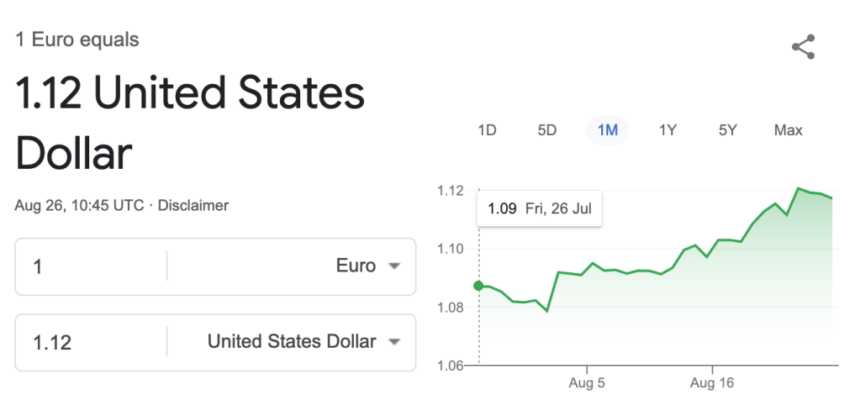

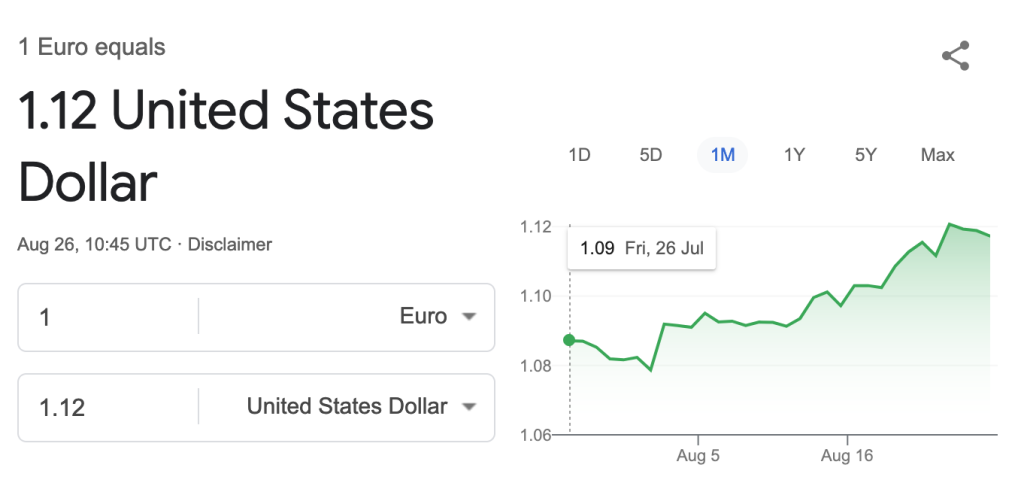

Hi, Yves. I take a bit of issue with Wolf’s assertion that Powell’s statement that a rate cut was finally on the cards was “inconsequential.” To be fair, though, he limited his statement to the Treasury market. The currency was a late believer. Look at the EUR vs. USD movement since early August, when Wolf portrayed the Treasury market as pricing in a rate cut. There was a move on August 2nd, but the larger cumulative increase came afterwards.

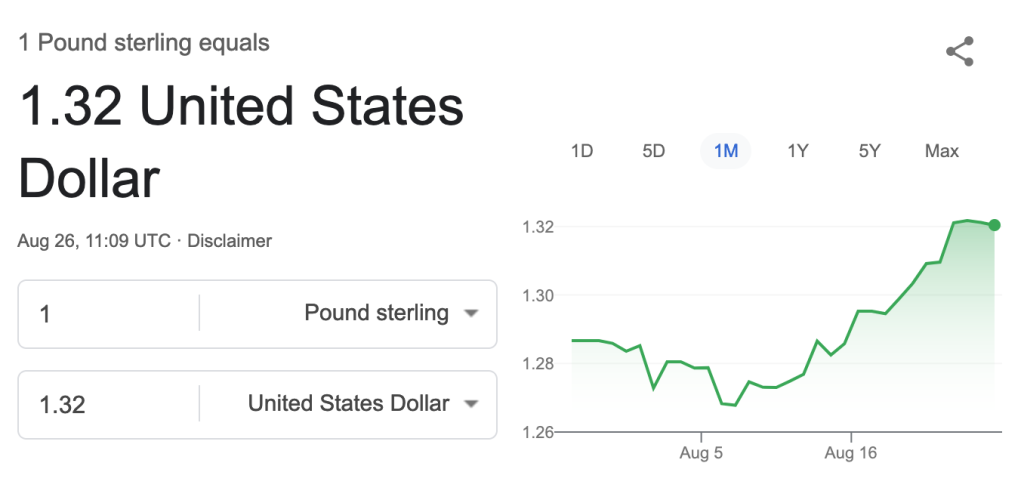

The Bank of England has announced that it will cut interest rates from 5.25% to 5.0%. As a result, the following measures are being taken:

