Jewight

Chevron Stocks Rise Amid Recent Concerns

Chevron Corporation (New York Stock Exchange:CVX) Investors are investing in crude oil futures (CL1:COM) (CO1:COM) continues to be affected by bearish market sentiment. OPEC+ extension Voluntary reduction The plan also meant that production cuts would begin to be lifted as early as October, sending conflicting signals to the market, which led to alarm among oil investors as WTI crude futures hit record highs in early April 2024. As a result, crude oil futures have fallen more than 15% since then, threatening to enter another bear market.

Despite the obvious negative sentiment that permeates the energy industry (XL), CVX stock is in the S&P 500 (Spocks) (spy) Since then, my Previous Bullish CVX Update March 2024. So Chevron investors are Crude oil futures showed weakness.

Investors are likely feeling confident about Chevron’s strong first-quarter production performance and medium-term production outlook. In addition, Hess Corporation’she) With recent shareholder approval of the Chevron acquisition, Chevron expands ambitions in Guyana. Nevertheless, Clarification Regarding Chevron and ExxonMobil Arbitration (ZOM) is not expected until at least the fourth quarter. Still, Chevron executives remain confident that Exxon’s “right of first refusal does not apply to the Hess transaction.”

Just in case, Chevron’s first quarter earnings report The reports were mixed. Chevron recorded a significant increase of 12% compared to the previous year. The increase in total average production. However, lower realizations in Chevron’s upstream natural gas division and downstream refining margins impacted CVX’s adjusted EPS of $2.93. Nonetheless, Chevron’s ability to beat Wall Street expectations suggests that the market was already reflecting well-delayed expectations.

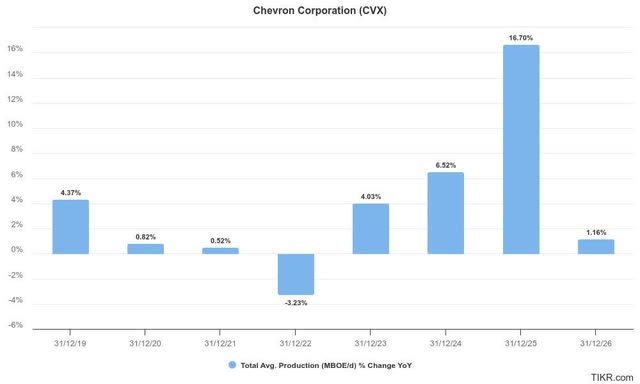

Chevron’s outlook for strong production growth

Chevron Total Average Production Estimate (MBOE per day) (TIKR)

As mentioned above, Chevron’s production volumes remain in a growth phase, which is expected to cushion the downside volatility from commodity price fluctuations. Nonetheless, Chevron’s management remains disciplined in its capital allocation and committed to pursuing profitable growth with a higher-value asset portfolio.

Therefore, Chevron is well positioned to leverage its asset base in the Permian Basin and DJ Basin. Permian Basin production has been strong, producing 859K BOE per day in the first quarter. Additionally, the DJ Basin also produced 400K BOE per day last quarter, contributing to a strong quarter. These are high quality assets in Chevron’s low-cost portfolio, helping it achieve “high cash margins and low breakeven barrels.”

Positive results for Hess could drive stock price upside

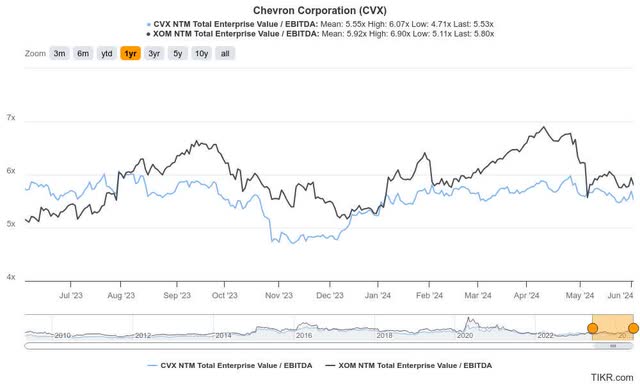

CVX vs XOM Rating Comparison (TIKR)

Given the current uncertainty surrounding Chevron’s acquisition of Hess, I assess that the market could raise the valuation of CVX if the arbitration outcome is in Chevron’s favor. Additionally, the valuation gap between CVX and XOM has narrowed significantly over the past month, suggesting buying interest in CVX remains strong.

Therefore, CVX’s valuation grade of “C-” suggests the company is not expensive and could be subject to rerating if the arbitration with Exxon is favorable.

Despite my optimism, I must emphasize that crude oil futures failed to sustain the consolidation zone above the $75 support level. As a result, WTI futures fell to $73.4 as the market became increasingly concerned about a potential increase in supply risk as OPEC+ was expected to scale back production cuts. Therefore, a subsequent bear market in crude oil futures could result in downward volatility in CVX. As a result, Saudi Arabia’s influence over OPEC+ could weaken, and if an oversupply situation is expected, the execution risk of Chevron increasing production to mitigate price declines could intensify.

Additionally, Chevron’s long-term investment must be balanced against the possibility of a long-term decline in oil demand as the world transitions to renewable energy technologies. Chevron emphasized that it plans to “allocate approximately $10 billion to new energy businesses.” However, being in the early stages of development, the ROI of these efforts may remain uncertain. Nonetheless, Chevron’s commitment to resume its annual share repurchase pace of $17.5 billion after the completion of the Hess acquisition should assure investors of financial discipline.

Should you buy, sell, or hold CVX stock?

Chevron investors have remained resilient, as evidenced by its relative outperformance over the past two months. The narrowing gap between CVX and XOM’s valuations suggests that CVX is not overvalued, which is supported by its valuation rating of ‘C-‘.

A favorable outcome in the Chevron-Exxon arbitration should provide impetus for further valuation reassessment as Chevron bolsters its asset portfolio with potentially higher-growth, lower-cost assets.

Rating: Maintain Buy.

Important Note: Investors are cautioned to conduct their due diligence and not rely on the information provided as financial advice. Consider this article as a supplement to your required research. Always exercise your independent thinking. Please note that unless otherwise specified, ratings are not intended to indicate specific entry/exit timings at the time of writing.

I want to hear your voice

Do you have any constructive comments to improve our paper? Did you find any significant flaws in our findings? Did you spot any important points that we didn’t notice? Do you agree or disagree? Please comment below to help everyone in the community learn better.