Ojos de Hollata

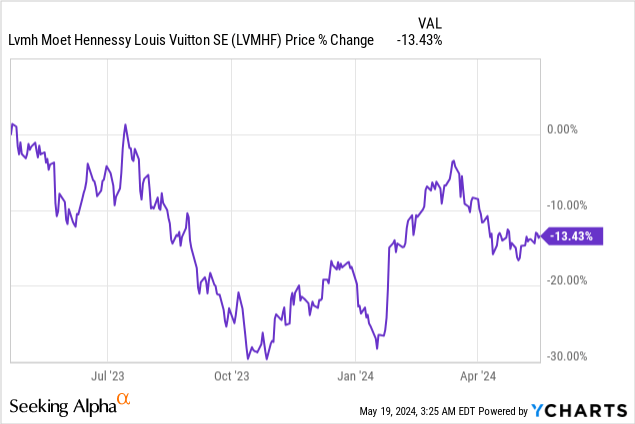

LVMH (OTCPK:LVMHF) (OTCPK:LVMUY), one of the best-run conglomerates in the luxury goods space, has been hit hard by the coronavirus, as currency headwinds more than offset the company’s 3% organic growth in Q1-2024. Sales decreased compared to the previous year for the first time since the virus outbreak.

The big unknown surrounding LVMH The question is whether the slump in earnings is just a matter of normalization or a long-term problem.

This will be answered in Q3-24. Let’s see why.

Overview and Background of the Luxury Goods Sector

I’ve been covering LVMH for Seeking Alpha since the beginning of 2023, and it’s been quite a roller coaster.

LVMH and its peers have positioned themselves well beyond COVID-19 with the perfect combination of pandemic savings and stimulus, superior design and marketing, and bulging demand driven by successful cost-cutting efforts in 2020. achieved amazing results.

This has led LVMH to grow its revenue at a CAGR of 24.5%, resulting in historically high revenue growth. Between 2020 and 2023, it achieved historically high profit margins, exceeding a 17.5% profit margin in 2023, leading to an impressive 47% net income CAGR.

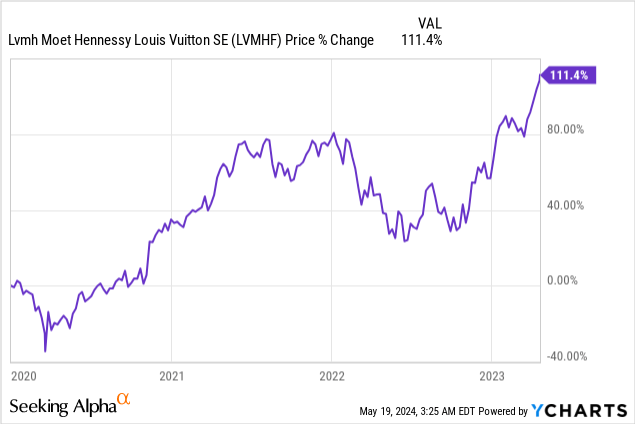

The stock price responded, more than doubling between January 2020 and April 2023.

At some point, this effort had to end. Starting in the third quarter of 2023, sales growth remained in the low single digits due to a much more challenging economic environment, currency headwinds, built-up inventories, and most importantly, a very tough business performance. .

After several quarters of lackluster growth, the stock is now down more than 13% from its April 2023 high. Will this situation continue, or will there be a significant recovery? Let’s find out.

First quarter highlights

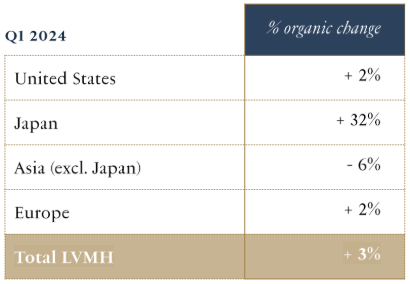

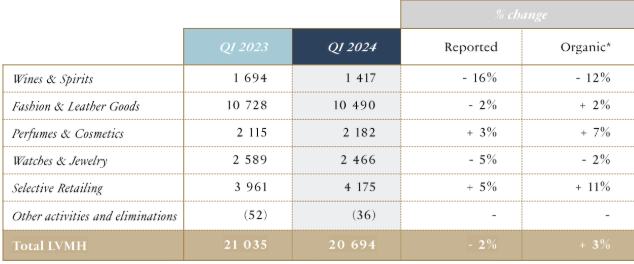

LVMH is off to a good start heading into 2024. Despite group-level organic growth of an underwhelming 3%, the company’s worst quarter since 2020, it was in line with expectations and outperformed peers such as Kering. (OTCPK:PPRUF) fell 10%, Richemont (OTCPK:CFRHF) increased by 2%.

