george peters

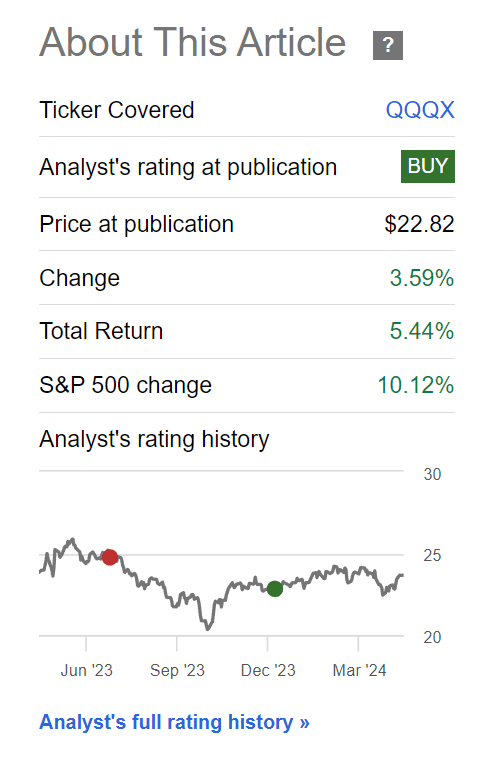

In January I raised My recommendation for the Nuveen NASDAQ 100 Dynamic Overwrite Fund (Nasdaq:QQQXI turned into a buy as the QQQX fund fell to a historically large 7% discount to net asset value (“NAV”).Although I have some concerns Regarding the “dynamic” nature of QQQX’s call writing strategy, I believed that QQQX’s discount to NAV was unreasonably large.

However, since my article, QQQX’s year-to-date market performance has been somewhat disappointing, with a total return of 5.4% compared to the S&P’s more than 10% gain (Figure 1).

Figure 1 – QQQX lags the S&P 500 (In search of alpha)

What’s behind QQQX’s recent poor performance? Would you still rate it a buy?

QQQX’s underperformance can be explained by the year-to-date relative weakness of the Nasdaq 100 Index and the widening of QQQX’s discount to NAV. I continue to believe that patient, conservative, income-oriented investors should accumulate wealth. QQQX has a 10% “margin of safety”.

Fund overview

The Nuveen Nasdaq 100 Dynamic Overwrite Fund offers investors 35% to 75% call options (with a long term target of 55% of the portfolio’s notional value) while holding a portfolio of stocks substantially similar to the Nasdaq 100 Index. brings income to.

QQQX’s “call over write” strategy is also known as “buy write” or “covered call” strategy. This is a popular derivatives overlay strategy that has been proven to reduce portfolio volatility and increase returns by trading off some of the portfolio’s upside (Figure 2).

Figure 2 – Covered Call Overview (Investopedia.com)

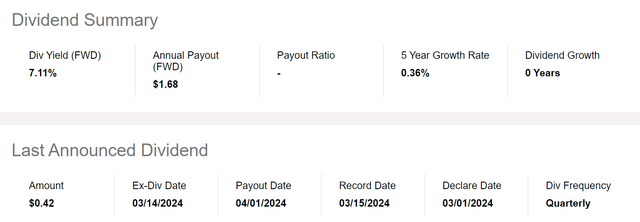

By applying a “call overwrite” strategy to the Nasdaq 100 Index, investors hope to capture a portion of the capital gains of major growth stocks like Microsoft (MSFT), apple (AAPL), NVIDIA (NVDA) while also enjoying a high dividend yield, currently set at 7.1% (Figure 3).

Figure 3 – QQQX Dividend Yield (In search of alpha)

The Nasdaq 100 has been a relative laggard since the beginning of the year.