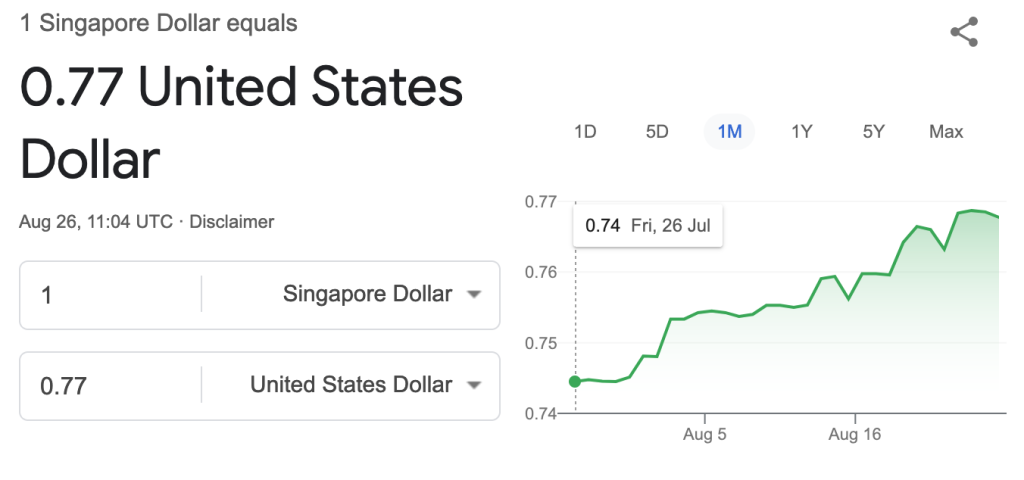

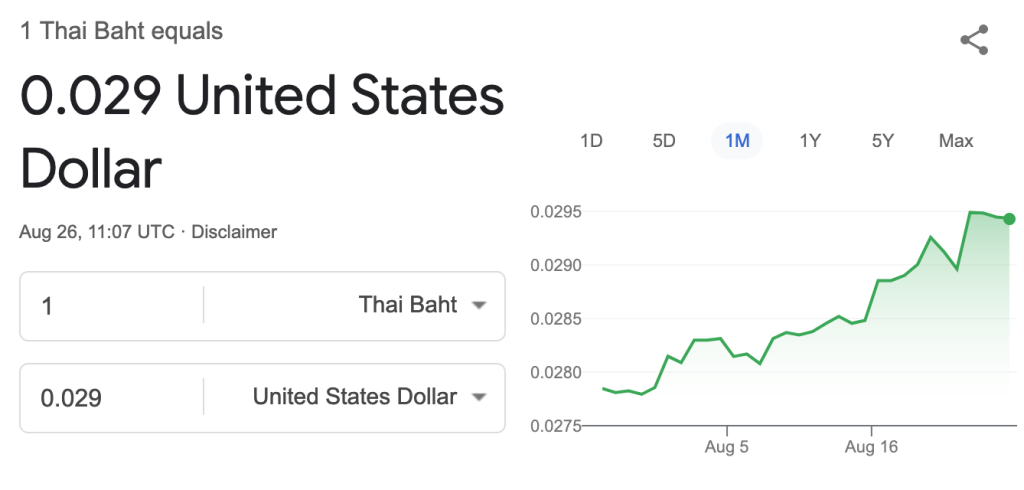

Emerging economy currencies:

And a local favorite:

