Hapabapa

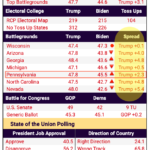

In the volatile stock market of 2024, winners are winning big and losers are falling further and further into the penalty box. But stock price performance is often not at all correlated with the underlying fundamental performance, and I believe that’s the case here. Roku (Nasdaq:Roku).

Roku, the streaming leader in both hardware and platform, is down nearly 40% so far this year. The company’s first-quarter earnings report in April showed: acceleration With revenue growth and profitability improving sharply, I believe now is a good time for investors to reassess their bullish outlook for Roku.

later Prices have fallen, making Roku’s bull market more favorable than ever

I I last wrote a bullish article about Roku back in March.At that time, the stock price was still At around the mid-$60 range, the stock was trading lower before the company released its first-quarter earnings. Given the subsequent drop in the stock price and the positive first-quarter update (discussed in the next section), I still believe strong On Roku for the rest of the year.

There are two notable product updates. First, the company said it’s seeing strong sales of its new Roku Pro TV. This is Roku’s high-end smart TV, priced starting at $699 (for a 55-inch model, with options for 65-inch and 75-inch screen sizes), and it includes AI brightness and color adjustments and a new side-speaker system. Investors were told that while the hardware doesn’t generate profits, it’s still a big part of the company’s profits. Roku (Indeed, strong hardware sales here are what drove the company’s gross profit decline year-over-year.) But it’s also an entry point into streaming and platform revenue.

Meanwhile, the company noted that distribution activity for its streaming services is accelerating. During the Super Bowl, the company generated revenue by driving viewers to Paramount+. Roku also processes payments for sign-ups through the Roku platform, creating an exclusive growth market for the Roku Pay segment. The company also continues to innovate its viewer experience to increase engagement and subscription sign-ups, especially in sports. The company’s new NBA zone complements its existing NFL zone, creating a one-stop shop for sports fans to access content via the Roku platform.

Now, let me reiterate my long-term bullish view on Roku.

-

Roku’s shift to a platform-first model has dramatically improved margins and revenue stability. Where once Roku’s revenue split between its low-margin hardware players and platform revenue was nearly 50/50, hardware now accounts for less than 20% of Roku’s total revenue. This has not only improved profitability, but also made Roku’s revenue more stable from quarter to quarter and less dependent on the seasonality of device sales.

- The long-term trend towards streaming and the shift away from traditional TV The company said streaming time in the U.S. increased 23% year-over-year in the first quarter, while traditional TV viewing time was down 13% year-over-year in the same period.

-

The company continues to grow through the Roku Channel and is a leader in original programming. The company’s platform is now one of the leading streaming services in the U.S. The channel also now produces original content, including some of Roku’s most popular programming, such as a new documentary in partnership with the NFL. The company’s sports-oriented hubs, like its NFL and NBA Zone, continue to drive engagement and sign-ups to other companies’ streaming services.

-

Streaming and Roku Pay The company is also accelerating its efforts to drive sign-ups for streaming services from its platform, which also generates revenue from transactions via Roku Pay.

-

International expansion opportunities – Roku The company has recently been aggressively expanding into the UK, Canada and Mexico, which it sees as its next growth pillar. This is hurting its ARPU (international markets have lower ad spend than the US), but it should focus on building viewership first and worrying about revenue contributions later.

- Ample cash balance – The company has more than $2 billion in net cash on its books and no debt, which is roughly a quarter of its current market cap of roughly $8 billion.

I’ll hold long here and buy when Roku dips.

Q1 Download

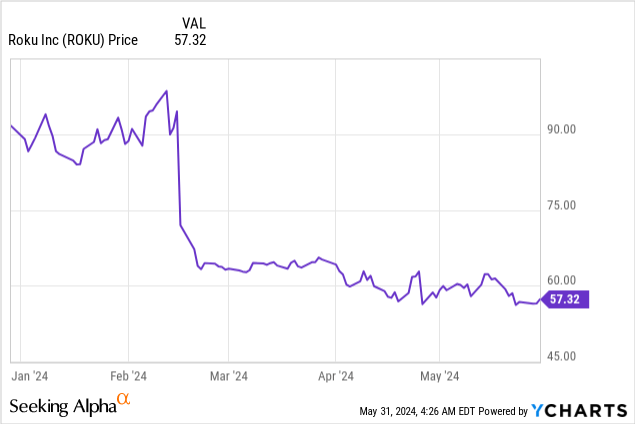

Let’s take a closer look at Roku’s latest quarterly earnings report. Highlights from the first quarter’s earnings are shown in the snapshot below.

