by Calculated Risk June 10, 2024 1:17 PM

Today’s Calculated Risk Real Estate Newsletter: First Quarter Update: Delinquencies, Foreclosures and REOs

Short excerpt:

we will do not have As happened after the housing bubble, we are likely to see a surge in foreclosures that will have a major impact on home prices for two main reasons: 1) mortgage lending is strong, and 2) most homeowners have significant equity in their homes.

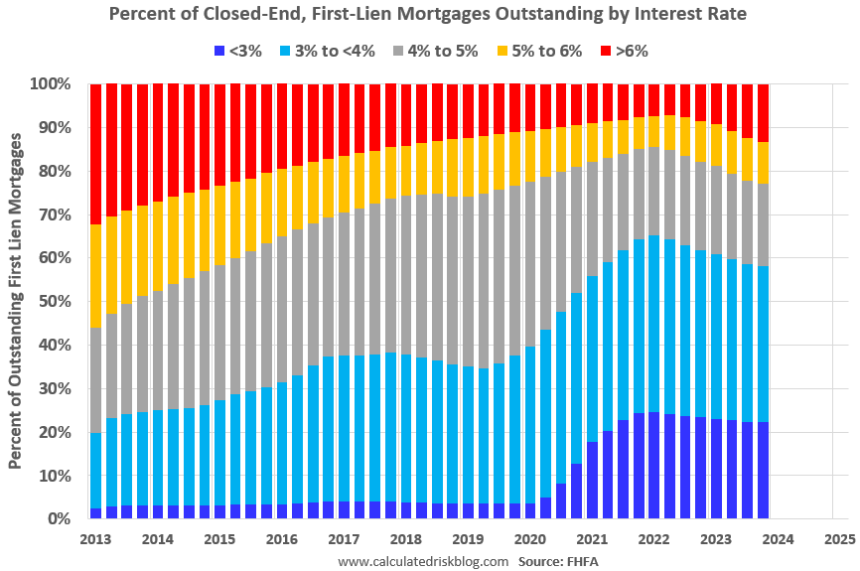

…For mortgage rates, data are available from FHFA’s National Mortgage Database, showing the distribution of interest rates on closed-end fixed-rate one- to four-family mortgages outstanding as of the end of each quarter from Q1 2013 through Q4 2023 (Q1 2024 data will be released in three weeks).

This reflects a sharp decline in mortgage rates during the pandemic, which has led to a sharp increase in the percentage of loans below 3% and even 4% since the beginning of 2020. Now, 22.2% of loans are below 3%, 58.1% are below 4% and 77.0% are below 5%.

With sufficient equity and low mortgage interest rates (most of which are fixed), homeowners are unlikely to get into financial difficulty..

There’s much more to this article. Subscribe now https://calculatedrisk.substack.com/