by Calculated Risk September 11, 2024 7:00 AM

From the MBA: Latest MBA Weekly Survey Shows Increase in Mortgage Applications

Mortgage applications for the week ending September 6, 2024 increased 1.4% from the previous week, according to data from the Mortgage Bankers Association’s (MBA) Weekly Applications Survey. This week’s results include an adjustment for the Labor Day holiday.

The Market Composite Index, a measure of mortgage application volume, increased 1.4% from the previous week on a seasonally adjusted basis. The unadjusted index was down 10% from the previous week. The Refinance Index increased 1% from the previous week and was 106% higher than the same week a year ago. The seasonally adjusted purchasing index rose 2% from the previous week.The unadjusted purchasing index fell 10% from the previous week, That’s 3 percent lower than the same week a year ago..

“Mortgage rates fell for the sixth consecutive week, with the 30-year fixed rate dropping to 6.29%, its lowest since February 2023. Treasury yields are reacting to data pointing to subsiding inflation, a slowing job market, and the Federal Reserve’s planned first rate cut later this month,” said Joel Kang, MBA associate dean and associate chief economist. “Interest rates are almost a full percentage point lower than a year ago, and refinance applications continue at a much higher pace than last year. However, with many borrowers still paying below 5% interest rates, refinancing opportunities remain somewhat limited. It is a positive development that some homeowners can benefit from refinancing as interest rates continue to fall.”

Kang added, “Purchase applications have increased in a week and are approaching last year’s levels. Although interest rates have fallen, other factors such as purchasing difficulties and low inventory may still be hindering purchase decisions.”

…

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) decreased from 6.43% to 6.29%, and points for loans with an 80% LTV (loan-to-value ratio) decreased from 0.56 (including origination fees) to 0.55.

Add emphasis

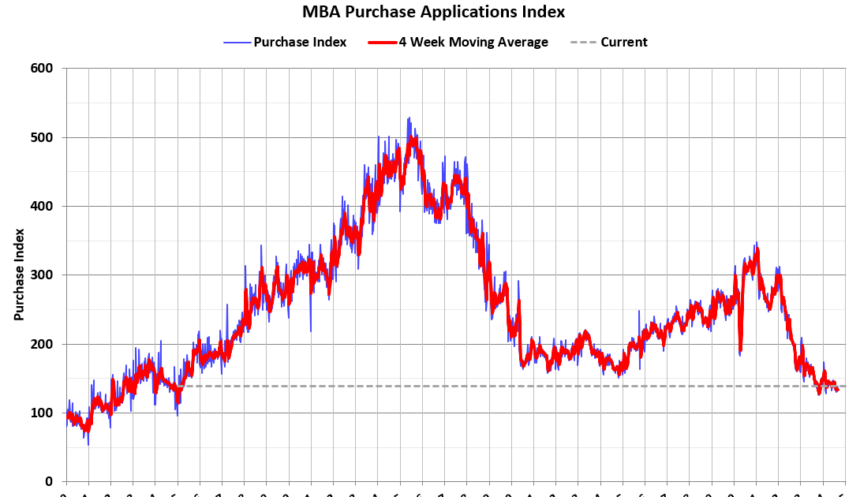

The first chart shows the MBA Mortgage Purchase Index.

Purchasing activity was down 3% year-over-year on an unadjusted basis, according to the MBA.

Red is the four-week average (blue is weekly).

Purchase application activity is up about 10% from its lows in late October 2023 but remains below the lows seen during the housing bubble collapse.

Rising mortgage rates caused the refinance index to fall sharply in 2022 after remaining roughly flat for two years, but it has been rising recently as mortgage rates have fallen.