Ryan Fletcher/iStock Editorial via Getty Images

Historically, airlines have been one of the worst-performing sectors in the stock market. Since its launch in 2015, the U.S. Airlines ETF (Jets) have not generated positive returns and are stuck in various trading ranges. Fundamentally, I would argue that airlines are not well suited to public markets. They are capital intensive, highly cyclical, face intense price competition (hard to create a niche/moat in), and can be hampered by government regulatory changes. That’s why in other countries airlines are often government-backed entities. Even in the US, many airlines are dependent on various government agencies. Government bailout.

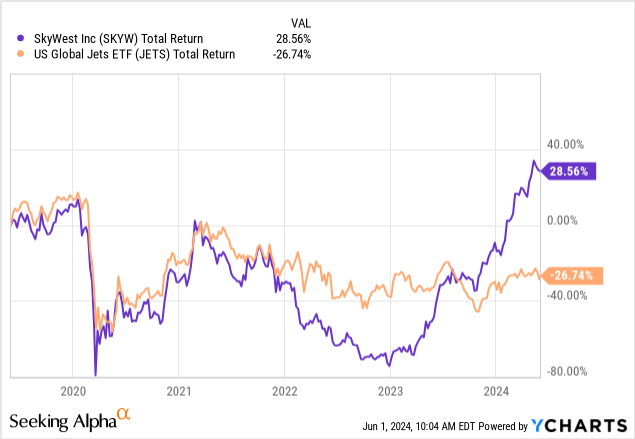

Airline stock prices have not recovered since 2020, Travel volume Hitting Consistently record highsThere are a few exceptions. SkyWestNasdaq:Sky) has had a strong performance over the past year, especially compared to the industry. See below.

Usually, stock It’s rare for a company to perform significantly better or worse than the industry as a whole. However, SkyWest does not appear to be immune to the ongoing woes facing airlines. In fact, SkyWest has many fundamental strengths compared to its peers. That said, the company’s stock is trading at a significant premium to most airlines and may not necessarily live up to the rosy expectations implied by its valuation. Therefore, I think now is a good time to take a closer look at the company and its macroeconomic exposure to determine its long-term value potential.

SkyWest’s Performance Secrets

SkyWest’s business model is fundamentally different from most other airlines. It’s a regional airline that focuses on smaller flights to smaller airports, and it’s already carved out a competitive niche for itself. SkyWest is the largest regional airline in the U.S., which gives it both cost scale and the slight oligopolistic pricing power inherent to regional airlines, creating a potential price advantage. This means that competition on route prices is much lower regionally than nationally.

SkyWest Airlines flights are operated by Alaska Airlines (Arc),American(Arabic), Delta (Dal), United (United AirlinesThe company typically has long-term, fixed-price contracts with these airlines to book regional routes. SkyWest’s large scale allows it to offer lower prices than other regional airlines and these airlines, giving it a significant competitive advantage and continued customer acquisition.

Additionally, SkyWest keeps its operating expenses low because it doesn’t control reservations or flight marketing. While airlines typically spend big to acquire customers in the highly competitive online marketing arena, SkyWest generally acquires them through its larger peers. In fact, its operating expenses-to-revenue ratio last year was 9.1 percent; United Airlines’ was 18.7 percent. Spirit Airlines (keep) and JetBlue (JBL) was also in the 18% range. Southwest Airlines (i love you) at 15.3%. American Airlines at 14.8%. Alaska Airlines, Frontier Airlines (ULCC), and Allegiant (Argut) has a similar operating expense ratio to SkyWest, but its stock price and earnings are terrible, suggesting it is shying away from marketing (and other overhead) spending to save money. Delta also had a low figure, but this is probably due to its high Customer loyalty and satisfaction.

Essentially, I would argue that SkyWest is a particularly unique airline that does not face many of the industry’s significant problems; that is, it is a regional airline and contracts with more prominent peers, so it faces much less competitive pressure than all the other major airlines. While SkyWest is still subject to capital intensity and cyclical risk, which is heightened by interest rates, I would argue that SkyWest is one of the few airlines with a significant financial wall of defense.