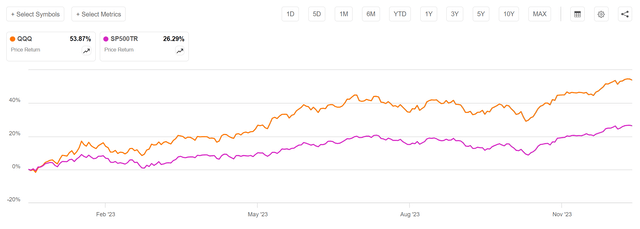

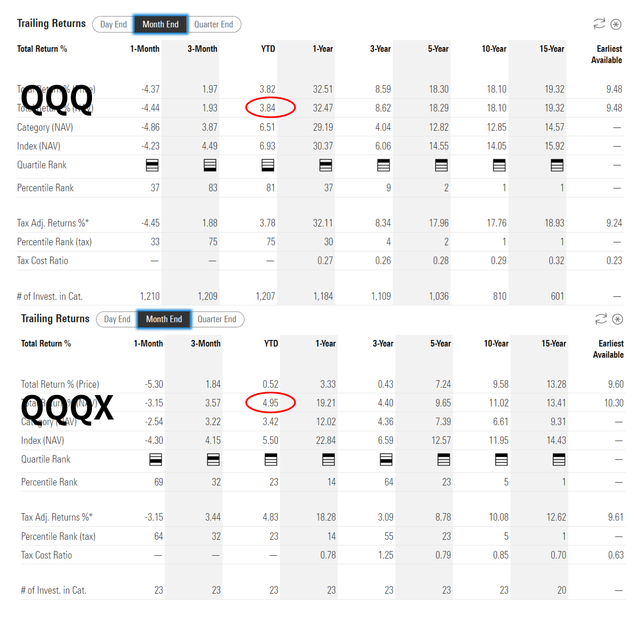

One of the issues behind QQQX’s relatively muted performance was the relative weakness of the Nasdaq 100 Index compared to the S&P 500. Invesco QQQ ETF (QQQ, a passive ETF based on the Nasdaq 100 Index), doubled the total return of the S&P 500 (53.9% vs. 26.3%) (Figure 4). It’s natural for winners to take a breather and for laggards to try to catch up.

Figure 4 – QQQ and S&P 500 Total Return, 2023 (In search of alpha)

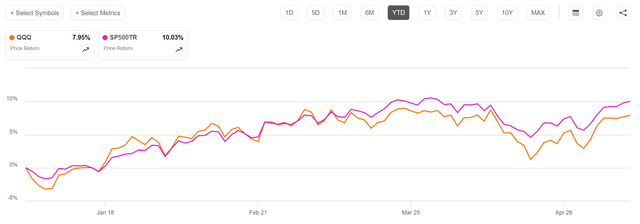

The QQQ ETF’s return for the first year of 2024 is 8.0%, which is relatively low compared to the S&P 500’s return of 10.0% (Figure 5).

Figure 5 – QQQ and S&P 500 Total Return, 2024-Year-to-date (In search of alpha)

The QQQX fund is based on the Nasdaq 100 index, so it’s no surprise that it underperforms the S&P 500.

Discount rate to NAV expands

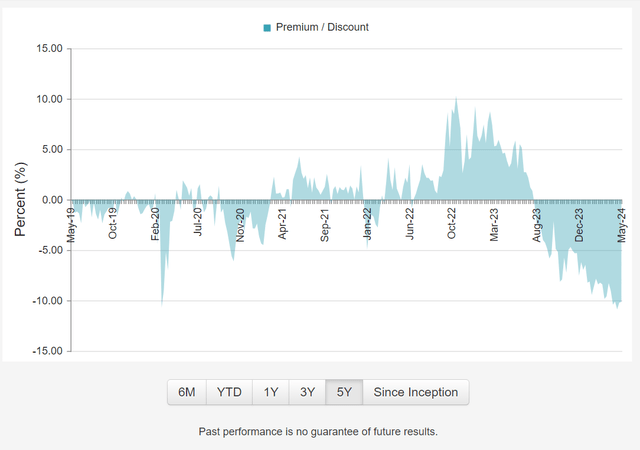

Another part of the problem for the QQQX fund is that the discount to NAV has widened from around 7% in January to 10% now, consistent with the historically broad levels last experienced in March 2020. (Figure 6).

Figure 6 – QQQX discount to NAV (cefconnect.com)

As John Maynard Keynes said, Markets may remain irrational for longer than we can remain solventand so far in 2024, the market has become even more irrational.

When does the discount to NAV end?

I cannot predict when QQQX’s discount to NAV will end, but I believe you can buy $1 worth of assets for 90 cents. The QQQX Fund is a relatively well-managed closed-end fund with over $1.2 billion in assets. The company’s holdings are transparent and not difficult to model, so it should not be penalized by a deep discount (Figure 7).

Figure 7 – QQQX Top 10 Stocks (nuveen.com)

In fact, when comparing the year-to-date NAV performance of the QQQX Fund and the QQQ ETF through April 30, 2024, QQQX’s year-to-date return was 5.0% versus 3.8%, due to premium income from selling calls, which actually It exceeds QQQ (Figure 8).

Figure 8 – Historical revenue comparison, QQQ and QQQX (Compiled by the author Lucifer)

For conservative investors with long investment horizons, we believe QQQX’s 10% discount to current NAV continues to provide excellent returns. ‘safety range’.

Risks to QQQX

The main risk for QQQX remains the potential for a market crash. This is because the call overwrite strategy preserves most of the downside of the underlying index while trading off the upside. If the market declines significantly in the coming months, the QQQX Fund will have very high downside exposure.

On the other hand, if the Nasdaq 100 index rises rapidly like it did in 2023, the QQQX fund will also lag QQQ as it has pulled off the rapid gains.

All in all, the QQQX fund is suitable for conservative long-term investors who want to generate up to 10% total return (as QQQX’s starting NAV CAGR is 10.3%) with a 7% distribution yield.

conclusion

I continue to recommend the QQQX fund. buy, because I believe the widening of the discount to the fund’s NAV is unreasonable and will eventually end. For a patient, conservative, income-oriented investor, I believe QQQX’s 10% discount to his NAV provides an excellent “margin of safety.”