Bilanol

Adams Natural Resources FundNew York Stock Exchange:Human Resources Professional) is a closed-end fund that invests primarily in energy and natural resource stocks. The fund is currently trading at a 14% discount to its net asset value. The fund is An increase of just over 13% Over the past year, I believe this fund is an ideal way to invest in the largest and most popular energy stocks. Plus, by owning just one fund, you get all the benefits and risk mitigation that come with the diversification this fund offers. Let’s take a closer look.

chart

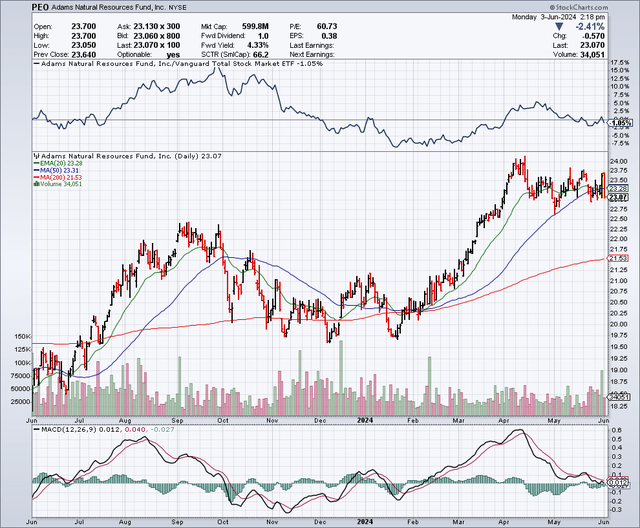

As the chart below shows, the fund’s share price has risen from around $19 at the beginning of the year to around $23 currently. The 50-day moving average is $23.30 and the 200-day moving average is around $21.52.

Stock Chart

Top Holdings

home page

Let’s take a closer look at the top three holdings.

Exxon Mobil (ZOM) accounts for about 19% of the portfolio, giving the oil giant a large weighting. ExxonMobil With a dividend yield of about 3.24%, the stock trades at about 12 times earnings. While this isn’t the most attractive stock in the oil sector, it’s definitely an income stock that many investors can sleep easy on.

Chevron (CVX)Currently, get Hess Corporation (he), this oil company will become an even bigger player in the industry. Chevron offers a yield of about 4% and trades at about 12 times earnings. The stock is in a solid uptrend through 2024, and this is a stock I will continue to buy on the dip. Chevron makes up about 12% of PEO’s portfolio holdings. Warren Buffett has Large holdings of Chevron stock.

ConocoPhillips (Police officer) represents just over 6% of the portfolio’s holdings. The stock yields about 2.7% and trades at about 13 times earnings. The company has been in acquisition mode recently, Announced Marathon Oil Acquisition Agreement (M.R.O.) for $17.1 billion.

dividend

This fund is Variable Dividend Payment PolicyIn 2023, it paid a total distribution of $1.35 per share, which equates to a yield of approximately 6.2%. In 2022, it paid $1.63 per share, which equates to a yield of approximately 8.2%. These distributions are derived from dividend income received and capital gains. Fortunately, these distributions do not represent a return of capital and may not be sustainable. Over the past five years, distributions from the PEO have ranged from 6.1% to 8.1%. It is important to note that one of the reasons this fund offers a strong distribution yield is because it trades at a 14% discount to its net asset value, which has increased shareholder returns.

Energy stocks stand to benefit from AI boom

Many people seem to think that using electricity is green energy, but the majority of electricity (about 60%) Produced from fossil fuelsIn fact, wind, solar, Hydroelectric only Thermal power generation accounts for approximately 21.4% of the electricity generated in the United States, while nuclear power generation accounts for approximately 18.6%.

The continued rise in demand for electric vehicles and relatively new industries such as AI and data centers will continue to drive energy demand from all sources, including fossil fuels. Additionally, the steady growth in global population and the emergence of a middle class in many developing countries are also major tailwinds for the energy sector. The International Energy Agency (IAE) confirms this long-term energy demand and predicts a significant increase in electricity consumption over the next few years. It states:

“Electricity consumption from data centers, artificial intelligence (AI), and the cryptocurrency sector could double by 2026. Data centers are a major driver of electricity demand growth in many regions. After consuming an estimated 460 terawatt-hours (TWh) globally in 2022, total electricity consumption from data centers could exceed 1,000 TWh in 2026. This demand is roughly equivalent to the electricity consumption of Japan.”

Potential downside risks

When investing in closed-end funds, there is always the risk that the discount to the net asset value could widen. This can happen if investor sentiment towards a particular sector becomes very negative. It can also happen during market corrections, as closed-end funds tend to be more volatile due to lack of liquidity, especially during market offerings.

The energy sector is prone to cyclical highs and lows as demand is dependent on the global economy. A global recession could cause oil prices to plummet, causing energy stocks to fall as well. Geopolitics and OPEC also play a large role in energy demand, as do regulations. All of these forces could impact investors and represent potential downside risks.

In summary

I believe PEOs are an ideal way to invest in the energy sector and gain diversification and above-average dividend yields. With long-term energy demand likely to remain strong due to population growth, a growing middle class in many emerging market economies, and large demand for electricity from AI and other new industries, I view PEOs as a strong buy, especially on dips.

No warranties or representations are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. Information is for informational purposes only. Always consult with your financial advisor.