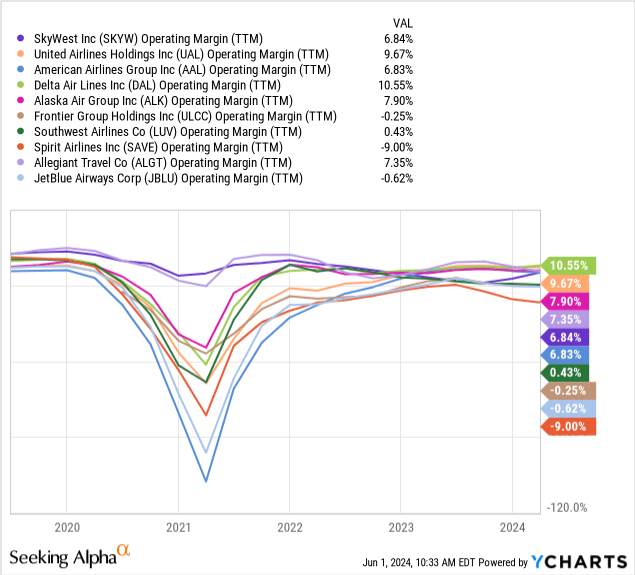

SkyWest’s business model is B2B, not B2C, so its primary objective is to offer lower prices in order to maintain an advantage in winning long-term contracts. As such, SkyWest’s gross margins are significantly lower than the major airlines, excluding the low-cost carriers that currently appear to be on the brink of bankruptcy (Spirit, Allegiant, Frontier). Overall, SkyWest’s profitability is in the middle of the US airline industry. That said, SkyWest’s margins are much more stable and will not suffer a devastating decline in 2020 or the reduced competitive pressures seen by today’s low-cost carriers. See below:

Again, I think this gives SkyWest a huge advantage over other airlines. From an investment perspective, margin stability is much more important than overall margins, because stocks are valued based on expectations. If there is no risk of major changes in expectations, you can usually expect a higher valuation.

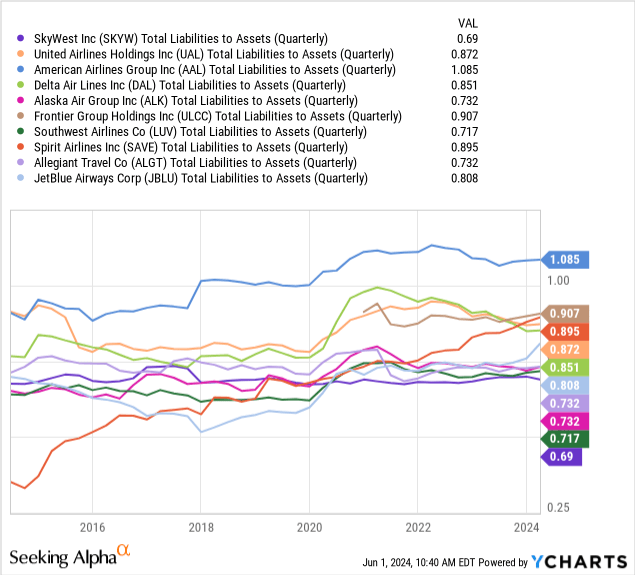

Moreover, SkyWest’s business model protected its profit margins in 2020 and it did not face the same significant debt increases that most other airlines did. Nearly all U.S. airlines had to take on large amounts of debt in 2020 and 2021 as lockdowns made them cash-flow negative. While total debt-to-asset ratios are an imperfect leverage measure, the debt-to-EBITDA ratio could be even worse because airline revenues are so volatile. By this metric, SkyWest is the least leveraged because it did not experience significant debt increases during lockdowns.

With interest rates rising, many airlines will need to repay or refinance debt at current interest rate levels, which could continue to put pressure on earnings. Rising interest rates.

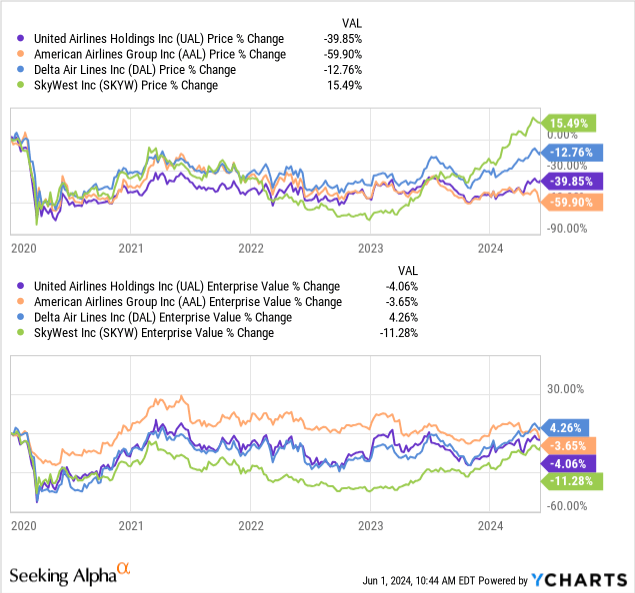

Moreover, many who don’t understand fundamentals often point out that low airline stock prices are a sign of undervaluation. Indeed, most airline stock prices are well below pre-2020 levels. But that alone is not a sign of undervaluation. An accurate indicator of undervaluation is market capitalization plus debt, or enterprise value, which measures the total value of a company. If a company has a lot of debt but does not grow revenue, its stock price should be low. This is true for most airlines today. In fact, from an enterprise value perspective, the major airlines have recovered. SkyWest has a much higher stock price but a lower enterprise value. See below.