LVMH Q1 2024 Presentation

Geographically, LVMH achieved positive growth in Europe, the United States, and Japan, but sales decreased in Asia, mainly due to China.

LVMH Q1 2024 Presentation

On a segment basis, Wine & Spirits performed the worst as inventory declines remained slow. Importantly, management said on the conference call that they are optimistic about the second quarter as the U.S. business is stabilizing. It’s also worth noting that Q2 will be the first negative growth quarter for this segment, making comps much easier.

The Watches & Jewelry division also had a tough quarter, with an organic decline of 2%, but Richemont grew by 2% and grew on a larger scale. however,

Selective Retailing performed well, driven by Sephora’s market share gains, with F&LG and P&C posting positive growth as well.

It’s all about comps, which means Q3-24.

LVMH’s normalized growth rate has historically ranged from 8% to 11%. This is driven by price increases, acquisitions, and volume.

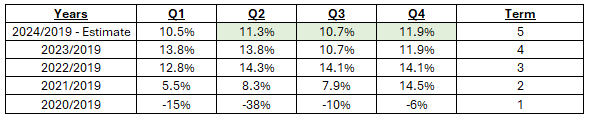

To normalize the significant post-COVID-19 growth, we look at the growth stack in the 2019 baseline.

Prepared and calculated by the author based on data from LVMH financial reports.

As you can see, LVMH remained at the high end of its historical growth range in Q1, reflecting a CAGR of 10.5% from Q1 to Q19. Based on my estimates and consensus, this should remain the case for the rest of the year.

That being said, investors are seeing 3% year-over-year organic growth and a 1.6% decline in reported sales. It’s hard to ignore these numbers, especially in an uncertain field like luxury retail.

But remember, this is a game of comps.

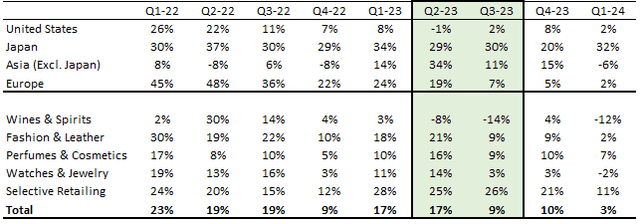

Prepared and calculated by the author based on data from LVMH financial reports.

Looking at the table above, there are several factors that could be considered positive in the short term.

In the second quarter of this year, the United States, an important country, will record negative growth, especially due to the strong dollar. This was also the first negative rating in the Wine & Spirits category. Conversely, Q2-Q23 was a very strong quarter in all other respects, so we expect only a slight acceleration.

The third quarter is when things get really interesting. As you can see, in all regions and in all segments except Selective Retailing, it’s been much easier compared to the first quarter. Additionally, this quarter was the quarter with the strongest currency headwinds, with an impact of approximately 8%.

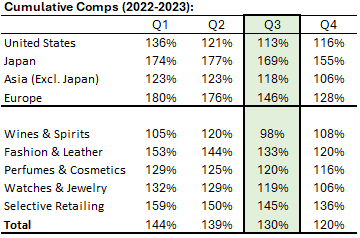

Prepared and calculated by the author based on data from LVMH financial reports.

Looking more broadly, we see a 5% decline from Q1 to Q2, an even steeper 9% decline from Q2 to Q3, and a decline from Q3 to Q4. You can see that there is an even steeper 10% decline.

All of this points to LVMH returning to high-single-digit year-on-year growth starting in the third quarter, if the fundamental flaws are not getting worse and are in the process of normalizing. Thing.