Roku first quarter results (Roku Q1 shareholder letter)

Roku’s revenue grew 19% year over year to $881.5 million, with platform (software and advertising) and device sales both increasing 19%. This beat Wall Street’s much more modest expectations of $850.4 million (up 15% year over year) by four percentage points, and accelerated beyond the 14% year over year growth rate in the fourth quarter, making the stock price drop after the earnings report even more puzzling.

This marks the start of a year in which Roku expects to see accelerated growth across the board, CEO Anthony Wood said during the company’s first-quarter earnings call.

The Company expects to accelerate platform revenue, adjusted EBITDA and free cash flow growth in 2025 by focusing on three key opportunities: maximizing Roku home screen adoption on TVs, growing Roku paid subscriptions and growing Roku advertising demand.

Roku’s home screen reaches nearly 120 million U.S. homes every day. With this huge reach comes a lot of opportunity. We see many ways to improve the user experience while expanding Roku’s monetization (…)

“We also see significant opportunities to grow Roku-billed subscriptions. Our payment and billing service, Roku Pay, simplifies the sign-up process for users, allowing them to transact and start streaming quickly, and helps content partners avoid losing subscriptions due to unnecessary friction at the point of purchase. Additionally, our broadening and deepening relationships with third-party platforms makes it easier for advertisers to run campaigns programmatically on the Roku platform.”

Roku’s second-quarter guidance suggests a deceleration to 10% year-over-year revenue growth, with gross margins on devices expected to be negative 10%. While it’s certainly impossible for Roku to paint a perfect story, investors should keep in mind that Roku’s strategy is to produce price-competitive devices and generate long-term revenue through advertising and subscriptions.

The burden of loss-leader products in the hardware division hasn’t hindered Roku’s profitability, with first-quarter adjusted EBITDA soaring to $40.9 million, a 4.6% margin. 14 points improvement from last year Adjusted EBITDA margin for the same period last year was -9.3%.

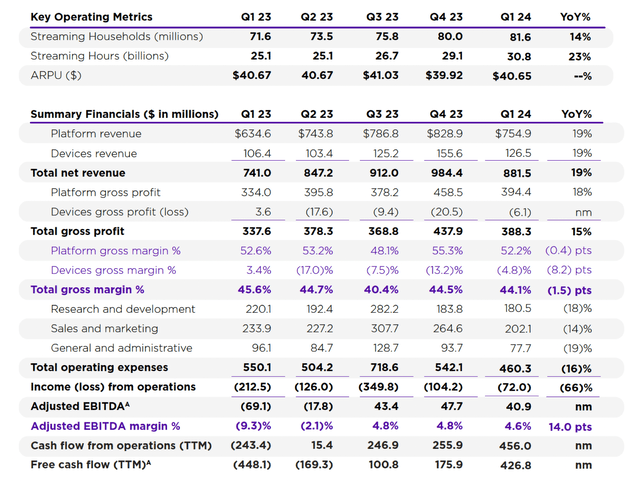

Also, Roku generated a huge profit of $427 million in FCF over the past 12 months, while FCF was Burn The same size as the same time last year.

RokuTTMFCF (Roku Q1 shareholder letter)

Evaluation and key points

At a current share price of nearly $57, Roku’s market cap is $8.26 billion, minus the $2.06 billion in cash listed on the company’s most recent balance sheet. The company is valued at $6.2 billion – this is, The TTM FCF multiple is 14.5x. We are exploring multiple levers to continue to achieve double-digit growth (and over the long term, adjusted EBITDA will increase as higher margin platform revenue continues to drive a higher percentage of hardware revenue). and Given the FCF margin, I think Roku stock is a bargain right now.

Don’t miss your chance to build a position while Roku is still cheap.