simonkr/E+ via Getty Images

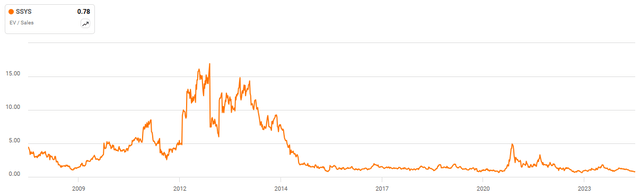

Stratasys (Nasdaq:SSYS)’s recent quarterly results were reasonable given the tough demand environment, but investors continue to shy away from the stock, which is down more than 30% this year.

Previously proposed Stratasys’ ongoing Losses will put downward pressure on the stock price, and will likely continue to do so going forward. In a weak demand environment, it will be difficult to make enough money to break even. But Stratasys’ balance sheet remains fairly healthy, and it has been able to significantly reduce its cash burn in recent quarters, putting it in a good position to weather the current downturn.

Stratasys is still pursuing a takeover bid, which should provide further support for the stock.NNDM) has proposed to acquire all of Stratasys’ outstanding shares. 2023 $16.50 per share Stratasys has been fairly hostile towards NanoDimension in the past, but the proposal still exists and the two companies appear to be in talks.

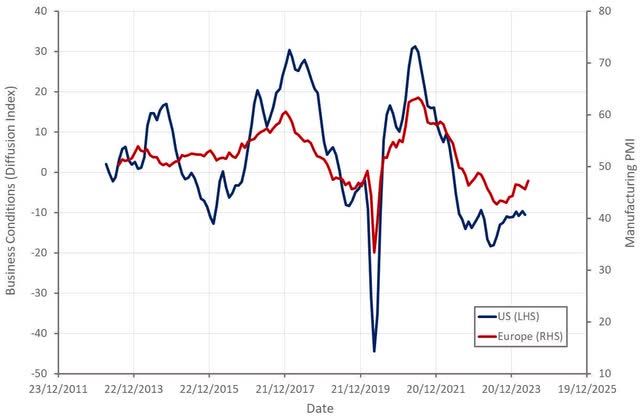

market conditions

Customer capital spending remains constrained as a result of the challenging financing environment, which poses ongoing challenges for Stratasys capital sales. The challenging conditions are expected to continue through 2024, resulting in continued purchase delays and longer sales cycles. Excluding divestitures, Stratasys revenue was roughly flat and the company We believe we are gaining market share.However, Stratasys’ sales cycle was reported to have improved slightly in the first quarter, and the company’s relationships with customers remain strong.

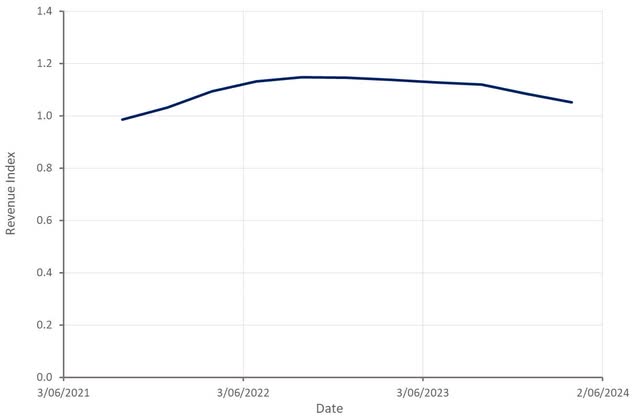

Figure 1: Manufacturing survey data (Source: Compiled by the author using Federal Reserve data)

Stratasys is not the only additive manufacturing company facing losses and declining revenue, suggesting that the company’s current struggles are primarily the result of macroeconomic conditions and not a specific company issue.

Figure 2: Sales Index of Listed Manufacturing Companies (Source: compiled by the author based on data from company reports)

Stratasys Business Update

Stratasys continues to expand its materials and printer offerings with a focus on high-volume manufacturing use cases. The F3300 will be available in late 2023 and Up to 2x the throughput Dramatically reduced production costs over standard FDM systems. Targeted at the high-end, large part FDM market. The F3300 is reportedly driving an expansion of Stratasys’ sales funnel, with initial orders exceeding the company’s expectations; however, further growth in F3300 revenue is not expected until later this year. Early customers include Toyota, BAE Systems, Sikorsky and Nissan.

Stratasys also recently released H350 version 1.5, which includes improved sensors and remote service capabilities. In addition to this, Stratasys has introduced SAF HighDef Printing capabilities to enable customers to create more complex parts. This is delivered as part of a firmware update and is backwards compatible with previous H350 models.

Stratasys also introduced a new material for FDM that will broaden its applications in industries such as aerospace and medical. VICTREX AM 200 is a PEEK-based polymer that is heat, corrosion and chemical resistant and has strong mechanical properties.

Stratasys also announced GrabCAD’s Parts on Demand, which will integrate its software platform with Stratasys Direct, giving customers access to Stratasys Direct’s 3D printers. Stratasys is committed to building a connected software ecosystem and believes that the integration of hardware and software will give it an advantage by providing access to logs that provide insight into customer needs. Success in this area will go a long way in realizing differentiation and improving Stratasys’ ability to generate profitable growth.

