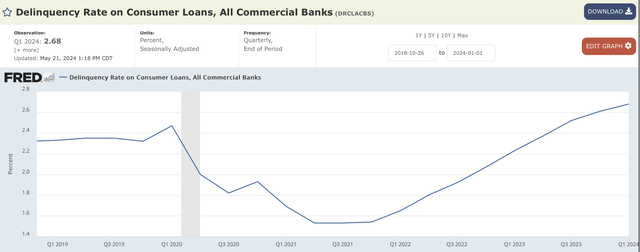

Throughout the pandemic and for several quarters since, consumer loan delinquency rates have been extremely low due to large-scale lending. This is driven by government stimulus and a strong labor market due to accommodative monetary and fiscal policies. However, as direct stimulus to the economy slowed amid surging inflation, consumer loan delinquencies began to rise significantly, forcing companies like Capital One to increase loan loss reserves and loan loss provisions. Fortunately, there have been signs of a slowdown in the growth of consumer loan delinquency rates over the past few quarters, providing a macroeconomic tailwind for Capital One.

Federal Reserve Bank of St. Louis

(sauce)

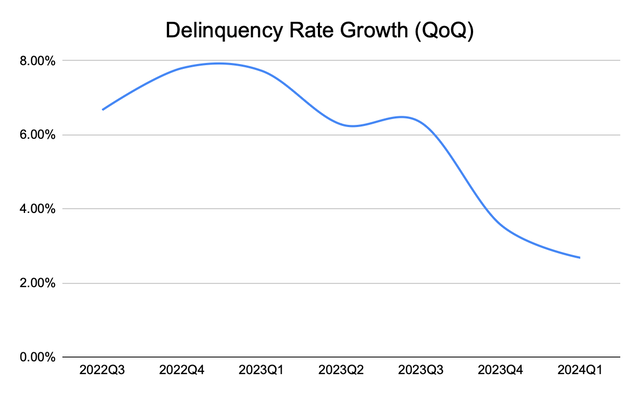

The graph above shows that overall consumer loan delinquencies have surged from pandemic lows and have begun to level off in recent months. While the leveling off may not be apparent from looking at the graph, the underlying data tells a different story. Quarterly consumer loan delinquency rates have slowed sharply since peaking in late 2022 and early 2023. The graph below shows the quarterly change in consumer loan delinquency rate growth and clearly illustrates the trend of consumer loan delinquency growth slowing.

Federal Reserve Bank of St. Louis

(Chart created by the author. sauce)

Therefore, I believe that current macroeconomic trends of slowing delinquency growth will create significant tailwinds for Capital One over the coming quarters as overall delinquency rates slowly move from increasing to flat or even decreasing.

A growing trend

A look at loan delinquency data for the past few quarters shows that the trend of overall slower growth has already begun and there are no clear signs of this trend ending, but how realistic is it to claim that the current trend will continue into the foreseeable future?

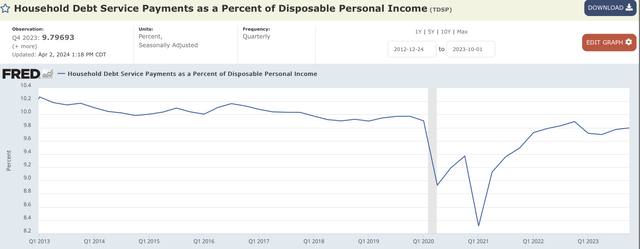

With inflation slowing and debt service payments as a percentage of consumers’ disposable income remaining at healthy levels or similar to pre-pandemic levels, I believe consumer loan delinquency rates will continue their positive trend toward eventual decline.

First, the chart below shows household debt service as a percentage of disposable income, clearly showing that households are not struggling with debt. Debt service payments are similar to pre-pandemic levels, which I believe means that the current increase in loan delinquency rates is simply a normalizing trend that will eventually settle back down to around pre-pandemic delinquency levels.

