Monty Laksen

In January of this year, I issued a bullish outlook. article upon Energy transfer (New York Stock Exchange:E.T.) At the time, the dividend yield was about 9%, which he argued put the company in a much safer position than a few years ago, when ET was forced to cut its dividend. In this article, I also highlighted several dynamics that created very favorable conditions for ET to achieve strong total returns. In other words, the investment case was centered not only on dividends, but also on ET’s organic and M&A growth potential.

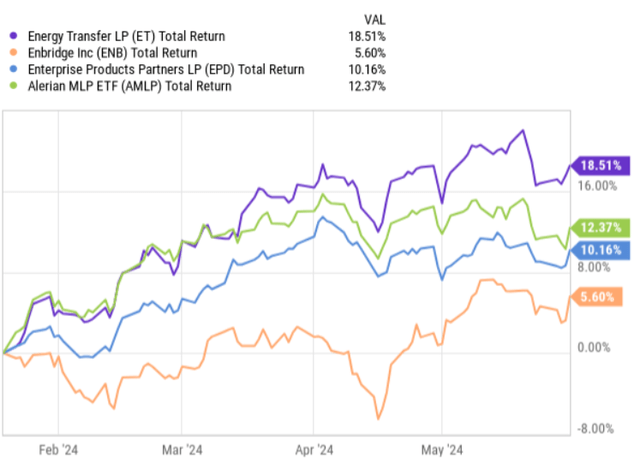

Since the announcement of this bull scenario, ET has outperformed the index and other popular midstream stocks that I have given a Buy recommendation rating.

This situation is what I Reassessed In the case of the post-2023 fourth quarter earnings announcement, there is a possibility of overvaluation or still ET has significant upside potential remaining.

Specifically, back in April of this year, I analyzed the fourth quarter report to see if fundamentals still justified an above-average multiple and higher share price. The combination of ET’s strengthening balance sheet, steady growth in its business segments, and the first signs of a more ambitious M&A program led me to maintain a bullish view on ET. Since then (April 14, 2024), ET has continued to deliver alpha above the MLP index.

Now let’s compare the latest data points from the Q1 2024 earnings report against the current bullish thesis to determine ET’s current attractiveness.

However, before analyzing the first quarter trends, I would like to emphasize that my investment strategy is not based on speculation or short-term gains. Rather, I am primarily focused on earning attractive dividends backed by solid fundamentals, with only the capital appreciation element coming into play.

Thesis Review

Overall, looking at the core performance metrics for Q1 2024, it is not surprising to see such an increase in ET’s stock price. All of ET’s business segments experienced growth compared to Q1 2023 and even the previous quarter. Compared to Q1 2023, net income and adjusted EBITDA increased 11% and 13%, respectively, in Q1 2024, which was driven by higher sales volumes and more favorable pricing.

Interestingly, ET also saw record volume in its crude oil pipelines division, which is one of ET’s most profitable divisions (i.e., the division with the highest cash conversion rate). As a result, its DCF for Q1 2024, which reflects actual cash generation levels, is $2.4 billion compared to $2.0 billion in Q1 last year. This allows ET to keep approximately $1.3 billion of cash on its books after paying quarterly dividends, translating into an annualized yield of 8.1%.

When thinking about the future, it is important to start with the fact that currently approximately 90% of ET’s adjusted EBITDA is made up of the fee-based segment, with only approximately 10% exposed to product market volatility (i.e. pure market risk). The fee-based segment is tied to periodic (annual) escalators and is inherently less volatile, providing ET with the stability it needs to keep its dividend safe and better manage its leverage profile.

Now, recently ET has been Acquisition WTG Midstream will pay approximately $3.2 billion in cash. The new acquisition is expected to accrete underlying DCF generation by an additional $0.04 per share already in 2025, with DCF projected to reach $0.07 per share by 2027 (after synergies are realized).

The move was recently announced by CEO Tom Long. Earnings Report:

Yes, that’s obviously a very good question. At Energy Transfer, we spend a lot of time strategizing here. First, I want to say that we feel that consolidation makes sense in the midstream space. So, the 50,000-foot answer to your question is, we’re going to continue to carefully evaluate different opportunities. So we’re not going to slow down on that front. Now, one of the things we look at is we’re always looking at things that connect downstream. We always like to talk about the well to water journey, and we do that across all of the commodities. So I think you can see the strategy as we look at these things and assets of how they connect across the value chain as we make acquisitions.

In other words, it is clear that ET is stepping up its M&A strategy to extract benefits from a fairly fragmented market, and as we can see from the details of the WTG Midstream acquisition, there is also the benefit of incremental diversification, particularly inorganic growth in the form of DCF generation.

Given all this, one might question ET’s ability to protect its balance sheet. This could certainly be an issue if ET continues to announce very large transactions that are done on a cash basis. However, given the current data points, I don’t see any risk on the balance sheet side.

First, as outlined above, ET is able to retain roughly $1.3 billion in cash per quarter, after debt repayments and dividend distributions.

Second, sustaining capex is fairly low relative to quarterly cash holdings: in Q1 2024, for example, ET spent about $460 million on organic growth capital, yet still had ample liquidity left to direct toward M&A.

Third, ET took notable steps to reduce its preferred stock holdings by redeeming all of its outstanding Series E Preferred Stock. Also during the quarter, ET redeemed $1.7 billion of its senior notes, partially using cash and partially using its credit revolving loan facility.

Fourth, in conjunction with the first quarter results, management increased its Adjusted EBITDA guidance to $15.0 billion to $15.3 billion from its previous guidance range of $14.5 billion to $14.8 billion, which will allow ET to access more liquidity each quarter to fund acquisitions and further optimize its balance sheet.

Now, at the beginning of this article, I stated that my ET bullish thesis is not based on near-term results or ET’s ability to match consensus expectations (rather it is focused on an attractive and steadily growing dividend), but rather on my belief that ET can achieve its revised EBITDA generation. A big driver of the increase in EBITDA guidance is the consolidation (or consolidation) of the NuStar assets, which was completed in May of this year. This effect alone will contribute $500 million to the increase in EBITDA generation, while the rest can easily be covered by additional bolt-on acquisitions and continued strong demand for oil and natural gas.

Finally, one could theoretically argue that ET’s multiple has become a bit overstretched and is now at a fairly high level. 7.8x EV/EBITDA could be considered higher than the average over the past 24 months, but Enbridge (NYSE:ENNB)(TSX:ENB:CA), Enterprise Products Partners (NYSE:Electronic Bulletin) or Plains All American Pipeline (NASDAQ:PAA), we can see that ET actually remains undervalued. For example, ENB, EPD and PAA have EV/EBITDA of 11.3x, 9.3x and 9.2x respectively. Given ET’s growth momentum backed by an investment grade balance sheet, the stock is undervalued in my view.

Conclusion

In my opinion, the recent surge in ET’s share price does not mean that the upside potential has already been exhausted: the share price increase was driven by strong underlying business performance and improving growth prospects, signs of which were already seen in my previous article on ET (in April this year).

Since my paper update, ET has started to take concrete steps by executing an M&A strategy to capture the benefits of the fragmented midstream market, where incremental consolidation should allow ET to become more diversified and maintain its growth momentum in the DCF.

Given the combination of strong EBITDA growth, profitable acquisitions, low-carrying capex, and ample quarterly cash retention (after paying dividends of approximately 8%), ET’s financial risk remains well managed.

As a result of the aforementioned trends, an improving growth profile, and an attractive, well-covered dividend, Energy Transfer remains a solid buy for me.