Financial Analysis

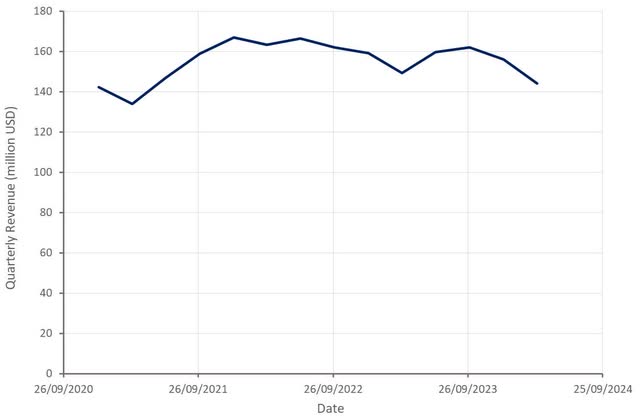

Generated by Stratasys Revenue: $144 million Product revenue in the first quarter was US$99 million, down 3.5% year-over-year. Excluding the divestitures of non-core businesses, revenue was roughly flat. Product revenue in the first quarter was US$99 million, down approximately 2% year-over-year. Given the high utilization of previously purchased systems, Stratasys expects these systems will eventually be replaced with more powerful systems, leading to a recovery in product revenue. Within product revenue, systems revenue decreased approximately 19% year-over-year, while consumables revenue increased approximately 10%. It should be noted that Covestro was acquired in April 2023 and contributes US$4 million to US$5 million per quarter. Without this, consumables revenue was roughly flat. Services revenue in the first quarter was US$45 million, down approximately 7% year-over-year. Excluding the divestitures, services revenue increased 1.8%.

Stratasys expects revenue of $630 million to $645 million in 2024, with sequential quarterly revenue growth and even higher growth expected in the second half of the year. This would imply growth of about 1.6% at the midpoint. Given Stratasys’ soft first quarter results and weak macroeconomic conditions, we are skeptical this will be achieved.

Figure 3: Stratasys Revenues (Source: Author’s compilation using data from Stratasys)

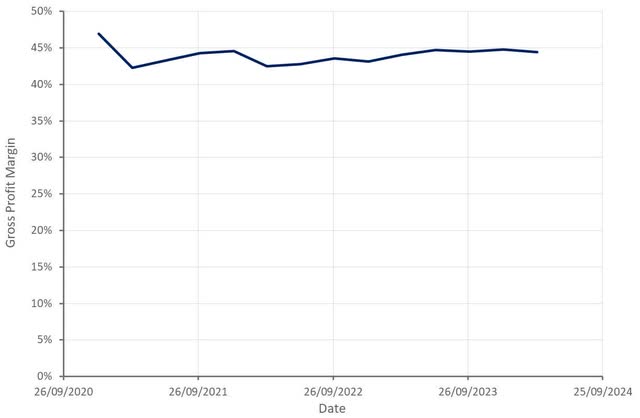

Stratasys’ gross margins have remained fairly stable in recent quarters, helped by strong consumables sales and rising margins at Stratasys Direct, and pandemic-related inflationary pressures are no longer an issue.

Figure 4: Stratasys Gross Margins (Source: Author’s compilation using data from Stratasys)

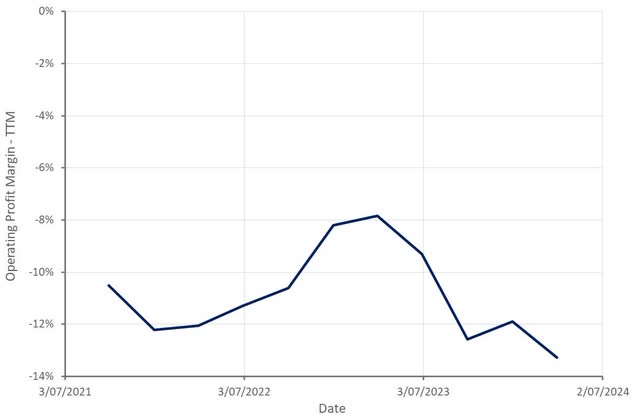

Stratasys Operating Expenses Total: $88.4 million Stratasys’ revenues in the first quarter increased approximately 7% compared to the same period last year. The increase was due to recent acquisitions and costs associated with the company’s strategic review process. As a result, the company’s profitability continues to decline. While this is clearly negative, Stratasys’ losses are manageable and cash flows are improving. Stratasys generated $7 million in operating cash flow in the first quarter and was free cash flow positive. The company expects to be cash flow positive for the full year.

Figure 5: Stratasys Operating Margins (Source: Author’s compilation using data from Stratasys)

Conclusion

Stratasys’ declining revenue and ongoing losses continue to weigh on the stock price. While this is negative, it is primarily due to a weak demand environment. Excluding divestitures, Stratasys’ revenues remain fairly strong, reducing the company’s cash burn. Stratasys also still has approximately $160 million in cash and cash equivalents on the balance sheet, providing flexibility.

I am not too optimistic about the outlook for most additive manufacturing companies, but the market may be too pessimistic at the moment: the current downturn has caused consolidation, forcing vendors to become more efficient, which should improve profitability when demand recovers.

In addition, a takeover bid is also being prepared in case Stratasys’ business continues to struggle.Stratasys has provided little information about the progress of its strategic review beyond saying it is still under review. Engage and progressHowever, Nano Dimension’s offer is still under negotiation and is significantly higher than Stratasys’ current share price.