Federal Reserve Bank of St. Louis

(sauce)

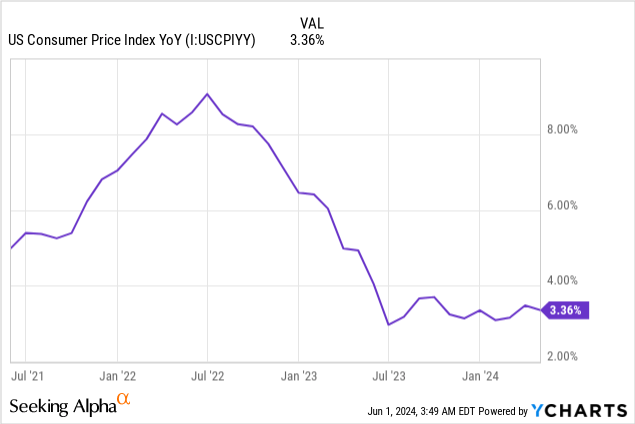

Moreover, the Consumer Price Index, an indicator of inflation, has slowed from its peak, as the chart below shows: While it is true that the Federal Reserve is struggling to keep inflation closer to its 2% target range, inflation is likely to remain stable near 3%, relieving consumers from additional financial burdens as the Fed continues to work to further rein in inflation.

(Chart created by the author using YCharts)

Finally, Capital One shares the view that the current increase in consumer loan delinquencies is temporary. First Quarter 2024 Earnings Forecast“The pace of year-over-year growth in loan loss reserves and delinquency rates has been declining steadily for several quarters and continued to narrow in the first quarter,” the company’s management said.

Therefore, given these factors supporting consumer financial health, I believe it is reasonable to make two points. First, the trend of improving consumer loan delinquency rates will continue for the foreseeable future. Second, after this period of normalization, consumer delinquency rates will likely return to pre-pandemic levels.

How is this beneficial?

Capital One will certainly benefit from lower delinquency rates on consumer loans, but how much will that boost the company’s profits?

Given the above discussion, if we assume that consumer loan delinquency rates trend toward pre-pandemic levels of about 2.47% in the first quarter of 2020, Capital One’s earnings could grow significantly.

First, Capital One can reduce its reserve coverage for potential credit losses. Q1 2024The company’s credit card reserve coverage ratio is 7.81%, significantly higher than its pre-pandemic coverage ratio of 6.31%. Therefore, Capital One will be able to release its reserves if delinquency and bad debt trends normalize. If Capital One can bring its coverage ratio closer to the pre-pandemic 6.50%, Capital One’s bottom line could increase by approximately $1,971.55 million during the period in which the company lowered its reserve coverage ratio. Given that Capital One reported annual net income for the third quarter of 2018, $4.77 billion In 2023, the tailwind from lower coverage could be significant, as the $1.971 billion represents roughly 41.3% of 2023 net income.

Second, Capital One could see a significant increase in net income due to a reduction in its reserve for credit losses. Capital One’s net reserve for credit losses was $2.616 billion in the first quarter of 2024. However, Q2 2023Capital One reported net loan loss reserves of approximately $2.185 billion when the market’s consumer loan delinquency rate was 2.37%, similar to pre-pandemic delinquency rates. Capital One’s net loan loss reserves increased as overall consumer loan delinquency rates rose from 2.37% to 2.68%. As such, if the increase in consumer loan delinquencies eases and eventually begins to decline toward pre-pandemic levels, Capital One’s loan loss reserves are expected to increase by $431 million quarterly, not accounting for organic growth. Since the company’s first-quarter 2024 net income was $1.28 billion, the decrease in loan loss reserves could boost bottom line earnings by approximately 37%.

A number of other factors, including loan loss reserve reductions and current and projected macroeconomic conditions, will determine the reserve ratio. Additionally, Capital One’s net income and loan loss reserves will vary from quarter to quarter. However, one thing is clear: if the market’s consumer loan delinquency rates begin to decline in the coming quarters, Capital One will likely see a significant gain of over 30%. Therefore, taking both possibilities into account, we believe Capital One has an opportunity for significant valuation upside in the coming quarters from potential earnings growth.

Risks of the paper

My bullish thesis calls for positive macroeconomic tailwinds, including continued declines in overall interest rates and strengthening consumer financial positions. However, if this is the case, and inflation persists and begins to rise, consumers could come under further financial pressure from both the cost of everyday living and potentially even higher interest rates. Thus, the current trend and momentum in delinquency rates could reverse, negatively impacting Capital One and my bullish thesis.

summary

The momentum of rising delinquency rates continues to weaken, which could eventually lead to delinquency rates declining from current high levels to pre-pandemic levels. This trend is supported by stronger consumer financial conditions and lower overall inflation, which is a tailwind for Capital One. As pressure from rising loan delinquency rates eases, Capital One could see a 30%+ gain in its bottom line and, as a result, the stock price overall. Therefore, I believe Capital One is a buy.