Wolf Richter, editor Wolf Street. Originally Wolf Street

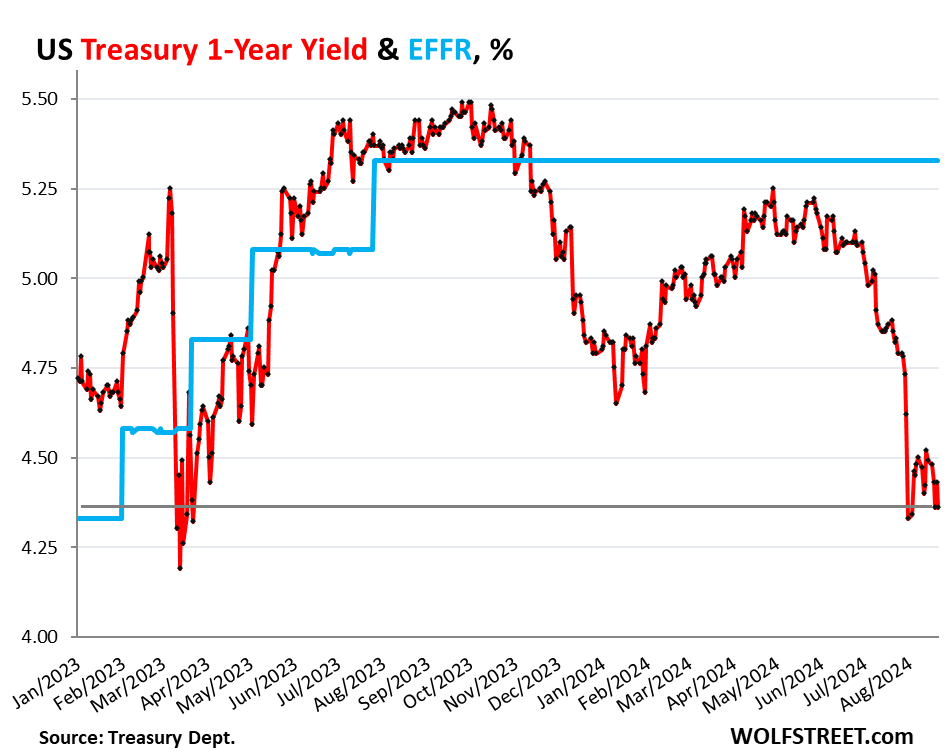

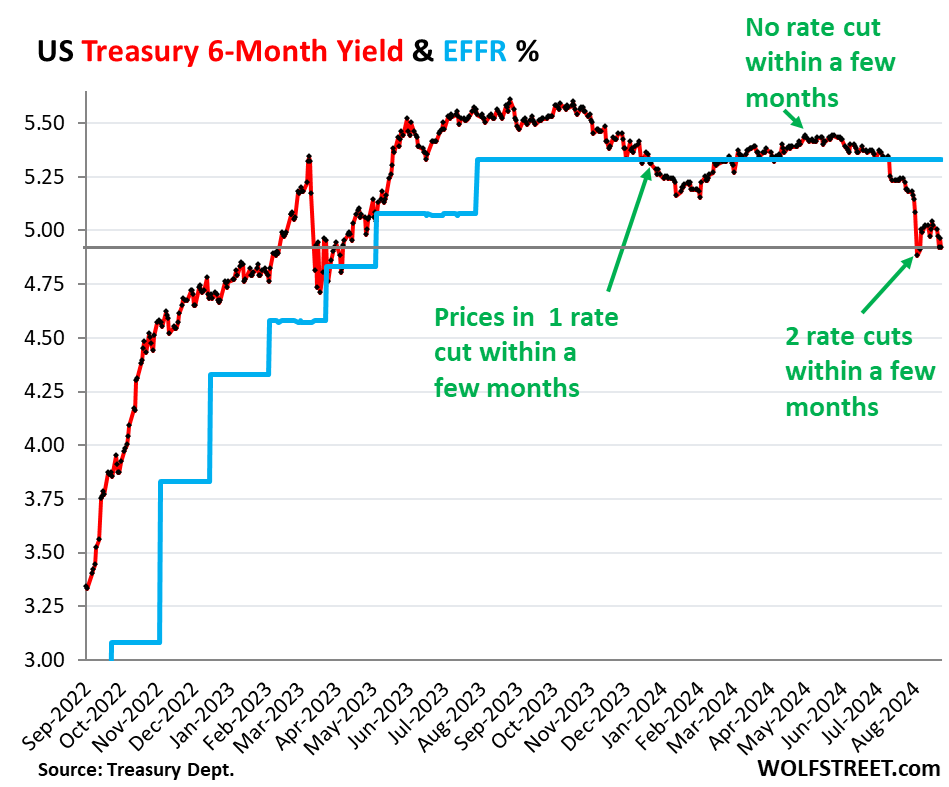

For the Treasury market, Powell’s speech was inconsequential: a September rate cut had been priced in since the Aug. 2 jobs report.

Powell reaffirms his position at Jackson Hole speech On Friday, he said a rate cut was due but did not mention “September.” “The time has come to adjust policy. The direction we need to go is clear…” he said.

But he said the “timing and pace of rate cuts will depend on upcoming data, the evolving outlook and the balance of risks.”

Chairman Powell delivered a balanced message: There was no panic. The two aspects of the Fed’s dual mandate (low inflation and full employment) were roughly balanced.

The Fed has been discussing rate cuts since its December 2023 meeting when it scheduled three rate cuts in 2024, which the market immediately interpreted as six rate cuts. It is now August 2024 and we are still waiting for a rate cut. But it is getting closer.

