by Calculated Risk August 15, 2024, 10:00 AM

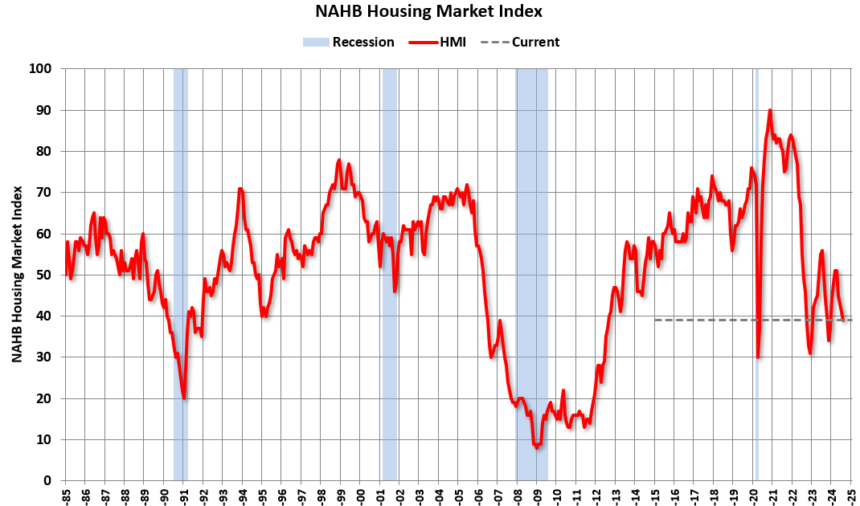

The National Association of Home Builders (NAHB) announced that its Housing Market Index (HMI) fell to 39 from 41 last month. A reading below 50 indicates that more builders view home sales conditions as poor than as good.

From the NAHB: Builder confidence weakens as market awaits interest rate cuts

Difficulties in home buying and buyer hesitation due to rising interest rates and high home prices contributed to a deterioration in homebuilder sentiment in August.

Builder confidence in the new single-family home market was 39 in August.According to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released today, the home price index fell 2 points from July’s downwardly revised reading of 41. This is the lowest reading since December 2023.

“Home affordability remains the top concern for prospective homebuyers in HMI’s latest data, as both current home sales and traffic volumes point to weakness,” said NAHB chairman Carl Harris, a custom home builder in Wichita, Kan. “The only sustainable way to effectively curb skyrocketing home prices is to implement policies that allow builders to build more accessible, affordable housing.”

Nearly three-quarters of responses to the August HMI were collected in the first week of the month, when rates averaged 6.73%, according to Freddie Mac. Mortgage rates fell sharply the following week to 6.47%, the lowest since May 2023.

“With current inflation data pointing to interest rates being cut by the Federal Reserve and mortgage rates dropping significantly in the second week of August, buyer interest and builder sentiment should improve in the coming months,” said Robert Dietz, NAHB chief economist.

The August HMI survey also revealed that 33% of homebuilders reduced home prices in August to boost sales.The August rate exceeded July’s 31% and was the highest for all of 2024. However, the average rate of price reduction in August was 6%, remaining flat for the 14th consecutive month. Meanwhile, the rate of use of sales incentives rose from 61% in July to 64% in August, the highest level since April 2019.

…

The HMI index, which measures current sales conditions, fell two points in August to 44, while a gauge showing how likely buyers are to visit stores also fell two points to 25. A component measuring sales expectations over the next six months rose one point to 49.Looking at the three-month moving average of regional HMI scores, the Northeast fell four points to 52, the Midwest fell four points to 39, the South fell two points to 42, and the West remained stable at 37.

Add emphasis

This graph shows the NAHB index since January 1985.

This was below consensus expectations.