As companies, SkyWest stock is currently 11.3% lower than in January 2020, while the big three are roughly the same. This alone doesn’t make SkyWest cheap, as it depends on how the company’s earnings outlook has changed. That said, it’s not logical to say the big three are cheap because their stock prices are low, since their debt levels have increased in proportion to the decline in equity value.

What is SkyWest currently worth?

In my view, SkyWest stands out as being much less risky than other airlines. Indeed, competition for pilots and customers puts many airlines at risk of declining revenues, and low-cost carriers are struggling with debt repayment pressures and appear at risk of significant financial strain. This makes SkyWest difficult to value, and its valuation ratios should be well above its peers. That said, SkyWest may still be overvalued, given the company’s exposure to cyclical risk of a downturn, especially if air travel volumes reverse.

Airlines are valued differently today because some face more severe risks than others. SkyWest trades at about 11 times forward earnings, putting it in the middle of the pack. JetBlue and Spirit are not profitable on a forward basis. I feel it is a competitive failure on their part.Southwest and Allegiant are valued at 23 and 18 times forward earnings, respectively, due to weak earnings outlooks. In my view, Southwest is strong because it’s trying too hard. Competing with the Big ThreeIt abandoned its more profitable regional roots.

Frontier’s valuation is on par with SkyWest’s at 11.4x, but its stock has fallen about 75% since 2020. In my view, both Frontier and Allegiant are at high risk for long-term revenue declines as they struggle in the highly competitive low-cost carrier space. Meanwhile, the Big Three are all valued lower than SkyWest, with UAL and AAL trading at about 5.2x and DAL trading at about 7.7x. That said, these companies are heavily loaded with debt.

The forward EV/EBITDA levels for these companies are more meaningful as they take into account debt leverage. SKWY’s forward EV/EBITDA is in the upper midrange at about 5.9x. JetBlue and Spirit are also higher at about 10x and 7x, respectively, due to their weak earnings outlook, but investors seem to expect them to survive. Frontier’s is only about 1.4x, indicating possible restructuring risk or fire sale discount due to low margins and huge debt leverage.

The EV/EBITDA ratios of other airlines range from about 3.6x (Alaska) to about 5.9x (Allegiant). Again, even adjusting for debt, SkyWest is valued significantly higher than the Big Three, whose EV/EBITDA ratios range from about 3.7x (United) to about 5x (Delta), averaging 4.5x. SkyWest’s multiple of about 5.9x is 31% higher than the Big Three average.

SkyWest EV is $5.08 billionand the company’s market cap is $3 billion, or about $2.1 billion higher. Because this difference is fixed (for purposes of valuation based on the most recent balance sheet), for EV to decline, market cap would have to decline more than enterprise value (in percentage terms). For a forward “EV/EBITDA” of 4.5x, EV would need to fall to about $3.87 billion, which would mean market cap would need to fall by about $1.2 billion, or about 40%.

In my view, this is a more accurate valuation metric than using the forward “P/E” ratio, given SkyWest’s low debt levels. As an example, the average forward “P/E” for UAL, AAL and DAL is currently around 6.1x, while SKYW is around 11x. The stock price would need to fall by around 45% for the “P/E” to fall to 6.1x. However, given the low debt levels, I would use an “EV/EBITDA” relative valuation methodology.

Conclusion

From a forward-looking “EV/EBITDA” perspective, I would argue that SKYW is about 66% higher than the big 3. Alternatively, it would need to be 40% lower to be in a similar range. You then need to ask yourself whether that significant premium is justified by lower risk and/or superior organic growth potential.

SkyWest’s business model, in my view, is much less risky than the big three’s business model because they have a huge wall of defense that is rare in the industry because they have contracts with the big three. 6% to 14% per year Sales growth over the next three years will exceed analyst expectations. Arabic, Daland United AirlinesThe Big Three’s revenue growth outlook isn’t necessarily expected to keep up with inflation, partially justifying the premium for SkyWest, which is more likely to continue to grow by being less dependent on general economic growth (which is almost nonexistent) and by outperforming smaller regional peers in its economic size.

SkyWest is also the only airline with a significant share repurchase program in recent times, which has caused shares to fall 20% in the last year. The company’s CFO has spent $744 million over the past year, and capital expenditures of $250 million are well below previous levels. I believe this indicates that SkyWest is pivoting away from recapitalization, but could still achieve significant EPS growth from share repurchases. Other forms of negative cash from capital raising (either dividends or debt reduction) could also have a positive impact on the stock price, as the company is likely to continue to earn significant cash returns over the next few years.

Overall, there is a lot to like about SkyWest. That said, I have a neutral outlook on SkyWest because I believe the positives are fully reflected in the valuation premium. Additionally, as I have detailed in a recent article, SkyWest could face downside risk if a new wave of inflationary pressures negatively impacts consumer spending and reduces air travel volumes. However, I am somewhat bearish on all other airlines. So, while I don’t believe SkyWest is undervalued, I do believe it is the best investment in what I believe to be a largely uninvestable industry.