by calculated risk 11/01/2024 09:10:00 AM

In today’s ‘Calculated Risk Real Estate’ newsletter: Inflation-adjusted house prices are 1.5% below their 2022 peak.

excerpt:

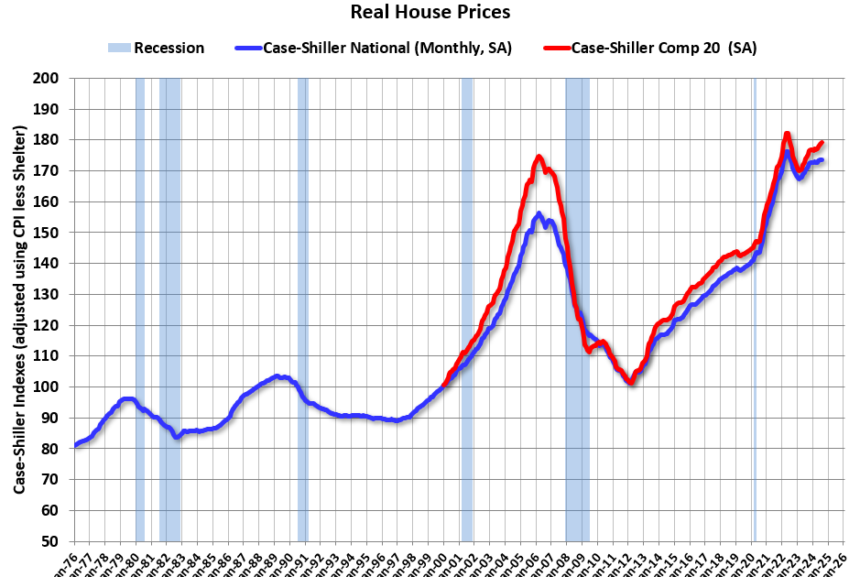

More than 18 years have passed since the peak of the bubble. in August Case-Shiller Home Price Index On Tuesday, the seasonally adjusted national index (SA) was reported to be 75% above its 2006 bubble peak. But in reality, the National Index (SA) is about 11% above the bubble peak (and historically, real house prices have been on an upward trend). The Composite Stock Index 20 is 3% above the bubble peak in real terms.

Usually people graph the nominal price of a home, but it’s also important to check the actual price. For example, if your home cost $300,000 in January 2010, the inflation-adjusted price would be $433,000 today (a 44% increase). That’s why the second graph below is important. This shows the “real” price.

The third graph shows the price to rent ratio and the fourth graph shows the affordability index. The final graph shows the five-year real returns based on the Case-Shiller National Index.

…The second graph shows the same two indices in real terms (adjusted for inflation using CPI).

In real terms (using CPI), the National Index is 1.5% below its recent peak in 2022, and the Composite 20 Index is 1.6% below its recent peak in 2022. Both indexes rose in real terms in August.

It’s been 27 months since the real peak in house prices. Typically, after a sharp price increase, it takes several years for real prices to reach new highs (see House prices: 7 years in purgatory)