As you will see below, the market seems to believe this will happen.

evaluation

LVMH has a very long track record of successful acquisitions, organic growth across markets and sectors, and consistent profit growth. You can debate the appropriate multiple for such companies or rely on the facts.

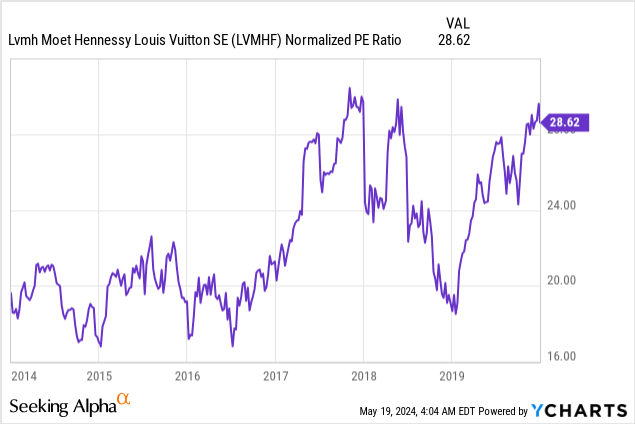

Between 2014 and 2017, LVMH traded in the 16x to 20x range. In 2017, the market as a whole rose, with an even bigger rise in luxury goods, and LVMH itself also showed double-digit growth and solid profit expansion this year. This pushed the stock into a new range, trading between 20x and 28x.

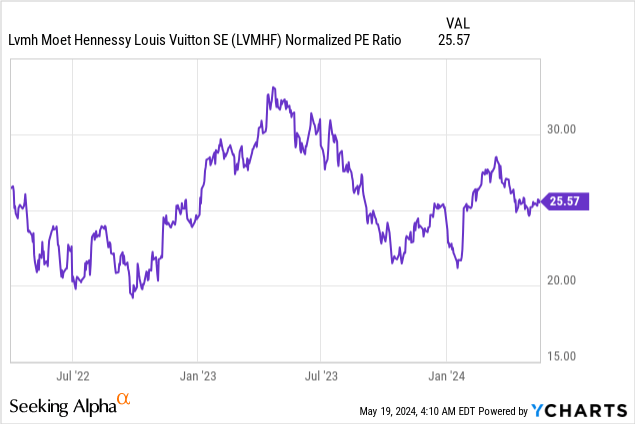

Post-pandemic, the company’s stock price has averaged about 25x, returning to its 2017-2020 range.

Based on the current share price of €783.2 and consensus EPS estimate of €32.0, LVMH trades at 24.5x 2024 earnings, slightly below the steady-state average.

Considering 25x as a fair multiple, the short-term upside algorithm is 2% with multiple expansions, and further upside if the company beats expectations.

The 2024 estimate reflects a 17.7% margin, which is consistent with the past two years, so I consider it quite reasonable. In terms of revenue, this reflects a slight acceleration to 1.6% in the second quarter and a sharp acceleration to 11% in the third quarter, which fits into the framework described in the previous section.

Looking further ahead, consensus forecasts are for 2025 revenue to grow 7.3% and margins to improve by 50 bps, resulting in a 2025 multiple of 22x. If our theory about normalization is correct, I think 7.3% is a bit low but reasonable.

As we all know, valuations are forward-looking. I have high confidence in LVMH’s recovery in the second half of 2023 and believe that it can achieve better than expected in 2025, so I have a target of €880 by the end of 2024, based on 25x 2025 EPS. Setting stock prices. This reflects an upside of approximately 13%.

For LVMHF ADR, this reflects a target price of $965.

conclusion

After an unusual two-and-a-half years since the pandemic, LVMH is set to slow down, which understandably made investors some negative.

Looking ahead, we expect a slight increase in the second quarter and a sharp acceleration in the third quarter. If this prediction comes true, I expect the stock price to start reflecting the 2025 outlook, which would represent a significant 13% increase.

Considering all of the above, I have strong confidence in LVMH’s ability to meet expectations and believe it should be rated a Buy.

If I’m wrong, it would indicate that LVMH has deeper problems than I originally thought, and I might downgrade the stock to a sell.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.