After nine months of waiting, the Fed is likely to cut interest rates at its September meeting. This has become increasingly clear recently, and the July FOMC minutes released on Wednesday included the word “September” in a statement that the market was expecting a rate cut in “September,” but there was nothing in the minutes that would dissuade the market from cutting rates.

Powell noted that inflation has fallen significantly. The policy rate has not fallen at all since July 2023 and is high relative to the inflation rate. The word “subdued” was used three times in his speech. The risk of inflation rising in the future has decreased. He said, “We have increasing confidence that inflation is on a sustainable path to 2%.” Inflation is much less of a problem than it used to be.

He said the labor market has cooled from its previous rapid growth and employment risks have increased, adding that “we do not want or welcome a further deterioration in labor market conditions.”

But there’s no need to panic. “So far, the rise in unemployment has not been due to an increase in layoffs, as is often the case during economic downturns. Rather, the rise in unemployment reflects primarily a large increase in the supply of workers (From the huge waves of immigrants) and a slowdown in the previously hectic pace of hiring.”

“There is every reason to believe that with an appropriate easing of policy restraints, the economy can return to 2 percent inflation while maintaining a strong labor market,” he said.

So there is no need to panic. It’s gradualism. If the economy continues to move in that direction, the 25 basis point cuts will continue.

If the labor market were to suddenly deteriorate, the Fed would step in with a larger rate cut. “Current rates provide ample room to respond to any risks we might face, including the risk of a further deterioration in labor market conditions.”

Everyone is looking for inspiration from the August jobs report due on September 6th to see if nonfarm job creation bounces back from July’s modest pace, which was likely affected by Hurricane Beryl, which struck Texas during the survey period. If nonfarm job creation bounces back, the cuts will be gradual. If it crashes and turns negative, meaning the first job losses, the cuts will be bigger.

The September meeting will also see the release of the July PCE Price Index report (not a big surprise given that the July CPI report is already out) and the August CPI report.

Fed likely to ‘ignore’ poor August CPI reportIf inflation accelerates further each month, July monthly accelerationcoupled with a strong recovery in nonfarm payrolls in August, the Fed could decide to “overlook” accelerating inflation, just as it “overlooked” the inflation spike in early 2021. With regard to the events of 2021, Chairman Powell said, “it may be appropriate for the central bank to overlook a temporary increase in inflation.” So this time around, if the CPI report is bad, the Fed will likely cut rates in September, even though it will likely vote against it.

Markets are already expecting a wave of rate cutsIn the federal funds futures market on Friday, at least The Fed is set to cut interest rates by 200 basis points by the end of 2025, amounting to eight 25 basis point cuts over 11 meetings. This is similar to its outlook in December 2023, when it forecast 150 basis point cuts over eight meetings in 2024.

But this rate cut trajectory may not go as expected. That’s because of the inflationary effects of economic and fiscal policy no matter who is in the White House, said Adam Posen, president of the Peterson Institute for International Economics. Market Watch.

The inflation policies promised by both candidates are: In addition to the current financial difficulties – Inflation will return and the Fed will have to deal with the next problem.

Posen told MarketWatch that Powell’s speech was too focused on the short term and didn’t take into account what will happen six months from now, which he said was a mistake.

“My view is that if Harris becomes president, there’s a 60 to 65 percent chance that the rate cut the market is expecting won’t happen,” Posen said. “If Trump becomes president, there’s an 80 to 90 percent chance that we’ll see a rate hike a year from now.”

There is never a dull moment in economics. The Wall Street Journal “This year’s candidates have not only disregarded economic principles, but have abandoned them altogether,” he lamented. “It’s as if they are giving the middle finger to the economic establishment.”

“Why doesn’t anyone listen to economists?” Glenn Hubbard, who served as chairman of President George W. Bush’s Council of Economic Advisers, told the Journal. It was a rhetorical question. “Economists don’t seem to be very involved in the campaigns or internal decisions of this administration these days,” he said.

Meanwhile, in the government bond market…

The big move started after the jobs report on Aug. 2. Yields have risen slightly since then, and Chairman Powell’s speech didn’t change much, as the Treasury market had already priced in a September rate cut and further cuts in the future.

6-Month Government Bond YieldThe yield, a gauge of market expectations for Fed interest rates over the next few months, fell 4 basis points to 4.92% on Friday, back to Wednesday’s level but surpassing the sharp drop to 4.88% on Aug. 2 after the employment data was released.

Note that six-month yields had mistakenly started pricing in a rate cut in early 2024 that never materialized. Throughout April and May, yields rose again to a no-cut scenario within the six-month time frame.

1-Year Government Bond YieldThe policy rate, looking out to mid-2025, ended Friday at 4.36%, the same level as Wednesday and up from a low of 4.33% on Aug. 2. It is starting to price in four rate cuts early on over a one-year period.